Brazil Acai Berry Market

Brazil Acai Berry Market Size, Share, and COVID-19 Impact Analysis, By Product Form (Frozen Acai Puree, Powdered Acai, Acai Extract, Organic Acai), By Application (Smoothies & Juices, Dietary Supplements, Cosmetic Products, Superfoods), By End User (Food & Beverage, Nutraceutical Brands, Personal Care, Health Food Retailers), and Brazil Acai Berry Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Acai Berry Market Insights Forecasts to 2035

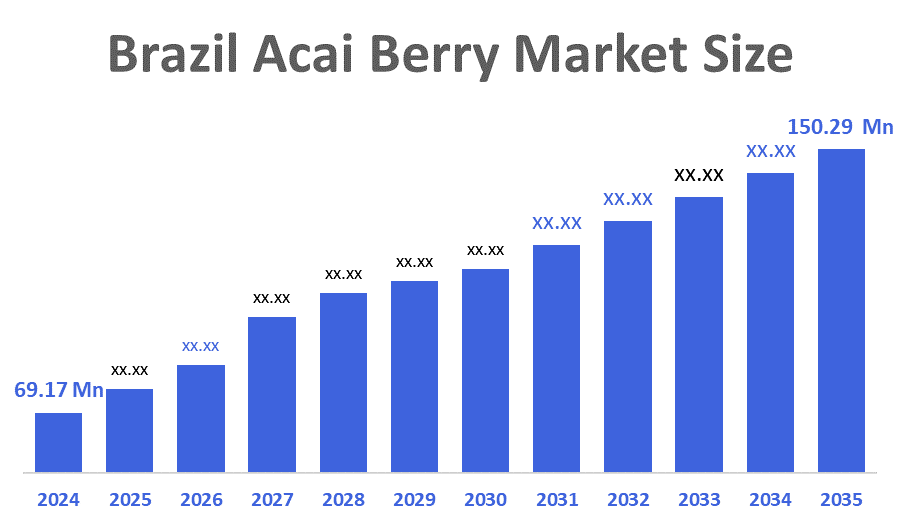

- The Brazil Acai Berry Market Size Was Estimated at USD 69.17 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.6% from 2025 to 2035

- The Brazil Acai Berry Market Size is Expected to Reach USD 150.29 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Brazil Acai Berry Market size is anticipated to reach USD 150.29 million by 2035, growing at a CAGR of 7.6% from 2025 to 2035. The Brazil açaí berry market is driven by rising health awareness, increasing demand for natural superfoods, strong domestic consumption, expanding export opportunities, growing use in beverages and supplements, and Brazil’s abundant açaí production, supported by favorable climatic conditions.

Market Overview

Açaí berry is a small, dark purple fruit harvested from the açaí palm tree native to the Amazon rainforest. It is rich in antioxidants, fiber, healthy fats, vitamins, and minerals, and is widely consumed in smoothies, bowls, juices, supplements, and functional food products. Additionally, the growth of the Brazil açaí berry market is driven by increasing health and wellness awareness, rising demand for antioxidant-rich superfoods, growing use in functional foods, beverages, and dietary supplements, expanding export demand, and strong domestic availability supported by Brazil’s natural açaí cultivation. Furthermore, the future outlook for the Brazil acai berry market appears promising, with steady growth anticipated due to increasing global demand for superfoods and health-conscious products. Acai berries are gaining popularity for their numerous health benefits, such as being rich in antioxidants and nutrients. Additionally, the trend towards health and wellness has also contributed to the rise in acai consumption, as consumers are seeking out natural and nutrient-rich foods. Additionally, the export market for Brazilian acai has been expanding, with countries around the world recognizing the quality and authenticity of acai products originating from Brazil. Overall, the Brazil acai berry market is witnessing steady growth driven by consumer preferences for healthy and natural food options.

The Brazilian government has various policies in place to regulate the acai berry market. The harvesting and trading of acai berries are monitored by environmental agencies to ensure sustainable practices and protect the Amazon rainforest, where the berries are primarily grown. Additionally, there are regulations to maintain quality standards and prevent adulteration of acai products. The government also supports the promotion of acai berries through marketing campaigns and initiatives to increase domestic consumption and boost exports. Overall, the policies aim to balance economic growth with environmental conservation and promote the sustainable development of the acai industry in Brazil.

Report Coverage

This research report categorizes the market for the Brazil acai berry market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil acai berry market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil acai berry market.

Driving Factors

The Brazil acai berry market is driven by rising consumer awareness of health and wellness, increasing demand for antioxidant-rich superfoods, and growing popularity of açaí-based beverages, smoothies, and functional foods. Strong domestic consumption, expanding export demand, and rising use in dietary supplements and cosmetics further support growth. Additionally, Brazil’s abundant natural resources, favorable climate, and improving processing and distribution infrastructure enhance market expansion.

Restraining Factors

The Brazil acai berry market faces restraints such as seasonal availability of raw acai, supply chain inefficiencies in remote Amazon regions, and price volatility. Limited cold storage and processing infrastructure, quality standardization challenges, and dependence on exports also restrict growth. Additionally, environmental concerns and sustainability regulations may increase production and logistics costs.

Market Segmentation

The Brazil acai berry market share is categorized by product form, application and end user.

- The frozen acai puree segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil acai berry market is segmented by product form into frozen acai puree, powdered acai, acai extract, and organic acai. Among these, the frozen acai puree segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its extensive use in traditional açaí bowls, smoothies, and beverages across the country. It retains the natural taste, texture, and nutritional value of fresh açaí better than other forms. High demand from foodservice outlets, juice bars, and quick-service restaurants, along with easy blending, longer shelf life through freezing, and strong consumer preference, further support the dominance of this segment.

- The smoothies & juices segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil acai berry market is segmented by application into smoothies & juices, dietary supplements, cosmetic products, and superfoods. Among these, the smoothies & juices segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to açaí’s traditional consumption as a blended beverage in Brazil, strong consumer preference for smoothies and juices, high availability in juice bars and foodservice outlets, ease of preparation, refreshing taste, and growing demand for natural, antioxidant-rich, and energy-boosting drinks among health-conscious consumers.

- The food & beverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil acai berry market is segmented by end user into food & beverage, nutraceutical brands, personal care, and health food retailers. Among these, the food & beverage segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to widespread consumption of açaí in traditional bowls, smoothies, juices, and desserts across the country. Strong demand from juice bars, cafés, restaurants, and packaged food manufacturers drives large-volume usage. Açaí’s versatility as an ingredient, appealing taste, and perception as a natural energy-boosting superfood further increase its adoption in food and beverage products. Additionally, continuous product innovation and growing health-conscious consumer trends support this segment’s leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil acai berry market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sambazon

- Frooty Açaí

- Açai Roots

- Amazonia Exportação

- Acai Exotic

- Rainforest Foods

- Acai Berry Company

- Petruz Açaí

- Tropfruit

- Açaí do Pará

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Sambazon, a leading acai berry brand, announced the launch of their new line of organic acai bowls, expanding their product portfolio and catering to the growing consumer demand for healthy, convenient food options.

- In November 2022, Tropical Acai launched organic shelf-stable liquid acai pulp, known as Acai Bowl in a Bag. The company offered unique, delicious, healthy Product Form to market, with aimed to provide best quality Acai to the market.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil acai berry market based on the below-mentioned segments:

Brazil Acai Berry Market, By Product Form

- Frozen Acai Puree

- Powdered Acai

- Acai Extract

- Organic Acai

Brazil Acai Berry Market, By Application

- Smoothies & Juices

- Dietary Supplements

- Cosmetic Products

- Superfoods

Brazil Acai Berry Market, By End User

- Food & Beverage

- Nutraceutical Brands

- Personal Care

- Health Food Retailers

FAQ’s

1. What is açaí berry?

- Açaí is a nutrient-rich fruit from the Amazon, known for high antioxidant and energy-boosting properties.

2. What drives the Brazil açaí berry market?

- Rising health awareness, strong domestic consumption, and growing demand for natural superfoods drive the market.

3. Which product form dominates the market?

- Frozen açaí puree dominates due to its widespread use in beverages and açaí bowls.

4. Which application segment leads the market?

- Smoothies and juices lead because of traditional consumption and high demand from foodservice outlets.

5. Which end-user segment dominates?

- The food and beverage segment dominates due to extensive use in drinks, desserts, and packaged foods.

6. What are the key challenges in the market?

- Seasonal availability, supply chain limitations, price volatility, and sustainability concerns are major challenges.

7. What is the future outlook of the market?

- The market is expected to grow steadily, supported by export demand, product innovation, and health-focused consumption trends.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 222 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |