Brazil Confectionery Market

Brazil Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, and Others), By Age Group (Children, Adult, and Geriatric), and Brazil Confectionery Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Confectionery Market Size Insights Forecasts to 2035

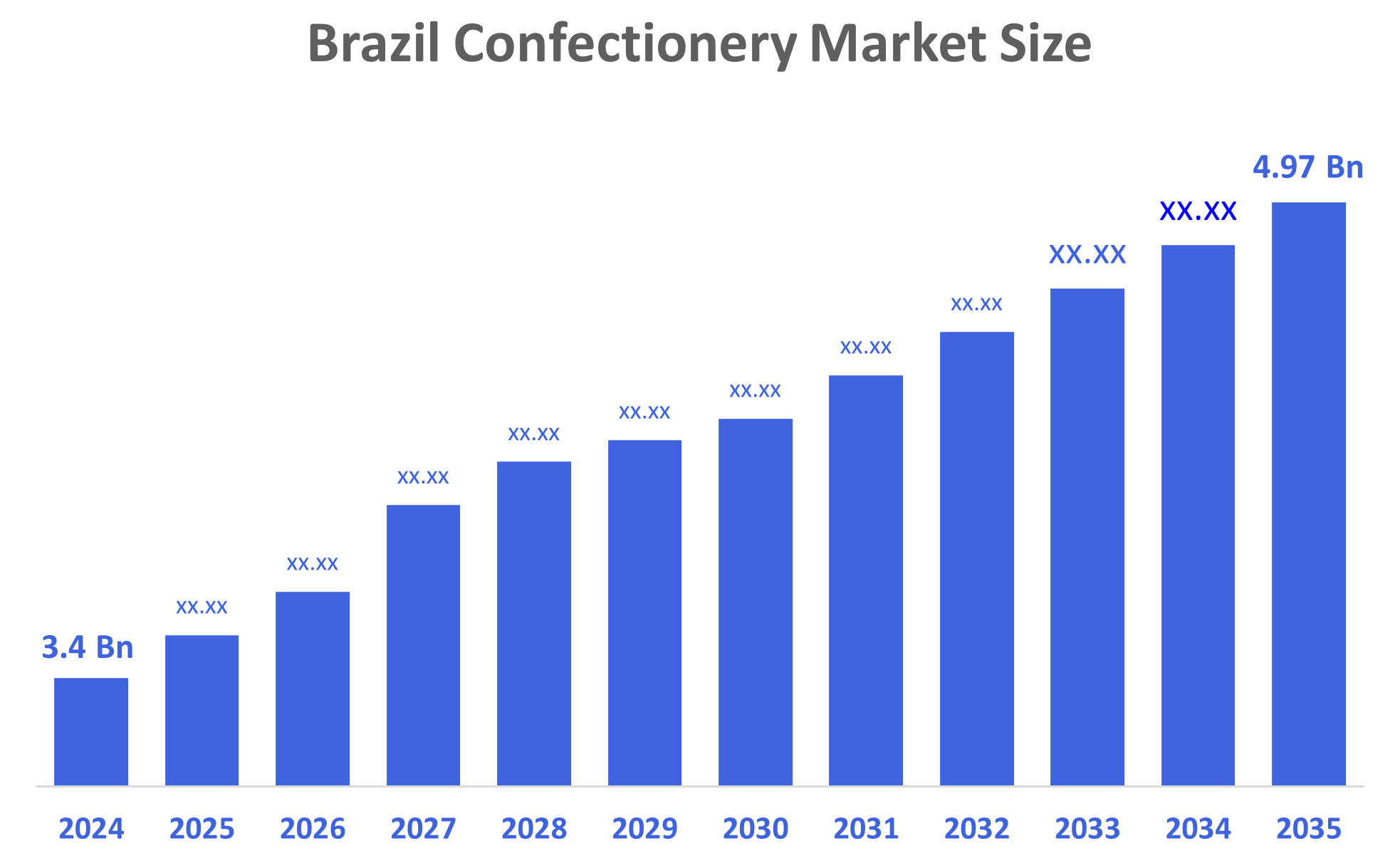

- The Brazil Confectionery Market Size was estimated at USD 3.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.51% from 2025 to 2035

- The Brazil Confectionery Market Size is Expected to Reach USD 4.97 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Confectionery Market Size is Anticipated to Reach USD 4.97 Billion by 2035, Growing at a CAGR of 3.51% from 2025 to 2035. The Brazil Confectionery Market is driven by the increasing the number of people during impulse buys, due to easy-to-use packaging. In addition to these trends, e-commerce is becoming increasingly popular, with brands being marketed through celebrities, and increasing demand during holidays for sweets providing manufacturers the ability to introduce exciting new tastes and product offerings.

Market Overview

The confectionery marketplace represents a market that sells sweet-tasting food such as treats, along with non-sweet-tasting desserts and represents companies which manufacture and sell these types of products to consumers. Confectionery products range greatly from chocolate to fruit-flavoured chewy gummy bears. Additionally, expanding e-commerce channels, increased consumer interest in gifting as well as rapid growth in the number of companies creating new products featuring Brazilian flavours will allow for further growth of brands within Brazil's extremely diverse population. Furthermore, Brazil's ANVISA has instituted rigorous nutrition labelling regulations for foods that are extremely high in sugar, salt, and fats. These regulations push companies who manufacture confectionery to change their recipes, be more open about what ingredients they put into their products and comply with regulations that promote public health.

Report Coverage

This research report categorizes the market for the Brazil confectionery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil confectionery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil confectionery market.

Driving Factors

The Brazil confectionery market is driven by the increase in demand for premium and artisanal sweets, such as the consumption of sugarless sweets and functional food, as well as a growing focus on ethics and sustainability in food production, to create an expanding chocolate market throughout Brazil. Additionally, Consumers are actively looking for better-quality products, healthier formulations, and eco-friendly manufacturing processes. As such, Brazilian manufacturers are using a wider variety of exotic ingredients, and adopting cleaner labels and fair-trade sourcing, which are helping them develop and market their products to consumers in both developing and developed countries. The changing preferences of consumers are therefore enhancing the overall value of these products and providing manufacturers with brand loyalty and growth potential.

Restraining Factors

The Brazil confectionery market is restrained by the high taxes on sugary products, considerable regulations on labels, widening concerns for health, and a growing preference for healthy foods. Also, fluctuating cocoa price levels, interruptions to supply chain activities due to COVID-19 and related issues, and increased expectations for sustainability will add to production costs and curtail activities associated with the growth of this segment of the market.

Market Segmentation

The Brazil confectionery market share is classified into product type and age group.

- The chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil confectionery market is segmented by product into hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others. Among these, the chocolate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to cultural preference, it has been reported that milk chocolate continues to be the highest volume varietal, followed by white chocolate. Additionally, the chocolate segment has expanded as consumers search for ways to enjoy chocolate daily, seek chocolate that is higher quality and healthier options, which has resulted in increased market value and this demand.

- The adult segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil confectionery market is segmented by age group into children, adult, and geriatric. Among these, the adult segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to they typically have greater earnings and buy more products due to the frequency of consumption as well as their interest in premium-priced, low-sugar and functional items. Additionally, the variety of flavours available has led to adults being very open-minded about experimenting with new tastes, and as such, this has contributed to an increasing amount of innovation throughout the entire candy market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil confectionery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Garoto

- Cacau Show

- Duas Rodas

- Docile Alimentos

- Peccin

- Riclan

- Village

- Belo Alimentos

- Nestle

- Mondelez

- Ferrero do

- Arcor do

- Hershey’s

- Mars

- Others

Recent Developments:

- In September 2024: Ferrero Rocher introduced chocolate bars in Brazil, offering white, milk, and dark chocolate (55% cocoa) varieties. This new packaging format was designed to expand the brand’s consumer base by providing a less formal and more affordable option for daily consumption, complementing its classic special-occasion chocolates.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Confectionery Market based on the below-mentioned segments:

Brazil Confectionery Market, By Product Type

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Brazil Confectionery Market, By Age Group

- Children

- Adult

- Geriatric

FAQ’s

Q: What is the Brazil confectionery market?

A: Brazil Confectionery Market is expected to grow from USD 3.4 billion in 2024 to USD 4.97 billion by 2035, growing at a CAGR of 3.51% during the forecast period 2025-2035.

Q: Who are the key players in the Brazil confectionery market?

A: Garoto, Cacau Show, Duas Rodas, Docile Alimentos, Peccin, Riclan, Village, Belo Alimentos, Nestle, Mondelez, Ferrero do, Arcor do, Hershey’s, Mars, and Others are the key players in the Brazil confectionery market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |