Brazil Agriculture Market

Brazil Agriculture Market Size, Share, and COVID-19 Impact Analysis, By Type (Animal Produce, Crop Production), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, E-Commerce, Others), and Brazil Agriculture Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Agriculture Market Insights Forecasts to 2035

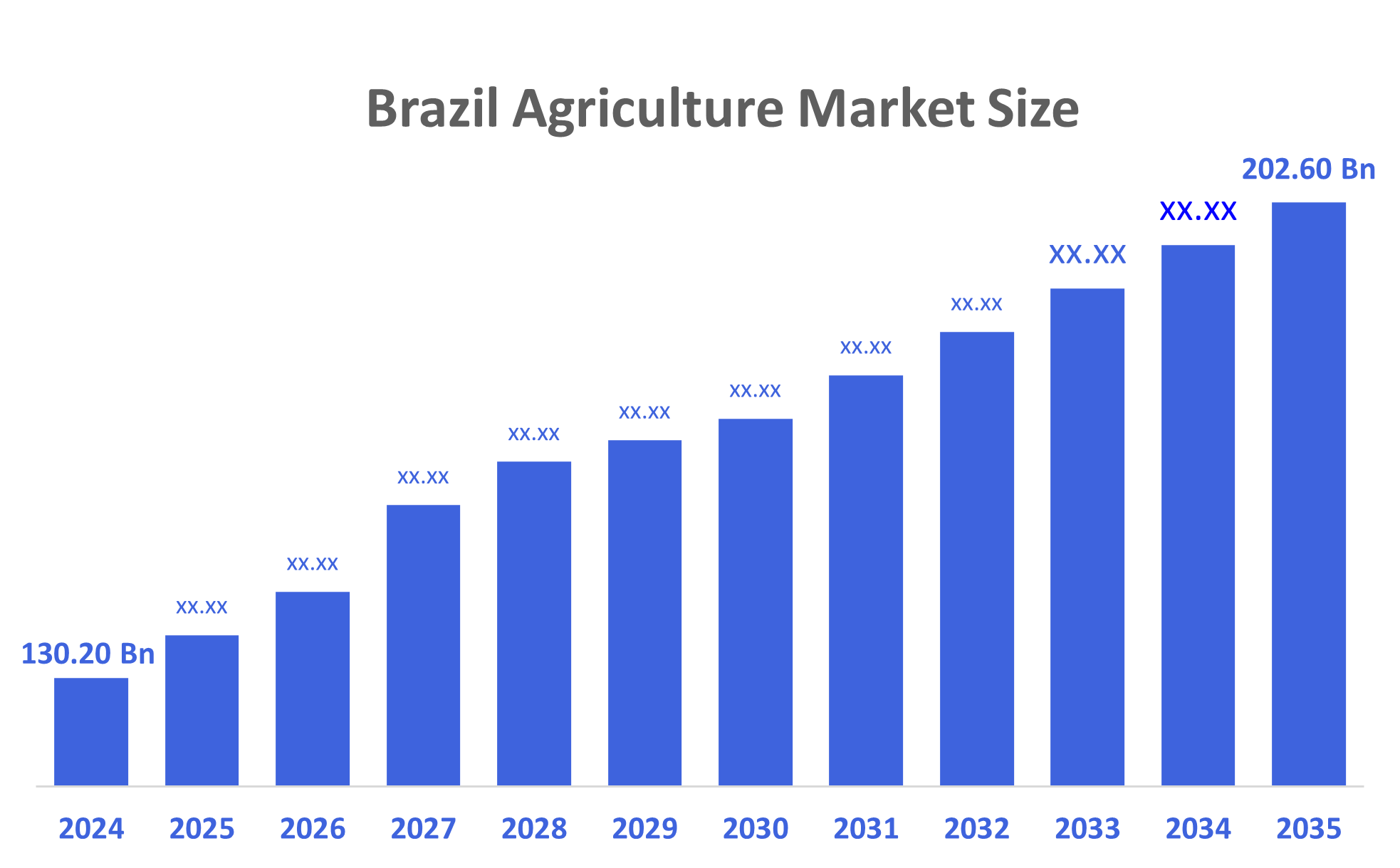

- The Brazil Agriculture Market Size Was Estimated at USD 130.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Brazil Agriculture Market Size is Expected to Reach USD 202.60 Billion by 2035

According to a research report published by Decision Advisors, the Brazil Agriculture Market size is anticipated to reach USD 202.60 Billion by 2035, growing at a CAGR of 4.1% from 2025 to 2035. The launch of various favourable policies by government bodies to support small-scale farmers, rising promotion of sustainable practices, high revenue generation and increasing export volume, and strong investments in R&D activities are primarily driving the market demand across the country.

Market Overview

Agriculture is the activity of growing plants and raising animals to produce food and other useful items. It includes farming, gardening, taking care of farm animals, using tools and machines to work on the land, and managing soil and water. Farmers grow crops like wheat, rice, fruits, and vegetables, and they also raise animals like cows, goats, and chickens. Agriculture helps provide food, clothes, medicines, and many materials we use every day. In Brazil, the market is growing due to rising global demand for soy, corn, and meat, strong export performance, and increasing domestic food consumption. Advanced technologies, mechanization, and improved farm productivity also boost growth. Supportive government policies, expanding cultivated land, and growing use of bio-fertilizers help further strengthen the sector, making Brazil a major global agricultural powerhouse. Additionally, the use of modern agricultural technologies, such as precision farming, drones, and artificial intelligence, can increase yields, reduce costs, and improve efficiency. The technological advancements are expected to increase productivity and efficiency in the sector, while sustainability concerns will also become increasingly important.

the Brazil government supports agriculture through credit programs, subsidies, crop insurance, and low-interest loans to farmers. It also invests in research via Embrapa, promotes sustainable farming, and funds rural infrastructure. Policies encouraging agritech adoption, irrigation, and export growth further strengthen productivity and help farmers improve yields and competitiveness in global markets. For instance, in 2024, Brazil was the second-biggest grain exporter in the world, with 19% of the international market share, and the fourth overall grain producer. Brazil is also the world's largest exporter of many popular agricultural commodities like coffee, soybeans, organic honey, beef, poultry, cane sugar, soybean meal, açai berry, orange juice, yerba mate, cellulose, tobacco, and the second biggest exporter of cotton, corn, pork, and ethanol. The country also has a significant presence as a producer and exporter of rice, wheat, eggs, refined sugar, soybean oil, cocoa, beans, nuts, cassava, sisal fiber, and diverse fruits and vegetables.

Report Coverage

This research report categorizes the market for the Brazil agriculture market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil agriculture market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil agriculture market.

Driving Factors

The Brazil agricultural market is driven by vast fertile land, a supportive climate, and strong global demand for crops like soybeans, corn, and sugarcane. Advanced technology, such as precision farming, satellite monitoring, modern machinery, improved seeds, and efficient irrigation, significantly boosts productivity and reduces costs. Government support through rural credit, low-interest loans, subsidies, crop insurance, and policies promoting sustainable farming further strengthens the sector. Rising investments in agribusiness, better storage and logistics infrastructure, and expansion of livestock production also contribute to growth. Together, technology adoption and strong government backing play a key role in accelerating Brazil’s agricultural development.

Restraining Factors

Brazil’s agriculture market faces restraints such as inconsistent government regulations, high logistics and transportation costs, and limited rural infrastructure. Climate challenges, including droughts and irregular rainfall, affect crop yields. Dependence on global commodity prices creates market instability. Environmental concerns, land-use restrictions, and deforestation pressures also limit expansion, while small farmers struggle with limited access to credit and modern technologies.

Market Segmentation

The Brazil agriculture market share is categorized by type and distribution channel.

- The crop production segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil agriculture market is segmented by type into animal products, crop production. Among these, the crop production segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the country is one of the world’s largest producers and exporters of major crops like soybeans, corn, sugarcane, and coffee. These crops occupy vast agricultural land and generate high export revenue, contributing significantly to GDP. Brazil’s favorable climate, advanced farming technologies, large commercial farms, and strong global demand further boost crop output. Investments in irrigation, seeds, fertilizers, and mechanization also increase yields. Compared to animal products, crop production has a much larger production scale and stronger international market presence.

- The supermarkets/hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil agriculture market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, E-commerce, and others. Among these, the supermarkets/hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to offering a wide variety of fresh and packaged products at competitive prices, attracting most urban consumers. Their strong supply chain networks, efficient cold storage systems, and partnerships with large farmers ensure consistent quality and availability. These stores also provide convenience by offering all grocery needs in one place. Their nationwide presence, promotional discounts, and trusted brands make them the primary shopping destination, far ahead of convenience stores and still-growing e-commerce platforms, which have limited reach in rural and semi-urban areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil agriculture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JBS S.A.

- SLC Agrícola

- Amaggi Group

- Bunge Brasil

- Cargill Brazil

- Cosan

- Marfrig Global Foods

- Cutrale

- Terra Santa Agro

- Natter Agro

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

30 September 2024: FMC Corporation has partnered with Ballagro Agro Tecnologia Ltda. to provide Brazilian growers with a wide range of biological crop protection solutions, aiming to strengthen its presence in the Brazilian market. The collaboration between FMC and Ballagro combines their expertise in microbial and fungi-based solutions to offer innovative, science-backed biological solutions to address evolving pest pressures and climate challenges faced by Brazilian growers.

1 May 2023: Bunge has launched a regenerative agriculture program in Brazil to help farmers transition to low-carbon agriculture, focusing on improving soil fertility, reducing greenhouse gas emissions, and promoting sustainability. The program offers technical support, customized action plans, and marketplace connections for participating farmers, covering approximately 250,000 hectares of land in six Brazilian states.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Brazil agriculture market based on the below-mentioned segments:

Brazil Agriculture Market, By Type

- Animal Produce

- Crop Production

Brazil Agriculture Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- E-Commerce

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |