Brazil Breast Pump Market

Brazil Breast Pump Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Electric Pumps, Manual Pumps, Wearable Pumps, Hospital-Grade Pumps), By Mechanism (Single/Double, Hand-Operated, Smart Technology, Hospital-Strength), By Application (Milk Extraction, Occasional Use, Discreet Pumping, NICU & Preterm Babies), and Brazil Breast Pump Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Breast Pump Market Insights Forecasts to 2035

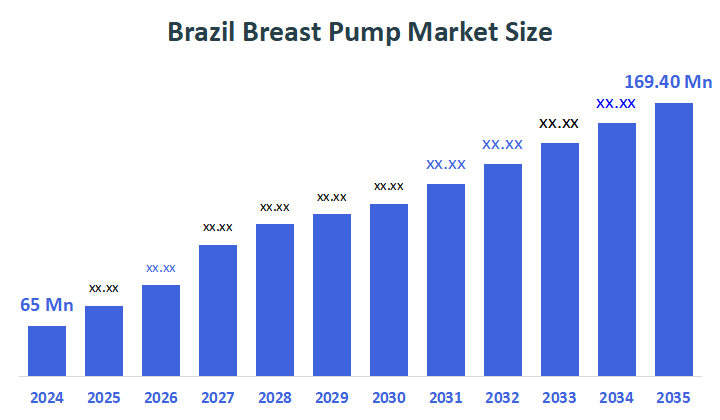

- The Brazil Breast Pump Market Size Was Estimated at USD 65 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.1% from 2025 to 2035

- The Brazil Breast Pump Market Size is Expected to Reach USD 169.40 Million by 2035

According to a research report published by Decisions Advisors & Consulting, the Brazil Breast Pump Market Size is anticipated to reach USD 169.40 Million by 2035, growing at a CAGR of 9.1% from 2025 to 2035. The Brazil Breast Pump Market Size is driven by increasing awareness of breastfeeding benefits, rising working mothers, growing e-commerce channels, technological advancements in portable and electric pumps, and supportive government initiatives promoting maternal and child health across urban and semi-urban areas.

Market Overview

A?????? breast pump is a medical device that is specifically made to take milk out of the breasts of a lactating mother. The device can be a manual one or a powered one. With this tool, mothers can collect milk for later feeding, keep their milk production going, ease from breast congestion, and help the process of breastfeeding, which is the most common scenario in the case of working mothers, or if the mother is facing feeding issues. On top of that, the Brazil Breast Pump Market Size expansion is mainly due to the increasing number of women who work outside the home, the level of awareness about the benefits of breastfeeding, the demand for convenient and hygienic feeding solutions, the technological development of portable and electric pumps, and the rise of online and retail channels for distribution. In addition to that, public health programs in Brazil aim at creating awareness about the practice of breastfeeding. The policies set up encourage mothers to use breast pumping safely. Government campaigns give out the idea of breast pumping as a mutual way of benefiting the mother and the child. Besides that, the cooperation between the government and NGOs in the country plays a very important role in education and the distribution of breast pumps. Such programs are growing very rapidly as they practically open the way to the largest number of users.

Furthermore, innovative ideas involving pump technologies are driving fuel to market expansion. Some of these features include, for example, rechargeable batteries, silent motors, and ergonomic designs, which are very attractive to users. In addition, Smart connectivity is greatly improving the ease of use and monitoring of the devices. More and more users are discovering that technological advancements in the field have made devices more efficient and also much easier to use. This factor is still changing the customers' perception of this product and, at the same time, increasing its sales. Besides that, the trend of mothers in Brazil shifting their preference to wearable and portable pumps just to be sure of the convenience is not fading away. These kinds of devices enable users to be discreet, free to move, and have a better overall experience. The reason for market penetration is mainly sophisticated lifestyles, as well as the requirements of the workplace. The creators of the appliances are coming up with new ideas, and the designs are getting lighter and quieter. This tendency is a reflection of the request for features without the sacrifice of ??????comfort.

Report Coverage

This research report categorizes the market for the Brazil breast pump market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil breast pump market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil breast pump market.

Driving Factors

The Brazil Breast Pump Market Size is primarily driven by the increasing number of working mothers seeking convenient breastfeeding solutions, coupled with growing awareness of the health benefits of breast milk for infants. Technological innovations, such as portable, electric, and hands-free pumps, enhance usability and efficiency. Rising e-commerce adoption and expanding retail networks improve accessibility across urban and semi-urban regions. Additionally, supportive government initiatives promoting maternal and child health, along with educational campaigns on breastfeeding, further propel market growth and adoption.

Restraining Factors

The Brazil Breast Pump Market Size faces restraints due to high product costs, especially for advanced electric models, which can limit affordability. Limited awareness in rural areas, cultural preferences for direct breastfeeding, and concerns over hygiene and maintenance of pumps also hinder adoption. Additionally, a lack of insurance coverage for breast pumps can restrict widespread accessibility and market penetration.

Market Segmentation

The Brazil breast pump market share is categorized by product type, mechanism, and application.

- The electric pumps segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil breast pump market is segmented by product type into electric pumps, manual pumps, wearable pumps, and hospital-grade pumps. Among these, the electric pumps segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their convenience and efficiency, allowing mothers to express milk quickly and comfortably, which is especially valuable for working women with limited time. Advanced features like adjustable suction, portability, and hands-free operation enhance user experience. Urban populations with higher disposable incomes prefer these modern solutions over manual pumps. Additionally, growing awareness of breastfeeding benefits, availability through e-commerce, and supportive healthcare initiatives further boost the adoption of electric pumps across the country.

- The single/double segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil breast pump market is segmented by mechanism into single/double, hand-operated, smart technology, and hospital-strength. Among these, the single/double segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its practicality and efficiency for everyday breastfeeding needs. Double pumps allow simultaneous milk expression from both breasts, saving time and supporting better milk supply, which appeals to working mothers. These mechanisms are widely available in electric models, offering adjustable suction and comfort. Compared to hospital-strength or smart technology pumps, single/double mechanisms are more affordable and suitable for home use, leading to higher adoption across urban households.

- The milk extraction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil breast pump market is segmented by application into milk extraction, occasional use, discreet pumping, NICU & preterm babies. Among these, the milk extraction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its essential role in supporting daily breastfeeding routines. Working mothers increasingly rely on breast pumps to express and store milk for regular feeding when they are away from their infants. Growing awareness of the nutritional and immunity benefits of breast milk further increases usage. Additionally, improved availability of electric and portable pumps through retail and online channels makes routine milk extraction more convenient, affordable, and widely adopted than other specialized applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil breast pump market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medela AG

- Pigeon Corporation

- Philips Avent

- Ameda AG

- Ardo Medical AG

- NUK

- Tommee Tippee Evenflo Feeding

- Spectra Baby USA

- Lansinoh Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Momcozy displayed its brand-new wearable breast pumps & massagers at the Florida International Medical Expo. The M5, S12 Pro & S9 Pro breast pumps & the 3-Mode Adjustable Kneading Lactation Massager received positive feedback from attendees. The M5 wearable pump features a unique baby mouth-shaped design, vibration suction mode, and a lightweight, compact design. The S12 Pro and S9 Pro breast pumps are top-sellers in Amazon North America’s Electric Breast Pumps category.

- In November 2022, Medela launched its first wearable breast pump, “the Freestyle Hands-free Breast Pump.” The collection cups are lightweight, comfortable & discreet, and connected to a handy pump motor according to Medela’s research. The breast pump integrates Medela's patented 2-Phase Expression technology and research-based 105? breast shields, delivering an exceptional hands-free pumping experience. The cups are designed to fit and complement the anatomy of the lactating breast, providing comfort and peace of mind. The Freestyle Hands-free Breast Pump can be worn with Medela’s 3-in-1 Nursing & Pumping Bra and most other nursing bras.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil breast pump market based on the below-mentioned segments:

Brazil Breast Pump Market, By Product Type

- Electric Pumps

- Manual Pumps

- Wearable Pumps

- Hospital-Grade Pumps

Brazil Breast Pump Market, By Mechanism

- Single/Double

- Hand-Operated

- Smart Technology

- Hospital-Strength

Brazil Breast Pump Market, By Application

- Milk Extraction

- Occasional Use

- Discreet Pumping

- NICU & Preterm Babies

FAQ’s

1. What is a breast pump?

- A breast pump is a device used by lactating mothers to extract and store breast milk for later feeding.

2. Which breast pump type is most popular in Brazil?

- Electric breast pumps are the most popular due to convenience, efficiency, and suitability for working mothers.

3. What drives the growth of the Brazil breast pump market?

- Rising working women, awareness of breastfeeding benefits, technological advancements, and e-commerce expansion drive market growth.

4. Which application segment dominates the market?

- Milk extraction dominates as pumps are mainly used for regular milk expression and storage.

5. What are the main challenges in the market?

- High costs of advanced pumps, limited rural awareness, and preference for direct breastfeeding are key challenges.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |