Brazil Battery Energy Storage Systems Market

Brazil Battery Energy Storage Systems Market Size, Share, and COVID-19 Impact Analysis, By Battery (Lithium-Ion Batteries, Advanced Lead-Acid Batteries, Flow Batteries), By Connection Type (On-grid, Off-grid), By Ownership (Customer-Owned, Third-Party Owned, Utility-Owned), and Brazil Battery Energy Storage Systems Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Battery Energy Storage Systems Market Insights Forecasts to 2035

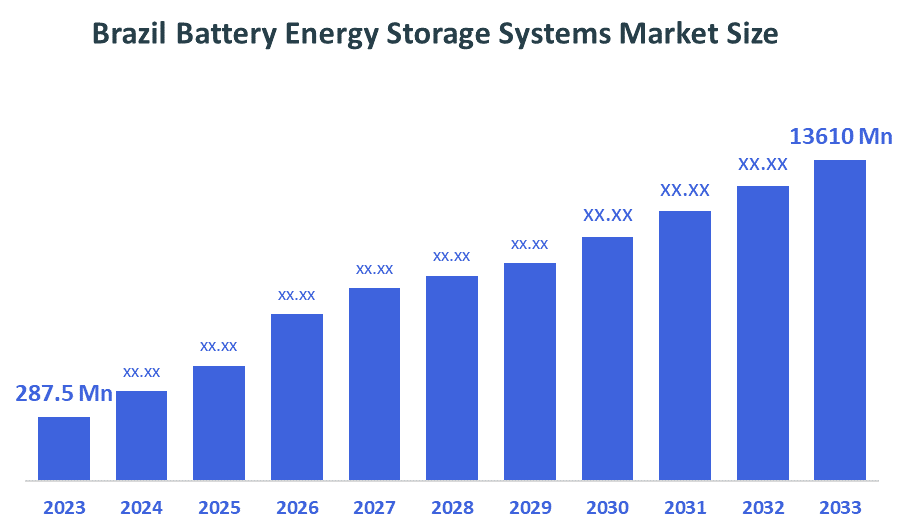

- The Brazil Battery Energy Storage Systems Market Size Was Estimated at USD 287.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 42% from 2025 to 2035

- The Brazil Battery Energy Storage Systems Market Size is Expected to Reach USD 13610 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the Brazil Battery Energy Storage Systems Market size is anticipated to reach USD 13610 Million by 2035, growing at a CAGR of 42% from 2025 to 2035. The Brazil battery energy storage systems market is driven by rapid solar and wind power deployment, fluctuating energy supply-demand, decarbonization goals, investment in smart grids, declining battery costs, technological advancements in lithium-ion and flow batteries, and increasing focus on energy resilience, peak shaving, and backup power solutions for both commercial and residential sectors.

Market Overview

Battery?????? Energy Storage Systems are indeed sophisticated setups that basically reserve the surplus electrical energy in chemical batteries for a later time. They facilitate managing energy supply and demand, stabilizing power grids, integrating renewables, giving backup power, and generally improving the efficiency, reliability, and flexibility of electricity networks. Besides that, the brazil market is expanding because of the increasing integration of renewable energy, government incentives for clean energy, rising electricity demand, grid modernization initiatives, and decreasing battery costs. Improved energy reliability, peak load management, and decarbonization strategy support are additional factors that are propelling the market to be adopted and expanded further. In addition, Brazil is witnessing the initial-stage installations of flow batteries, sodium-ion, and other alternatives. These are the technologies that can offer better scalability, longer duration, and safer thermal profiles. The innovation is largely due to the need for storage beyond 4–6 hours. More and more companies are investing in R&D to not only localize battery manufacturing but also to have various chemistry options.

Impositions by the government, feed-in tariffs, and capital subsidies are the main factors that are pushing the use of battery storage in Brazil. Energy storage obligation schemes, net metering, and storage tenders are some of the programs that are being introduced. Different regional levels are implementing storage policies that are meant to facilitate project developers and investors by bringing them clarity and giving them ??????incentives.

Report Coverage

This research report categorizes the market for the Brazil Battery energy storage systems market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil battery energy storage systems market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil battery energy storage systems market.

Driving Factors

The Brazil battery energy storage systems market is driven by rising renewable energy adoption, especially solar and wind, requiring reliable storage solutions. Government incentives and policies promote clean energy integration. Declining battery costs make systems more affordable for utilities and industries. Growing electricity demand, grid modernization projects, and the need for peak load management further accelerate adoption. Additionally, businesses seek energy reliability, backup power, and decarbonization solutions, while technological advancements enhance efficiency, safety, and system scalability.

Restraining Factors

The Brazil battery energy storage systems market faces restraints such as high initial investment costs, complex installation and maintenance requirements, and limited local manufacturing infrastructure. Regulatory uncertainties and grid integration challenges can slow adoption. Additionally, battery lifespan, recycling issues, and dependency on imported components hinder large-scale deployment, while a lack of skilled workforce and awareness among end-users further restrict market growth.

Market Segmentation

The Brazil battery energy storage systems market share is categorized by battery, connection type, and ownership.

- The lithium-ion batteries segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil battery energy storage systems market is segmented by battery into lithium-ion batteries, advanced lead-acid batteries, and flow batteries. Among these, the lithium-ion batteries segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its high energy density, longer lifespan, declining costs, and widespread adoption in utility-scale, commercial, and residential applications. Lithium-ion batteries also integrate efficiently with renewable energy sources and smart grid technologies, making them the preferred choice over advanced lead-acid and flow batteries.

- The on-grid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil battery energy storage systems market is segmented by connection type into on-grid and off-grid. Among these, the on-grid segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s expanding renewable energy capacity, particularly solar and wind, which requires reliable storage to stabilize the grid. Utilities invest in on-grid storage for peak load management, frequency regulation, and energy balancing. Government incentives and policies encourage large-scale adoption, while technological advancements improve system efficiency and scalability. In contrast, off-grid systems remain limited to remote areas, making on-grid solutions the primary choice nationwide.

- The utility-owned segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil battery energy storage systems market is segmented by ownership into customer-owned, third-party owned, and utility-owned. Among these, the utility-owned segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the rapid growth of renewable energy, particularly solar and wind, which requires large-scale, reliable storage for grid stability and peak load management. Utility ownership allows better operational control, efficient cost management, and access to government incentives and financing. Utilities can deploy systems across multiple sites, optimize energy distribution, and ensure a consistent power supply, whereas customer-owned and third-party-owned systems are smaller, limited in scale, and less widespread.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil battery energy storage systems market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SecPower

- Powersafe

- UCB Power

- Matrix Energia

- Tecnogera

- WEG

- Sungrow

- Deye

- FoxESS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In May 2025, CATL unveiled the TENER Stack, a 9 MWh ultra-large energy storage system designed for high-density, flexible, and mobile use, offering improved efficiency and supporting applications from AI data centers to industrial electrification.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil battery energy storage systems Market based on the below-mentioned segments:

Brazil Battery Energy Storage Systems Market, By Battery

- Lithium-Ion Batteries

- Advanced Lead-Acid Batteries

- Flow Batteries

Brazil Battery Energy Storage Systems Market, By Connection Type

- On-grid

- Off-grid

Brazil Battery Energy Storage Systems Market, By Ownership

- Customer-Owned

- Third-Party Owned

- Utility-Owned

FAQ’s

Q1: What is a Battery Energy Storage System?

- Brazil battery energy storage system stores electrical energy in batteries for later use, improving grid stability, managing peak loads, and integrating renewable energy.

Q2: Which battery type dominates the Brazil battery storage energy systems market?

- Lithium-ion batteries dominate due to high energy density, efficiency, and declining costs.

Q3: What are the key applications of BESS in Brazil?

- Grid stabilization, peak load management, renewable energy integration, backup power, and microgrids.

Q4: Who are the major players in Brazil’s BESS market?

- SecPower, Powersafe, WEG, Sungrow, BYD, Tesla, LG Chem, Fluence, ABB, among others.

Q5: What drives the growth of BESS in Brazil?

- Rising renewable energy adoption, government incentives, declining battery costs, and increasing electricity demand

Q6: What challenges does the market face?

- High initial costs, limited local manufacturing, grid integration issues, and recycling or disposal concerns.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |