Brazil Dermatological Drugs Market

Brazil Dermatological Drugs Market Size, Share, and COVID-19 Impact Analysis, By Type (Prescription and Over-the-counter), By Therapy (Acne, Psoriasis, Rosacea, Alopecia, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and Brazil Dermatological Drugs Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Dermatological Drugs Market Insights Forecasts to 2035

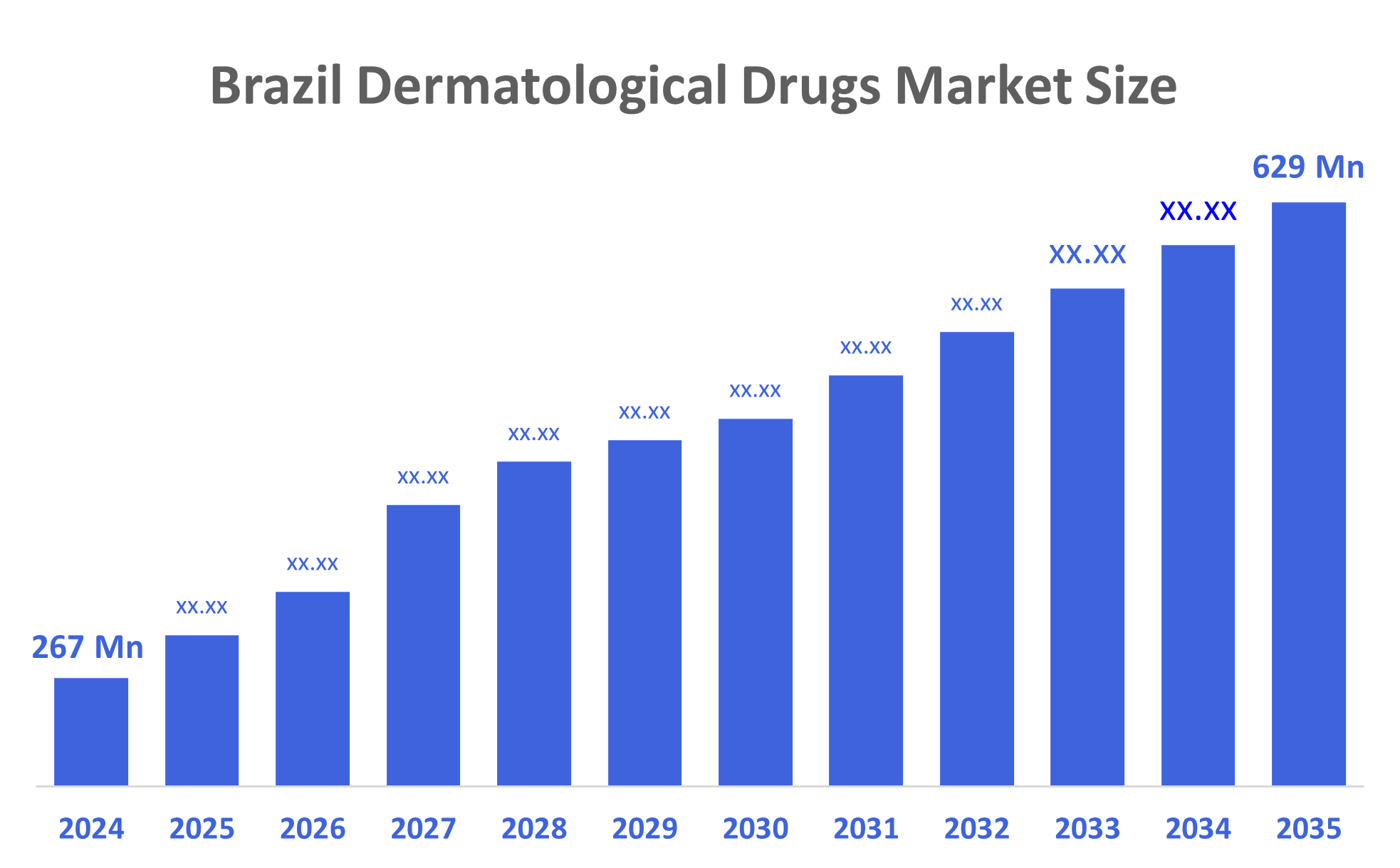

- The Brazil Dermatological Drugs Market Size Was Estimated at USD 267 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.1% from 2025 to 2035

- The Brazil Dermatological Drugs Market Size is Expected to Reach USD 629 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Dermatological Drugs Market Size is Anticipated to Reach USD 629 Million by 2035, Growing at a CAGR of 8.1% from 2025 to 2035. The Brazil dermatological drugs market is driven by increasing prevalence of skin disorders, rising awareness of skincare, growing cosmetic and aesthetic treatments, and technological advancements in drug formulations. Additionally, supportive healthcare policies, urbanization, and higher disposable incomes contribute to the expanding demand for effective dermatological therapies in Brazil.

Market Overview

The use of dermatological drugs in the treatment and prevention of skin disease and the management of skin problems - through creams, gels, ointments, lotions and medications taken orally - as well as through other delivery systems (for example, by injection) for specific conditions such as acne, psoriasis and infections - produces an improvement in overall skin health along with the reduction of inflammation, infection and promoting healing of damaged tissue - ultimately leading to better skin care and protection. Additionally, some of the factors driving the rapid growth of the Brazilian dermatology drug market are: increased consumer awareness of skin health, the increasing number of people suffering from skin disorders (acne, psoriasis, etc.), and the increased use of new technology for treating skin conditions (Biologics and Personalised therapies). The availability of E-Commerce, tele-Dermatology, and better healthcare infrastructure will continue to increase market demand. Furthermore, the emergence of new technologies in the Brazilian dermatological drug market includes sophisticated biologics, targeted therapies for skin problems, and individualised formulations based on the patient's specific type and condition. There has been an increase in the use of digital innovation (tele-Dermatology, Artificial Intelligence (AI), smart delivery systems), which has improved treatment effectiveness, increased adherence by patients to prescribed regimens, and created greater access to Dermatology services, thus facilitating the modernisation and growth of the dermatology health care industry.

The large amount of funds spent on research and development of new dermatological drugs is driving the emergence of new drugs in Brazil's dermatology market, as well as the ready availability of OTC (over-the-counter) dermatology products. Improving consumer awareness of skin-related health issues, the necessity for rapid skin diagnosis, and the demand for innovative treatment modalities have contributed to overall market growth.

Report Coverage

This research report categorizes the market for the Brazil dermatological drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil dermatological drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil dermatological drugs market.

Driving Factors

The market is driven by the rising prevalence of skin disorders, growing awareness of skincare and cosmetic treatments, and technological advancements in dermatological drug formulations, including biologics and personalized therapies. Expanding access through tele-dermatology, e-commerce platforms, and enhanced healthcare infrastructure supports wider adoption. Additionally, increasing disposable incomes, urbanization, and supportive government healthcare initiatives further fuel market growth, encouraging consumers to seek effective and advanced dermatological treatments across Brazil.

Restraining Factors

Market growth is restrained by limited, insufficient healthcare infrastructure in rural areas, high costs of innovative dermatological treatments, and low patient awareness about chronic skin conditions. Additionally, lengthy regulatory approval processes, dependence on imported active ingredients, and competition from natural or home-based remedies slow the adoption of prescription dermatological drugs. Economic instability and fluctuating currency values also increase operational costs for manufacturers, further restraining market expansion.

Market Segmentation

The Brazil dermatological drugs market share is categorized by type, therapy, and distribution channel.

- The prescription segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil dermatological drugs market is segmented by type into prescription and over-the-counter. Among these, the prescription segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to the increasing prevalence of chronic and complex skin conditions, such as psoriasis, eczema, and severe acne, which require medical supervision and clinically proven treatments. Physicians primarily recommend prescription drugs for their higher efficacy and targeted action compared to over-the-counter products. Hospitals, dermatology clinics, and specialized healthcare centers serve as major distribution channels, ensuring widespread adoption. Additionally, advancements in biologics, targeted therapies, and personalized treatments, which are prescription-only, further drive demand, making this segment the largest in terms of market revenue and growth potential.

- The acne segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil dermatological drugs market is segmented by therapy into acne, psoriasis, rosacea, alopecia, and others. Among these, the acne segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its high prevalence among adolescents and adults, influenced by hormonal changes, lifestyle factors, and environmental conditions. Acne affects a broad demographic, creating consistent demand for both prescription and over-the-counter treatments, including topical gels, creams, and oral medications. Growing awareness of skincare, cosmetic appearance, and early intervention further drives treatment adoption. Compared to less common conditions like psoriasis, rosacea, or alopecia, acne impacts a larger population, ensuring higher sales volumes and making it the leading revenue-generating therapy segment in Brazil’s dermatological drugs market.

- The retail pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil dermatological drugs market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and others. Among these, the retail pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its widespread presence in urban and semi-urban areas, making dermatological products easily accessible to a large population. Retail pharmacies offer both prescription and over-the-counter treatments for conditions like acne, eczema, and minor skin issues, providing convenience and faster availability compared to hospital pharmacies. They also cater to preventive and cosmetic skincare needs, attracting regular consumer purchases. The broad product range, coupled with growing awareness of skin health and self-care trends, ensures retail pharmacies generate the highest sales and market coverage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil dermatological drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eurofarma

- EMS S.A.

- Aché Laboratórios Farmacêuticos S.A.

- Cristália

- Neo Química

- Galderma

- Pfizer Inc.

- GlaxoSmithKline (GSK)

- Johnson & Johnson

- Novartis AG

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In December 2023, Daewoong Pharmaceutical and Zydus Lifesciences signed a licensing agreement to jointly develop and market a generic leuprolide acetate depot, enhancing affordability and accessibility for treating endometriosis, prostate cancer, and uterine fibroids.

In November 2022, Cipla and Cipla USA launched Leuprolide Acetate Injection Depot 22.5?mg, FDA-approved via the 505(b)(2) pathway, providing a convenient treatment for hormone-related conditions and boosting market demand.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil dermatological drugs market based on the below-mentioned segments:

Brazil Dermatological Drugs Market, By Type

- Prescription

- Over-the-counter

Brazil Dermatological Drugs Market, By Therapy

- Acne, Psoriasis

- Rosacea

- Alopecia

- Others

Brazil Dermatological Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |