Brazil Cardiac Pacemakers Market

Brazil Cardiac Pacemakers Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Implantable Cardiac Pacemaker, External Cardiac Pacemaker) by Technology (Single Chamber Pacemaker, Dual Chamber Pacemaker, Biventricular Pacemaker), and Brazil Cardiac Pacemakers Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Cardiac Pacemakers Market Insights Forecasts to 2035

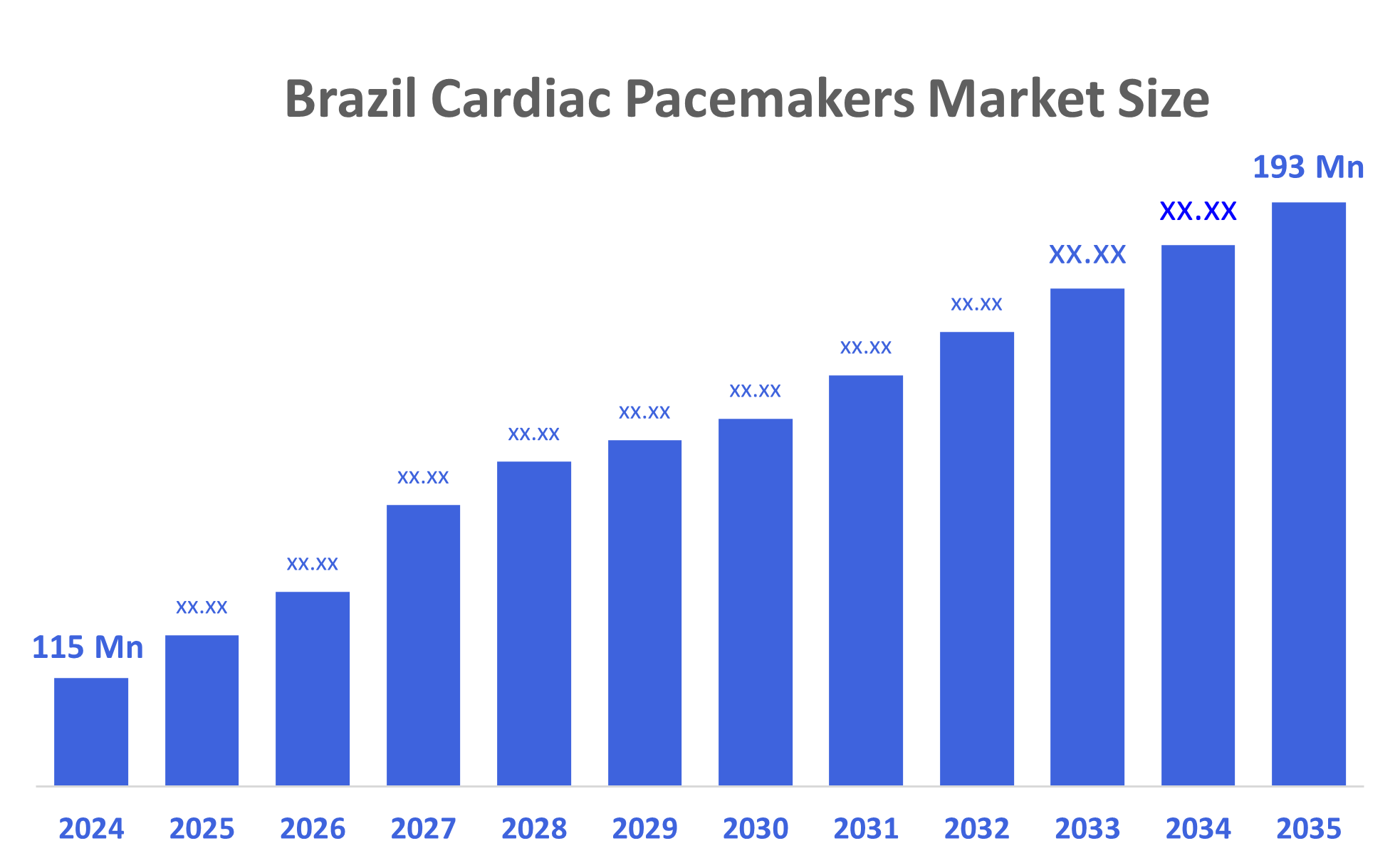

- The Brazil Cardiac Pacemakers Market Size Was Estimated at USD 115 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.8% from 2025 to 2035

- The Brazil Cardiac Pacemakers Market Size is Expected to Reach USD 193 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Cardiac Pacemakers Market Size is Anticipated to Reach USD 193 Million by 2035, Growing at a CAGR of 4.8% from 2025 to 2035. At present, with a rising number of individuals experiencing conditions like coronary artery disease, arrhythmia, and heart failure, the demand for medical devices, including stents, defibrillators, and diagnostic equipment, is growing. Supportive government initiatives and healthcare reforms are driving the Brazil cardiovascular devices market share.

Market Overview

The cardiac pacemaker system provides information about the development of new medical devices designed to treat heart rhythms. These systems also document how to care for patients with pacemakers after they receive implants for an abnormal heartbeat or heart attack. The current developing technology of the cardiac pacemaker is enhancing consumer comfort and the long-term success of these devices in the marketplace. The growth of the Brazilian cardiac pacemaker business is enhanced by the increase in patients suffering from cardiovascular illness, the increasing number of geriatric patients, the improved access to cardiologists, and the increasing use of the latest technologies to support the imaging and monitoring of patients receiving cardiac procedures. More investment in health care and increased rates of diagnosis of arrhythmias all aid in the continued growth of this segment of the health care industry. Additionally, Technology similar to the developments mentioned above continues to increase in use in Brazil, such as the use of leadless pacemakers, remote monitoring, and longer battery life. Additionally, in Brazil, government funding is a major influence on the expansion of public health care to underwrite a greater number of cardiac procedure starters and provide access to technologies to develop cardiac care models, leading to greater use of modern technologies for patients with abnormal heartbeats. The increase in these advanced technologies is a promise to the patient and the investor for a successful return on investment from investments made in advanced cardiac technologies.

Report Coverage

This research report categorizes the market for the Brazil cardiac pacemakers market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil cardiac pacemaker’s market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil cardiac pacemakers market.

Driving Factors

The Brazil cardiac pacemaker market is driven by increasing cases of cardiovascular diseases and arrhythmias, a growing elderly population, and improved diagnostic capabilities that enhance early detection. Advancements such as leadless, MRI-compatible, and remote-monitoring pacemakers are boosting adoption. Government investment in cardiac care infrastructure, wider health insurance coverage, and expanding access to specialized cardiology centers also support growth. Additionally, rising awareness of heart rhythm disorders and the resumption of elective procedures continue to drive steady demand for pacemaker implants nationwide.

Restraining Factors

the Brazil cardiac pacemakers market is restrained by including high device and implantation costs, limited reimbursement coverage in some regions, and budget constraints within the public healthcare system. Regional disparities in access to advanced cardiology facilities and specialist shortages also slow adoption. Additionally, regulatory delays, supply-chain challenges, and the high price of newer technologies restrict widespread penetration across the country.

Market Segmentation

The Brazil cardiac pacemakers market share is categorized by product type and technology.

- The implantable cardiac pacemakers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil cardiac pacemakers market is segmented by product type into implantable cardiac pacemakers, external cardiac pacemakers. Among these, the implantable cardiac pacemakers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by these devices provide long-term, reliable rhythm correction for chronic conditions such as bradycardia and heart block, which account for most pacing needs. They offer advanced features like MRI compatibility, longer battery life, miniaturized designs, and remote-monitoring capabilities, making them more suitable for sustained patient care. Brazilian hospitals also prioritize permanent implants due to better clinical outcomes and reduced follow-up interventions. As diagnostic rates rise and cardiac care infrastructure improves, implantable pacemakers remain the preferred and most widely adopted option.

- The dual-chamber pacemakers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil cardiac pacemakers market is segmented by technology into single-chamber pacemakers, dual-chamber pacemakers, and biventricular pacemakers. Among these, the dual-chamber pacemakers segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to these devices supporting a more natural heart rhythm by coordinating both atrial and ventricular pacing, improving cardiac output, and reducing symptoms in a wide range of arrhythmia patients. Physicians prefer them due to superior clinical outcomes, lower risk of complications, and better long-term performance compared to single-chamber systems. Additionally, Brazil’s expanding cardiology infrastructure and training have increased the adoption of advanced pacing technologies. Their versatility across multiple indications makes dual-chamber pacemakers the most commonly implanted option in both public and private healthcare settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil cardiac pacemakers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BIOTRONIK

- Medtronic

- Boston Scientific

- Abbott Laboratories

- LivaNova

- Osypka Medical

- MEDICO

- MicroPort Scientific

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2025, Abbott launched a dual-chamber leadless pacemaker system using two tiny, wirelessly communicating devices placed in the right atrium and ventricle. Synchronizing beat-by-beat, it eliminates leads and surgical pockets and extends the AVEIR VR platform’s benefits to more patients, particularly those with bradycardia.

- In September 2025, Medtronic launched the global ELEVATE-HFpEF trial to study personalized conduction system pacing in up to 700 HFpEF patients using MRI-compatible pacemakers. The trial aims to assess whether tailored pacing improves symptoms and outcomes, marking a key step in expanding pacemaker use for broader cardiac conditions.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil cardiac pacemakers market based on the below-mentioned segments:

Brazil Cardiac Pacemakers Market, By Product Type

- Implantable Cardiac Pacemaker

- External Cardiac Pacemaker

Brazil Cardiac Pacemakers Market, By Technology

- Single Chamber Pacemaker

- Dual Chamber Pacemaker

- Biventricular Pacemaker

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |