Brazil Cold Chain Logistics Market

Brazil Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Type (Chilled, Frozen, and Others), By Application (Horticulture, Meats, Fish, and Poultry, Processed Food Products, Pharmaceuticals, Life Sciences, and Chemicals, and Others), and Brazil Cold Chain Logistics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Cold Storage Market Size Insights Forecasts to 2035

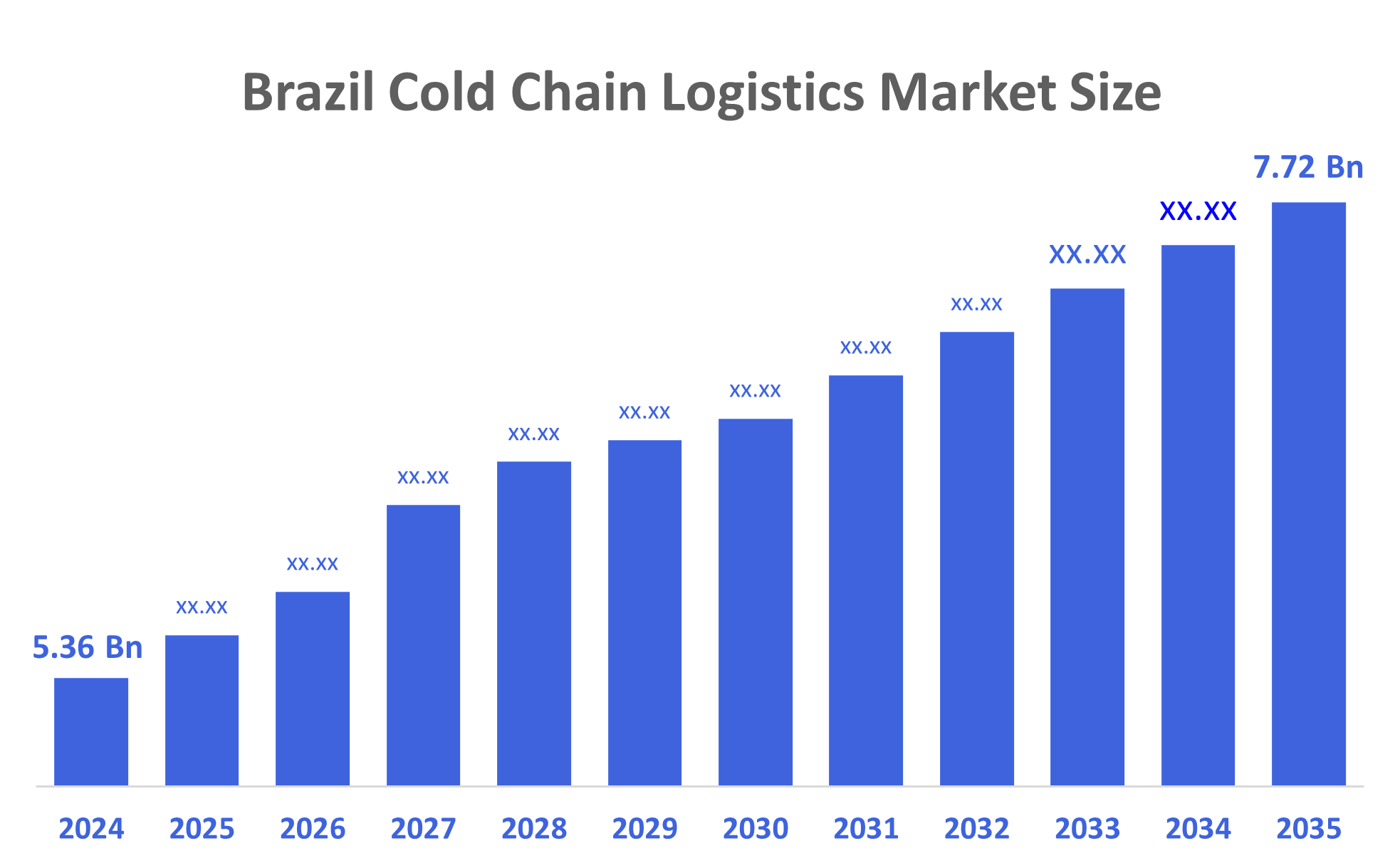

- The Brazil Cold Chain Logistics Market Size was estimated at USD 5.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.86% from 2025 to 2035

- The Brazil Cold Chain Logistics Market Size is Expected to Reach USD 13.23 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Cold Chain Logistics Market Size is Anticipated to Reach USD 13.23 Billion by 2035, Growing at a CAGR of 8.86% from 2025 to 2035. The Brazil cold chain logistics market is driven by increase in agricultural export activity, increased number of people in cities, changing lifestyles, an increase in organized retail stores, the expansion of the quick serve restaurant market, development of port infrastructure, establishment of private sector partnerships to support growth, and increasing use of third-party cold chain service providers.

Market Overview

The cold chain logistics market covers the specialized storage, handling, and transportation of temperature sensitive products until their production or consumption. These products are kept at their proper quality and effectiveness through a secure, controlled shipping method utilizing refrigeration, freezers, and temperature monitoring devices to preserve their required environmental conditions like temperature, humidity, shock, vibration. Additionally, the increased adoption of internet of things (IoT) technology for temperature tracking, monitoring, and real-time location tracking, the increased number of automatic cold storage, and the increased availability of energy-efficient refrigeration systems are creating more and broader opportunities for businesses. Furthermore, through public-private partnerships and the purchase of supplies for emergency preparedness planning, the Brazilian government is also increasing demand for products in all areas related to supply chains.

Report Coverage

This research report categorizes the market for the Brazil cold chain logistics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil cold chain logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil cold chain logistics market.

Driving Factors

The main determinants of the growth of the cold chain logistics industry in Brazil are expected to be increased demand for pharmaceuticals, vaccines and other biological products requiring temperature-controlled distributions, the growing demand for fresh and frozen foods, the increasing number of e-commerce businesses as well as increased regulation of the retail sector, increased use of IoT devices to monitor temperature in real time, improvements made to cold chain storage and transportation systems, and government assistance in creating a better environment for transport and storage of food and pharmaceuticals within Brazil while maintaining sustainable energy supplies and providing energy efficient distribution solutions.

Restraining Factors

The Brazil cold chain logistics market restrained due to the cost of energy needed to operate them, the limited availability of cold chain services in remote areas, inability to connect cold chain transport with other modes of transportation, unavailability of trained personnel for the various processes involved, issues complying with complex regulations related to cold chain transport, The difficulty of maintaining a controlled temperature during long shipments and frequent power outages.

Market Segmentation

The Brazil cold chain logistics market share is classified into type and application.

- The frozen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil cold chain logistics market is segmented by type into chilled, frozen, and others. Among these, the frozen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is since freezing extends the shelf life dramatically, reduces waste, preserves the nutritional value of the product, and allows for better long-distance shipping. In addition, continued growth in frozen foods, growth of the biopharmaceutical and vaccine industries, and increased investment in the cold chain enhance demand.

- The meats, fish, and poultry segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil cold chain logistics market is segmented by application into horticulture, meats, fish, and poultry, processed food products, pharmaceuticals, life sciences, and chemicals, and others. Among these, the meats, fish, and poultry segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to the trend towards higher quality, more hygienic meat and seafood is becoming popular among consumers. There is an urgent need for exporters to control the temperature of meat and seafood shipped overseas. Due to the advancements made in the processing of meat and seafood, modern slaughterhouses, processing facilities, and cold storage facilities help ensure compliance with regulations and decrease waste.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil cold chain logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Friozem Armazens Frigorificos Ltda.

- Emergent Cold LatAm

- Comfrio Logística

- Brado Logistics SA

- Movecta

- Others

Recent Developments:

- 26 May 2025: Brazil’s Minister of Health, Dr. Alexandre Padilha, and Dr. Sania Nishtar, CEO of Gavi, the Vaccine Alliance, met on the sidelines of the 78th World Health Assembly to reaffirm and strengthen their long-standing partnership, focusing on equitable access to vaccines and resilient health systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Cold Chain Logistics Market based on the below-mentioned segments:

Brazil Cold Chain Logistics Market, By Type

- Chilled

- Frozen

- Others

Brazil Cold Chain Logistics Market, By

- Horticulture

- Meats, Fish, and Poultry

- Processed Food Products

- Pharmaceuticals, Life Sciences, and Chemicals

- Others

FAQ’s

Q: What is the Brazil Cold Chain Logistics Market size?

A: Brazil Cold Chain Logistics Market size is expected to grow from USD 5.2 billion in 2024 to USD 13.23 billion by 2035, growing at a CAGR of 8.86 % during the forecast period.

Q: Who are the key players in the Brazil Cold Chain Logistics Market?

A: Friozem Armazens Frigorificos Ltda., Emergent Cold LatAm, Comfrio Logística, Brado Logistics SA, Movecta and Others are the key players in the Brazil cold chain logistics market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |