Brazil Blood Glucose Monitoring Market

Brazil Blood Glucose Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Self-Monitoring Blood Glucose Meters (SMBG), Continuous Glucose Monitoring (CGM) Systems, Test Strips, Lancets, Wearable Glucose Monitoring Devices), By Application (Type 1 Diabetes Management, Type 2 Diabetes Management, Gestational Diabetes Management, Pre-Diabetes Monitoring), By Technology (Invasive Monitoring, Non-Invasive Monitoring), and Brazil Blood Glucose Monitoring Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Blood Glucose Monitoring Market Size Insights Forecasts to 2035

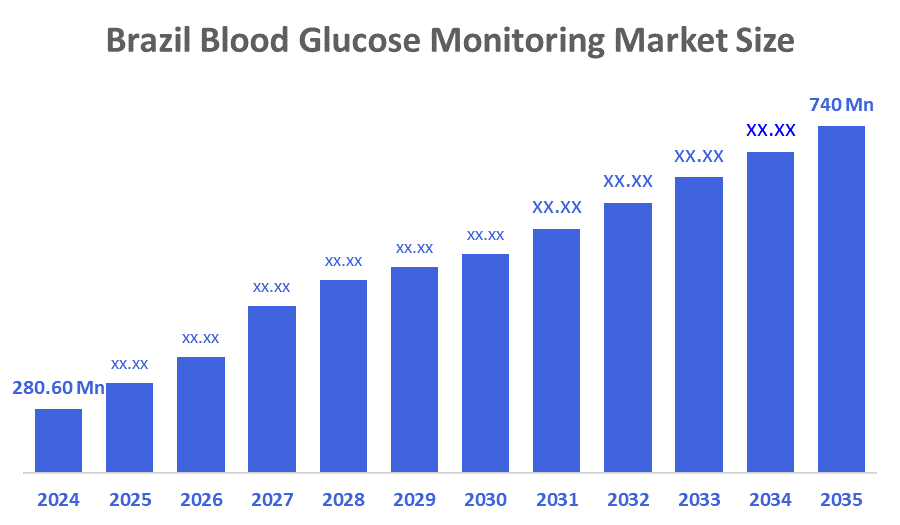

- The Brazil Blood Glucose Monitoring Market Size Was Estimated at USD 280.60 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.2% from 2025 to 2035

- The Brazil Blood Glucose Monitoring Market Size is Expected to Reach USD 740 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Blood Glucose Monitoring Market Size is anticipated to Reach USD 740 Million by 2035, Growing at a CAGR of 9.2% from 2025 to 2035. A blood glucose monitoring system refers to the device used to track the glucose levels in the blood for the management of diabetes among the patient population. The increasing prevalence of type 1 and type 2 diabetes is one of the crucial factors supporting the growing demand for regular monitoring among patients. The increasing patient pool, growing technological advancements in these systems, improving healthcare access, and increasing healthcare expenditure are some of the additional factors contributing to the growth of the Brazil market.

Market Overview

The blood glucose monitoring in Brazil to the regular measurement of the blood sugar level to manage diabetes and prevent complications. It involves using glucose meters or continuous monitoring systems, guided by healthcare professionals and national health policies, to improve diabetes control, patient education, and overall public health outcomes. The use of blood glucose monitoring in Brazil is growing as more consumers learn about diabetes and get access to better technology. With support from government programs, new digital tools, and stronger health education, more Brazilians are taking control of their diabetes and improving their daily lives. For instance, in June 2024 MicroTech Medical's AiDEX CGMS recently cleared the rigorous assessment by the Brazilian National Health Surveillance Agency (ANVISA) and has forged a strategic partnership with the esteemed local glucose equipment distributor, Medlevensohn. This milestone marks the official entry of AiDEX CGMS into the Brazilian market.

Report Coverage

This research report categorizes the market for the Brazil blood glucose monitoring market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazilian blood glucose monitoring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil blood glucose monitoring market.

Driving Factors

The growth of Brazil's blood glucose monitoring market is driven by increasing diabetes prevalence, rising health awareness, government healthcare initiatives, and technological advancements. Expanding access to digital monitoring devices and improved patient education further support market development and diabetes management across the country.

Restraining Factors

The Brazil blood glucose monitoring market faces restraints such as high device costs, limited access in rural areas, and a lack of awareness about regular monitoring. Inconsistent healthcare infrastructure, insufficient insurance coverage, and dependence on imports also hamper market growth and prevent widespread adoption of advanced monitoring technologies

Market Segmentation

The Brazil blood glucose monitoring market share is categorized by product type, application, and technology

The continuous glucose monitoring (CGM) Systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil blood glucose monitoring market is segmented by product type into self-monitoring blood glucose meters (SMBG), continuous glucose monitoring (CGM) systems, test strips, lancets, and wearable glucose monitoring devices. Among these, the continuous glucose monitoring (CGM) systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Continuous glucose monitoring (CGM) dominates the Brazil market due to its ability to provide real-time, accurate blood sugar data without frequent finger pricks. It helps patients track glucose trends, prevent complications, and improve diabetes management. Growing awareness, technological innovation, and increasing adoption among urban, tech-savvy populations further strengthen CGM’s market leadership.

The type 2 diabetes management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil blood glucose monitoring market is segmented by application into type 1 diabetes management, type 2 diabetes management, gestational diabetes management, and pre-diabetes monitoring. Among these, the type 2 diabetes management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the country has a high prevalence of type 2 diabetes. Factors such as sedentary lifestyles, unhealthy diets, urbanization, and rising obesity rates have significantly increased the number of patients. As a result, the demand for regular blood glucose monitoring and advanced diabetes management devices is much higher in this segment compared to others.

The invasive monitoring segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil blood glucose monitoring market is segmented by technology into invasive monitoring and non-invasive monitoring. Among these, the Invasive monitoring segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is dominated due to its offers accurate and reliable results at an affordable cost. Devices like traditional glucose meters and test strips are easily available, simple to use, and widely trusted by patients and healthcare providers, making them the most common choice for daily diabetes management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil blood glucose monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Diagnostics

- Abbott Laboratories

- Medtronic plc

- Johnson & Johnson (LifeScan)

- Dexcom, Inc.

- Ascensia Diabetes Care Holdings AG

- Bayer Healthcare

- Arkray Inc.

- Trividia Health

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In June 2024, in Brazil, MicroTech Medical introduced the AiDEX CGM system, which uses cutting-edge sensor technology to monitor real-time blood glucose levels.

Market Segment

Brazil Blood Glucose Monitoring Market, By Product Type

- Self-Monitoring Blood Glucose Meters (SMBG)

- Continuous Glucose Monitoring (CGM) Systems

- Test Strips

- Lancets

- Wearable Glucose Monitoring Devices

Brazil Blood Glucose Monitoring Market, by Application

- Type 1 Diabetes Management

- Type 2 Diabetes Management

- Gestational Diabetes Management

- Pre-Diabetes Monitoring

Brazil Blood Glucose Monitoring Market, by Technology

- Invasive Monitoring

- Non-Invasive Monitoring

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 263 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |