Brazil 3PL Market

Brazil 3PL Market Size, Share, and COVID-19 Impact Analysis, By Services (Domestic Transportation Management, International Transportation Management, Other), By End User (Automobile, Retail and E-Commerce, Manufacturing, Life Sciences and Healthcare, Other), By Logistics Model (Asset-Light, Asset-Heavy, and Hybrid), and Brazil 3PL Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil 3PL Market Size Insights Forecasts to 2035

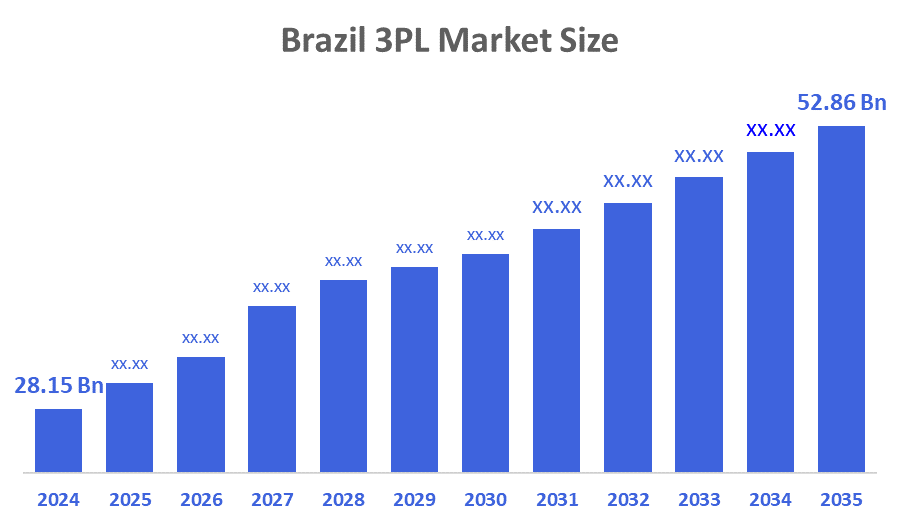

- The Brazil 3PL Market Size Was Estimated at USD 28.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.9% from 2025 to 2035

- The Brazil 3PL Market Size is Expected to Reach USD 52.86 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil 3PL Market Size is anticipated to Reach USD 52.86 Billion by 2035, Growing at a CAGR of 5.9% from 2025 to 2035. The Brazil 3PL market is driven by expanding e-commerce, growth in retail and manufacturing, rising demand for efficient transportation and warehousing, increased international trade, infrastructure development, and companies’ focus on cost reduction, scalability, and supply chain optimization through outsourcing logistics activities.

Market Overview

Third-party logistics (3PL) is a concept where a company hires an external service provider to manage its logistics functions, which may include the transportation, warehousing, storage, and delivery of goods. Rather than controlling every aspect by themselves, enterprises engage 3PL vendors to save time, cut expenses, and deliver products to customers in the most efficient way. Besides the growth factors, the market is characterized by rapid e-commerce expansion, increased domestic and international trade, extensive investments in transportation and warehousing infrastructure, rising demand for efficient supply chain solutions, widespread technological adoption, and businesses' tendency to focus on cost reduction and service flexibility. Trends in Brazil 3PL market indicate that the government's regulatory reforms and the incentives aimed at attracting foreign investment in the logistics and transportation sectors are being implemented effectively. In addition to that, the revival of the manufacturing industry and the booming exports of agricultural commodities have contributed heavily to the increased demand for integrated supply chain services. According to an industry report, in 2024, Brazil's agribusiness sector was a major contributor to the country's export revenue, making a total of USD 164.4 billion in exports and thus, representing 49% of the overall export value of Brazil. Furthermore, the use of digital technologies like warehouse automation, GPS tracking, and data analytics is quite significant in restructuring the capabilities of 3PL providers. Also, companies that are under greater cost optimization pressure, need to scale more quickly and want to improve customer satisfaction are the ones primarily responsible for the strategic outsourcing of logistics functions to specialized third, party providers.

Report Coverage

This research report categorizes the market for the Brazil 3PL market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil 3PL market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil 3PL market.

Driving Factors

The Brazil 3PL market is driven by rising demand for faster and more reliable logistics services across industries. Growth in online shopping, retail expansion, and industrial production increases the need for professional transportation and warehousing. Companies prefer outsourcing logistics to reduce operational costs and improve efficiency. Expanding road networks, ports, and logistics hubs support smoother goods movement. Additionally, supply chain complexity and the need for flexible, scalable logistics solutions continue to boost demand for 3PL services across Brazil.

Restraining Factors

The Brazil 3PL market faces restraints such as inadequate transportation infrastructure in remote regions, high logistics and fuel costs, and traffic congestion. Regulatory complexities, tax burdens, and customs delays increase operational challenges. Additionally, security issues, cargo theft, and limited adoption of advanced technologies by smaller providers restrict overall market efficiency and growth.

Market Segmentation

The Brazil 3PL market share is classified into services, end users, and logistics models.

- The domestic transportation management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil 3PL market is segmented by services into domestic transportation management, international transportation management, and other. Among these, the domestic transportation management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Domestic transportation management dominates because Brazil has a vast geographic area and a strong dependence on road freight for moving goods within the country. High domestic demand from agriculture, manufacturing, retail, and rapidly growing e-commerce drives a continuous need for nationwide distribution. Companies increasingly outsource domestic logistics to reduce costs, improve delivery speed, and manage complex last-mile operations. Compared to international logistics, internal freight volumes are significantly higher, supporting this segment’s leadership.

- The retail and e-commerce segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil 3PL market is segmented by end user into automobile, retail and e-commerce, manufacturing, life sciences, healthcare, and other. Among these, the retail and e-commerce segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Retail and e-commerce dominate due to rapid growth in online shopping, digital marketplaces, and omnichannel retail models. Increasing consumer expectations for fast delivery, efficient returns, and real-time tracking push retailers to outsource logistics operations. 3PL providers support this segment with warehousing, inventory management, order fulfilment, and last-mile delivery services. Compared to other end users, retail and e-commerce generate higher shipment volumes and require continuous logistics support, strengthening their market dominance.

- The asset-light segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil 3PL market is segmented by logistics models into asset-light, asset-heavy, and hybrid. Among these, the asset-light segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The asset-light segment dominates because it offers greater flexibility, lower capital investment, and faster scalability compared to asset-heavy models. Brazilian shippers prefer asset-light providers that can quickly adapt to demand fluctuations, regional complexities, and seasonal volumes by using outsourced fleets and warehouses. This model also reduces operational risks and costs for 3PL companies while enabling them to focus on technology, network optimization, and customer service, making it widely adopted across industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil 3PL market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DHL Supply Chain (Deutsche Post AG

- A.P.?Moller – Maersk Logistics & Services

- BBM Logística SA

- JSL SA

- CEVA Logistics AG

- Kuehne?+?Nagel International AG

- C.H. Robinson Worldwide Inc.

- FedEx Corp.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In May 2025, Uber and iFood announced a strategic partnership in Brazil, integrating their services. iFood users can now book Uber rides, while Uber users gain access to iFood’s delivery services. This partnership enhances logistics and delivery efficiency, leveraging 3PL capabilities to improve convenience and streamline consumer experiences across Brazil.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil 3PL market based on the below-mentioned segments:

Brazil 3PL Market, By Services

- Domestic Transportation Management

- International Transportation Management

- Other

Brazil 3PL Market, By End User

- Automobile

- Retail and E-Commerce

- Manufacturing

- Life Sciences and Healthcare

- Other

Brazil 3PL Market, By Logistics Model

- Asset-Light

- Asset-Heavy and Hybrid

FAQ’s

Q1: What drives the demand for 3PL services in Brazil?

Growing e-commerce, expanding retail chains, and rising domestic transportation needs push companies to outsource logistics for efficiency, cost reduction, and faster delivery.

Q2: Which service segment is most used in Brazil 3PL?

Domestic transportation management dominates due to Brazil’s large geography and heavy reliance on road freight for intra-country shipments.

Q3: What end-user industries benefit most from 3PL?

Retail and e-commerce lead, followed by manufacturing, healthcare, and automotive sectors requiring scalable logistics and fast order fulfilment.

Q4: Why is the asset-light model preferred?

Asset-light providers reduce capital investment, increase flexibility, and allow rapid expansion by leveraging outsourced transport and warehouse networks.

Q5: Are international logistics services significant in Brazil?

They are growing but smaller than domestic services, mostly supporting exports, imports, and cross-border supply chain operations.

Q6: What challenges do 3PL providers face in Brazil?

Poor road conditions, high freight costs, complex regulations, and regional disparities increase operational challenges for logistics companies.

Q7: What opportunities exist in the Brazil 3PL market?

Rising e-commerce, technology adoption, and last-mile delivery demand create growth potential for flexible, tech-driven 3PL solutions.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 142 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |