Brazil Bunker Fuel Market

Brazil Bunker Fuel Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (High Sulfur Fuel Oil, Very Low Sulfur Fuel Oil, Marine Gas Oil, Liquefied Natural Gas, and Other), By Vessel Type (Containers, Tankers, General Cargo, Bulk Carriers, and Other), and Brazil Bunker Fuel Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Bunker Fuel Market Insights Forecasts to 2035

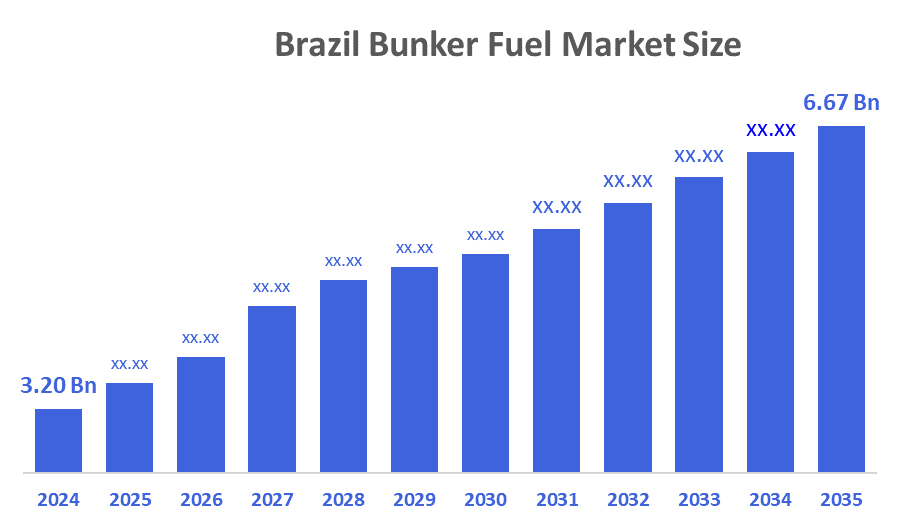

- The Brazil Bunker Fuel Market Size Was Estimated at USD 3.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.9% from 2025 to 2035

- The Brazil Bunker Fuel Market Size is Expected to Reach USD 6.67 Billion by 2035

According to a research report published by Decision Advisor & Consulting, The Brazil Bunker Fuel Market Size is Anticipated to reach USD 6.67 Billion by 2035, Growing at a CAGR of 6.9% from 2025 to 2035. The Brazil bunker fuel market is driven by the growth of maritime trade, increasing shipping activities, government initiatives supporting port infrastructure, rising demand for fuel in logistics and transportation, and the adoption of cleaner, low-sulfur fuels in compliance with IMO regulations.

Market Overview

The Brazil bunker fuel market refers to the industry involved in the production, supply, and distribution of fuel used by ships and vessels for propulsion and energy needs. It includes various types of marine fuels such as heavy fuel oil, marine diesel, and low-sulfur alternatives. The market is influenced by maritime trade, shipping activities, environmental regulations, and technological advancements in fuel efficiency and emissions control. Furthermore, the growth of the market is driven by expanding maritime trade, increasing shipping volumes, port infrastructure development, rising demand for marine fuels, and stricter environmental regulations promoting low-sulfur and cleaner fuel alternatives in the shipping industry.

The Brazil bunker fuel market is witnessing three key trends shaping its future. First, there is a strong shift toward low-sulfur and cleaner fuels due to IMO 2020 regulations, compelling ships to reduce sulfur emissions and adopt environmentally compliant fuel alternatives. Second, the adoption of alternative fuels like LNG and biofuels is increasing, driven by sustainability goals and the need for more efficient, eco-friendly energy sources. Third, digitalization and port efficiency improvements are transforming fuel management through smart monitoring, automation, and optimized distribution, reducing operational costs and enhancing overall supply chain performance.

The Brazilian government supports the bunker fuel market through regulations, incentives, and infrastructure development aimed at promoting cleaner fuels and sustainable maritime operations. Policies aligned with IMO standards encourage the adoption of low-sulfur fuels and alternative energy sources, while investments in port modernization and logistics enhance fuel distribution efficiency. Technological innovations, such as digital fuel management systems, automated monitoring, and emission-reduction technologies, are being integrated to optimize operations and compliance. Together, government initiatives and technology advancements drive market growth, sustainability, and competitiveness in Brazil’s maritime fuel sector.

Report Coverage

This research report categorizes the market for the Brazil bunker fuel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil bunker fuel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil bunker fuel market.

Driving Factors

The Brazil bunker fuel market is primarily driven by the growth of maritime trade and increasing shipping activities, which directly boost fuel demand. Expanding port infrastructure and logistics networks facilitate efficient fuel distribution, supporting market expansion. Regulatory compliance with the international maritime organization 2020 sulfur limits is pushing shipping companies to adopt low-sulfur and cleaner fuel alternatives. Additionally, rising environmental awareness and sustainability goals are accelerating the use of alternative fuels like LNG and biofuels. Technological advancements in fuel management and monitoring further enhance operational efficiency, fueling market growth.

Restraining Factors

The Brazil bunker fuel market faces restraints from fluctuating crude oil prices, which increase operational costs for shipping companies. Strict environmental regulations and high compliance costs for low-sulfur and alternative fuels also limit market growth. Additionally, the slow adoption of advanced technologies and infrastructure challenges at some ports hinder efficient fuel distribution and supply chain optimization, restraining overall market expansion.

Market Segmentation

The Brazil bunker fuel market share is classified into fuel type and vessel type.

- The high sulfur fuel oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil bunker fuel market is segmented by fuel type into high sulfur fuel oil, very low sulfur fuel oil, marine gas oil, liquefied natural gas, and other. Among these, the high sulfur fuel oil segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of high sulfur fuel oil (HSFO) in the market is primarily due to its lower cost compared to very low sulfur fuel oil (VLSFO) and alternative fuels, making it economically attractive for shipping operators. Additionally, existing infrastructure and storage facilities are better equipped for HSFO, ensuring easy availability. Many vessels, especially older ships, are designed to use HSFO, and despite stricter environmental regulations, the transition to cleaner fuels is gradual, sustaining HSFO’s market share.

- The tankers segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil bunker fuel market is segmented by vessel type into containers, tankers, general cargo, bulk carriers, and other. Among these, the tankers segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the tanker segment in the market is driven by its high fuel consumption during long-distance voyages and continuous engine operation. Tankers transport large volumes of crude oil, petroleum products, and chemicals, requiring substantial fuel for propulsion and onboard operations. Additionally, Brazil’s significant oil export activities increase tanker traffic, further boosting fuel demand. Compared to other vessels, tankers operate more frequently and over longer routes, making them the primary consumers of bunker fuels in the country.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil bunker fuel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bunker Holding A/S

- World Fuel Services Corp

- Monjasa Holding A/S

- AP?Moeller?Maersk?A/S

- Peninsula Petroleum Ltd

- Shell Brasil

- BP Brasil

- Petrobras

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In June 2024, ExxonMobil launched a new series of bunker fuels with lower sulphur content aimed at reducing environmental impact and aligning with stricter maritime emission regulations, strengthening its presence in the South American market.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Brazil bunker fuel market based on the below-mentioned segments:

Brazil Bunker Fuel Market, By Fuel Type

- High Sulfur Fuel Oil

- Very Low Sulfur Fuel Oil

- Marine Gas Oil

- Liquefied Natural Gas

- Other

Brazil Bunker Fuel Market, By Vessel Type

- Containers

- Tankers

- General Cargo

- Bulk Carriers

- Other

FAQ’s

1. What is the Brazil bunker fuel market?

The Brazil bunker fuel market refers to the industry involved in the production, supply, and distribution of marine fuels used by ships and vessels in Brazilian waters.

2. What are the key drivers of the Brazil bunker fuel market?

The market is driven by maritime trade growth, rising shipping activities, port infrastructure development, and regulatory compliance with IMO sulfur limits.

3. Which fuel types dominate the Brazil bunker fuel market?

High sulfur fuel oil (HSFO) currently dominates, though very low sulfur fuel oil (VLSFO), marine gas oil, and LNG are gaining adoption.

4. How is the Brazil bunker fuel market segmented by vessel type?

The market is segmented into tankers, containers, bulk carriers, general cargo, and other vessels, with tankers being the largest consumers.

5. What are the major trends in the Brazil bunker fuel market?

Key trends include a shift to low-sulfur fuels, adoption of alternative fuels like LNG and biofuels, and digitalization of fuel management and port operations.

6. Who are the key companies operating in the Brazil bunker fuel market?

Major players include Petrobras, Shell Brasil, BP Brasil, Maersk, Bunker Holding, and World Fuel Services.

7. What are the restraints affecting the Brazil bunker fuel market?

High compliance costs for low-sulfur fuels, fluctuating crude oil prices, and infrastructure limitations in some ports restrain market growth.

8. How is technology influencing the Brazil bunker fuel market?

Technological innovations, such as automated fuel management systems, emission reduction technologies, and digital monitoring, are improving efficiency and regulatory compliance.

9. What role does the Brazilian government play in the bunker fuel market?

The government supports the market through regulations, incentives for cleaner fuels, and investments in port and logistics infrastructure.

10. What is the future outlook for the Brazil bunker fuel market?

The market is expected to grow steadily, driven by increasing maritime trade, environmental regulations, the adoption of cleaner fuels, and technological advancements in fuel management.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |