Global Biosimilar Contract Manufacturing Market

Global Biosimilar Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Source (Mammalian, Non-mammalian), By Therapeutic Area (Oncology, Blood Disorders, Growth Hormonal Deficiency, Chronic & Autoimmune Disorders, Rheumatoid Arthritis, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Biosimilar Contract Manufacturing Market Size Summary

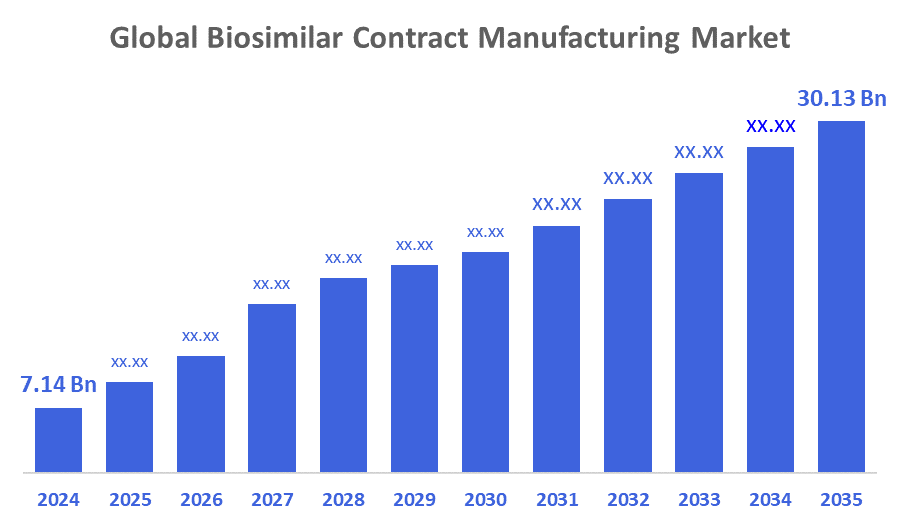

The Global Biosimilar Contract Manufacturing Market Size Was Estimated at USD 7.14 Billion in 2024 and is Projected to Reach USD 30.13 Billion by 2035, Growing at a CAGR of 13.98% from 2025 to 2035. The market for biosimilar contract manufacturing is expanding as a result of the growing need for low-cost, high-quality treatments for chronic illnesses worldwide, the expiration of patents on pricey biologic medications, the difficulty and expense of producing biosimilars, and improvements in manufacturing technologies that improve productivity and quality.

Key Regional and Segment-Wise Insights

- In 2024, the biosimilar contract manufacturing market in North America accounted for 33.25% and led the global market.

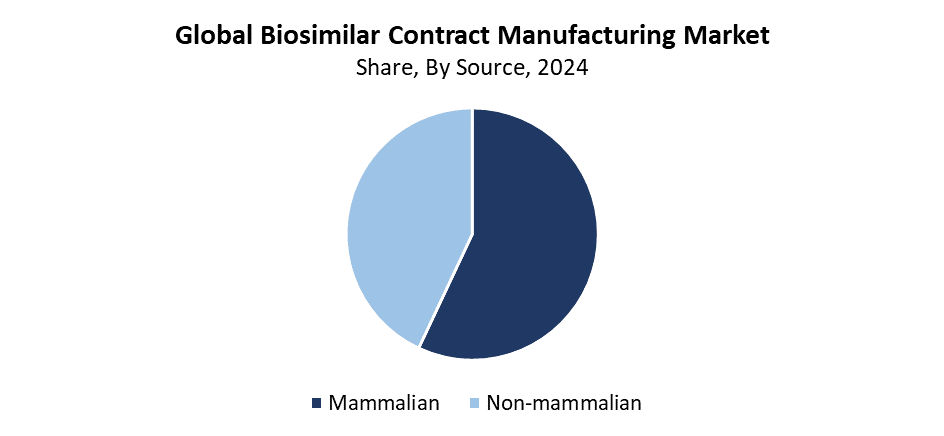

- According to the source, the mammalian segment had the biggest market share of 57.4% in 2024.

- In 2024, the rheumatoid arthritis segment had the highest revenue share by therapeutic area.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 7.14 Billion

- 2035 Projected Market Size: USD 30.13 Billion

- CAGR (2025-2035): 13.98%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Biosimilar contract manufacturing represents a specialized market sector that provides outsourced production and manufacturing of biosimilar medications that match licensed biologics. The main drivers behind this market expansion include rising demand for cost-effective therapies, growing chronic disease rates, and upcoming patent expirations of essential biologic products. Pharmaceutical companies depend more on contract manufacturers to reduce manufacturing expenses and speed product launches, and to focus their resources on marketing, research, and development. The expanding market stems from rising patient and healthcare provider approval of biosimilars, particularly in developing countries where price reduction matters most.

The manufacturing productivity, together with the product excellence of biosimilars, experiences enhancement through technological innovations in bioprocessing, which involve automation and continuous manufacturing, and single-use systems. These advancements in bioprocessing enable contract manufacturing organizations (CMOs) to deliver enhanced, adaptable solutions together with scalable manufacturing operations. The biosimilar industry receives support from governments worldwide, which provide funding programs to boost domestic production and implement faster approval procedures and enhanced regulatory systems. Biosimilar market development receives assistance from the FDA and EMA through specific guidelines, and South Korea and India by offering manufacturing incentives.

Source Insights

The mammalian segment led the biosimilar contract manufacturing market with the largest revenue share of 57.4% during 2024. The growing requirement for advanced biologics, which include monoclonal antibodies and therapeutic proteins that need mammalian cell lines for proper production, causes this segment to lead the market. The ideal platform for making biosimilars consists of mammalian systems, including Chinese Hamster Ovary (CHO) cells, since they yield excellent protein folding together with high-quality post-translational modifications. The popularity of mammalian-based contract manufacturing services has increased because the FDA gives more biosimilar approvals and the biopharmaceutical sector increasingly chooses outsourcing. This market segment continues to lead substantial growth and innovation within the global biosimilar manufacturing industry.

Throughout the forecast period, the non-mammalian segment of the biosimilar contract manufacturing market is predicted to grow at a significant CAGR. The increasing adoption of microbial expression systems consisting of yeast and Escherichia coli enables high-yield manufacturing at reasonable costs, which drives this growth. The production of straightforward biosimilars, such as insulin, along with growth hormones and particular enzymes, utilizes these manufacturing techniques. The progress in fermentation alongside genetic engineering technologies has enhanced both the efficiency and scalability of non-mammalian manufacturing platforms. The rising demand for non-mammalian contract manufacturing services stems from biosimilar producers seeking faster production cycles, along with lower costs, which will drive this sector to expand significantly during the upcoming years.

Therapeutic Area Insights

In 2024, the rheumatoid arthritis segment dominated the biosimilar contract manufacturing market by holding the largest revenue share. The widespread occurrence of rheumatoid arthritis throughout the globe, combined with the extensive use of monoclonal antibodies and TNF inhibitors in its treatment, drives its market dominance. Biosimilars targeting rheumatoid arthritis face increased demand because important biologics, including etanercept and adalimumab, and infliximab, lose their patent protection. Contract manufacturing organizations (CMOs) serve as primary partners for biopharmaceutical companies to handle production tasks, which help them meet growing market requirements. The robust market share of this segment stems from the affordable pricing of biosimilars as well as increased healthcare reach and favorable regulatory conditions.

The biosimilar contract manufacturing market's oncology segment is anticipated to grow at the fastest CAGR throughout the forecast period. The rising need for affordable biologic treatments, along with increasing global cancer cases, drives this accelerated expansion. The biosimilar substitute market experienced exponential growth when patent protections for high-cost oncology biologics such as rituximab, bevacizumab, and trastuzumab ended. The contract manufacturing organizations (CMOs) play a vital role in meeting market demand by offering cheap, scalable manufacturing capabilities. The biosimilar market will grow due to regulatory support, combined with faster approval processes for cancer biosimilars, which attract new manufacturers to join the market.

Regional Insights

The biosimilar contract manufacturing market is dominated by the North America region by holding the largest revenue share of 33.25% in 2024. The well-established biopharmaceutical industry, along with advanced manufacturing capabilities and increasing biosimilar usage for affordable biologic therapies, drives this region to lead the market. Biosimilar development, along with outsourcing activities, has grown because significant contract manufacturing organizations (CMOs) exist, and the FDA provides beneficial regulatory frameworks through the Biologics Price Competition and Innovation Act (BPCIA). The increasing demand for high-quality biosimilars stems from rising chronic disease rates, including cancer and autoimmune disorders, which has solidified North America's position as the global market leader.

Europe Biosimilar Contract Manufacturing Market Trends

The biosimilar contract manufacturing industry in Europe experiences substantial growth because of strong government support, advanced pharmaceutical infrastructure, and increasing biosimilar adoption throughout the region. Europe took the lead in establishing regulatory frameworks that generated supportive conditions for biosimilar development and marketing. The market receives additional support from multiple contract manufacturing organizations that possess advanced technical expertise and industry knowledge. Manufacturing outsourcing stands as a necessary strategy for biopharmaceutical businesses because it helps reduce expenses and decreases product development timelines while important biologic patents expire and healthcare costs rise. Patient and healthcare professional understanding and acceptance of biosimilars drive the market expansion, while Europe maintains its global leadership position in biosimilar contract manufacturing through ongoing investment and innovation.

Asia Pacific Biosimilar Contract Manufacturing Market Trends

The biosimilar contract manufacturing market in Asia Pacific will register the fastest CAGR during the forecast period. The rapid market expansion stems from main factors such as expanding biopharmaceutical industry in the region alongside lower manufacturing expenses and growing investments toward advanced manufacturing facilities. The development and production of biosimilars has made China and India key biosimilar centers because of their supportive government initiatives and favorable regulatory frameworks. The rising number of chronic diseases together with the need for affordable biologic drugs in Asia Pacific drives market growth. The strong market expansion in the region stems from global and regional biopharma companies outsourcing their biosimilar production needs to contract manufacturing organizations (CMOs).

Key Biosimilar Contract Manufacturing Companies:

The following are the leading companies in the biosimilar contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim GmbH

- Cambrex Corporation

- FUJIFILM Diosynth Biotechnologies

- Catalent, Inc.

- WuXi Biologics

- ProBioGen

- Toyobo Co. Ltd.

- AbbVie, Inc.

- AGC Biologics

- Pfizer Inc.

- Lonza

- Samsung Biologics

- Thermo Fisher Scientific, Inc.

- Siegfried Holding AG

- Others

Recent Developments

- In June 2025, UCB announced a USD 5 billion U.S. investment to promote patient growth, innovation, and sustainable healthcare by expanding CMO alliances, building a state-of-the-art biologics facility, and creating 300 skilled jobs.

- In May 2025, ProBioGen and Polpharma Biologics collaborate to offer high-performance cell line development utilizing DirectedLuck and CHO.RiGHT technology, guaranteeing reliable, superior biosimilar production and speeding up Polpharma's growing portfolio.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the biosimilar contract manufacturing market based on the below-mentioned segments:

Global Biosimilar Contract Manufacturing Market, By Source

- Mammalian

- Non-mammalian

Global Biosimilar Contract Manufacturing Market, By Therapeutic Area

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Chronic & Autoimmune Disorders

- Rheumatoid Arthritis

- Others

Global Biosimilar Contract Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 243 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |