Brazil Ceramic Tiles Market

Brazil Ceramic Tiles Market Size, Share, By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch Free Ceramic Tiles, and Others), By Application (Wall Tiles and Floor Tiles), By Distribution Channel (Specialty Stores, Home Improvement Stores, Online Retail, Direct Sales), Brazil Ceramic Tiles Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Ceramic Tiles Market Size Insights Forecasts to 2035

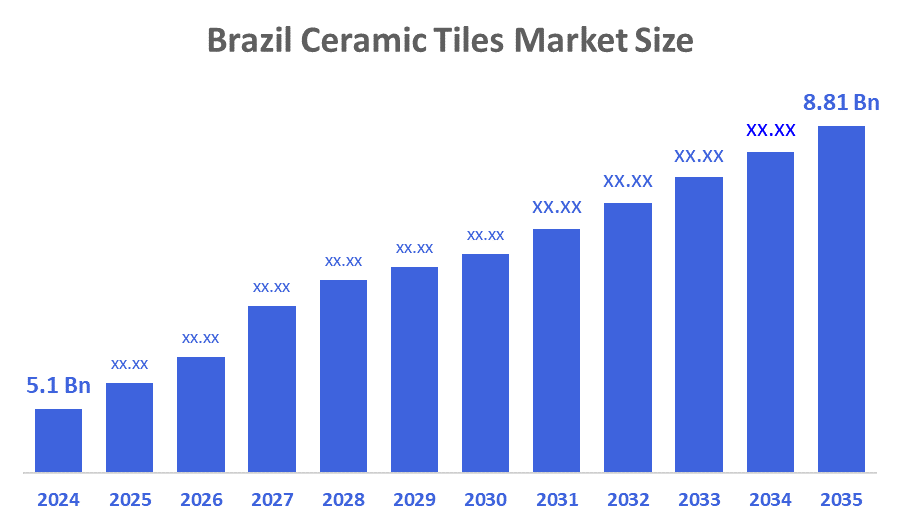

- Brazil Ceramic Tiles Market Size 2024: USD 5.1 Bn

- Brazil Ceramic Tiles Market Size 2035: USD 8.81 Bn

- Brazil Ceramic Tiles Market CAGR 2024: 5.1%

- Brazil Ceramic Tiles Market Segments: Product Type, Application, Distribution Channel.

Ceramic Tiles Market Size are durable flooring and wall materials made from natural clay, minerals, and water, shaped and fired at high temperatures. They are widely used in residential, commercial, and industrial spaces due to their strength, moisture resistance, easy maintenance, and variety of designs, colors, and surface finishes. Furthermore, The Brazil ceramic tiles market is growing due to rapid construction of homes and buildings, increasing renovation activities, affordable tile prices, wide design choices, and rising demand for durable, easy-to-clean flooring and wall materials in residential and commercial spaces.

Technological innovations in production processes are playing a crucial role in shaping the ceramic tiles market in Brazil. Advances in manufacturing technology, such as digital printing and automated production lines, enable manufacturers to produce high-quality tiles with intricate designs and improved durability. These innovations not only enhance the aesthetic appeal of ceramic tiles but also reduce production costs and time. As of 2025, it is expected that the adoption of advanced technologies could lead to a 15% increase in production efficiency within the ceramic tiles market. This efficiency may allow manufacturers to meet the growing demand while maintaining competitive pricing.

The growth of the Brazil ceramic tiles market is closely interlinked with broader trends in the construction industry. Urban expansion, residential development, and commercial infrastructure projects have together driven demand for high-quality building materials in Brazil. As cities grow to accommodate ever-expanding populations, so too has the need for robust, versatile, and cost-effective materials raised the profile of ceramic tiles. In addition, efficiency, durability, and flexibility in design are increasingly the concerns in all modern construction projects. Ceramic tiles cover a wide range of requirements for wear and tear resistance, water, and environmental conditions, besides offering an incredible diversity in design and finish. Innovations in tile sizes, textures, and colors have made it possible for architects and interior designers to create singular experiences in spaces. In January 2025, Grupo Formigres, a renowned Brazilian floor and wall tile specialist, announced it would launch new products and innovative formats to enhance design sophistication and market appeal. Moreover, these tendencies point to the ongoing paradigmatic shift in construction where functional demands are matched by aesthetic ambitions, making ceramic tiles one of the important choices for urban and residential projects.

Market Dynamics of the Brazil Ceramic Tiles Market:

The Brazil ceramic tiles market is mainly driven by strong growth in residential and commercial construction, supported by urbanization and government housing programs. Rising renovation and remodeling activities also boost demand, as ceramic tiles are affordable, durable, and easy to maintain. Increasing consumer preference for visually attractive interiors, availability of diverse designs and sizes, and technological advancements such as digital printing further support market growth. Additionally, expanding real estate development, improving living standards, and growing use of tiles in kitchens, bathrooms, and outdoor areas continue to fuel demand across Brazil.

The Brazil ceramic tiles market faces restraints from fluctuating raw material and energy costs, which increase production expenses. Economic instability and high inflation can slow construction activities. Additionally, competition from alternative flooring materials like vinyl and wood, along with environmental regulations on mining and emissions, may limit market growth.

The Brazil ceramic tiles market has strong opportunities driven by rising demand for affordable housing and renovation projects. Growing consumer interest in premium, digitally printed, and eco-friendly tiles creates scope for product innovation. Expansion of smart cities, commercial spaces, and infrastructure projects further boosts demand. Increasing online sales channels and exports to neighboring Latin American countries also provide opportunities for manufacturers to expand reach, improve brand visibility, and achieve higher profit margins through differentiated designs and sustainable production methods.

Market Segmentation

The Brazil Ceramic Tiles Market share is classified into product type, application, and distribution channel.

By product:

The Brazil ceramic tiles market is divided by product into glazed ceramic tiles, porcelain tiles, scratch-free ceramic tiles, and others. Among these, the porcelain tiles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Porcelain tiles dominate because they offer superior durability, low water absorption, and high resistance to stains, scratches, and heavy foot traffic. These properties make them suitable for both residential and commercial applications, especially in humid and high-use environments. Additionally, advanced digital printing enables porcelain tiles to replicate premium materials like marble and wood, increasing consumer preference. Rapid urbanization, infrastructure development, and demand for long-lasting, low-maintenance flooring further support their market leadership.

By Application:

The Brazil ceramic tiles market is divided by application into wall tiles and floor tiles. Among these, the floor tiles segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Floor tiles dominate due to their extensive use in residential, commercial, and industrial construction. High demand for durable, moisture-resistant, and easy-to-clean flooring in homes, shopping centers, offices, and public infrastructure drives this segment. Floor tiles also benefit from frequent renovation activities and replacement cycles compared to wall tiles. Additionally, the popularity of porcelain and large-format tiles for flooring, along with Brazil’s growing urbanization and real estate development, further strengthens floor tiles’ market dominance.

By Distribution Channel:

The Brazil ceramic tiles market is divided by distribution channel into specialty stores, home improvement stores, online retail, and direct sales. Among these, the home improvement store segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Home improvement stores dominate because they offer a wide product range, competitive pricing, and immediate availability, making them preferred for both residential and commercial buyers. Consumers often want to physically inspect tile quality, color, and texture before purchase, which favors offline channels. These stores also provide expert guidance, bulk purchase options, and installation accessories in one place. Strong relationships with builders, contractors, and renovation professionals further reinforce their leading market position.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil ceramic tiles market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Ceramic Tiles Market:

- Portobello S.A.

- Eliane Revestimentos Cerâmicos S.A.

- Cecrisa (Ceusa)

- Incepa

- Cerâmica Carmelo Fior

- Cerâmica Almeida

- Angelgrês

- Alfagrês

- Buschinelli Pisos e Revestimentos

- Grupo Cedasa

- Others

Recent Developments in Brazil Ceramic Tiles Market:

In April 2025, Cerbras, a ceramic tile company from Brazil, introduced over 100 products at Coverings 2025 to emphasize the innovation and quality of Brazilian design. Highlighting lines like Studio C and Cerbras, the brand reinforced Brazil’s industrial strength and aimed to expand its global presence and partnerships across 33 export markets.

In January 2025, Eliane Revestimentos unveiled its 2025 portfolio, spotlighting the marble-look Tibre series and wood-tone Igapó line, underscoring minimalist design and natural textures.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil ceramic tiles market based on the below-mentioned segments:

Brazil Ceramic Tiles Market, By Product

- Glazed Ceramic Tiles

- Porcelain Tiles

- Scratch-Free Ceramic Tiles

- Others

Brazil Ceramic Tiles Market, By Application

- Wall Tiles

- Floor Tiles

Brazil Ceramic Tiles Market, By Distribution Channel

- Specialty Stores

- Home Improvement Stores

- Online Retail

- Direct Sales

FAQ

Q1. How does Brazil’s natural resource availability impact ceramic tile production?

- Brazil has abundant clay and feldspar reserves, which reduce raw material dependency on imports and support cost-efficient large-scale tile manufacturing.

Q2. What role does sustainability play in the Brazilian ceramic tiles industry?

- Manufacturers increasingly adopt water recycling, waste heat recovery, and low-emission kilns to comply with environmental regulations and attract eco-conscious buyers.

Q3. How important are exports for Brazilian ceramic tile manufacturers?

- Exports are significant, with Brazilian tiles shipped to Latin America, North America, and Europe due to competitive pricing and modern designs.

Q4. Are digital printing technologies influencing the market?

- Yes, digital inkjet printing enables realistic stone, wood, and marble finishes, helping manufacturers differentiate products and meet changing design trends.

Q5. How does the real estate cycle affect ceramic tile demand in Brazil?

- Demand closely follows residential and commercial construction activity, with market growth accelerating during housing booms and renovation cycles.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 156 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |