Brazil Data Center Physical Security Market

Brazil Data Center Physical Security Market Size, Share, By Solutions Types (Video Surveillance, Access Control Solutions, and Monitoring Solutions), By Service Type (Security Consulting Services, Professional Services, and System Integration Services), By Vertical (IT and Telecom, Healthcare, BFSI, Government, Energy, and Others), Brazil Data Center Physical Security Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Data Center Physical Security Market Size Insights Forecasts to 2035

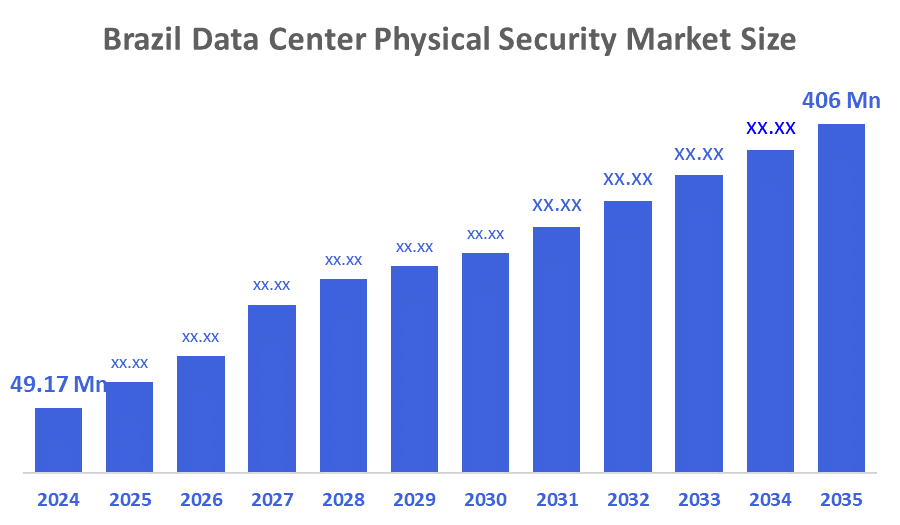

- Brazil Data Center Physical Security Market Size 2024: USD 49.17 Mn

- Brazil Data Center Physical Security Market Size 2035: USD 406 Mn

- Brazil Data Center Physical Security Market CAGR 2024: 21.60%

- Brazil Data Center Physical Security Market Segments: Solution Types, Service Type, Vertical.

Data Center Physical Security Market Size refers to the implementation of appropriate measures and controls to protect the facility, hardware, and infrastructure against unauthorized access, theft, natural disasters, or any instance of physical damage. It relies on surveillance and access controls, security personnel, environmental controls, and secure layouts to ensure the confidentiality, integrity, and availability of the data and systems residing in the data center. Besides, the Brazil data center physical security market is booming, fueled by factors such as the increasing number of data center deployments, rising cyber and physical threats, strict regulatory compliance (LGPD), the adoption of AI, IoT, based security solutions, and the growing demand for secure cloud and IT infrastructure.

The innovations such as AI, analytics, IoT, sensors, and cloud-based security management are revolutionizing the competitive landscape. The changes will likely speed up market expansion, security effectiveness, and new revenue opportunities in the medium term. In addition, several significant trends are propelling the Brazilian data center physical security market towards considerable growth. The widespread use of cloud computing and the rise of hyperscale data centers are the leading factors that call for advanced security solutions to safeguard the critical infrastructure and valuable

The significant trend is the increased popularity of managed security services. More and more, data center operators are handing over their security management to specially equipped providers and are thus enjoying the expertise and the economies of scale of such. The phenomenon is particularly significant in the case of small data centers that do not have the necessary resources to hire a security expert for their own staff.

Market Dynamics of the Brazil Data Center Physical Security Market:

The Brazil data center physical security market is driven by the rapid expansion of data centers to support cloud computing, digital transformation, and e-commerce growth. Increasing concerns over data breaches, theft, and physical damage have heightened the demand for robust security solutions. Strict regulatory frameworks like LGPD require organizations to ensure data protection. Additionally, adoption of advanced technologies such as AI, IoT, and biometric systems enhances monitoring and access control, further propelling the market’s growth and investment in physical security infrastructure.

The Brazil data center physical security market faces restraints due to high implementation and maintenance costs of advanced security systems. Limited skilled personnel, integration challenges with existing infrastructure, and potential system downtime during upgrades hinder adoption. Additionally, smaller organizations may find investments in comprehensive physical security economically unfeasible, slowing widespread deployment despite increasing demand for data protection and regulatory compliance.

The Brazil data center physical security market presents significant opportunities driven by the country’s growing digital economy, increasing cloud adoption, and expansion of IT and telecom infrastructure. Rising investments in smart security technologies, including AI-powered surveillance, IoT-enabled monitoring, and biometric access control, offer innovative solutions for enhanced protection. Additionally, government initiatives promoting data localization and compliance with regulations like LGPD create demand for secure, certified facilities. Collaborations between security solution providers and data center operators further open avenues for market growth and technological advancement.

Market Segmentation

The Brazil data center physical security market share is classified into solution types, service type, and vertical.

By Solution Types:

The Brazil data center physical security market is divided by solution types into video surveillance, access control solutions, and monitoring solutions. Among these, the video surveillance segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of the video surveillance segment is due to its ability to provide continuous, real-time monitoring of critical infrastructure, ensuring early detection of unauthorized access, theft, or vandalism. Integration with AI, analytics, and remote monitoring enhances threat response efficiency. Regulatory compliance, such as LGPD, mandates stringent security measures, further driving adoption. Compared to access control or monitoring solutions, video surveillance offers a comprehensive, visible deterrent and detailed audit trails, making it indispensable for safeguarding data centers.

By Service Type:

The Brazil data center physical security market is divided by service type into security consulting services, professional services, and system integration services. Among these, the system integration services segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of system integration services in Brazil’s data center physical security market is driven by the increasing complexity of modern data centers, which require seamless integration of video surveillance, access control, and monitoring systems. Integrated solutions enable centralized management, real-time monitoring, and automated threat response, reducing security gaps. Organizations prefer system integrators for their expertise in deploying scalable, customized, and compliant security infrastructures. This demand surpasses standalone consulting or professional services, as integrated systems ensure higher efficiency, reliability, and regulatory compliance.

By Vertical:

The Brazil data center physical security market is divided by vertical into IT and telecom, healthcare, BFSI, government, energy, and others. Among these, the IT and telecom segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of the IT and telecom vertical in Brazil’s data center physical security market is driven by the sector’s extensive reliance on data centers to manage large volumes of sensitive customer, operational, and network data. The rapid expansion of cloud computing, 5G networks, and digital services increases the need for robust physical security measures. Strict regulatory compliance requirements, such as LGPD, further necessitate secure facilities. Compared to other sectors, IT and telecom invest more in integrated security solutions to ensure uninterrupted operations and data protection.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil data center physical security market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Data Center Physical Security Market:

- Honeywell International Inc.

- Johnson Controls International

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- Siemens AG

- Schneider Electric

- ABB Ltd.

- Genetec

- Hikvision

- Others

Recent Developments in Brazil Data Center Physical Security Market:

In April 2023, Schneider Electric launched a new service, EcoCare, for Modular Data Center Services membership. Special expertise in maximizing the efficiency of modular data centers by continuously monitoring and maintaining conditions 24 hours a day is available to members of this innovative service plan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil data center physical security market based on the below-mentioned segments:

Brazil Data Center Physical Security Market, By Solution Types

- Video Surveillance

- Access Control Solutions

- and Monitoring Solutions

Brazil Data Center Physical Security Market, By Service Type

- Security Consulting Services

- Professional Services

- System Integration Services

Brazil Data Center Physical Security Market, By Vertical

- IT and Telecom

- Healthcare

- BFSI

- Government

- Energy

- Others

FAQ

Q1: Why is physical security critical for Brazilian data centers?

Physical security prevents unauthorized access, theft, vandalism, and environmental damage, ensuring data integrity, uptime, and regulatory compliance in Brazil’s rapidly growing digital and cloud infrastructure sector.

Q2: Which solution type is most implemented in Brazil?

Video surveillance dominates due to real-time monitoring, AI-enabled threat detection, and continuous recording, providing comprehensive protection against physical breaches and supporting compliance with LGPD regulations.

Q3: What service type drives adoption in this market?

System integration services lead, as they unify video surveillance, access control, and monitoring solutions into centralized, automated platforms, improving efficiency, response times, and overall security management.

Q4: Which industry vertical invests the most in physical security?

IT and telecom dominate due to large-scale data centers, cloud computing expansion, high-value data storage, and strict operational and regulatory requirements demanding advanced security infrastructure.

Q5: What factors fuel market growth in Brazil?

Expansion of cloud services, rising cyber-physical threats, regulatory mandates, and adoption of AI, IoT, and biometric technologies drive investments in advanced, integrated physical security solutions.

Q6: What challenges limit market adoption?

High costs, integration complexity, limited skilled personnel, and downtime during system upgrades hinder widespread deployment of advanced physical security systems across data centers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 144 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |