Brazil Central Nervous System Therapeutic Market

Brazil Central Nervous System Therapeutic Market Size, Share, and COVID-19 Impact Analysis, By Disease (Neurovascular Diseases, CNS Trauma, Mental Health Neurodegenerative Diseases), By Drug Class (Anesthetics, Anticonvulsants, CNS Stimulants, Pain Relievers, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Other), and Brazil Central Nervous System Therapeutic Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Central Nervous System Therapeutic Market Insights Forecasts to 2035

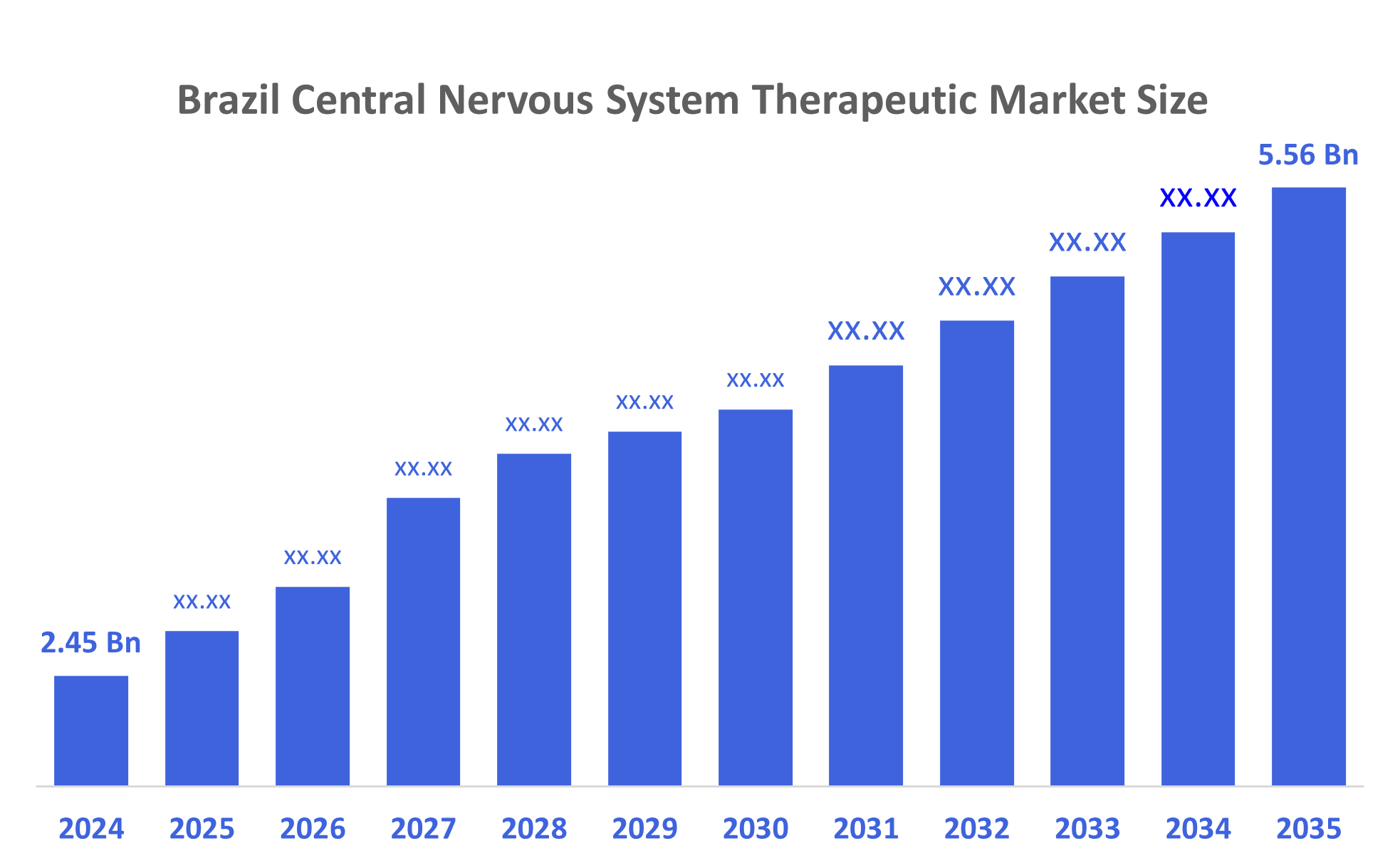

- The Brazil Central Nervous System Therapeutic Market Size Was Estimated at USD 2.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.9% from 2025 to 2035

- The Brazil Central Nervous System Therapeutic Market Size is Expected to Reach USD 5.56 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Central Nervous System Therapeutic Market Size is Anticipated to Reach USD 5.56 Billion by 2035, growing at a CAGR of 7.9% from 2025 to 2035. Brazil's central nervous system (CNS) therapeutics market is driven by several factors. These include the increasing prevalence of CNS disorders due to a growing aging population, government initiatives to improve mental healthcare, and heightened public awareness of mental health issues. Furthermore, advances in R&D and innovative treatment options are propelling market expansion.

Market Overview

Central Nervous System (CNS) therapeutics include medications and treatments designed to manage disorders affecting the brain, spinal cord, and neural pathways. These therapies aim to improve neurological function, alleviate symptoms, and slow disease progression in conditions such as epilepsy, Parkinson’s disease, Alzheimer’s, multiple sclerosis, depression, and anxiety. They work by targeting neurotransmitters, neural signalling, inflammation, or neurodegeneration to restore balance and function. Furthermore, Brazil’s CNS therapeutics market is expanding due to rising neurological disorders, an aging population, and growing government involvement through public healthcare support, reimbursement programs, and improved access to advanced treatments, along with increased pharmaceutical investment and stronger mental-health awareness nationwide.

For instance, in Brazil, there is a growing interest in innovative treatments such as gene therapy, stem cell therapy, and other emerging approaches, providing optimism for individuals grappling with CNS disorders that lack effective treatments. Brazilian pharmaceutical companies and research institutions are directing their attention towards CNS therapeutics, actively creating novel drugs and formulations designed to address the unique requirements of the local population.

Report Coverage

This research report categorizes the market for the Brazil central nervous system therapeutic market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil central nervous system therapeutic market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil central nervous system therapeutic market.

Driving Factors

Brazil’s CNS therapeutic market is growing as neurological and psychiatric disorders rise and the government expands support through public healthcare and reimbursement programs. Technological advancements such as AI-driven diagnostics, advanced neuroimaging, long-acting drug formulations, and emerging gene and stem-cell therapies are improving treatment precision. For instance, recent developments, including ANVISA’s approval of new gene therapy trials and increasing adoption of deep-brain stimulation for Parkinson’s patients, are further accelerating innovation and strengthening access to advanced CNS treatments across Brazil.

Restraining Factors

The Brazil CNS therapeutic market faces restraints due to limited access to specialized neurological services, high costs of advanced therapies, and slow regulatory approvals that delay innovation. Regional disparities in healthcare infrastructure, shortages of trained neurologists, and low public awareness about early diagnosis further hinder treatment uptake, reducing patient access and slowing overall market expansion.

Market Segmentation

The Brazil central nervous system therapeutic market share is categorized by disease, drug class, and distribution channel.

- The mental health segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil central nervous system therapeutic market is segmented by disease into neurovascular diseases, CNS trauma, mental health neurodegenerative diseases. Among these, the mental health segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The mental health segment leads the Brazil CNS therapeutics market mainly due to the rising prevalence of depression, anxiety, and stress-related disorders, driven by urban lifestyles, socioeconomic pressures, and post-pandemic mental-health challenges. Increased public awareness, government-backed mental-health programs, and expanding access to psychiatric care through the SUS system further boost treatment demand. Additionally, growing acceptance of antidepressants and antipsychotics, along with greater investment by pharmaceutical companies in innovative therapies, strengthens the segment’s overall dominance.

The pain relievers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil central nervous system therapeutic market is segmented by drug class into anesthetics, anticonvulsants, CNS stimulants, pain relievers, and others. Among these, the pain relievers segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the high prevalence of chronic pain, headaches, migraines, and musculoskeletal disorders in Brazil, which significantly increases demand for analgesics. Their easy over-the-counter availability, low cost, frequent medical prescriptions, and widespread consumer preference for quick relief further strengthen the dominance of pain-relief medications in the country’s CNS therapeutic market.

The hospital pharmacy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil central nervous system therapeutic market is segmented by distribution channel into hospital pharmacy, retail pharmacy, and other. Among these, the hospital pharmacy segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to hospitals treating the most severe CNS conditions, where patients require advanced medications, intensive monitoring, and rapid intervention. These settings handle emergency neurological events, administer high-cost therapies, and maintain reliable stocks of specialized drugs. Their structured treatment pathways, strong clinical oversight, and higher patient turnover result in significantly greater CNS drug utilization than other distribution channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil central nervous system therapeutic market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer

- Novartis

- Biogen

- Eli Lilly

- Merck & Co.

- Johnson & Johnson

- AstraZeneca

- Eurofarma

- EMS

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In July 2023, Neuraxpharm Group (Neuraxpharm), a prominent European specialty pharmaceutical company specializing in the management of central nervous system (CNS) disorders, reported the formation of subsidiaries in Brazil as an expansion plan.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Central Nervous System Therapeutic Market based on the below-mentioned segments:

Brazil Central Nervous System Therapeutic Market, By Disease

- Neurovascular Diseases

- CNS Trauma

- Mental Health

- Neurodegenerative Diseases

Brazil Central Nervous System Therapeutic Market, By Drug Class

- Anesthetics

- Anticonvulsants

- CNS Stimulants

- Pain Relievers

- Others

Brazil Central Nervous System Therapeutic Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Other

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |