Brazil Clinical Laboratory Service Market

Brazil Clinical Laboratory Service Market Size, Share, and COVID-19 Impact Analysis, By Service Provider (Hospital-Based Laboratories, Stand-Alone Laboratories, and Clinic-Based Laboratories), By Application (Bioanalytical and Lab Chemistry Services, Toxicology Testing Services, Cell and Gene Therapy Related Services, Preclinical and Clinical Trial Related Services, Drug Discovery and Development Related services, and Others), and Brazil Clinical Laboratory Service Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Brazil Clinical Laboratory Service Market Insights Forecasts to 2035

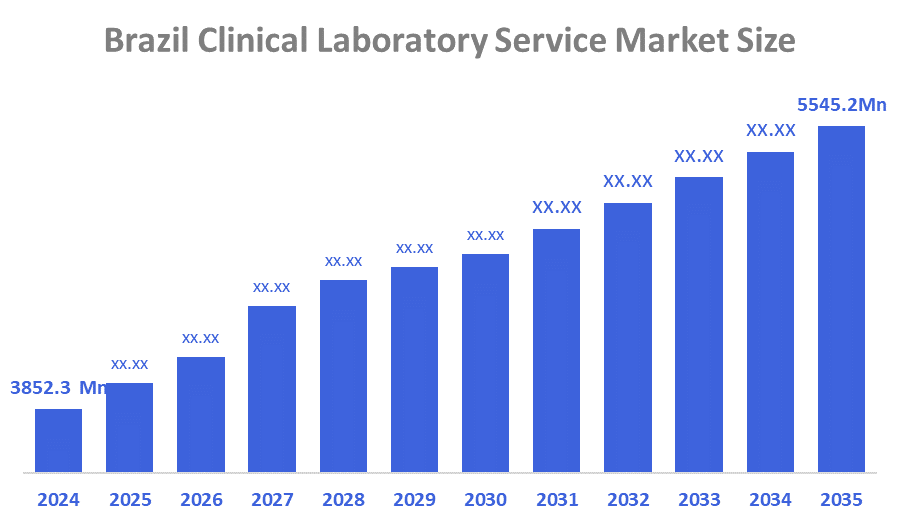

- Brazil Clinical Laboratory Service Market Size was estimated at USD 3852.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.37% from 2025 to 2035

- The Brazil Clinical Laboratory Service Market Size is Expected to Reach USD 5545.2 Million by 2035

According to a research report published by Decision Advisior & Consulting, the Brazil Clinical Laboratory Service Market is anticipated to reach USD 5545.2 million by 2035, growing at a CAGR of 3.37% from 2025 to 2035. The Brazilian clinical laboratory service market is driven by medical tourism continues to rise, Private Industry spending is increasing with an expanding number of partnerships between private healthcare providers and pharmaceutical companies, point of care testing will continue to expand, a greater focus on research & development, new applications, and capabilities, more laboratory accreditation opportunities available to laboratories, demand for new specialized diagnostic services and our trend toward more personalized medicine.

Market Overview

Clinical laboratory service provides the facilities and providers that can perform the required diagnostic tests using biological fluids and tissues like blood, urine, and other biological samples to assist clinicians with the diagnosis of diseases, to monitor disease development, and manage patients with chronic disease. The Brazilian clinical laboratory services marketplace has the potential for increased demand for diagnostic services because of chronic disease increases in Brazil, improvements to the government healthcare system of Brazil and the use of technology. Similarly, as more tests become specialized, and as investments flowed into less-served areas, increased investment and innovation became focused on Brazil. Additionally, the Brazilian government promotes clinical labs through financing via the national health system, establishing regulatory compliance by ANVISA, developing measures to support the development of diagnostic infrastructure, and providing greater access to health care services, including preventative and diagnostic tests, by implementing national health policies.

Report Coverage

This research report categorizes the market for the Brazil clinical laboratory service market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil clinical laboratory service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil clinical laboratory service market.

Driving Factors

The Brazilian clinical laboratory service market is driven by an increase in chronic and infectious diseases, an increase in the aging population, an increase in preventive health awareness among the public, an increase in healthcare coverage under the SUS, an increase in the use of advanced technology for diagnostic testing, a greater need for early and accurate detection of disease, an increased demand for hospitals and laboratories to expand their services, an increase in use of automation and molecular testing in laboratories, and an increase in governmental support for improving access to diagnostic services throughout Brazil.

Restraining Factors

The Brazilian clinical laboratory service market is restrained by the high costs of diagnostic equipment, scarcity of skilled professionals, reimbursement difficulties with respect to SUS, strict regulatory compliance from ANVISA, downward pricing pressures from public healthcare contracts, uneven access to services in rural areas, and the lag in introducing advanced diagnostic technology.

Market Segmentation

The Brazil clinical laboratory service market share is classified into service providers and application.

- The stand-alone laboratories accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil clinical laboratory service market is segmented by service providers into hospital-based laboratories, stand-alone laboratories, and clinic-based laboratories. Among these, the stand-alone laboratories segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due an increase in chronic disease cases, increasing public awareness about preventive healthcare, advancement in technology, greater urban access to healthcare services, strong demand for outpatient care, and government programs supporting diagnostic service provision as well as establishing quality criteria for laboratories across Brazil have contributed to the rapid growth of Brazil's clinical laboratory sector.

- The bioanalytical and lab chemistry services dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil clinical laboratory service market is segmented by application into bioanalytical and lab chemistry services, toxicology testing services, cell and gene therapy related services, preclinical and clinical trial related services, drug discovery and development related services, and others. Among these, the bioanalytical and lab chemistry services segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to it supporting medical professional and researchers in Brazil for their role in providing routine diagnostics, aiding in pharmaceutical research, performing drug testing, conducting clinical trials, being adopted by more hospitals and stand-alone laboratories, increasing prevalence of chronic disease, and an increased need for accurate and timely laboratory test results in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil clinical laboratory service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OPKO Health Inc

- SYNLAB Group

- Labcorp Holdings Inc

- Mayo Clinic

- Charles River Laboratories International Inc

- Siemens Healthineers AG ADR

- Qiagen NV

- Eurofins Scientific SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil Clinical Laboratory Service Market based on the below-mentioned segments:

Brazil Clinical Laboratory Service Market, By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

Brazil Clinical Laboratory Service Market, By Applications

- Bioanalytical and Lab Chemistry Services

- Toxicology Testing Service s

- Cell and Gene Therapy Related Services

- Preclinical and Clinical Trial Related Services

- Drug Discovery and Development Related services

- Others

FAQ’s

Q: What is the Brazil clinical laboratory service market size?

A: Brazil clinical laboratory service market size is expected to grow from USD 3852.3 million in 2024 to USD 5545.2 million by 2035, growing at a CAGR of 3.37% during the forecast period.

Q: Who are the key players in the Brazil clinical laboratory service market?

A: OPKO Health Inc, SYNLAB Group, Labcorp Holdings Inc, Mayo Clinic, Charles River Laboratories International Inc, Siemens Healthineers AG ADR, Qiagen NV, Eurofins Scientific SE, and Others are the key players in the Brazil clinical laboratory service market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 178 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |