Brazil Car Insurance Market

Brazil Car Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Third-Party Liability Coverage, Collision/Comprehensive/Other Optional Coverage), By Application (Personal Vehicles, Commercial Vehicles), By Distribution Channel (Direct Sales, Individual Agents, Brokers, Banks, Online, Other), and Brazil Car Insurance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Car Insurance Market Insights Forecasts to 2035

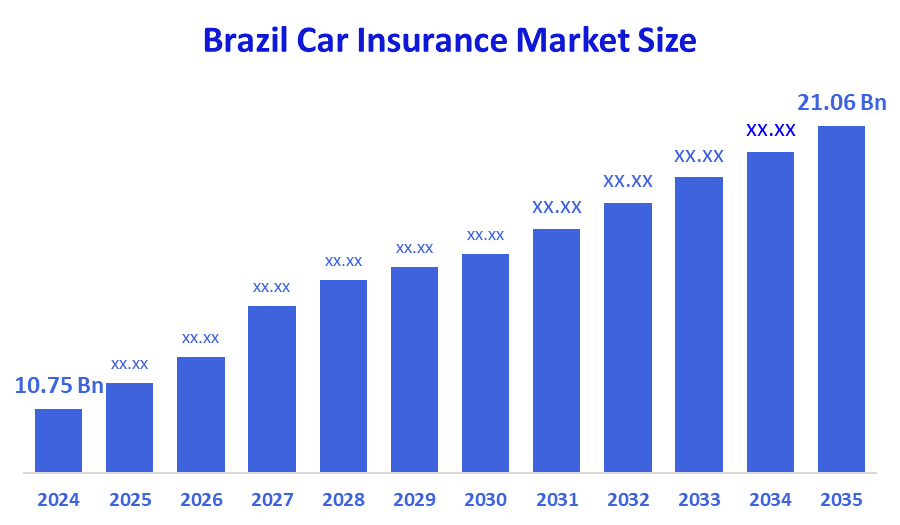

- The Brazil Car Insurance Market Size Was Estimated at USD 10.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.3% from 2025 to 2035

- The Brazil Car Insurance Market Size is Expected to Reach USD 21.06 Billion by 2035

According To A Research Report Published By Decision Advisors, The Brazil Car Insurance Market Size Is Anticipated To Reach USD 21.06 Billion By 2035, Growing At A CAGR Of 6.3% From 2025 To 2035. The Brazil Car Insurance Market Is Driven By Rising Vehicle Ownership, Increasing Urbanization, High Accident And Theft Rates, Mandatory Insurance Requirements, Growing Awareness Of Financial Protection, Digital Insurance Platforms, And Demand For Affordable, Customized Coverage Solutions Across Private And Commercial Vehicles.

Market Overview

The Brazil car insurance market refers to the provision of financial protection products that cover private and commercial vehicles against risks such as accidents, theft, natural disasters, third-party liability, and vehicle damage. The market plays a vital role in Brazil’s automotive and financial services ecosystem, supported by a large and growing vehicle parc and increasing road traffic density. Market growth is driven by rising vehicle ownership, high accident and crime rates in urban areas, mandatory third-party liability coverage, and increasing consumer awareness about financial risk management. Additionally, digital distribution channels and competitive pricing strategies are expanding insurance penetration, particularly among middle-income and first-time vehicle owners.

Several key trends are shaping the Brazil car insurance market. First, digitalization and insurtech adoption are transforming policy sales, claims processing, and customer engagement through mobile apps, AI-based underwriting, and online comparison platforms. Second, usage-based insurance and telematics solutions are gaining traction, allowing insurers to price premiums based on driving behaviour and mileage. Third, demand for customized and flexible insurance plans is increasing, with consumers seeking add-on covers, short-term policies, and affordable premium options. Fourth, partnerships between insurers, automakers, and ride-hailing platforms are expanding embedded insurance offerings, improving market reach and customer convenience.

Government policy and regulatory support play an important role in the market’s development. The Brazilian government mandates compulsory vehicle insurance for personal injury coverage, ensuring basic protection and supporting market stability. Regulatory oversight by insurance authorities promotes transparency, consumer protection, and solvency of insurers. Additionally, initiatives encouraging digital financial services and data security are supporting innovation in insurance distribution. Government efforts to improve road safety and traffic regulations indirectly contribute to sustained demand for car insurance across the country.

Report Coverage

This research report categorizes the market for the Brazil car insurance market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil car insurance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil car insurance market.

Driving Factors

The Brazil car insurance market is driven by rising vehicle ownership, increasing urbanization, and heavy traffic congestion, which raise accident risks. High rates of vehicle theft and vandalism further increase demand for comprehensive coverage. Mandatory third-party liability insurance ensures baseline market participation. Growing awareness of financial protection among consumers, expanding middle-class income levels, and the availability of affordable, customized policies support adoption. Additionally, digital insurance platforms, faster claims processing, and competitive pricing strategies are encouraging wider penetration across private and commercial vehicle segments.

Restraining Factors

The Brazil car insurance market faces restraints from high premium costs, which limit adoption among low-income vehicle owners. Insurance fraud and false claims increase operational expenses for insurers. Low insurance awareness in rural areas, economic volatility, and complex claims procedures also discourage consumers from purchasing or renewing car insurance policies.

Market Segmentation

The Brazil car insurance market share is classified into coverage, application, and distribution channel.

- The collision/comprehensive/other optional coverage segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil car insurance market is segmented by coverage into third-party liability coverage, collision/comprehensive/other optional coverage. Among these, the collision/comprehensive/other optional coverage segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The collision, comprehensive, and other optional coverage segment dominates the market because it offers wider financial protection against theft, accidents, vandalism, and natural disasters, which are common risks in Brazil’s urban areas. High vehicle crime rates and congested traffic increase demand for full coverage. Additionally, owners of new and high-value vehicles prefer comprehensive policies to avoid costly out-of-pocket repairs, making this segment more attractive than basic third-party liability coverage.

- The personal vehicles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil car insurance market is segmented by application into personal vehicles and commercial vehicles. Among these, the personal vehicles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The personal vehicles segment dominates the market due to the large number of privately owned cars compared to commercial fleets. Rapid urbanization, daily commuting needs, and rising middle-class income levels are increasing personal car ownership. Individual vehicle owners are also more likely to purchase comprehensive insurance to protect against accidents, theft, and repair costs. Additionally, mandatory third-party coverage and growing awareness of financial security further support higher insurance adoption in the personal vehicle segment.

- The brokers segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil car insurance market is segmented by application into direct sales, individual agents, brokers, banks, online, and other. Among these, the brokers segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The brokers segment dominates the market because brokers offer personalized advice, policy comparison across multiple insurers, and assistance with claims, which builds strong customer trust. Many consumers prefer brokers to navigate complex coverage options and pricing. Brokers also have wide distribution networks and long-standing relationships with insurers and customers. This channel is especially popular among personal and commercial vehicle owners seeking tailored coverage, competitive premiums, and reliable after-sales support.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil car insurance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Porto Seguro

- Bradesco Seguros

- MAPFRE Seguros

- Tokio Marine Seguradora

- Allianz Seguros

- Liberty Seguros

- HDI Seguros

- Zurich Santander Seguros

- Itaú Seguros

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

?In June 2023, the Brazilian government announced plans to implement a partial federal diesel tax reduction to lower vehicle costs for consumers. Automobile manufacturers will be offered tax credits as an incentive to reduce the prices of their vehicles.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Brazil car insurance market based on the below-mentioned segments:

Brazil Car Insurance Market, By Coverage

- Third-Party Liability Coverage

- Collision/Comprehensive/Other Optional Coverage

Brazil Car Insurance Market, By Application

- Personal Vehicles

- Commercial Vehicles

Brazil Car Insurance Market, By Distribution Channel

- Direct Sales

- Individual Agents

- Brokers

- Banks

- Online

- Other

FAQ’s

1. What is the Brazil car insurance market?

The Brazil car insurance market includes insurance products that provide financial protection against vehicle-related risks such as accidents, theft, damage, and third-party liabilities for personal and commercial vehicles.

2. What are the key driving factors of the Brazil car insurance market?

The market is driven by rising vehicle ownership, high accident and theft rates, mandatory third-party liability coverage, growing awareness of financial security, and increasing adoption of digital insurance platforms.

3. Which coverage segment dominates the Brazil car insurance market?

The collision, comprehensive, and other optional coverage segment dominates the Brazil car insurance market due to demand for broader protection against theft, accidents, and repair costs.

4. Which application segment leads the Brazil car insurance market?

The personal vehicles segment leads the Brazil car insurance market, supported by a large base of privately owned vehicles and higher insurance penetration among individual car owners.

5. Which distribution channel dominates the Brazil car insurance market?

The brokers segment dominates the Brazil car insurance market as brokers offer policy comparison, customized solutions, and strong customer support, increasing consumer trust.

6. What are the major restraining factors in the Brazil car insurance market?

High premium costs, insurance fraud, low awareness in rural areas, economic instability, and complex claims processes restrain growth in the Brazil car insurance market.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |