Brazil Baby Care Products Market

Brazil Baby Care Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cosmetics & Toiletries, Baby Food, Baby Safety & Convenience, and Others), By End-user (Infants and Toddlers), By Distribution Channel (Online and Offline), and Brazil Baby Care Products Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Baby Care Products Market Size Insights Forecasts to 2035

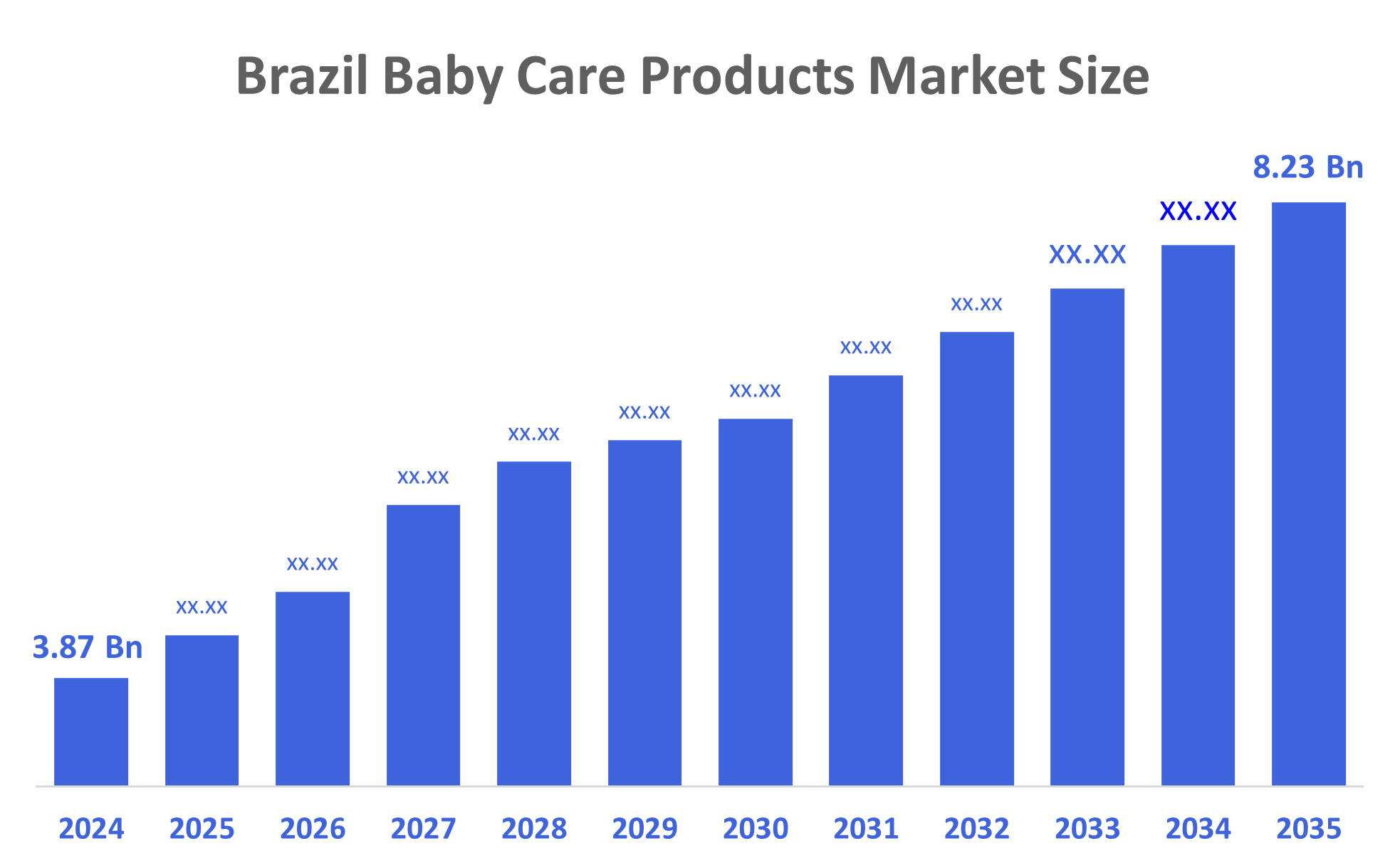

- The Brazil Baby Care Products Market Size Was Estimated at USD 3.87 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.1% from 2025 to 2035

- The Brazil Baby Care Products Market Size is Expected to Reach USD 8.23 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Baby Care Products Market Size is Anticipated to Reach USD 8.23 Billion by 2035, Growing at a CAGR of 7.1% from 2025 to 2035. The Brazil baby care products market is driven by rising birth rates, growing parental awareness of infant hygiene, increasing demand for premium and organic products, expanding urbanization, higher disposable incomes, and strong retail penetration through e-commerce and supermarkets across the country.

Market Overview

Baby?????? care products are those that include diapers, wipes, mild shampoos, lotion, baby powder, and other requirements for the health of a newborn. These little ones can be made comfortable and protected through these products because they are made of gentle and safe ingredients for sensitive skin. Every product, from baby oils to diaper creams, is very important for a baby's health and wellness. Moreover, the Brazil baby care products market is becoming bigger as parents are getting more and more conscious about the necessity of safe and gentle products for their babies. As a result of increasing incomes, more families are opting for natural, chemical-free, and high-quality products. The process of urbanization and the popularity of online shopping are also contributing to the market ??????demand.

Brazilian?????? parents are looking more and more to use natural, organic, and hypoallergenic baby care products that are free from harsh chemicals, parabens, and synthetic fragrances. Such a consumer change is a manifestation of their increased awareness of the safety of the ingredients and of their environmental responsibility. Dermobaby moved its distribution in Brazil to a new level by landing its products on the shelves of the major pharmacy chain Drogaria São Paulo in 2024. The brand offers natural, dermatologically tested, paraben-free, and dye-free baby care products aimed at parents who want to provide their infants with gentle and safe hygiene and skincare. Just to give you an example, in 2024, Huggies Eco Protect, a brand of Kimberly-Clark, launched a hybrid diaper in Brazil: a washable cloth diaper with a disposable, plant-based absorbent ??????pad.

Report Coverage

This research report categorizes the market for the Brazil baby care products market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil baby care products market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil baby care products market.

Driving Factors

The Brazil baby care products market is driven by increasing parental awareness of infant hygiene and safety, rising demand for natural and chemical-free products, and a growing middle-class population with higher spending power. Urbanization, improved access to modern retail and e-commerce platforms, and strong promotional activities by brands further support market expansion. Additionally, the trend toward premium, dermatologically tested products encourages parents to invest more in high-quality baby care essentials.

Restraining Factors

The Brazil baby care products market is restrained by the high cost of premium and organic products, which limits affordability for many families. Limited awareness in rural areas, supply chain challenges, and price-sensitive consumer behavior also slow market growth. Additionally, rising competition and counterfeit products reduce brand trust and market stability.

Market Segmentation

The Brazil baby care products market share is categorized by product type, end user, and distribution channel.

- The cosmetics & toiletries segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil baby care products market is segmented by product type into cosmetics & toiletries, baby food, baby Safety & convenience, and others. Among these, the cosmetics & toiletries segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment’s growth is driven by the essential role these products play in daily infant hygiene and their need for frequent replenishment. Baby lotions, soaps, wipes, and shampoos are used regularly, ensuring steady demand. Increasing awareness of skin safety, a rising preference for gentle and dermatologically tested formulas, and strong product availability across supermarkets and online platforms further reinforce this segment’s leading position in the market.

- The infants segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil baby care products market is segmented by end user into infants and toddlers. Among these, the infants segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to newborns and younger babies requiring constant and intensive care, leading to higher consumption of essential products such as diapers, wipes, lotions, soaps, and feeding items. Parents are more cautious during the early months, increasing demand for gentle, dermatologically tested products. Additionally, frequent product usage and regular replenishment needs contribute to the larger market share of the infant category compared to toddlers.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil baby care products market is segmented by distribution channel into online and offline. Among these, the offline segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to parents preferring to purchase baby essentials from physical stores where they can inspect product quality, ingredients, and safety labels directly. Supermarkets, pharmacies, and baby specialty stores offer easy accessibility, immediate availability, and a wide product range. Many customers also trust in-store recommendations and promotions. Additionally, essential items like diapers, wipes, and toiletries are often bought during routine grocery shopping, strengthening offline sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil baby care products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson

- Procter & Gamble (P&G)

- Unilever PLC

- Nestlé S.A.

- Danone Brazil

- Kimberly Clark Corporation

- Reckitt Benckiser Group (RB)

- Natura & Co

- Phisalia Produtos de Beleza Ltda.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2021, Personal care Johnson & Johnson launched its new range of ‘Cottontouch” baby care products that include lotion, oil, wash, and cream. The company plans to sell these products through multiple channels such as stores and multi-brand e-commerce platforms.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil baby care products market based on the below-mentioned segments:

Brazil Baby Care Products Market, By Product Type

- Cosmetics & Toiletries

- Baby Food

- Baby Safety & Convenience

- Others

Brazil Baby Care Products Market, By End-user

- Infants

- Toddlers

Brazil Baby Care Products Market, By Distribution Channel

- Online

- Offline

FAQ’s

Q1: What types of products are included in the baby care market?

- The market includes skincare, toiletries, diapers, wipes, feeding products, baby food, grooming items, and safety products.

Q2: How is the market segmented by age?

- The market is segmented into infants and toddlers, with infants being the larger segment.

Q3: Why is there a growing demand for natural baby products in Brazil?

- Parents prefer chemical-free and gentle formulas to ensure baby safety and reduce skin irritation.

Q4: How does urbanization affect the baby care market?

- Urbanization increases access to retail stores and e-commerce, boosting product availability and convenience for parents.

Q5: Are online sales significant in Brazil?

- Online sales are growing rapidly due to convenience, promotions, and home delivery, though offline stores remain dominant.

Q6: What influences parents’ purchase decisions?

- Product safety, brand reputation, ingredient quality, dermatological testing, and recommendations from healthcare professionals strongly influence choices.

Q7: Which product category sees the highest repeat purchase?

- Diapers, wipes, and daily skincare products see the highest repeat purchase due to constant usage.

Q8: What role do local brands play in the market?

- Local brands offer affordable, specialized, and natural products, complementing multinational companies and expanding consumer options.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |