Global Botanical Bioactives Market

Global Botanical Bioactives Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Source (Herbs, Spices, Fruits, and Vegetables), By Application (Dietary Supplements, Functional Food & Beverages, Pharmaceuticals, and Cosmetics & Personal Care), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Botanical Bioactives Market Summary, Size & Emerging Trends

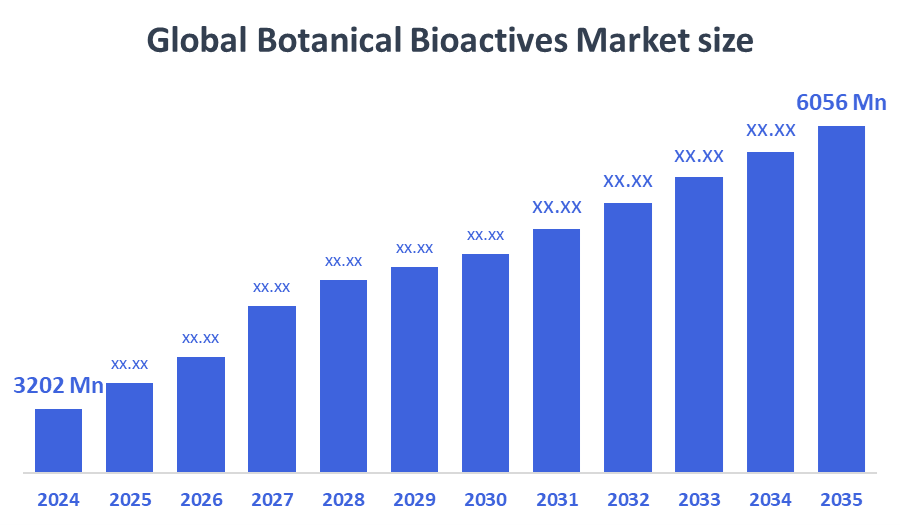

According to Decision Advisors, The Global Botanical Bioactives Market Size is Expected to Grow from USD 3,202 Million in 2024 to USD 6,056 Million by 2035, at a CAGR of 5.96% during the forecast period 2025-2035. Growing demand for natural health products, plant-derived ingredients, and clean-label supplements is a key driver for the botanical bioactives market.

Key Market Insights

- Europe is expected to account for the largest market share due to rising demand for herbal health solutions and regulatory support.

- In terms of application, the dietary supplements segment led the market in 2024 due to consumer preference for plant-based wellness products.

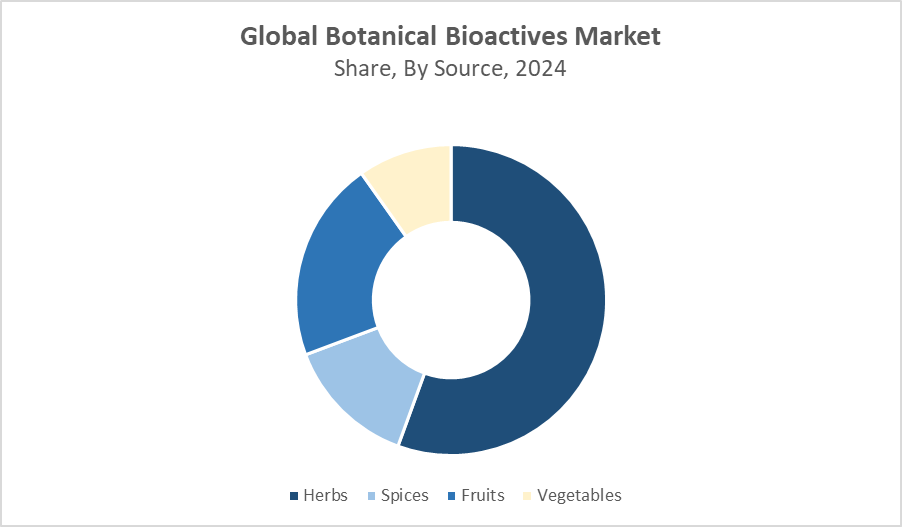

- Herbs remain the leading source of botanical bioactives owing to their long-standing use in traditional and modern medicine.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3,202 Million

- 2035 Projected Market Size: USD 6,056 Million

- CAGR (2025-2035): 5.96%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Botanical Bioactives Market

The botanical bioactives market revolves around naturally occurring compounds extracted from plants that exhibit biological activity beneficial to human health. These bioactives are widely used in dietary supplements, functional foods, pharmaceuticals, and cosmetics due to their antioxidant, anti-inflammatory, and therapeutic properties. Rising consumer preference for natural and organic ingredients, combined with the increased focus on preventive healthcare, is accelerating market demand. Companies are leveraging plant-based innovations to meet clean-label trends and respond to growing regulatory scrutiny. The market is also supported by investments in research & development, ensuring the extraction, standardization, and commercialization of high-quality botanical ingredients.

Botanical Bioactives Market Trends

- Clean-label and organic demand are pushing manufacturers to innovate with transparent sourcing and plant-based formulations.

- Integration of botanical extracts in sports nutrition, cognitive health, and anti-aging products is rising.

- Biotechnology and green chemistry are improving the extraction and efficiency of bioactive compounds.

Botanical Bioactives Market Dynamics

Driving Factors: Consumers increasingly prefer natural supplements over synthetic options

The botanical bioactives market is experiencing strong growth due to rising awareness of the health benefits of plant-based compounds. Consumers increasingly prefer natural supplements over synthetic options, driven by trends in clean-label, organic, and holistic wellness. Ageing populations and rising chronic diseases further support demand, particularly for preventive and personalised nutrition. Additionally, regulatory bodies in Europe and Asia are easing rules around herbal products, encouraging innovation and commercial adoption. Manufacturers are responding by diversifying their product portfolios with plant-derived ingredients that align with modern health-conscious lifestyles, promoting sustainable, effective alternatives for immunity, digestion, cognitive health, and general well-being.

Restraint Factors: Adulteration and potency inconsistencies in raw botanicals raise concerns among manufacturers

Despite its potential, the botanical bioactives market faces scalability issues due to high production costs and raw material variability. Many plant sources depend on seasonality and geographic factors, leading to inconsistent supply and quality. The absence of standardised testing methods across regions makes it difficult to validate safety, dosage, and efficacy. Regulatory frameworks are fragmented globally, complicating market entry and compliance. Additionally, adulteration and potency inconsistencies in raw botanicals raise concerns among manufacturers and healthcare providers. Some traditional extracts also lack robust clinical validation, limiting their acceptance in regulated pharmaceutical or therapeutic settings, especially in more scientifically rigorous markets.

Opportunity: The global rise in plant-based diets and veganism is fueling demand for natural

Emerging markets such as India, Brazil, and Southeast Asia offer substantial growth opportunities, with governments modernising traditional medicine systems like Ayurveda and TCM to meet global standards. Increasing investments in healthcare infrastructure and rising disposable incomes are expanding consumer access to natural health solutions. On the technological front, innovations in extraction techniques, encapsulation, and nanotechnology are enhancing the bioavailability and effectiveness of botanical bioactives. Additionally, the global rise in plant-based diets and veganism is fueling demand for natural, plant-derived ingredients across food, beverage, and nutraceutical sectors, creating new avenues for product development and targeted functional health solutions.

Challenges: International trade tensions and restrictions may hinder the export and import of key ingredients

The market faces notable challenges related to sourcing and geopolitical instability. Seasonal and climate-related fluctuations can impact the availability and quality of botanical raw materials, disrupting supply chains. Moreover, international trade tensions and restrictions may hinder the export and import of key ingredients, especially for companies dependent on cross-border sourcing. Consumer skepticism also remains a barrier, particularly in Western markets where evidence-based medicine dominates. Without sufficient clinical studies or regulatory approvals, some consumers and practitioners remain cautious about the effectiveness of botanical bioactives. These factors require industry-wide efforts in quality control, traceability, and scientific validation to ensure sustained growth.

Global Botanical Bioactives Market Ecosystem Analysis

The ecosystem includes raw material growers (herbal farms and cultivators), extract manufacturers, nutraceutical and pharma companies, formulators, regulatory agencies, and end-users across food, healthcare, and cosmetic industries. Collaboration across this chain is critical to ensure quality, traceability, and efficacy. Countries like India and China dominate as raw material suppliers, while Europe and North America are key consumers. This dynamic interplay ensures continued market innovation, regulatory evolution, and commercial scale-up.

Global Botanical Bioactives Market, By Source

What key advantages helped the herbs segment outperform others in the global botanical bioactives market in 2024?

The herbs segment dominated the global botanical bioactives market, accounting for approximately 40% of total revenue, owing to its wide range of applications, long-standing traditional use, and high consumer trust. Herbs are widely recognised for their therapeutic benefits and are integral to dietary supplements, pharmaceuticals, functional foods, and cosmetics. Their well-documented safety profiles, combined with a strong foundation in traditional medicine systems like Ayurveda, Traditional Chinese Medicine, and Western herbalism, have made them highly marketable. Growing consumer preference for natural and plant-based health solutions, alongside increased R&D validating the efficacy of herbal bioactives, further boosted their market position.

How did the fruits segment achieve its substantial market share in the botanical bioactives market in 2024?

The fruits segment held a significant 30% share of the global botanical bioactives market due to their rich content of vitamins, antioxidants, and phytochemicals that provide numerous health benefits. Fruits are widely used across dietary supplements, functional foods, and nutraceuticals, making them highly versatile and in demand. Their natural appeal, combined with growing consumer awareness about preventive healthcare and clean-label products, contributed to their strong market position. Additionally, advancements in extraction technologies have enhanced the availability and potency of fruit-derived bioactives, further boosting their competitive edge.

Global Botanical Bioactives Market, By Application

Why was the dietary supplements category preferred over other botanical bioactive applications in 2024?

The dietary supplements segment dominated the botanical bioactives market, holding approximately 45% of the total market share, driven by the rising consumer focus on health, wellness, and preventive care. The segment benefits from strong consumer trust in natural, plant-based ingredients that support immune health, energy, and overall well-being. The versatility of botanical bioactives in supplement formulations, combined with growing awareness and accessibility through retail and e-commerce channels, has significantly boosted market penetration. Additionally, ongoing scientific research validating the efficacy of bioactive compounds has further enhanced consumer confidence.

What made functional foods and beverages a major segment in the global botanical bioactives market in 2024?

Functional foods and beverages constituted approximately 30% of the botanical bioactives market, driven by increasing consumer demand for convenient and health-promoting products. The integration of botanical bioactives into everyday food and drink options offers a natural way to enhance nutrition, support wellness, and prevent chronic diseases, making these products highly attractive. Innovations in formulation and flavor enhancement have improved the appeal and effectiveness of these products, encouraging wider adoption. Additionally, rising awareness of the benefits of plant-based ingredients and clean-label products has fueled growth in this segment.

Europe leads the botanical bioactives market with an estimated 35% share, driven by strong consumer demand for herbal wellness products and natural health solutions. Countries like Germany and France have well-established herbal medicine traditions supported by favourable regulatory frameworks that encourage product safety and efficacy. The growing emphasis on clean-label products and sustainability is influencing manufacturers to develop eco-friendly and transparent formulations. Additionally, increasing consumer awareness around preventive health and organic ingredients supports market growth.

Asia Pacific is the fastest-growing market for botanical bioactives market, with a projected CAGR of 9.8%. This growth is fueled by the widespread use of traditional medicine systems such as Ayurveda, Traditional Chinese Medicine, and other indigenous therapies that heavily rely on botanical ingredients. Rising middle-class incomes and urbanisation increase consumer spending on health and wellness products. Significant investments in healthcare infrastructure and the modernization of traditional practices boost demand.

WORLDWIDE TOP KEY PLAYERS IN THE BOTANICAL BIOACTIVES MARKET INCLUDE

- Naturex (Givaudan)

- Sabinsa Corporation

- DSM Nutritional Products

- Indena S.p.A.

- Arjuna Natural Pvt. Ltd.

- Nutraceutical Corporation

- Glanbia Nutritionals

- Herbalife Nutrition Ltd.

- Kemin Industries

- Symrise AG

- Others

Product Launches in Botanical Bioactives Market

- In May 2024, Arjuna Natural unveiled a new turmeric extract designed with enhanced bioavailability to improve cognitive health benefits. This product leverages patented green extraction technology, which aligns with clean-label and sustainability trends—important factors for today’s health-conscious consumers. The improved absorption ensures better efficacy, making it attractive for use in dietary supplements and functional foods targeting brain health and memory support.

- In January 2024, DSM Nutritional Products launched a multi-botanical blend specifically formulated for sports recovery drinks. This innovation targets the rapidly growing functional beverage segment in Europe and North America, aiming to meet the needs of active consumers seeking natural solutions for muscle recovery, inflammation reduction, and energy restoration. The blend combines various plant-based bioactives to deliver synergistic health benefits in convenient drink formats.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the botanical bioactives market based on the below-mentioned segments:

Global Botanical Bioactives Market, By Source

- Herbs

- Spices

- Fruits

- Vegetables

Global Botanical Bioactives Market, By Application

- Dietary Supplements

- Functional Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

Global Botanical Bioactives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. Which region holds the largest share in the botanical bioactives market and why?

Europe is the largest market due to its established herbal medicine traditions, strong consumer demand for natural health solutions, favorable regulatory frameworks, and growing emphasis on clean-label and sustainable products.

Q. Why is Asia Pacific the fastest-growing market?

The Asia Pacific market is expanding rapidly because of widespread use of traditional medicine systems like Ayurveda and Traditional Chinese Medicine, increasing middle-class incomes, urbanization, government initiatives to modernize traditional medicines, and investments in healthcare infrastructure.

Q. What are the main sources of botanical bioactives?

The market is segmented by source into herbs, spices, fruits, and vegetables. Herbs dominate due to their broad applications and traditional use, while fruits hold a significant share due to their rich antioxidant and phytochemical content.

Q. Why do dietary supplements lead the application segment?

Dietary supplements hold the largest share because of consumer focus on health and wellness, trust in natural ingredients, accessibility via retail and e-commerce, and growing scientific validation of botanical bioactives.

Q. What challenges does the market face?

Challenges include variability and adulteration of raw materials, high production costs, fragmented regulatory landscapes, supply chain disruptions due to geopolitical issues, and consumer skepticism in evidence-based medicine markets due to limited clinical validation.

Q. What opportunities are available in the botanical bioactives market?

Opportunities exist in emerging markets such as India and Brazil, modernization of traditional medicine systems, technological innovations in extraction and delivery, and increasing global adoption of plant-based diets and vegan lifestyles.

Q. Who are the key players in the botanical bioactives market?

Key market players include Naturex (Givaudan), Sabinsa Corporation, DSM Nutritional Products, Indena S.p.A., Arjuna Natural Pvt. Ltd., Nutraceutical Corporation, Glanbia Nutritionals, Herbalife Nutrition Ltd., Kemin Industries, and Symrise AG.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |