Brazil Car Rental Market

Brazil Car Rental Market Size, Share, And COVID-19 Impact Analysis, By Vehicle Type (Economy Cars, Premium Cars, Mid-Size Vehicles, SUVs & Trucks, And Commercial Vehicles), By Customer Type (Leisure Travellers, Business Travellers, Corporate Accounts, And International Tourists), By Booking (OTA, Direct, And Corporate Portals), By Rental Duration (Daily Rentals and Weekly Rentals, Monthly Rentals, And Long-Term Leasing), And Brazil Car Rental Market Size Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

Brazil Car Rental Market Size Insights Forecasts to 2035

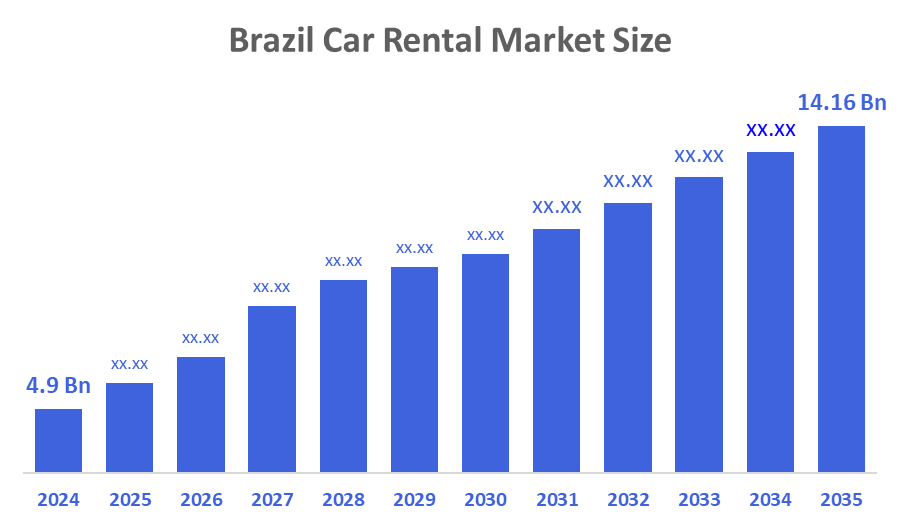

- Brazil Car Rental Market Size Was Estimated at USD 4.9 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 10.13% from 2025 to 2035.

- Brazil Car Rental Market Size is Expected to Reach USD 14.16 Billion by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Car Rental Market Size is Anticipated to Reach USD 14.16 Billion by 2035, Growing at a CAGR of 10.13% from 2025 to 2035. The Brazil Car Rental Market is driven by tourism sector recovery, business travel growth, urbanization trends creates customer bases in metropolitan cities, digital transformation reduce operational costs, and infrastructure development support market expansion.

Market Overview

A car rental is an arrangement in which customers pay to use a car for a short period, a few hours to a few weeks, through companies that are located near a city and provide travellers and locals with access to cars on a temporary basis for convenience, tourism, or other special needs. This typically requires an agreement and a fee. The Brazilian car rental market is the overall ecosystem for car rental services that operate throughout the Brazilian territory and includes short and long-term car rental services from established operators, up-and-coming digital platforms, and traditional car rental providers that meet various types of transportation needs in urban and rural markets across Brazil. Due to the development in the tourism sector, increasing business travel, and changing consumer preferences for flexible mobility solutions, the Brazil car rental market has great potential for growth. The Industry has been successful in overcoming its many challenges due to the implementation of various technological innovations to improve its operating efficiency and customer satisfaction levels.

Brazil is expected to have an expanding car rental market driven by an increase in visitors from abroad looking for rented automobiles as well as an increase in urbanization and changing lifestyles, increasing vehicle repair costs, driving more people towards their need for rental services and an overall increase in digital bookings supported by government for green transportation initiatives. The market also consisted of about 1.6 million vehicles with over 31,500 rental companies and created more than 105,000 direct employment opportunities contributing largely to the growth of the Brazil car rental market.

Report Coverage

This research report categorizes the market for the Brazil car rental market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil car rental market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil car rental market.

Driving Factors

The Brazil car rental market in Brazil is driven by urbanization with a growing focus on flexibility of rental payments options, the growth of tourism arriving at Brazilian airports, Increased demand for online booking systems, the expanding corporate rental market and long term subscription-based options, and the Brazilian government incentives to promote electric vehicle use within fleets creating a demand for more eco-friendly rental options.

Restraining Factors

Volatile fuel prices, high operational costs, intense completion from ride-sharing apps, complex regulations, economic instability impacting consumer spending, and significant traffic and safety concerns in cities restrain the overall car rental market in Brazil.

Market Segmentation

The Brazil car rental market share is classified into vehicle type, customer type, booking, and rental duration.

- The economy cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil car rental market is segmented by vehicle type into economy cars, premium cars, mid-size vehicles, SUVs & trucks, and commercial vehicles. Among these, the economy cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by cost effectiveness for budget-conscious tourists, students, and families, lower operational maintenance costs, high demand for fuel-efficiency beneficial for renters and operators, serve both short term leisure needs and basic business travel.

- The leisure travellers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil car rental market is segmented by customer type into leisure travellers, business travellers, corporate accounts, and international tourists. Among these, the leisure travellers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to Brazil’s rich tourism sector, millions of domestic and international visitors seeking flexibility for sightseeing, longer trip durations, and the need for transport to explore diverse destinations, with significant demand for both vacationers and business travellers extending leisure trips.

- The OTA segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil car rental market is segmented by booking type into OTA, direct, and corporate portals. Among these, the OTA segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by convenience source that allow users to compare price, vehicle types, and rental conditions from multiple providers, increased internet penetration making online booking the preferred method, and shift towards digital platforms drives the market.

- The daily rentals and weekly rentals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil car rental market is segmented by rental duration into daily rentals and weekly rentals, monthly rentals, and long-term leasing. Among these, the daily rentals and weekly rentals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to Brazil’s large tourism sector creating huge demand for short-term car hiring for exploring destinations, business flexibility making it ideal over long commitments, and cost efficient for non-permanent needs appealing to budget-conscious travellers and locals needing temporary cars.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Brazil car rental market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Localiza Rent a Car

- Movida

- Unidas

- Foco Rent a Car

- Turbi

- Avis Budget Group

- Sixt

- Europcar

- Enterprise Rent a Car

- Zarp Localiza

- LM Frotas

- Concept Lacadora de Veiculos

- Mister Car Rent a Car

- Realiza Rent a Car

- Gaudium Garage

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In October 2025, Turbi secured R$156 million in local notes from Itau Unibanco for domestic expansion and to prepare for an IPO, focusing on hourly rentals to monthly rentals subscriptions. Its vehicles are available 24/7 at approximately 300 partner parking lots, providing a high level of convenience without the bureaucracy of traditional car rental services.

• In May 2025, Mobilize, Renault’s mobility brand launched car-sharing for employees at Curitiba’s Copel headquarters, focusing on integrated, app-based corporate mobility offerings electric and combustion vehicles for personal and professional use, building on earlier trials and expanding corporate mobility solutions in Brazil.

• In July 2023, BYDC, the world’s leading manufacturer of new energy vehicles, collaborated with 99 and announced a vehicle-for-hire company operating in Brazil owned by Didi Chuxing , the arrival of 300 D1 EVs, the first electric vehicle tailor-made to meet the ride-hailing market’s demands through an application, marking a new milestone in fleet electrification for passengers in Brazil.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2025 to 2035. Decisions Advisors has segmented the Brazil Car Rental Market based on the below-mentioned segments:

Brazil Car Rental Market, By Vehicle Type

- Economy Cars

- Premium Cars

- Mid-Size Vehicles

- SUVs & Trucks

- Commercial Vehicles

Brazil Car Rental Market, By Customer Type

- Leisure Travellers

- Business Travellers

- Corporate Accounts

- International Tourists

Brazil Car Rental Market, By Booking

- OTA

- Direct

- Corporate Portal

Brazil Car Rental Market, By Rental Duration

- Daily Rentals & Weekly Rentals

- Monthly Rentals

- Long-Term Leasing

FAQ’s

Q. What is the projected market size & growth rate of the Brazil car rental market?

A. Brazil car rental market was valued at USD 4.9 Billion in 2024 and is projected to reach USD 14.16 Billion by 2035, growing at a CAGR of 10.13% from 2025 to 2035.

Q. What are the key driving factors for the growth of the Brazil car rental market?

A. The Brazil car rental market in Brazil are driven by urbanization and flexible mobility for rentals over ownership due to high costs and maintenance, tourism boom especially from airports, online booking platforms enhancing accessibility, corporate and long-term rentals with subscription models gaining traction, and government incentives push for EV adoption in fleets, creating a niche for green rental options.

Q. What are the top players operating in the Brazil car rental market?

A Localiza Rent a Car, Movida, Unidas, Foco Rent a Car, Turbi, Avis Budget Group, Sixt, Europcar, Enterprise Rent a Car, Zarp Localiza, LM Frotas, Concept Lacadora de Veiculos, Mister Car Rent a Car, Realiza Rent a Car, Gaudium Garage, and Others.

Q. What segments are covered in the Brazil car rental market report?

A. Brazil car rental market is segmented based on Vehicle Type, Customer Type, Booking, and Rental Duration.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 176 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |