Brazil Antifungal Drugs Market

Brazil Antifungal Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Azoles, Echinocandins, Polyenes, Allylamines, Others), By Drug Distribution (Hospital Pharmacies, Retail Pharmacies, Others), and Brazil Antifungal Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Antifungal Drugs Market Size Insights Forecasts to 2035

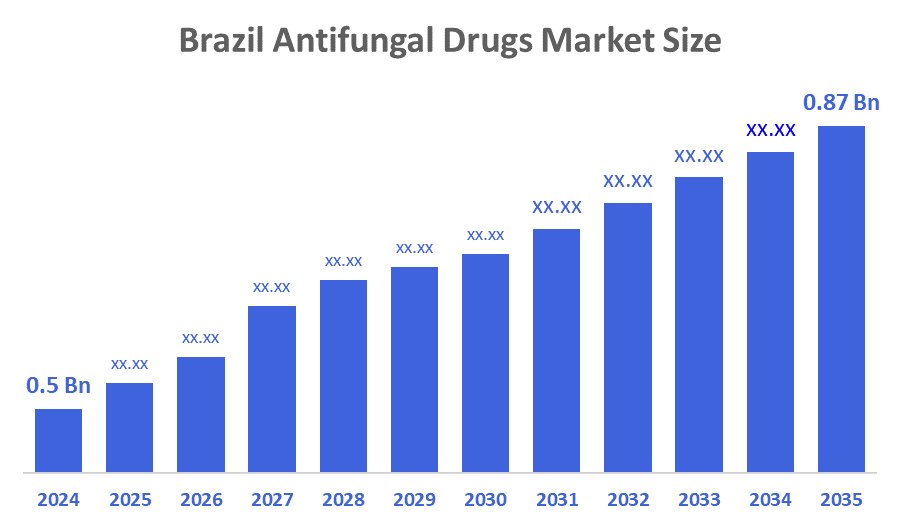

- The Brazil Antifungal Drugs Market Size Was Estimated at USD 0.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Brazil Antifungal Drugs Market Size is Expected to Reach USD 0.87 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Antifungal Drugs Market Size is anticipated to Reach USD 0.87 Billion by 2035, Growing at a CAGR of 5.1% from 2025 to 2035. The major factors driving the market are rising awareness of fungal infections, the increasing incidence of antifungal infections, and rising government and corporate funding in the industry. Further, more and more public-private partnerships in the pharmaceutical industry and the rising popularity of over-the-counter antifungal drugs for dermal infections are vastly responsible for increasing the market size. Also, the increase in population with weak individuals, in whom the occurrence of fungal infections is much more than average, will drive the market.

Market Overview

Antifungal drugs are medications used to prevent or treat fungal infections by inhibiting fungal growth or destroying fungal cells. They target specific components of fungal cell membranes or metabolic pathways, helping manage infections ranging from superficial conditions like athlete’s foot to serious systemic infections. These drugs include azoles, echinocandins, polyenes, and allylamines, each designed for different infection types. furthermore, the Brazil antifungal drugs market is growing due to rising fungal infections fueled by humid weather, urban density, and greater public awareness. Government support through expanded healthcare programs, improved access to essential medicines, and strengthened infectious-disease control initiatives further boost demand. An aging population, better diagnostics, and the increased use of immunosuppressive treatments also contribute to steady market expansion. The technological improvements, like quicker diagnostic tests, better ways to deliver medicines, and newer antifungal drugs that are safer and more effective, are helping patients get faster, more reliable treatment. Along with this, Brazil’s growing elderly population and the rising use of immunosuppressive therapies are increasing the need for antifungal medicines, supporting steady market growth.

Report Coverage

This research report categorizes the market for the Brazil antifungal drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazilian antifungal drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil antifungal drugs market.

Driving Factors

The Brazil antifungal drugs market is driven by rising fungal infections, a growing immunocompromised population, improved healthcare access, and strong government support through essential drug programs. Increasing awareness and better diagnostics also boost demand. Recent developments include upgraded rapid diagnostic technologies, improved drug delivery systems, expansion of telepharmacy for wider access, and government protocols for distributing advanced antifungals like liposomal amphotericin B. Partnerships between pharma companies and research institutes are further enhancing innovation and treatment effectiveness in the country.

Restraining Factors

The Brazil antifungal drugs market faces restraints such as high costs of advanced treatments, growing antifungal resistance, and limited awareness in rural regions. Inadequate access to advanced diagnostics delays proper care, while the side effects and toxicity of some drugs reduce patient adherence. Additionally, regulatory delays and slow approval processes hinder the introduction of new, more effective antifungal therapies in the market.

Market Segmentation

The Brazil antifungal drugs market share is categorized by drug class and drug distribution.

- The azoles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Antifungal Drugs market is segmented by drug class into azoles, echinocandins, polyenes, allylamines, and others. Among these, the azoles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The azoles segment holds the largest share due to its broad-spectrum activity, affordability, and widespread use for both superficial and systemic fungal infections. Azoles are preferred in clinical settings because they offer effective treatment, lower toxicity compared to older antifungals, and are readily available through Brazil’s public and private healthcare systems, making them the dominant drug class in the market.

- The hospital pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Antifungal Drugs market is segmented by drug distribution into hospital pharmacies, retail pharmacies, and Others. Among these, the hospital pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to most severe and systemic fungal infections require prescription-based, advanced antifungal treatments that are primarily administered in hospital settings. Hospitals also stock a wider range of specialized antifungals, manage critical patients, and follow standardized treatment protocols, making them the key distribution channel and the largest contributor to market revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil antifungal drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EMS

- Eurofarma

- Abbott

- Merck & Co.

- Astellas Pharma

- Pfizer

- GlaxoSmithKline (GSK)

- Bayer

- Novartis

- Sanofi

- Gilead Sciences

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In Jul 2023, A study conducted at the University of São Paulo (USP) in Brazil shows that brilacidin, a new drug tested for the treatment of diseases ranging from bacterial skin infections to COVID-19, can kill drug-resistant strains of fungi when combined with two classes of antifungals available on the market.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil antifungal drugs market based on the below-mentioned segments:

Brazil Antifungal Drugs Market, By Drug Class

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

Brazil Antifungal Drugs Market, By Drug Distribution

- Hospital Pharmacies

- Retail Pharmacies

- Others

FAQ’s

1. What drives the growth of the Brazil antifungal drugs market?

- Rising fungal infections, better diagnostics, government support, and a growing immunocompromised population.

2. Which drug class dominates the market?

- Azoles lead due to broad-spectrum effectiveness and affordability.

3. Which distribution channel holds the largest share?

- Hospital pharmacies dominate because severe fungal infections require prescription-based treatments.

4. What factors restrain market growth?

- High treatment costs, drug resistance, limited rural awareness, and regulatory delays.

5. Which regions in Brazil show higher antifungal drug demand?

- Urban and humid regions, including São Paulo, Rio de Janeiro, and northern states.

6. What recent trends are shaping the market?

- Rapid diagnostics, improved drug delivery systems, telepharmacy expansion, and public–private partnerships.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 289 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |