Brazil Commercial Printing Market

Brazil Commercial Printing Market Size, Share, By Printing Technology (Digital Printing, Lithography Printing, Flexographic, Screen Printing, Gravure Printing, and Others), By Application (Packaging, Advertising, and Publishing), Brazil Commercial Printing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Commercial Printing Market Size Insights Forecasts to 2035

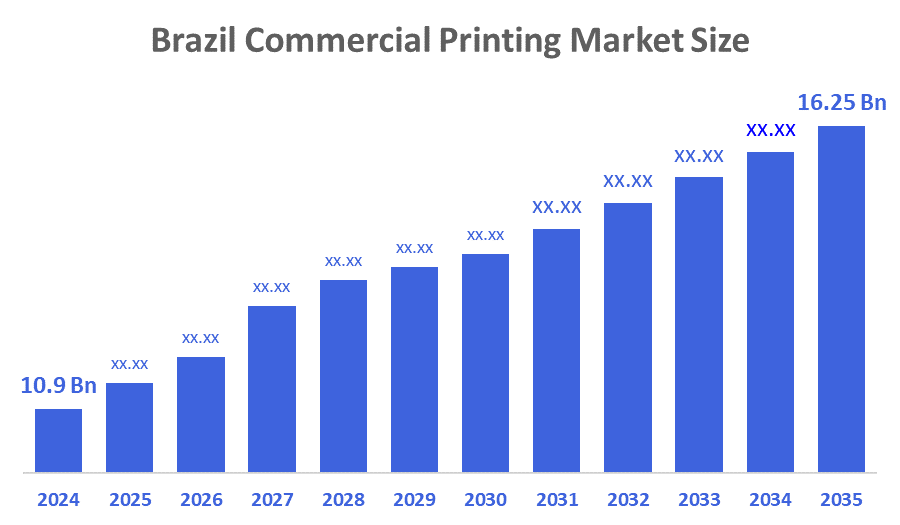

- Brazil Commercial Printing Market Size 2024: USD 10.9 Bn

- Brazil Commercial Printing Market Size 2035: USD 16.25 Bn

- Brazil Commercial Printing Market CAGR 2024: 3.7%

- Brazil Commercial Printing Market Segments: Printing Technology and Application.

Commercial printing is the professional production of printed materials in large quantities using advanced printing technologies. It involves services such as brochures, business cards, catalogs, magazines, and packaging. The process is focused on delivering high-quality output, efficiency, and consistency, and is mainly targeted at businesses, publishers, and marketers who need visually appealing and mass-produced printed materials for promotional, informational, or commercial purposes. Moreover, the Brazil commercial printing market is expanding due to the increasing demand for packaging and promotional materials, the adoption of digital and hybrid printing technologies,

The e-commerce growth and the rising trend of eco-friendly and sustainable printing practices contribute to market growth. Innovations in digital printing, UV, curable inks, high-speed inkjet systems, and automated finishing are revolutionizing quality while also reducing turnaround time. Print service providers are investing in hybrid presses that combine offset and digital technologies. Improved workflow automation is helping to reduce errors and increase color accuracy. These technological advancements are making commercial printing solutions more dependable and versatile. The adoption of advanced systems is a key driver of market growth.

Digital printing is rapidly gaining share across Brazil as businesses demand faster turnaround, customization, and short-run production. On-demand printing reduces waste and eliminates the need for large inventories, making it cost-efficient for small and medium enterprises. Variable data printing enables personalization in marketing materials, direct mailers, and product labels. Digital presses offer high-resolution output with minimal setup time, driving adoption across commercial printers. Companies benefit from flexible production and lower operational costs. This trend is reshaping the printing landscape with digital technology at its center.

Sustainability trends across Brazil lead to increased adoption of soy-based inks, water-based inks, biodegradable coatings, and recycled paper substrates. Environmental regulations encourage manufacturers to reduce VOC emissions and waste generation. Commercial printers invest in energy-efficient machinery and waste reduction workflows. Corporate clients increasingly specify eco-friendly printing methods as part of ESG commitments. This trend accelerates the shift toward sustainable and environmentally responsible printing ecosystems.

Market Dynamics of the Brazil Commercial Printing Market:

The Brazil commercial printing market is primarily driven by the growing demand for high-quality packaging, labels, and promotional materials, driven by the expanding retail and e-commerce sectors. Increasing adoption of digital and hybrid printing technologies enables faster, cost-effective, and customized production. Rising marketing and advertising activities by businesses further boost the need for printed materials. Additionally, a growing focus on eco-friendly and sustainable printing practices encourages investments in advanced, environmentally responsible printing solutions, supporting overall market growth.

The Brazil commercial printing market faces restraints from high initial investment costs for advanced printing technologies and equipment. Additionally, increasing digitalization and a shift toward online advertising reduce demand for traditional print media. Fluctuating raw material prices, such as paper and ink, along with environmental regulations, also challenge market growth by increasing operational costs and limiting large-scale production.

The Brazil commercial printing market presents opportunities due to the rising demand for customized and personalized print products for marketing and branding. Growth in the e-commerce and packaging sectors increases the need for high-quality printing solutions. Adoption of digital and hybrid printing technologies enables faster, cost-effective production. Additionally, the growing focus on sustainable and eco-friendly printing practices creates new avenues. Emerging small and medium enterprises seeking professional printing services further expand market potential.

Market Segmentation

The Brazil Commercial Printing Market share is classified into printing technology and application.

By Printing Technology:

The Brazil Commercial Printing market is divided by printing technology into digital printing, lithography printing, flexographic printing, screen printing, gravure printing, and others. Among these, the digital printing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The digital printing segment dominates because it provides high-quality, customized, and short-run print materials efficiently. Businesses prefer it for faster production, lower costs, and flexibility compared to traditional methods. Growth in e-commerce and marketing campaigns increases demand for personalized packaging and promotional materials. Advancements in digital printing technology, including better color accuracy and automation, improve productivity and reliability, making digital printing the most favored choice for various commercial printing applications across industries.

By Application:

The Brazil Commercial Printing market is divided by application into packaging, advertising, and publishing. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of the growing e-commerce and retail sectors, which increase demand for durable, high-quality, and visually appealing packaging. Companies focus on branding and product differentiation, using printed packaging to attract customers. Rising consumer preference for customized and innovative designs further boosts demand. Additionally, expansion in the food, beverage, and consumer goods industries requires large-scale printed packaging solutions, making this segment more significant than advertising and publishing applications in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil commercial printing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Commercial Printing Market:

- Pancrom Indústria Gráfica Ltda

- Heidelberger Druckmaschinen AG

- Copy House — Gráfica Digital do Rio

- FastPrint

- Nilpeter

- R.R.?Donnelley & Sons

- Quad/Graphics, Inc.

- Toppan Printing Co., Ltd.

- Transcontinental Inc.

- Others

Recent News in Brazil Commercial Printing Market:

In February 2025, Agfa, a top firm in inkjet printing technologies, is to present its newest innovations at FESPA Brasil 2025, providing an extensive array of advanced inkjet solutions for different printing needs. The company seeks to assist sign & display, packaging, and industrial printing firms in producing top-notch, efficient prints, reflecting a dedication to ongoing innovation.

In September 2023, Etirama introduced its latest SPS3 flexo press at Labelexpo Europe 2023, showcasing Industry 4.0 connectivity, extensive customization options, and the capability to operate at speeds reaching 150m/min. The SPS3 press is adaptable and capable of handling self-adhesive materials, lightweight cardboard, paper substrates, and unsupported films for diverse label creation, and it's also appropriate for printing aluminum blister packs.

In October 2023, Heidelberg introduced a revised Versafire EV and EP model of digital presses, designed for autonomous operation and compatibility with hybrid workflows, which is able to print banners as long as 1,260 mm and accommodate substrates ranging from 40 gsm to 470 gsm.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil commercial printing market based on the below-mentioned segments:

Brazil Commercial Printing Market, By Printing Technology

- Digital Printing

- Lithography Printing

- Flexographic

- Screen Printing

- Gravure Printing

- Others

Brazil Commercial Printing Market, By Application

- Packaging

- Advertising

- Publishing

FAQ

Q1: What types of printing technologies are used in Brazil?

The market uses digital, lithography, flexographic, screen, and gravure printing, with digital printing growing fastest due to flexibility and customization.

Q2: Which sector contributes most to commercial printing demand?

Packaging leads, driven by e-commerce, retail, and consumer goods industries needing high-quality, attractive packaging.

Q3: What challenges does the market face?

High machinery costs, fluctuating paper and ink prices, and competition from digital media limit growth.

Q4: What opportunities exist for businesses?

Growth in personalized prints, eco-friendly solutions, and short-run digital printing creates new business opportunities.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |