Brazil Breast Implants Market

Brazil Breast Implants Market Size, Share, and COVID-19 Impact Analysis, By Product (Silicone Breast Implants, Saline Breast Implants, and Others), By Application (Cosmetic Surgery, Reconstructive Surgery), By End User (Hospital, Specialty Clinics, and Others), and Brazil Breast Implants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Breast Implants Market Insights Forecasts to 2035

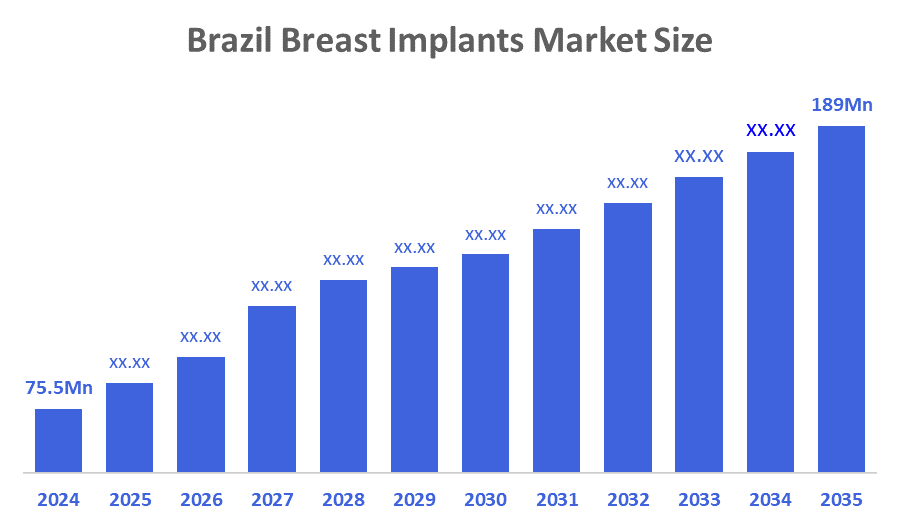

- The Brazil Breast Implants Market Size Was Estimated at USD 75.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.7% from 2025 to 2035

- The Brazil Breast Implants Market Size is Expected to Reach USD 189 Million by 2035

According To a Research Report Published By Decisions Advisors & Consulting, The Brazil Breast Implants Market Size Is Anticipated To Reach USD 189 Million By 2035, Growing At A CAGR Af 8.7% From 2025 to 2035. The Brazil breast implants market is driven by rising cosmetic surgery demand, growing body-image awareness, increasing disposable income, medical tourism growth, and advancements in implant materials and surgical techniques, supported by a strong presence of skilled plastic surgeons across the country.

Market Overview

Breast?????? implants are artificially made devices that are implanted surgically beneath the breast tissue or the muscles of the chest to increase the size of the breasts, change their shape or make them symmetrical, or recreate the breasts that have been removed after a mastectomy or have been damaged due to an accident. Generally, the implants are made of silicone gel or saline and can differ in size, shape, and surface texture. Moreover, the Brazil breast implants market is positively impacted by various factors such as the increasing awareness of cosmetics, a well-established aesthetic procedure culture, rising medical tourism, enhanced implant safety and quality, the growing number of reconstructive surgeries, and the ease of cosmetic implant acceptance by different age groups. Besides that, the government of Brazil is monitoring the breast implant market in order to maintain product safety, quality standards, and consumer protection. The regulatory frameworks might comprise implant design standards, manufacturing processes, and post-market surveillance to ensure continued safety and effectiveness. Moreover, government policies concerning medical device registration, patient education, and healthcare provider training could help inform patients and make them safer in the breast implant market in Brazil.

Technological enhancements in implant materials are making implants safer and more comfortable in Brazil. The use of lighter implants alleviates post-surgery discomfort and long-term fatigue. The use of cohesive gels and textured implants allows natural results and lowers the risk of complications. To obtain higher patient satisfaction, the manufacturers are putting a lot of money into the development of biocompatible designs. This movement is changing the norms of implant safety and technological ??????advancement.

Report Coverage

This research report categorizes the market for the Brazil breast implants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil breast implants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil breast implants market.

Driving Factors

The Brazil breast implants market is driven by a strong demand for cosmetic and aesthetic procedures, increasing body-image awareness, and cultural acceptance of plastic surgery. Growth in medical tourism, availability of skilled and internationally recognized plastic surgeons, and advanced healthcare facilities support market expansion. Additionally, rising disposable income, improved implant safety and durability, growing reconstructive surgeries after breast cancer, and continuous innovation in implant materials and surgical techniques further accelerate market growth.

Restraining Factors

The Brazil breast implants market faces restraints such as high procedure costs, potential health risks and complications, and concerns over implant safety and long-term effects. Strict regulatory requirements, fear of revision surgeries, and limited affordability among lower-income populations also restrict market growth and slow wider adoption.

Market Segmentation

The Brazil breast implants market share is categorized by product, application and end user.

- The silicone breast implants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil breast implants market is segmented by product into silicone breast implants, saline breast implants, and others. Among these, the silicone breast implants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their close mimicry of the natural feel and appearance of breast tissue, which aligns with Brazil’s strong aesthetic preferences. Plastic surgeons widely recommend silicone implants due to their long-lasting results, lower rippling risk, and improved safety with modern cohesive gel technology. Additionally, high demand for cosmetic enhancement and reconstructive surgeries, along with greater patient awareness and willingness to invest in premium outcomes, further support silicone implant dominance.

- The cosmetic surgery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil breast implants market is segmented by application into cosmetic surgery and reconstructive surgery. Among these, the cosmetic surgery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to Brazil’s strong beauty-conscious culture and high acceptance of aesthetic procedures. A large number of women seek breast augmentation to enhance their body appearance and confidence. The availability of highly skilled plastic surgeons, advanced surgical facilities, and comparatively affordable procedure costs further boosts demand. Additionally, social media influence, rising disposable income, and growing medical tourism contribute to the higher volume of cosmetic breast implant procedures compared to reconstructive surgeries.

- The specialty clinics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil breast implants market is segmented by end user into hospitals, specialty clinics, and others. Among these, the specialty clinics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of this segment is due to the fact that most cosmetic breast implant procedures are performed in dedicated plastic surgery and aesthetic clinics. These clinics provide specialized expertise, advanced surgical equipment, personalized patient care, and shorter waiting times compared to hospitals. Brazil’s large number of well-established cosmetic surgery clinics with experienced plastic surgeons attracts both domestic and international patients. Additionally, competitive pricing, high procedure volumes, and strong patient trust further reinforce the dominance of specialty clinics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil breast implants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Silimed

- AbbVie Inc. (Allergan)

- Establishment Labs S.A.

- GC Aesthetics

- Johnson & Johnson / Mentor Worldwide LLC

- Sientra, Inc.

- Groupe Sebbin SAS

- Polytech Health & Aesthetics GmbH

- CEREPLAS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- December 2022, Sientra, Inc. announced that it had received regulatory approval from the United Arab Emirates Ministry of Health and Prevention for the commercialization of its silicone gel breast implants in the country.

- In September 2022, Sientra, Inc. announced that it had received the Saudi Food & Drug Authority’s regulatory approval for the commercialization of silicone gel implants for breast implant procedures in Saudi Arabia.

- October 2022, GC Aesthetics announced that it had obtained the CE approval for LUNA xt, a micro-textured anatomical breast implant. With this approval, LUNA xt became the first implant approved under the European Medical Device Regulation (MDR).

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil breast implants market based on the below-mentioned segments:

Brazil Breast Implants Market, By Product

- Silicone Breast Implants

- Saline Breast Implants

- Others

Brazil Breast Implants Market, By Application

Cosmetic Surgery

Reconstructive Surgery

Brazil Breast Implants Market, By End User

- Hospital

- Specialty Clinics

- Others

FAQ’s

Q1: What types of breast implants are available in Brazil?

- The market primarily offers silicone and saline implants, with silicone being preferred for its natural look and feel.

Q2: Why do specialty clinics dominate breast implant procedures in Brazil?

- Specialty clinics provide advanced surgical expertise, personalized care, modern equipment, and faster procedures, making them the preferred choice over hospitals.

Q3: How does Brazil’s culture influence breast implant demand?

- Brazil has a strong aesthetic-conscious culture, encouraging women to undergo cosmetic enhancements, including breast augmentation.

Q4: Are reconstructive procedures common in Brazil?

- While present, reconstructive surgeries are less frequent than cosmetic procedures, with most implants used for aesthetic purposes.

Q5: What challenges restrict market growth?

- High procedure costs, potential complications, regulatory constraints, and concerns over long-term implant safety limit wider adoption.

Q6: Which innovations are boosting the market?

- Advanced silicone gels, safer implant materials, minimally invasive techniques, and better post-surgery outcomes are driving adoption.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |