Brazil Automotive Composites Market

Brazil Automotive Composites Market Size, Share, By Production Process (Hand Lay-Up, Compression Molding, Injection Molding, and Continuous Process), By Material Type (Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, and Glass Fiber), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles, and Two-Wheelers), Brazil Automotive Composites Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Automotive Composites Market Size Insights Forecasts to 2035

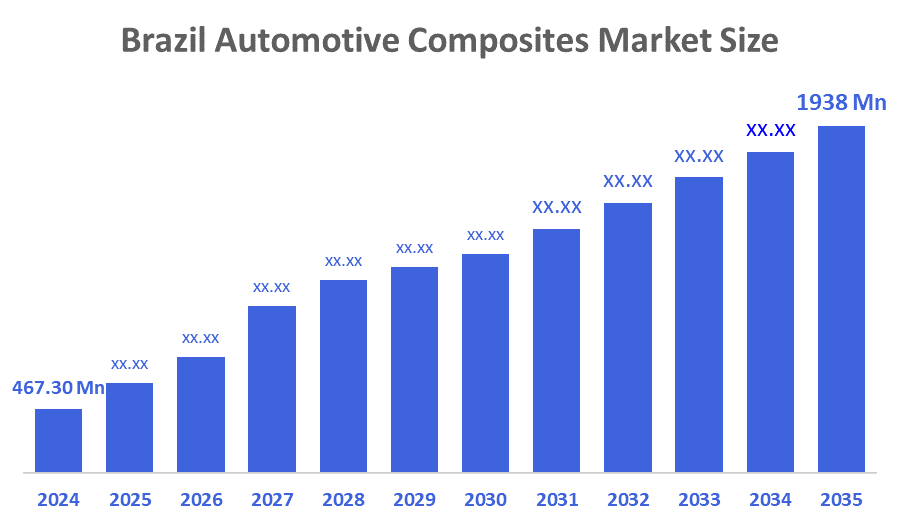

- Brazil Automotive Composites Market Size 2024: USD 467.30 Mn

- Brazil Automotive Composites Market Size 2035: USD 1938 Mn

- Brazil Automotive Composites Market CAGR 2024: 13.8%

- Brazil Automotive Composites Market Segments: Production Process, Material Type, Vehicle Type.

Automotive Composites are advanced materials that result from the combination of fibers like carbon, glass, or natural fibers with polymer resins. These materials are used extensively in the structures and components of vehicles to achieve weight reduction, strength improvement, fuel efficiency enhancement, design flexibility increase, and the facilitation of better performance, safety, and lower emissions in modern automobiles. Consequently, the Brazil automotive composites market expansion is a result of factors such as the rising demand for lightweight vehicles, the improvement of fuel efficiency standards, the growth of electric vehicle production, the imposition of stricter emission regulations, the utilization of advanced materials, and the occurrence of technological advancements in composite manufacturing processes.

The government in Brazil sets policies to extend the automotive composites market that are focused on lightweighting, fuel efficiency, and sustainability in the automotive industry. The policies may comprise various incentives such as funding for research and development activities in automotive composites, including carbon fiber reinforced polymers (CFRP), glass fiber reinforced polymers (GFRP), and natural fiber composites with the objective of vehicle weight reduction and performance improvement. Besides, government regulations and standards might be put in place to guarantee safety and durability in the use of composite materials in automotive applications. Furthermore, support for vehicle manufacturing with composites may be realized through provision of technical assistance, training programs, and investment incentives.

The trend in the Brazil automotive composites market is that manufacturers in Brazil are combining carbon and glass fibers or integrating thermoplastics with natural fibers to develop cost, effective, performance, performance-optimized hybrid composites. Moreover, composite materials are being adopted in Brazil for battery casings, underbody panels, and crash structures in EVs to ensure thermal stability, EMI shielding, and structural strength. Another notable trend is research in Brazil that is broadening to smart composites embedded with sensors, actuators, or energy harvesting capabilities for next-gen connected and autonomous vehicles.

Market Dynamics of the Brazil Automotive Composites Market:

The Brazil automotive composites market is driven by increasing demand for lightweight materials to improve fuel efficiency and reduce vehicle emissions. Stricter government regulations on emissions and safety are encouraging automakers to replace traditional metals with composites. Growth in electric vehicle production, rising vehicle manufacturing, and advancements in composite technologies further support adoption. Additionally, composites offer design flexibility, corrosion resistance, and durability, making them attractive for structural, interior, and exterior automotive applications across passenger and commercial vehicles.

The Brazil automotive composites market is restrained by the high cost of composite materials and complex manufacturing processes compared to traditional metals. Limited recycling infrastructure, longer production cycles, and the need for skilled labor also restrict widespread adoption, especially among cost-sensitive vehicle manufacturers.

The Brazil automotive composites market offers strong opportunities driven by the growing adoption of electric and hybrid vehicles, which require lightweight materials to extend driving range. Increasing investment in sustainable and natural fiber composites, rising demand for fuel-efficient vehicles, and expansion of local automotive manufacturing create new growth avenues. Technological advancements in low-cost, high-volume composite production and increasing use of composites in structural, interior, and exterior components further enhance market potential.

Market Segmentation

The Brazil automotive composites market share is classified into production process, material type, and vehicle type.

By Production Process:

The Brazil automotive composites market is divided by production process into hand lay-up, compression molding, injection molding, and continuous process. Among these, the compression molding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Compression molding dominates because it offers an ideal balance between cost, strength, and large-scale production efficiency. The process enables faster cycle times, uniform material distribution, and consistent part quality, which are critical for mass automotive manufacturing. It is widely used for producing durable structural and exterior components, supports lightweight vehicle design, and allows efficient use of thermoset and thermoplastic composites, making it highly preferred by Brazilian automakers.

By Material Type:

The Brazil automotive composites market is divided by material type into thermoset polymer, thermoplastic polymer, carbon fiber, and glass fiber. Among these, the glass fiber segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Glass fiber dominates because it offers an excellent balance of cost, durability, and performance. Compared to carbon fiber, glass fiber is significantly more affordable while still providing good strength, flexibility, and corrosion resistance. It is well-suited for high-volume automotive production and is widely used in body panels, interior components, and structural parts. Additionally, its easy processing compatibility with thermoset and thermoplastic polymers supports broad adoption by Brazilian automakers.

By vehicle type:

The Brazil automotive composites market is divided by vehicle type into passenger cars, commercial vehicles, electric vehicles, and two-wheelers. Among these, the passenger cars segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Passenger cars dominate due to their high production and sales volumes compared to other vehicle types. Automakers increasingly use composites in passenger cars to reduce vehicle weight, improve fuel efficiency, and meet emission regulations. Growing consumer demand for comfort, safety, and enhanced vehicle performance also drives the use of composites in interiors, exteriors, and structural components. Additionally, frequent model upgrades and design flexibility further increase composite adoption in the passenger car segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil automotive composites market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Automotive Composites Market:

- Hexcel Corporation

- Owens Corning

- Solvay

- Teijin Limited

- Toray Industries

- BASF SE

- Mitsubishi Chemical Group

- SGL Carbon

- Braskem

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil automotive composites market based on the below-mentioned segments:

Brazil Automotive Composites Market, By Production Process

- Hand Lay-Up

- Compression Molding

- Injection Molding

- Continuous Process

Brazil Automotive Composites Market, By Material Type

- Thermoset Polymer

- Thermoplastic Polymer

- Carbon Fiber

- Glass Fiber

Brazil Automotive Composites Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

- Two-Wheelers

FAQ

1. What are automotive composites used for in Brazil?

They are used in body panels, interiors, exteriors, and structural components to reduce vehicle weight and improve performance.

2. Why are composites important for the automotive industry?

Composites improve fuel efficiency, reduce emissions, enhance safety, and provide greater design flexibility compared to traditional materials.

3. Which material type is most commonly used?

Glass fiber composites are most widely used due to their cost-effectiveness and good strength-to-weight ratio.

4. Which vehicle segment drives demand the most?

Passenger cars drive the highest demand due to large production volumes and frequent model upgrades.

5. What limits the adoption of automotive composites in Brazil?

High material costs, complex manufacturing processes, and limited recycling infrastructure are key challenges.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |