Brazil Animal Feed Market

Brazil Animal Feed Market Size, Share, By Form (Pellets, Crumbles, Mash, and Others), By Animal Type (Swine, Ruminants, Poultry, Aquaculture, and Others), Brazil Animal Feed Market Insights, Industry Trends, Forecasts to 2035

Report Overview

Table of Contents

Brazil Animal Feed Market Insights Forecasts to 2035

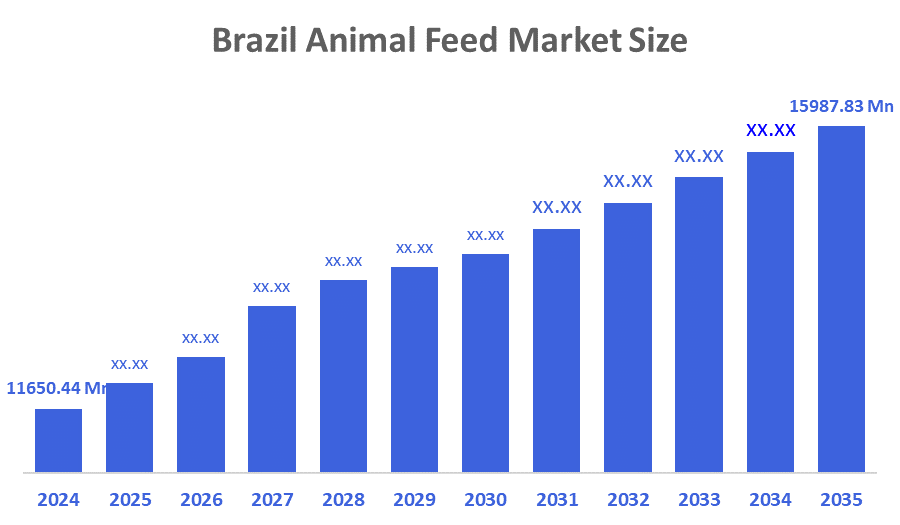

- Brazil Animal Feed Market Size 2024: USD 11,650.44 Mn

- Brazil Animal Feed Market Size 2035: USD 15,987.83 Mn

- Brazil Animal Feed Market CAGR (2025–2035): 2.92%

- Brazil Animal Feed Market Segments: Form and Animal Type

The Brazilian market for animal feeds encompasses a range of commercial feed products, which are formulated to satisfy the nutritional needs of various types of livestock and aquaculture species. These products are designed to promote healthy growth and overall productivity through their ability to convert food into actual gain in weight and muscle. The major characteristics of the Brazil feed market are large-scale production, product formulations that are standardized across all manufacturers, and an increasing use of value-added ingredients. In addition, there is a growing awareness regarding improving animal nutrition, improving biosecurity in production, and improving the potential for increased animal productivity, which will continue to drive demand within the industry.

There are numerous public and private initiatives in support of the Brazil animal feed market, including government initiatives supporting increased livestock productivity, food safety standards and practices, and the development and implementation of sustainable agricultural practices, which in turn promote the adoption of quality feed solutions. There are several private sector investments from feed manufacturers, integrators, and agribusinesses that will continue to expand capacity, promote quality assurance, and enhance supply chain efficiencies, thus helping position Brazil as a leading global producer of livestock and feed.

Technology in the Brazil animal feed market is advancing rapidly. These advancements include precision nutrition, fully automated feed milling processes, and the ability to create feed formulations based on empirical data. For example, the application of advanced processing technologies such as extrusion and micro-ingredient dosing technology to feed products increases the quality and consistency of these products, while innovative feed additives such as probiotics and enzymes have improved the performance of animals and reached sustainability goals.

Market Dynamics of the Brazil Animal Feed Market

The Brazil animal feed market is driven due to the growing population and demand for animal protein, as a result, the livestock and poultry industries have continued to expand from year to date, and continues to develop in terms of development. The introduction of the need for keeping animals healthy and productive through balanced feeds, as well as the shift from traditional feedstuffs to compound feeds, support continued growth for Brazil feed manufacturing. Furthermore, the growing agricultural production base for Brazil, combined with the growing integration between feed manufacturing and livestock production, and the ongoing improvements in feed manufacturing facilities, will ultimately lead to an increase in the number of feed manufacturers, thus creating increased support for Brazil animal feed production.

The Brazil animal feed market is restrained by the pricing volatility of raw material prices, the heavy reliance upon agricultural commodity supplies, and the increased cost of production. Additionally, many environmental regulations and logistical issues from one region to another, and the price sensitivity of smallholder farmers has limited their ability to adopt premium and specialty feed products.

The Brazil Feed Market will experience growth due to developing specialty functional feeds and expanding aquaculture aquafeed. Increased demand for Antibiotic-Free animals and organic animal products will drive this development, through innovations around alternative protein sources and precision feeding.

Market Segmentation

The Brazil Animal Feed Market share is classified into form and animal type.

By Form:

The Brazil animal feed market is divided by form segmented into pellets, crumbles, mash, and others. Among these, pellets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The pellets segment has captured the bulk of market growth due to many benefits. These include improved feed conversion rates, reduced wastage, consistent nutrition, and easier usage and transport. Additionally, the pellets market was the fastest growing segment in Brazil's poultry and livestock production systems.

By Animal Type:

The Brazil animal feed market is divided by animal type into swine, ruminants, poultry, aquaculture, and others. Among these, the poultry segment accounted for the highest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The poultry sector generated the largest revenue in Brazil because of the very high number of poultry in the country, increasing export demand for poultry meat globally, rapid production cycles, the fact that there is a high level of feed consumed per bird and the widespread use of formulated feed to help birds grow faster, become more productive, or increase feed efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil animal feed market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Animal Feed Market:

- Cargill Brasil

- ADM do Brasil

- Nutreco Brasil

- BRF Ingredients

- JBS Nutricao Animal

- Cooperativa Aurora

- DSM-Firmenich Brasil

- Alltech Brasil

- Evonik Brasil

- Matsuda Group

- Others

Recent Developments in Brazil Animal Feed Market:

In October 2025, Nutreco Brasil introduced innovative aquaculture feed solutions via Skretting’s new functional fish diet, Necto, designed to improve feed conversion efficiency and environmental performance by enhancing fish health, resilience, and welfare with proprietary Phyto Complexes.

In September 2024, ADM Brasil introduced enhanced ruminant feed formulations designed to improve nutrient efficiency and promote sustainable animal performance through optimized rumen function and feed utilization.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil animal feed market based on the following segments:

Brazil Animal Feed Market, By Form

- Pellets

- Crumbles

- Mash

- Others

Brazil Animal Feed Market, By Animal Type

- Swine

- Ruminants

- Poultry

- Aquaculture

- Others

FAQ

Q: What is the Brazil animal feed market size?

A: Brazil Animal Feed Market is expected to grow from USD 11,650.44 million in 2024 to USD 15,987.83 million by 2035, at a CAGR of 2.92% during 2025–2035.

Q: What are the key growth drivers of the market?

A: Growth is driven by livestock expansion, rising meat exports, increasing demand for balanced nutrition, and investments in feed manufacturing and technology.

Q: What factors restrain the Brazil animal feed market?

A: Raw material price volatility, high production costs, and regulatory and logistics challenges restrain market growth.

Q: How is the market segmented?

A: The market is segmented by form into pellets, crumbles, mash, and others and animal type into swine, ruminants, poultry, aquaculture, and others.

Q: Who are the target audiences for this report?

A: Market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and VARs.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 190 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |