Brazil Contraceptive Devices Market

Brazil Contraceptive Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Condoms, Diaphragms and Cervical Caps, Vaginal Sponges, Vaginal Rings, Intra-Uterine Devices (IUD), Subdermal Implants and Other), By Gender (Male, Female), By Distribution Channel (Public Health System, Hospital Pharmacies, Retail Pharmacies & Drugstores and Other), and Brazil Contraceptive Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

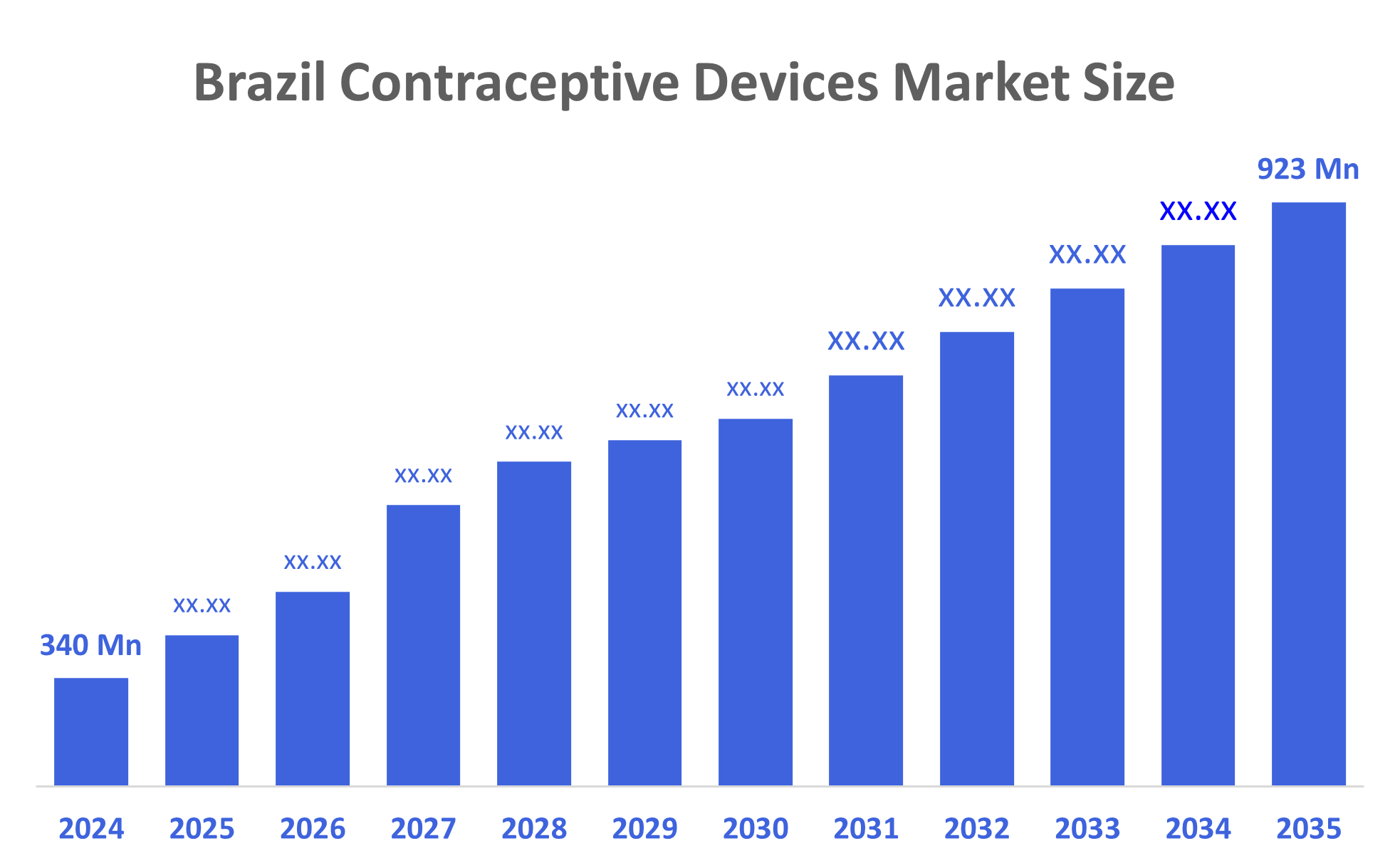

Brazil Contraceptive Devices Market Insights Forecasts to 2035

- The Brazil Contraceptive Devices Market Size Was Estimated at USD 340 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.5% from 2025 to 2035

- The Brazil Contraceptive Devices Market Size is Expected to Reach USD 923 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Contraceptive Devices Market Size is Anticipated to Reach USD 923 Million by 2035, growing at a CAGR of 9.5% from 2025 to 2035. The increased awareness about family planning and sexual health, implementation of educational campaigns, healthcare initiatives, and community-based programs, the rising working women population, and advancements in contraceptive technology represent some of the key factors driving the market.

Market Overview

Contraceptive devices are medical tools used to prevent pregnancy by stopping sperm from reaching the egg, preventing ovulation, or blocking implantation. They include condoms, intrauterine devices (IUDs), implants, and diaphragms. These devices offer safe, reversible, and effective options for individuals and couples to manage fertility and plan their families according to their needs and preferences. Here is an expanded. Brazil’s contraceptive devices market is growing due to rising awareness of sexual health, government-backed family planning programs, and increased availability of affordable devices. Higher rates of unintended pregnancies, wider adoption of long-acting reversible contraceptives, and improved access through public hospitals also drive demand. Urbanization, women’s empowerment, and growing preference for safe, convenient, and discreet contraceptive options further accelerate market expansion. Moreover, IUDs are small, T-shaped devices that are inserted into the uterus by a healthcare provider. They can be hormonal (releasing progestin) or non-hormonal (copper). IUDs prevent pregnancy by altering the uterine environment, making it less favorable for sperm survival and inhibiting fertilization. Different methods suit different individuals, and are chosen in consultation with a healthcare provider to ensure safety and effectiveness. For instance, new technologies in Brazil’s contraceptive device market focus on improving comfort, effectiveness, and accessibility. Innovations include smaller, low-dose hormonal IUDs designed for easier insertion, long-acting subdermal implants with extended release, and biodegradable condom materials. Digital fertility-monitoring tools and app-based contraceptive tracking are also rising. Telehealth platforms now support prescription and counseling, making advanced contraceptive solutions more accessible to women across Brazil.

Report Coverage

This research report categorizes the market for the Brazil contraceptive devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil contraceptive devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil contraceptive devices market.

Driving Factors

The Brazilian contraceptive device market is driven by rising awareness of reproductive health, government-supported family-planning programs, increasing use of long-acting reversible contraceptives, and growing demand for safe, convenient, and affordable options. Urbanization, digital access, and women’s empowerment further support adoption. Recent developments include the introduction of smaller hormonal IUDs, expansion of subdermal implants, growth of telehealth-based contraceptive services, adoption of biodegradable materials, and ANVISA’s regulatory updates that speed up approval and market entry.

Restraining Factors

The Brazil contraceptive devices market faces restraints such as cultural and religious barriers that reduce acceptance in certain regions. Limited awareness about long-acting reversible contraceptives, especially in rural areas, restricts adoption. Supply-chain gaps and inconsistent availability in public health facilities also hinder usage. Concerns about side effects of hormonal methods, high costs of IUDs and implants, and dependence on imported devices further slow market growth. Additionally, misinformation and lower male participation in family planning create additional challenges.

Market Segmentation

The Brazil contraceptive devices market share is categorized by type, Gender, and distribution channel.

- The condoms segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil contraceptive devices market is segmented by type into condoms, diaphragms, cervical caps, vaginal sponges, vaginal rings, intra-uterine devices (IUD), subdermal implants, and others. Among these, the condoms segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of this segment is due to condoms being highly accessible, affordable, and widely distributed through pharmacies, supermarkets, and public-health programs. They provide dual protection, preventing both pregnancy and sexually transmitted infections, which makes them the preferred first-line choice, especially among young adults. Government campaigns actively promote condom use, increasing awareness and adoption. Condoms also require no medical supervision, making them convenient, easy to use, and suitable for individuals across all socioeconomic groups.

- The female segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil contraceptive devices market is segmented by Gender into male and female. Among these, the female segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to women having access to a wider variety of contraceptive options, including IUDs, implants, vaginal rings, diaphragms, and female condoms. Long-acting reversible contraceptives (LARCs), which are highly effective and widely promoted in Brazil’s public-health system, are used exclusively by women, further increasing their market share. Women also tend to take a primary role in family planning and reproductive health decisions, leading to higher adoption of female-controlled contraceptive devices.

- The retail pharmacies and drugstores segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil contraceptive devices market is segmented by Distribution Channel into public health system, hospital pharmacies, retail pharmacies & drugstores, and other. Among these, the retail pharmacies & drugstores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their offering the widest accessibility, long operating hours, and convenient nationwide coverage, especially in urban and semi-urban areas. Consumers prefer pharmacies for privacy, quick purchase, and immediate availability of condoms, IUD accessories, emergency contraceptives, and related products. Pharmacies also run frequent discounts, partner with major brands, and provide pharmacist-led guidance, making them the most trusted and commonly used channel for purchasing contraceptive devices in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil contraceptive devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- Reckitt Benckiser (Durex)

- Ansell Ltd.

- Hypera Pharma S.A.

- CooperSurgical (The Cooper Companies)

- Merck & Co.

- Pfizer Inc.

- Church & Dwight Co., Inc.

- Organon & Co.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In June 2024, the Ministry of Health initiates a national Carnival campaign promoting condom use under the slogan “Carnival, respect and protection.

In February 2024, the Ministry of Health launched a booklet on sexual education as a transformation policy.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil contraceptive devices market based on the below-mentioned segments:

Brazil Contraceptive Devices Market, By Type

- Condoms

- Diaphragms and Cervical Caps

- Vaginal Sponges

- Vaginal Rings

- Intra-Uterine Devices (IUD)

- Subdermal Implants

- Other

Brazil Contraceptive Devices Market, By Gender

- Male

- Female

Brazil Contraceptive Devices Market, By Distribution Channel

- Public Health System

- Hospital Pharmacies

- Retail Pharmacies & Drugstores

- Other

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |