Brazil Analgesics Market

Brazil Analgesics Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Opioid Analgesics, Non-Opioid Analgesics, NSAIDs, Antidepressant Analgesics), By Application (Post-Surgery Pain Relief, Chronic Pain Management, Acute Pain Relief, Neuropathic Pain Treatment), and Brazil Analgesics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Analgesics Market Size Insights Forecasts to 2035

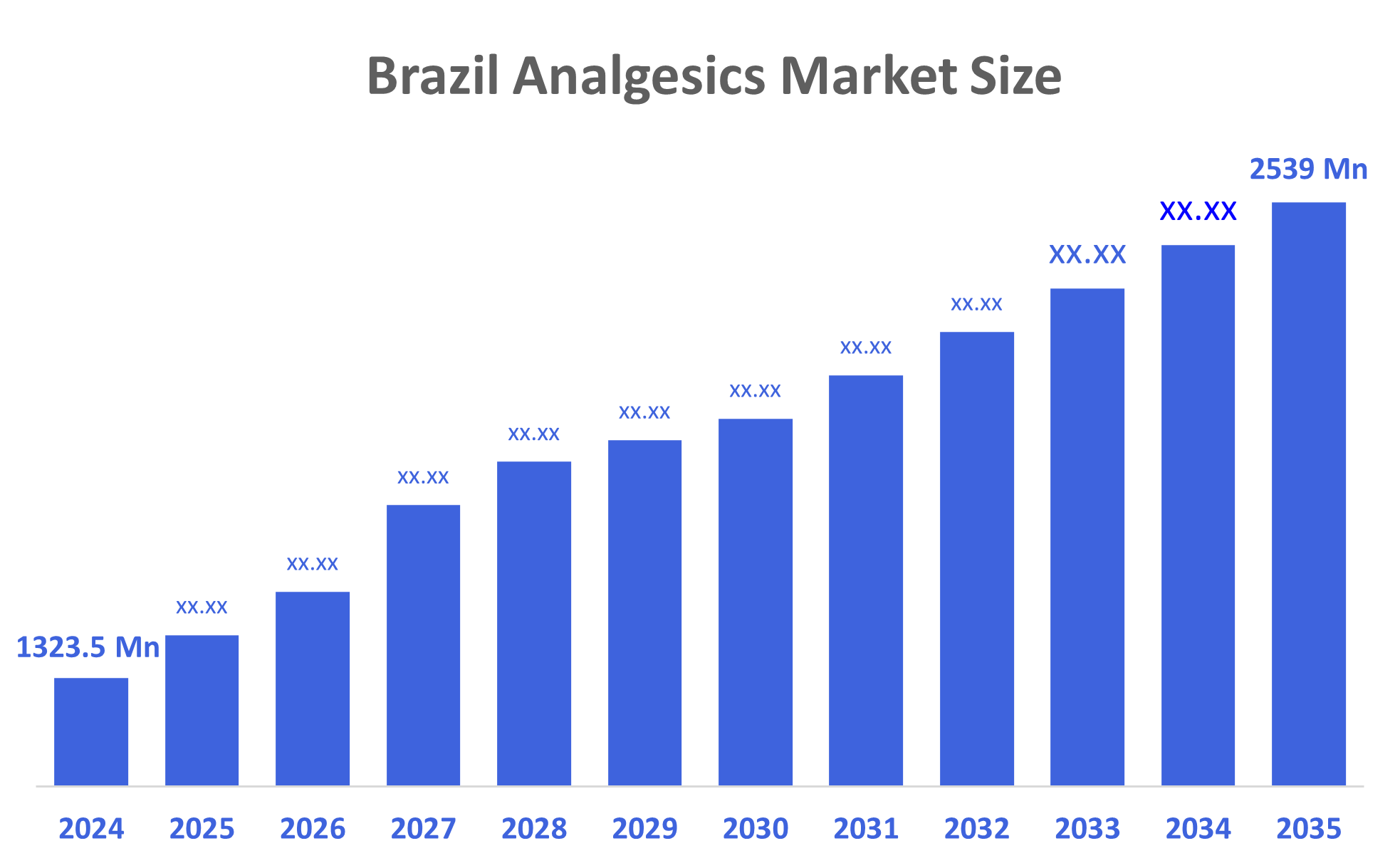

- The Brazil Analgesics Market Size Was Estimated at USD 1,323.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Analgesics Market Size is Expected to Reach USD 2539 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Analgesics Market Size is Anticipated to Reach USD 2539 Million by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. The Brazil analgesics market is driven by rising chronic pain cases, an expanding geriatric population, increasing self-medication practices, and broader access to OTC pain relief drugs. Growing healthcare awareness, improved distribution networks, and the introduction of safer, fast-acting formulations further strengthen market demand.

Market Overview

Analgesics are medications designed to relieve pain without causing loss of consciousness. They work by blocking pain signals in the nervous system or reducing inflammation. Common types include non-steroidal anti-inflammatory drugs, acetaminophen, and opioids, used to manage mild to severe pain from various medical conditions. Additionally, the Brazil analgesics market is growing due to the rising incidence of headaches, musculoskeletal disorders, and chronic pain, along with increasing adoption of OTC medications. Expanding healthcare access, wider retail pharmacy penetration, and continual introduction of safer, rapid-acting formulations further accelerate overall market expansion. Furthermore, Innovative drug delivery methods, including slow-release oral tablets, injectable microspheres, and transdermal patches, are becoming more popular in Brazil. Such methods improve patient compliance and allow for pain relief to be maintained for a longer period with a minimal number of side effects. ??????

There is a growing trend in Brazil toward personalized medicine, where treatment plans are tailored based on genetic profiles, pain sensitivity, and comorbidities. This trend is fostering innovation in targeted analgesic formulations. Additionally, the recent trend of incorporating natural ingredients in analgesic products to cater to the demand for more holistic and organic options has also gained traction. Regulatory frameworks and government policies play a crucial role in shaping the dynamics of the Brazilian analgesics market, ensuring product quality and safety for consumers. Moreover, the Brazilian government, through ANVISA, regulates analgesics by overseeing their registration, marketing, and pricing. OTC drugs like paracetamol and ibuprofen follow strict labeling rules, while prescription analgesics especially opioids are tightly controlled to prevent misuse. ANVISA also sets price limits to maintain affordability, balancing market growth with public health protection

Report Coverage

This research report categorizes the market for the Brazil analgesics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil analgesics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil analgesics market.

Driving Factors

The Brazil analgesics market is driven by the rising prevalence of chronic pain conditions, headaches, and musculoskeletal disorders, along with a growing geriatric population that requires continuous pain management. Increasing reliance on OTC pain relievers, broader pharmacy and retail access, and improved healthcare awareness further boost demand. Product innovations offering faster relief and better safety profiles, combined with government efforts to ensure medication affordability, also contribute to sustained market growth across the country.

Restraining Factors

The Brazil analgesics market faces restraints such as strict regulatory controls on prescription analgesics, especially opioids, to prevent misuse. Safety concerns related to the overuse of OTC painkillers, potential side effects, and rising awareness of alternative therapies also limit demand. Price caps and compliance requirements further challenge market expansion.

Market Segmentation

The Brazil analgesics market share is categorized by product type and application.

- The non-opioid analgesics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil analgesics market is segmented by product type into opioid analgesics, non-opioid analgesics, NSAIDs, and antidepressant analgesics. Among these, the non-opioid analgesics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the fact that they are widely accessible as OTC products, affordable, and perceived as safe for frequent use. Medications like paracetamol and dipyrone are commonly used for everyday pain, fever, and headaches, driving high consumption. Their minimal regulatory restrictions, strong physician recommendations, and cultural familiarity further reinforce demand. Additionally, growing awareness of opioid risks encourages consumers to choose non-opioid options as the primary pain management solution in Brazil.

- The acute pain relief segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil analgesics market is segmented by application into post-surgery pain relief, chronic pain management, acute pain relief, and neuropathic pain treatment. Among these, the acute pain relief segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to a high prevalence of short-term conditions such as headaches, fever, menstrual pain, and minor injuries, driving frequent use of fast-acting OTC analgesics. Easy access to pharmacies, strong consumer preference for self-medication, and widespread availability of affordable non-opioid drugs further boost demand. Acute pain treatments require immediate relief, making these products the most commonly purchased and consistently consumed across the country.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil analgesics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eurofarma

- EMS S.A.

- Hertz Farmacêutica

- Johnson & Johnson

- Pfizer Inc.

- GlaxoSmithKline (GSK)

- Bayer AG

- Sanofi S.A.

- Novartis AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Kedrion Biopharma, a biopharmaceutical company specializing in plasma-derived products, announced the completion of a Phase 3 clinical trial for its novel subcutaneous immunoglobulin (SCIG) therapy, KEDRABIO. The trial demonstrated the safety and efficacy of KEDRABIO in patients with primary immunodeficiencies, offering a potential alternative treatment option.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil analgesics market based on the below-mentioned segments:

Brazil Analgesics Market, By Product Type

- Opioid Analgesics

- Non-Opioid Analgesics

- NSAIDs

- Antidepressant Analgesics

Brazil Analgesics Market, By Application

- Post-Surgery Pain Relief

- Chronic Pain Management

- Acute Pain Relief

- Neuropathic Pain Treatment

FAQ’s

1. What are analgesics used for?

- Analgesics are used to relieve pain caused by headaches, injuries, chronic conditions, surgeries, and inflammation.

2. Which type of analgesic is most commonly used in Brazil?

- Non-opioid analgesics such as paracetamol and dipyrone are the most widely used due to safety and accessibility.

3. Are analgesics available without a prescription?

- Yes, many analgesics especially non-opioid and NSAID types are available OTC in pharmacies and supermarkets.

4. Are opioid analgesics easily accessible in Brazil?

- No, opioid-based products require a doctor’s prescription and are strictly regulated to prevent misuse.

5. What factors influence analgesic purchases in Brazil?

- Product availability, affordability, brand trust, safety, and the need for quick pain relief drive consumer choices.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |