Brazil Cybersecurity Market

Brazil Cybersecurity Market Size, Share, By Solution (Security Software, Hardware Security, Security Services), By Deployment Type (Cloud-based, On-premises, Hybrid), By End Use (BFSI, Retail, Healthcare, Government, Telecommunications), Brazil Cybersecurity Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Cybersecurity Market Size Insights Forecasts to 2035

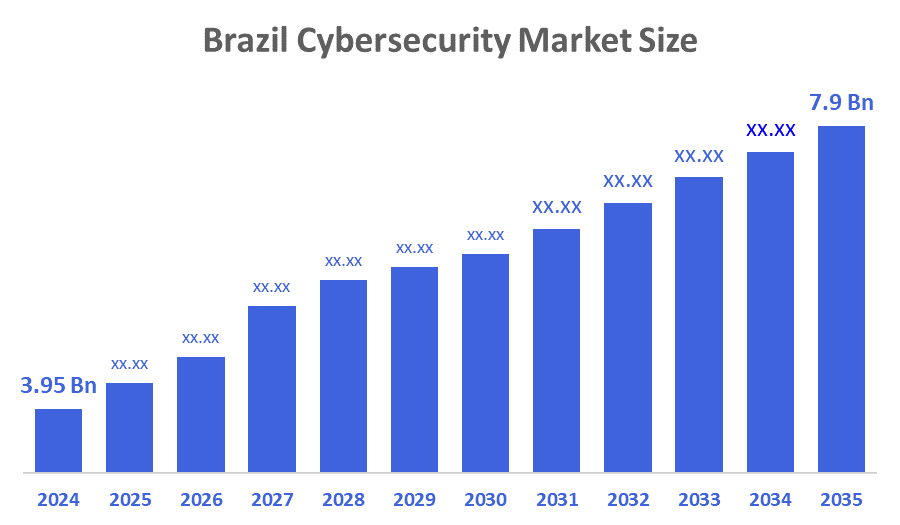

- Brazil Cybersecurity Market Size 2024: USD 3.95 Bn

- Brazil Cybersecurity Market Size 2035: USD 7.9 Bn

- Brazil Cybersecurity Market CAGR 2024: 6.5%

- Brazil Cybersecurity Market Segments: Solution, Deployment Type, End User.

Cybersecurity Market Size is the practice of protecting computers, networks, systems, and digital data from unauthorized access, cyberattacks, damage, or theft. It involves technologies, processes, and best practices designed to ensure data confidentiality, integrity, and availability, safeguarding individuals, organizations, and governments against threats such as malware, phishing, ransomware, and data breaches. Furthermore, Brazil’s cybersecurity market is growing mainly due to rising cyber threats and strict data-protection laws like LGPD, which force companies to invest in security. Increased digital payments, cloud adoption, and digital transformation also push demand, while regulatory compliance and expanded online services boost spending on advanced cybersecurity solutions.

The Brazilian government has implemented several initiatives to bolster cybersecurity, including the national cybersecurity strategy launched in the current year. This strategy allocates BRL 600 million for cybersecurity projects over the next five years, aiming to enhance national resilience against cyber threats. Additionally, the General Data Protection Law (LGPD) mandates compliance, further driving organizations to invest in cybersecurity solutions to avoid hefty fines and ensure data protection.

The rise of AI-driven security solutions offers a substantial opportunity for innovation in Brazil's cybersecurity market. As organizations seek to enhance their threat detection capabilities, investments in AI technologies are anticipated to exceed BRL 5 billion in the near future. This trend will enable cybersecurity firms to create more effective, automated solutions that can adapt to evolving threats, thereby improving overall security posture across various sectors. Furthermore, Brazil has witnessed a significant rise in cyber threats, with reported incidents increasing by 30% from the previous year to the current year. The Brazilian government reported over 2 million cyberattacks in the current year alone, highlighting the urgent need for robust cybersecurity measures. This surge in threats is driving organizations to invest heavily in cybersecurity solutions, with spending expected to reach BRL 25 billion in the near future, reflecting a growing awareness of the risks associated with digital operations.

Market Dynamics of the Brazil Cybersecurity Market:

Brazil’s cybersecurity market is driven by the rise in sophisticated cyber threats, pushing businesses to strengthen defenses and protect sensitive data. Strict regulations like the LGPD force companies to invest in security solutions to ensure compliance. Digital transformation, cloud adoption, and remote work trends expand attack surfaces and boost demand for advanced cybersecurity tools and services. Growing awareness and training further encourage proactive security investments across industries.

A key restraining factor in Brazil’s cybersecurity market is the shortage of skilled cybersecurity professionals, which limits the effective implementation of advanced solutions. High costs of deployment and maintenance also deter small and medium enterprises. Additionally, low awareness among smaller organizations and budget constraints slow adoption despite rising cyber threats.

Brazil’s cybersecurity market offers strong opportunities due to rapid digital transformation across banking, healthcare, retail, and government sectors. Expanding cloud computing, IoT, AI, and 5G networks create demand for advanced threat detection and data protection solutions. SME digitalization, growing e-commerce and digital payments, and increasing focus on managed security services (MSS) open new revenue streams. Additionally, LGPD compliance needs, rising investments in cybersecurity training, and adoption of AI-driven security platforms present long-term growth potential.

Market Segmentation

The Brazil Cybersecurity Market share is classified into solution, deployment type, and end user.

By Solution:

The Brazil cybersecurity market is divided by solution into security software, hardware security, and security services. Among these, the security services segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The security services segment dominates because organizations increasingly outsource security management to address complex and evolving cyber threats. Limited in-house expertise, rising cyberattacks, and strict LGPD compliance requirements push demand for managed security services, consulting, and incident response. Services offer continuous monitoring, cost efficiency, and scalability, making them attractive to enterprises and SMEs. Additionally, rapid cloud adoption and remote work environments increase reliance on specialized service providers to ensure real-time threat detection and regulatory compliance across industries.

By Deployment Type:

The Brazil cybersecurity market is divided by deployment type into cloud-based, on-premises, and hybrid. Among these, the on-premises segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The on-premises deployment segment dominates because large enterprises, banks, and government organizations prioritize data control, privacy, and regulatory compliance under laws such as LGPD. On-premises systems allow greater customization and direct oversight of sensitive information, which is critical for sectors handling confidential financial and citizen data. Many organizations also rely on legacy IT infrastructure, making on-premises solutions more practical. Additionally, concerns over cloud security, data residency, and integration challenges continue to support strong adoption of on-premises cybersecurity deployments.

By End User:

The Brazil cybersecurity market is divided by deployment type into BFSI, retail, healthcare, government, and telecommunications. Among these, the government segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The government segment dominates because it manages large volumes of sensitive citizen data and critical national infrastructure. Rising cyberattacks on public systems, elections, and digital government platforms drive high security spending. Strict compliance requirements, national security priorities, and continuous digitalization of public services further boost demand. Government agencies also invest heavily in advanced threat detection, data protection, and network security to ensure service continuity and protect against cyber espionage and large-scale cyber incidents.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil cybersecurity market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Cybersecurity Market:

- IBM Security

- Microsoft

- Cisco Systems

- Palo Alto Networks

- Check Point Software Technologies

- Fortinet

- Trend Micro

- CrowdStrike

- Tempest Security Intelligence

- Cipher

- Others

Recent Developments in Brazil Cybersecurity Market:

In August 2021, A new iteration of Palo Alto Networks' Cortex XDR platform was unveiled. The new version is anticipated to increase the investigation, monitoring, and detection capabilities, providing the security operation centre (SOC) teams with broader and better protection.

In May 2022, the public release of the Cisco Cloud Controls Framework (CCF) was announced by Cisco Systems Inc. A comprehensive collection of international and domestic security compliance and certification criteria has been consolidated under the Cisco CCF framework.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil cybersecurity market based on the below-mentioned segments:

Brazil Cybersecurity Market, By Solution

- Security Software

- Hardware Security

- Security Services

Brazil Cybersecurity Market, By Deployment Type

- Cloud-based

- On-premises

- Hybrid

Brazil Cybersecurity Market, By End User

- BFSI

- Retail

- Healthcare

- Government

- Telecommunications

FAQ

Q1. What is driving growth in Brazil’s cybersecurity market?

- Rising cyber threats, digital transformation, cloud adoption, and strict regulations like LGPD are the main growth drivers.

Q2. Which segment dominates the market?

- The government and BFSI sectors dominate due to high data sensitivity and strong security requirements.

Q3. Which deployment type is most used?

- On-premises deployment currently dominates because of data control and compliance needs.

Q4. What is the biggest challenge in the market?

- Lack of skilled professionals and high implementation costs, especially for small and medium enterprises.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |