Global Bone Marrow Failure Market

Global Bone Marrow Failure Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Therapeutics, Diagnostic Tests, and Supportive Care Products), By Application (Aplastic Anemia, Myelodysplastic Syndromes, and Other Bone Marrow Disorders), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Bone Marrow Failure Market Size Insights Forecasts to 2035

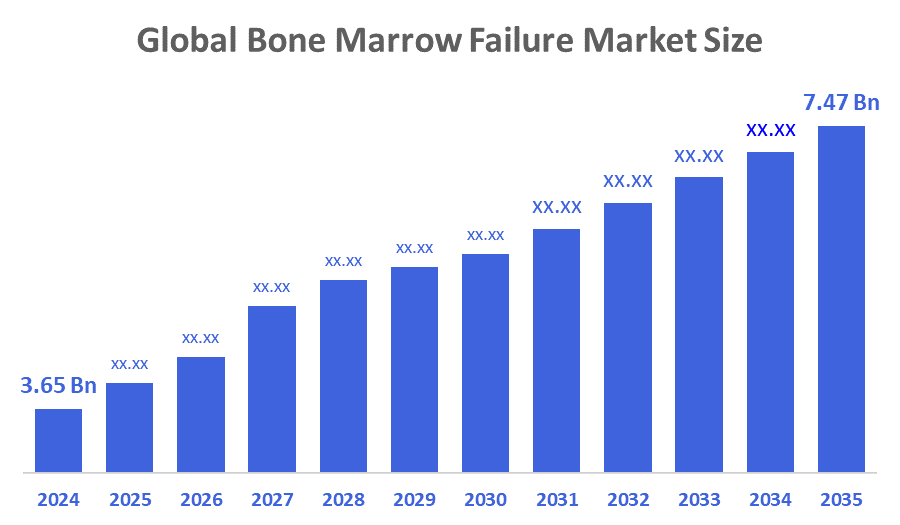

- The Global Bone Marrow Failure Market Size Was Estimated at USD 3.65 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.73 % from 2025 to 2035

- The Worldwide Bone Marrow Failure Market Size is Expected to Reach USD 7.47 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Bone Marrow Failure Market Size Was Worth Around USD 3.65 Billion In 2024 And Is Predicted To Grow To Around USD 7.47 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.73 % From 2025 To 2035. Several things are driving this growth, such as more individuals managing bone marrow disorders, and novel therapies keep arising. Additionally, individuals are now recognising these health issues earlier and taking action to address them. There is a strong drive toward new treatments—such as gene therapy and stem cell transplants. The available options are no longer merely experimental; physicians are employing them increasingly in daily medical practice.

Market Overview

Bone marrow failure happens when the body doesn’t make enough blood cells and ends up with low red blood cells, so they experience tiredness, weakness, and possibly breathlessness. With a decreased amount of white blood cells become more susceptible to infections. In case there is a deficiency in platelets, they bruise and bleed more easily than usual. It’s possible see your complexion appear pale, small red dots appear beneath the skin, or occasionally your liver or spleen gets bigger. The physician typically begins by inquiring about your medical background and looking over. They might use flow cytometry—a test that tags your cells with fluorescent markers to check for specific signs of disease. Afterwards comes the bone marrow aspiration along with the biopsy, which is the place where a sample is taken in order to determine how many cells are being made and whether anything looks off with blood cell production. The World Health Organisation says bone marrow failure syndromes are becoming more common. In the U.S. alone, doctors diagnose about 5,000 new cases of aplastic anaemia every year. Thanks to better diagnostics, people are getting diagnosed earlier, which means more patients need treatment. Drug companies are pouring more money into research and development, looking for new therapies and ways to improve how we treat these conditions. Biotech firms and research institutions are teaming up more than ever, and that’s pushing the field forward. Together, they’re coming up with fresh solutions for patients who still don’t have great treatment options.

Report Coverage

This research report categorizes the bone marrow failure market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bone marrow failure market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the bone marrow failure market.

Driving Factors

Growing numbers of individuals are managing genetic disorders that mess with bone marrow function and prevent it from producing enough blood cells, which is really pushing the bone marrow failure market forward. Moreover, there is an increasing amount of risk factors—such as toxins, hazardous chemicals, vitamin deficiencies, viral infections, and certain meds. All of these are adding even more momentum. Many physicians are turning to stem cell therapies now. Basically, they exchange the faulty bone marrow with healthy tissue, which restores blood cell production. This shift is giving the market a significant lift. Immunosuppressants such as anti-thymocyte globulin and cyclosporine are also getting a lot of attention. Moreover, there is androgen hormone treatment, which is catching on because it kickstarts erythrocyte production and raises total blood counts. All these factors are set to keep the market for bone marrow failure expanding during the upcoming years.

Restraining Factors

The bone marrow failure market faces challenges from supply chain bottlenecks and regulatory hurdles. Logistical issues, manufacturing complexities, and stringent approval processes delay therapy availability, limiting patient access and slowing overall market growth despite a positive outlook.

Market Segmentation

The Bone marrow failure market share is classified into product type and application.

- The therapeutics segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the product type, the bone marrow failure market is divided into therapeutics, diagnostic tests, and supportive care products. Among these, the therapeutics segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of this segment is driven by the increasing demand for better treatment options, including immunosuppressive therapies and stem cell transplants. This growth is supported by improvements in diagnostic technologies that allow for earlier detection of bone marrow disorders.

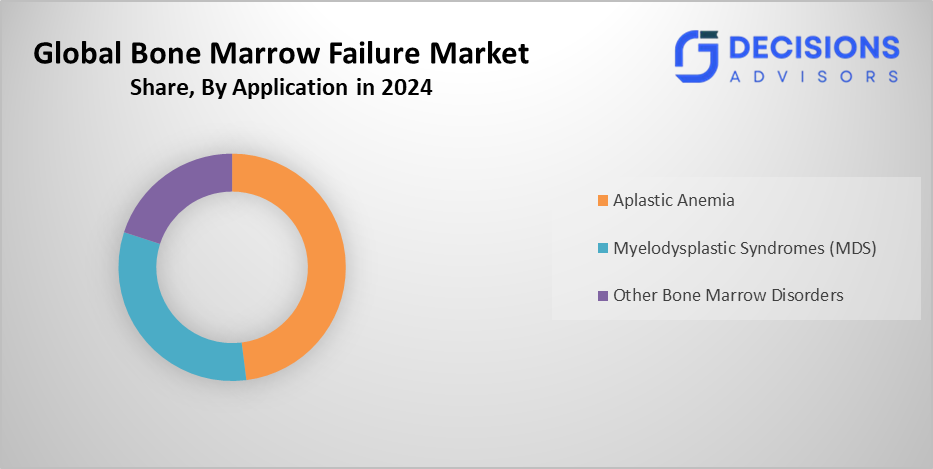

- The aplastic anaemia segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the bone marrow failure market is divided into aplastic anaemia, myelodysplastic syndromes, and other bone marrow disorders. Among these, the aplastic anaemia segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth of this segment is driven by the rising number of disease cases and the availability of effective treatment options. This is supported by increased awareness and improvements in treatment methods.

Regional Segment Analysis of the Bone Marrow Failure Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the bone marrow failure market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the bone marrow failure market over the predicted timeframe. A growing number of individuals are getting sick, and healthcare spending keeps going up. Countries such as China and India are experiencing an increase in cases of bone marrow disorders, so there’s a bigger need for treatments. Efforts like India’s National Health Mission aim to make medical care simpler to obtain and better overall, which pushes the market forward. In addition, when healthcare providers and drug manufacturers join forces, they eventually develop new approaches for treating these disorders.

In January 2026, ShardaCare-Healthcity, Greater Noida, inaugurated its Institute of Bone Marrow Transplant to treat complex blood disorders in children and adults. The centre will address leukaemia, lymphoma, multiple myeloma, aplastic anaemia, thalassemia, and sickle cell disease, with advanced transplant techniques.

Europe is expected to grow at a rapid CAGR in the bone marrow failure market during the forecast period. Germany and the UK lead the way here. More people are dealing with bone marrow disorders, and new treatments are catching on fast. The European Medicines Agency has rolled out policies that actually make it easier to develop advanced therapies, and that’s giving the market a boost. Moreover, as personalised medicine gets more attention, demand for targeted therapies just keeps climbing across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bone marrow failure market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Celgene Corporation (Bristol-Myers Squibb)

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Novartis AG

- Takeda Pharmaceutical Company Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Australia established the Australian Marrow Failure Biobank (AMFB), led by Monash University and Maddie Riewoldt’s Vision, to accelerate breakthroughs in rare bone marrow failure syndromes. The biobank integrates biospecimens with clinical data, supporting nationwide collaboration and advancing research into life-threatening blood disorders.

- In June 2025, the FDA approved omidubicel?only (Omisirge, Gamida Cell Ltd), the first HSCT therapy for severe aplastic anaemia. Indicated for patients aged six and older without compatible donors, the cord blood stem cell therapy enhanced with nicotinamide achieved neutrophil engraftment in 12 of 14 patients, with a median recovery in 11 days.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the bone marrow failure market based on the below-mentioned segments:

Global Bone Marrow Failure Market, By Product Type

- Therapeutics

- Diagnostic Tests

- Supportive Care Products

Global Bone Marrow Failure Market, By Application

- Aplastic Anaemia

- Myelodysplastic Syndromes

- Other Bone Marrow Disorders

Global Bone Marrow Failure Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the market size and growth rate?

The market was USD 3.65 billion in 2024 and is expected to reach USD 7.47 billion by 2035, with a CAGR of 6.73% from 2025 to 2035.

- What is bone marrow failure?

It occurs when the bone marrow fails to produce enough blood cells, causing fatigue, infections, bruising, bleeding, paleness, and enlarged organs due to low red cells, white cells, or platelets.

- Which product type leads the market?

Therapeutics dominated in 2024 and is projected to grow at a remarkable CAGR, driven by demand for immunosuppressants, stem cell transplants, and androgen therapies.

- What application has the highest revenue?

Aplastic anaemia led revenue in 2024 and is expected to grow at a significant CAGR due to rising cases and effective treatments like transplants.

- Which regions are dominant?

Asia-Pacific holds the largest share due to rising cases and healthcare investments in China and India; North America grows fastest with advanced diagnostics and therapies.

- What are the key recent developments?

ShardaCare-Healthcity (India) opened a bone marrow transplant institute in Jan 2026; FDA approved Omisirge for aplastic anaemia in Jun 2025; Australia launched a biobank in Jul 2025.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |