Brazil Computed Tomography Market

Brazil Computed Tomography Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Low Slice, Medium Slice, High Slice), By Application (Oncology, Neurology, Cardiovascular, Musculoskeletal), and Brazil Computed Tomography Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Computed Tomography Market Size Insights Forecasts to 2035

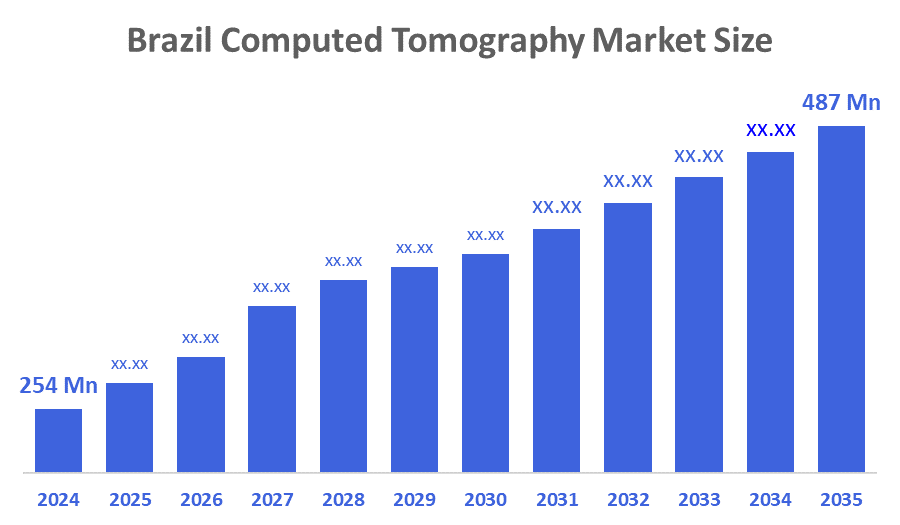

- The Brazil Computed Tomography Market Size Was Estimated at USD 254 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Computed Tomography Market Size is Expected to Reach USD 487 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Computed Tomography Market Size is anticipated to Reach USD 487 Million by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. The improving healthcare infrastructure and continuous investments in upgrading and expanding healthcare facilities, increasing prevalence of chronic diseases and non-communicable conditions, and the integration of advanced technologies represent some of the key factors driving the market.

Market Overview

Computed Tomography (CT) is a medical imaging technique that uses X-rays and a computer to create detailed cross-sectional images of the inside of the body. It shows bones, organs, blood vessels, and tissues more clearly than regular X-rays. Doctors use CT scans to diagnose diseases, detect injuries, and plan treatments. Additionally, the Brazil Computed Tomography (CT) market is growing due to rising demand for early disease diagnosis, increasing cases of cancer and cardiovascular disorders, and expanding access to advanced healthcare facilities. Government investments in public hospitals, the adoption of modern CT technologies, and growing awareness about preventative imaging also support market expansion. For instance, computed tomography (CT) was used to assess COVID in the nation, according to a research report published in July 2020 with the title "Computed tomography findings in a Brazilian cohort of 48 patients with pneumonia owing to coronavirus disease.

Additionally, experience from a Brazilian reference centre" was published in October 2020 at the Universidade Federal do Rio Grande do Sul, Program in Pneumology Sciences, Porto Alegre, RS, Brazil. In the early stages of the Brazilian COVID-19 outbreak, the study assessed the sensitivity, specificity, accuracy, and reproducibility of chest CT standards. A 16-slice CT was used for the chest CT, and patients were placed in the supine position during end-inspiration without receiving any contrast agent. Therefore, these studies would help the market grow. Thus, the market is expected to grow in the future.

Report Coverage

This research report categorizes the market for the Brazil computed tomography market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil computed tomography market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil computed tomography market.

Driving Factors

The Brazil CT market is driven by rising chronic diseases such as cancer, stroke, and heart disorders, increasing the need for accurate and rapid diagnostic imaging. Growing investments in hospital modernization, expansion of diagnostic centres, and wider availability of advanced multi-slice CT systems support market growth. Technological upgrades like AI-assisted imaging, faster scan times, and lower radiation doses improve adoption. Additionally, government programs to strengthen public healthcare and improve access to imaging services further boost demand for CT equipment.

Restraining Factors

The Brazil CT market faces restraints such as high equipment and installation costs, making advanced systems less accessible for smaller hospitals. Limited reimbursement coverage and budget constraints in public healthcare slow adoption. Shortages of trained radiologists, long maintenance times, and concerns about radiation exposure also restrict widespread use. Economic fluctuations further impact investment in premium imaging technologies.

Market Segmentation

The Brazil computed tomography market share is categorized by product type and application.

- The high slice segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil Computed Tomography market is segmented by product type into low slice, medium slice, and high slice. Among these, the high slice segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the growing demand for high-precision diagnostics in Brazil is driving the adoption of high-slice CT scanners as healthcare providers look for advanced imaging solutions to detect diseases faster and more accurately. Increased cases of cardiovascular disease, oncology, and neurological disorders are driving investments in cutting-edge medical imaging to improve diagnostic accuracy and reduce patient turnaround time. Furthermore, rising government healthcare spending and the growth of private diagnostic centers are driving demand for high-slice CT scanners, especially in urban hospitals and specialized imaging facilities. Furthermore, advances in AI-powered image reconstruction and low-radiation dose technologies are driving adoption as providers strive to improve clinical efficiency, workflow automation, and early disease detection capabilities across Brazil's healthcare sector.

- The oncology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil Computed Tomography market is segmented by application into oncology, neurology, cardiovascular, and musculoskeletal. Among these, the oncology segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the rising cancer prevalence in Brazil is driving significant demand for oncology CT applications, which are required for early detection, precise tumor localization, and treatment planning. With cancer cases expected to increase, healthcare providers are investing in advanced imaging technologies to improve diagnosis accuracy, optimize radiation therapy, and improve patient care. Government initiatives that support cancer screening programs help to accelerate CT adoption. Furthermore, Brazil's expanding healthcare infrastructure and increased investment in diagnostic imaging centers are driving market growth. The integration of AI-powered CT solutions improves imaging efficiency, scan times, and clinical outcomes. As the demand for minimally invasive and personalized treatments grows, oncology CT applications will continue to play an important role in improving cancer care across the country.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil computed tomography market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- Siemens Healthineers

- Philips

- Canon Medical Systems

- Carestream Health

- Planmeca

- Dentsply Sirona

- NeuroLogica

- United Imaging Healthcar

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In April 2020, in Brazil, the search for a benchmark was published. Additionally, nearly 16% of all radiologists reported that CT imaging was their primary imaging technique, per a study titled "Estimating the productivity of radiologists in Brazil: the search for a benchmark," which was published in April 2020. This suggests that CT-related diagnostic techniques are becoming more prevalent across the nation. Collaboration is another key factor in market growth.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil computed tomography market based on the below-mentioned segments:

Brazil Computed Tomography Market, By Product Type

- Low Slice

- Medium Slice

- High Slice

Brazil Computed Tomography Market, By Application

- Oncology

- Neurology

- Cardiovascular

- Musculoskeletal

FAQ’s

1. What is Computed Tomography (CT)?

- CT is an imaging technique that uses X-rays and computers to create detailed cross-sectional images of the body for diagnosis.

2. What is driving the CT market growth in Brazil?

- Rising chronic diseases, increased hospital modernization, and the adoption of advanced multi-slice CT systems.

3. Which CT product segment dominates the market?

- High-slice CT scanners dominate due to better speed, clarity, and diagnostic accuracy.

4. What factors restrain the market?

- High equipment cost, limited reimbursement, lack of trained radiologists, and economic constraints.

5. Which end users mainly adopt CT scanners?

- Hospitals, diagnostic imaging centers, and specialty clinics.

6. What technologies are improving CT adoption?

- AI-based image analysis, low-dose radiation systems, and faster multi-slice scanners.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 259 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |