Brazil Agricultural Biologicals Market

Brazil Agricultural Biologicals Market Size, Share, By Function (Crop Nutrition, Crop Protection), By Crop Type (Cash Crops, Horticultural Crops, Row Crops), By Mode of Application (Foliar Spray, Seed Treatment, Soil Treatment, Post-Harvest), Brazil Agricultural Biologicals Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Agricultural Biologicals Market Insights Forecasts to 2035

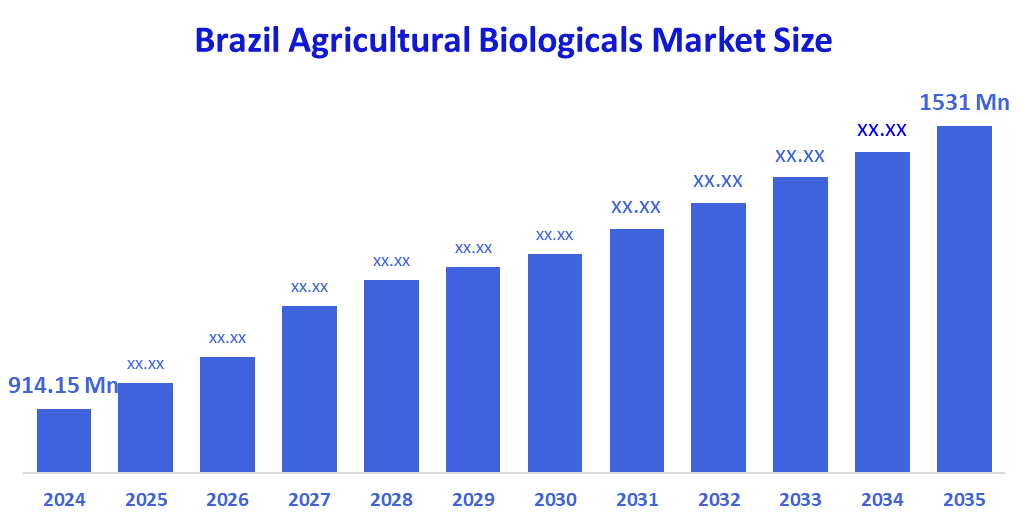

- Brazil Agricultural Biologicals Market Size 2024: USD 914.15 Mn

- Brazil Agricultural Biologicals Market Size 2035: USD 1531 Mn

- Brazil Agricultural Biologicals Market CAGR 2024: 4.8%

- Brazil Agricultural Biologicals Market Segments: Function, Crop Type, Mode of Application.

Agricultural biologicals refer to biologically based products that include biofertilizers, biopesticides, and biostimulants. These are substances that are introduced in agriculture to enhance crop growth, provide protection against pests and diseases, and improve soil fertility. Along with that, Agricultural biologicals offer sustainable, environmentally friendly solutions to the problem of global food demand. They allow for cleaner agriculture and hence, contribute to maintaining ecological balance and also promote long-term soil as well as ecosystem health. What's more, the Brazilian agricultural biologicals market is expanding as a result of increased demand for sustainable agriculture, government incentives for bio-based inputs, widespread adoption of biofertilizers and biopesticides, large-scale agricultural production, research breakthroughs, and farmers' awareness of the benefits to the environment and their economy.

The purpose of Brazil's Plano ABC+ is to help in the transition to low-carbon agriculture. To this effect, it foresees a subsidy of up to 50% on the total amount that is spent on agricultural biologicals, which is verified, supported by BRL 5.05 billion (USD 1.01 billion) for the 20242025 cycle. The scheme grants preferential credit to farms that are able to provide evidence of soil carbon gains. It does so, therefore, by encouraging participation in multiyear initiatives that lead to demand stabilization. When biological data is used to supplement carbon accounting protocols and extension services, it becomes easier to see that environmental performance is directly linked to policy incentives. This financial support contributes to lowering payback periods, thus making biologicals a strategic, cost-effective input. In addition, it creates a government-backed avenue for the agricultural biologicals market in Brazil to grow in a scalable manner.

The production and demand for biocontrol agents in Brazil were typically on a progressive wave. The demand for biopesticides, biofertilizers, and biostimulants is driven by environmental awareness and sustainable agriculture practices. Brazilian agribusinesses are developing biologically-based products by taking advantage of the country's biodiversity. The market will expand as more farmers use biological solutions to satisfy consumer demand for organic products and comply with environmental regulations. This trend is also reinforced by government programs that support sustainable agriculture and the gradual substitution of chemical inputs.

Agricultural biologicals have become a necessity in the agricultural sector in Brazil. The demand for sustainable, friendly farm practices is the major driving force for agricultural biologicals. The main end-use biological products are soybeans, sugarcane, coffee, maize, and fruits of the temperate climate. The use of biologicals is mainly attributed to high-value crops where quality and safety are the main concerns. Biopesticides are broadly used for pest and disease management, while biofertilizers improve soil health and nutrient availability. The demand for biostimulants is likewise on the rise, as they foment crop resilience and productivity under diverse environmental conditions. This phenomenon will be perpetuated by further R&D and the ever-increasing knowledge of biological product advantages.

Market Dynamics of the Brazil Agricultural Biologicals Market:

The Brazil agricultural biologicals market is driven by increasing adoption of sustainable farming practices and rising awareness of eco-friendly crop protection solutions. Government initiatives like Plano ABC+ provide financial incentives, reimbursements, and preferential credit for soil-carbon gains, encouraging farmers to invest in biologicals. Additionally, Brazil’s large-scale crop production, growing export demand, and technological advancements in biofertilizers, biopesticides, and biostimulants further propel market growth. Reduced reliance on chemical inputs and the focus on environmental sustainability make biologicals a preferred choice for Brazilian farmers.

The growth of Brazil’s agricultural biologicals market is restrained by high costs of bio-based products, limited awareness and technical knowledge among small-scale farmers, inconsistent regulatory frameworks, and the longer time required to see results compared to chemical inputs. Additionally, inadequate distribution networks and challenges in storage, formulation stability, and large-scale adoption hinder widespread use, slowing overall market expansion.

The Brazil agricultural biologicals market presents significant opportunities due to increasing government support for low-carbon and sustainable farming, including incentives like Plano ABC+. Rising demand for organic and environmentally friendly crops, coupled with growing awareness among farmers about soil health and long-term productivity, creates potential for market expansion. Advancements in microbial formulations, biostimulants, and integrated crop management technologies offer scope for innovation. Additionally, Brazil’s large-scale agriculture and export-oriented crop production provide a vast platform for scaling biological solutions nationwide.

Market Segmentation

The Brazil Agricultural Biologicals Market share is classified into function, crop type, and mode of application.

By Function:

The Brazil agricultural biologicals market is divided by function into crop nutrition and crop protection. Among these, the crop protection segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Crop protection dominates because Brazilian farmers face high pest and disease pressure due to the country’s tropical climate and year-round cropping. Biological crop protection products, such as biopesticides and biocontrol agents, are increasingly adopted to manage resistance to chemical pesticides and meet strict export residue standards. Government support for sustainable agriculture, faster regulatory approvals for biologicals, and proven field-level effectiveness further accelerate demand, making crop protection the leading phase type segment in Brazil.

By Crop Type:

The Brazil agricultural biologicals market is divided by crop type into cash crops, horticultural crops, and row crops. Among these, the row crops segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Row crops dominate due to Brazil’s extensive cultivation of soybeans, corn, and other grains across large agricultural areas. These crops rely heavily on biological inoculants, biopesticides, and biostimulants to improve soil fertility, enhance nitrogen fixation, and maintain high productivity. Additionally, strong export demand, increasing sustainability requirements, and the cost-effective application of biological inputs at scale drive higher adoption in row crops compared to cash and horticultural crops.

By mode of application:

The Brazil agricultural biologicals market is divided by mode of application into foliar spray, seed treatment, soil treatment, and post-harvest. Among these, the foliar spray segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Foliar spray dominates because it enables quick and uniform application of biological products directly onto plant surfaces, ensuring faster absorption and visible results. Farmers prefer this method for its flexibility, ease of integration with existing spraying equipment, and effectiveness in controlling pests and diseases during critical crop growth stages. Additionally, foliar application supports repeated use across large-scale farms, especially for row crops, driving higher adoption than seed, soil, or post-harvest treatments.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil agricultural biologicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Agricultural Biologicals Market:

- Bayer CropScience

- Corteva Agriscience

- FMC Corporation

- Novozymes

- Valagro

- Koppert Biological Systems

- Andermatt Group

- UPL Limited

- Valent BioSciences

- Vittia Fertilizantes e Biológicos

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil agricultural biologicals market based on the below-mentioned segments:

Brazil Agricultural Biologicals Market, By Function

- Crop Nutrition

- Crop Protection

Brazil Agricultural Biologicals Market, By Crop Type

- Cash Crops

- Horticultural Crops

- Row Crops

Brazil Agricultural Biologicals Market, By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Post-harvest

FAQ

1. How does Brazil’s climate influence the use of agricultural biologicals?

Brazil’s tropical and subtropical climate fosters high microbial activity, enhancing the effectiveness of biological products and promoting their widespread adoption.

2. Are agricultural biologicals used in integrated pest management in Brazil?

Yes, they are widely integrated with IPM programs to control pests and diseases while reducing dependence on synthetic chemicals.

3. Do agricultural biologicals help in export certification?

Yes, biological inputs help farmers meet international residue limits and sustainability standards required by major export markets.

4. Which farm size adopts agricultural biologicals the most in Brazil?

Large commercial farms lead adoption due to better access to technology, technical guidance, and economies of scale.

5. How is product innovation shaping this market?

Innovation focuses on multi-strain microbes, longer shelf life, and compatibility with chemical inputs, improving performance and farmer confidence.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 207 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |