Brazil Dental Implants Market

Brazil Dental Implants Market Size, Share, and COVID-19 Impact Analysis, By Design (Tapered Implants and Parallel Walled Implants), By Type (Endosteal Implants, Subperiosteal Implants, and Transosteal Implants), and Brazil Dental Implants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Dental Implants Market Insights Forecasts to 2035

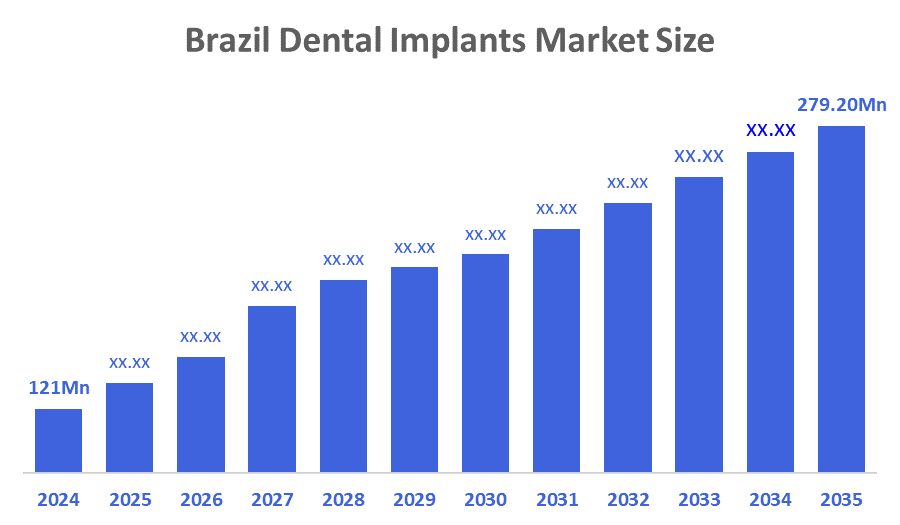

- The Brazil Dental Implants Market Size Was Estimated at USD 121 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.9% from 2025 to 2035

- The Brazil Dental Implants Market Size is Expected to Reach USD 279.20 Million by 2035

According to a Research Report Published By Decisions Advisors & Consulting, The Brazil Dental Implants Market Size Is Anticipated To Reach USD 279.20 Million By 2035, Growing At a CAGR of 7.9% From 2025 to 2035. The Brazil dental implants market is driven by growing cosmetic dentistry demand, rising edentulism in the aging population, technological advancements in implant materials, increasing dental tourism, expanding access to private dental care, and greater awareness of long-term oral health solutions.

Market Overview

A dental implant is an artificial tooth root made of titanium or zirconia that is surgically inserted into the jawbone to replace missing teeth. After bonding with the bone, it supports a crown, bridge, or denture, restoring natural chewing function, stability, appearance, and long-term oral health. Additionally, the Brazil dental implants market is growing due to increasing awareness of oral health, rising dental tourism, technological advancements in implant materials, a growing aging population with tooth loss, expanding private dental care access, and a rising preference for cosmetic dentistry, driving higher demand for durable and aesthetic dental solutions. Furthermore, the total count of Dental Implants and Abutment Procedures performed in Brazil was 1,410,164 in 2022. The dental implant procedure involves the replacement of the roots of the tooth with metal (usually made of titanium or zirconia), screw-like cylindrical, and/or tapered posts. An artificial tooth (crown) is placed on an extension of the post (abutment) on the dental implant. Moreover, the accelerating growth of Brazil’s elderly population is a major driver fueling demand for dental implants. Between 2010 and 2022, the population aged 65 and above increased by 57%, rising from 14.1 million to 22.2 million. This demographic trend is directly linked to the rising incidence of edentulism, as older adults are more vulnerable to chronic dental conditions like periodontitis and decay. As age-related tooth loss becomes more common, the need for reliable, long-term restorative solutions such as dental implants is growing. Furthermore, the increasing adoption of digital technology is revolutionizing the Brazilian dental implant market. Tools such as 3D imaging, CAD/CAM systems, intraoral scanners, and guided surgical platforms are transforming how dental professionals diagnose, plan, and execute implant procedures. These digital workflows enhance precision, minimize chair time, and lead to improved patient outcomes, making implant treatments more efficient and appealing.

Report Coverage

This research report categorizes the market for the Brazil dental implants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil dental implants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil dental implants market.

Driving Factors

The Brazil dental implants market is primarily driven by the increasing prevalence of tooth loss and edentulism, particularly among the aging population. Rising awareness of oral health and cosmetic dentistry fuels demand for aesthetic and functional tooth replacement solutions. Technological advancements in implant materials and procedures enhance success rates and patient comfort. Additionally, the growth of dental tourism and expanding access to private dental care in urban areas contribute to market growth. Increased disposable income and preference for long-term oral health solutions further accelerate the adoption of dental implants in Brazil.

Restraining Factors

The Brazil dental implants market faces restraints such as high treatment costs, limiting affordability for a large population. Additionally, the requirement for skilled dental professionals and advanced infrastructure restricts widespread adoption. Procedural risks, post-surgery complications, and patient apprehension also hinder market growth. Economic fluctuations and limited insurance coverage for dental implants further pose challenges to market expansion.

Market Segmentation

The Brazil dental implants market share is categorized by design and type.

- The tapered implants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil dental implants market is segmented by design into tapered implants and parallel-walled implants. Among these, the tapered implants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their superior primary stability, which ensures better integration with the jawbone, even in cases of low bone density. Their design closely resembles natural tooth roots, allowing for easier placement and improved aesthetic outcomes. Additionally, tapered implants support immediate loading and reduce surgical complexity, making them preferred by dentists. These advantages, combined with growing patient demand for durable and natural-looking tooth replacements, drive higher adoption of tapered implants over parallel-walled designs in Brazil.

- The endosteal implants segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil dental implants market is segmented by type into endosteal implants, subperiosteal implants, and transosteal implants. Among these, the endosteal implants segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their proven high success rates and long-term stability, making them suitable for a wide range of patients with adequate jawbone density. They are surgically placed directly into the jawbone, providing strong support for crowns, bridges, and dentures, ensuring both functional efficiency and aesthetic appeal. Compared to subperiosteal and transosteal implants, endosteal implants involve less invasive procedures, shorter recovery times, and more predictable outcomes. Their versatility, reliability, and preference among dental professionals and patients drive their leading position in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil dental implants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Straumann Group (Neodent)

- Dentsply Sirona

- Zimmer Biomet Holdings

- Osstem Implant Co., Ltd.

- S.I.N. Implant System

- Bicon, LLC

- Thommen Medical AG

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

- September 2022: DENTSPLY SIRONA Inc. announced new products and digital solutions at Dentsply Sirona World 2022.

- March 2022: Neodent (Straumann Group) launched the Zi zirconia-based dental implant system.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil dental implants market based on the below-mentioned segments:

Brazil Dental Implants Market, By Design

- Tapered Implants

- Parallel Walled Implants

Brazil Dental Implants Market, By Type

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

FAQ’s

Q1. What are dental implants?

- Dental implants are artificial tooth roots, usually made of titanium or zirconia, surgically placed into the jawbone to support crowns, bridges, or dentures.

Q2. What factors are driving the dental implants market in Brazil?

- Key drivers include rising tooth loss, growing cosmetic dentistry awareness, an aging population, technological advancements, and increased dental tourism.

Q3. Which type of dental implant is most popular in Brazil?

- Endosteal implants dominate due to high success rates, versatility, and strong jawbone integration.

Q4. What are the main challenges in the market?

- High treatment costs, need for skilled professionals, procedural risks, limited insurance coverage, and patient apprehension are major restraints.

Q5. Who are the leading companies in the Brazilian dental implants market?

- Straumann Group (Neodent), Envista Holdings (Nobel Biocare, Implant Direct), Dentsply Sirona, Zimmer Biomet, Osstem, S.I.N. Implant System, Bicon, and Thommen Medical AG., and Others.

Q6. What trends are shaping the market?

- Growing demand for aesthetic and minimally invasive procedures, technological innovations in implant materials, and increasing dental tourism.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |