Brazil Diabetes Devices Market

Brazil Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (BGM Devices, Continuous Glucose Monitoring Devices, Insulin Delivery Devices), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and E-Commerce / Online Pharmacies), and Brazil Diabetes Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Diabetes Devices Market Size Insights Forecasts to 2035

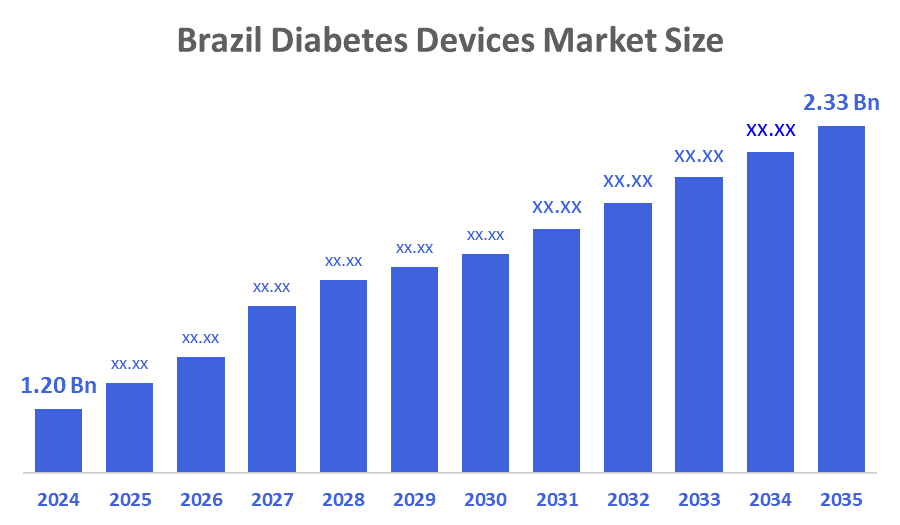

- The Brazil Diabetes Devices Market Size Was Estimated at USD 1.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.2% from 2025 to 2035

- The Brazil Diabetes Devices Market Size is Expected to Reach USD 2.33 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Diabetes Devices Market Size is anticipated to Reach USD 2.33 Billion by 2035, Growing at a CAGR of 6.2% from 2025 to 2035. The market is propelled by the increasing prevalence of diabetes, technological advancements in diabetes management, growing awareness about diabetes care, expanding healthcare infrastructure, and government initiatives and insurance coverage for diabetes care across the country.

Market Overview

The technological advances found in diabetes devices provide consumers with diabetes easy access to checking and managing their blood-sugar levels via glucose meters, test strips, continuous glucose monitors, and insulin delivery devices. These devices allow for better tracking of sugar levels, insulin intake, and everyday health. The growing number of cases and the increasing use of advanced glucose monitors have contributed to the growth of Brazil's diabetes-device marketplace as work continues to improve health-care access in Brazil by increasing the awareness of early diagnosis and government support for better management of chronic diseases, the use of technology is continuing to support the growth of the diabetes-device market and establish a continued steady expansion across the country. By implementing additional funding for diabetes-related care through public health, increasing access to diabetes-related products in the SUS clinics, and developing digital monitoring tools for integration into the chronic-care program, Brazil's government is positively impacting the diabetes-device market and encouraging patient access to early intervention and treating long-term conditions.

As awareness of diabetes grows due to national diabetes campaigns and better reimbursement policies for advanced devices, there will be a greater opportunity for increased patient access to advanced diabetes devices and the creation of greater continuing long-term market demand. As a technology to support the growth of the diabetes-device market, there has been a continued increase in the development of continuous glucose monitors, Blutooth enabled glucometers, artificial Intelligence insulin pens, and artificial intelligence-based sensors, which supply users with real-time data, predictive alerts, and ease of connection with application software, all of which create increased convenience and improved accuracy for patients using these devices.

Report Coverage

This research report categorizes the market for the Brazil diabetes devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil diabetes devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil diabetes devices market.

Driving Factors

The Brazil diabetes devices market is driven by the rapidly increasing prevalence of diabetes, growing obesity rates, and an aging population requiring continuous monitoring. Rising awareness of early diagnosis, along with government support through SUS for glucose testing supplies, boosts device adoption. Advancements in technology, such as continuous glucose monitors, Bluetooth-connected glucometers, and smart insulin delivery systems, enhance accuracy and convenience. Expanding healthcare infrastructure, improving access to treatment, and the shift toward home-based monitoring also contribute significantly. Increased digital health integration further strengthens market growth across the country.

Restraining Factors

The Brazil diabetes devices market faces restraints such as high prices of advanced devices like CGMs and insulin pumps, limited reimbursement for newer technologies, and income disparities that reduce access for low-income patients. Supply shortages in public healthcare, limited awareness in rural areas, and the need for frequent consumables also hinder broader adoption and slow market growth.

Market Segmentation

The Brazil diabetes devices market share is categorized by type and distribution channel.

- The BGM devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil diabetes devices market is segmented by type into BGM devices, continuous glucose monitoring devices, and insulin delivery devices. Among these, the BGM devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by it is the most affordable and accessible option for daily glucose testing. BGM devices, including glucometers and test strips, are widely distributed through pharmacies and supported by SUS, making them available to a large diabetic population. Many patients, especially those with limited income, prefer BGM due to its low upfront cost and simplicity. It also remains essential for routine monitoring, even for individuals not using insulin. These factors ensure high usage rates, keeping BGM ahead of CGM and insulin-delivery devices.

- The hospital pharmacies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil diabetes devices market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and e-commerce / online pharmacies. Among these, the hospital pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to most patients are diagnosed and begin treatment in hospitals, where devices are readily provided. Hospitals can supply higher-cost, advanced devices like insulin pumps and continuous glucose monitors, often with professional guidance. Additionally, hospital pharmacies simplify reimbursement and record-keeping under public and private healthcare plans. Their widespread availability, combined with trained staff support, ensures patients receive the correct devices and instructions. These factors make hospital pharmacies the primary distribution channel, surpassing retail and e-commerce in both volume and revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil diabetes devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche

- Abbott

- Medtronic

- Johnson & Johnson

- Becton Dickinson (BD)

- Novo Nordisk

- Dexcom

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In May 2023, Medtronic reached an agreement to purchase EOFlow, a manufacturer of insulin devices. Integrating EOFlow with Medtronic's Meal Detection Technology algorithm and advanced continuous glucose monitor (CGM) is anticipated to enhance the company's capacity to serve a broader range of individuals with diabetes

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil diabetes devices market based on the below-mentioned segments:

Brazil Diabetes Devices Market, By Type

- BGM Devices

- Continuous Glucose Monitoring Devices

- Insulin Delivery Devices

Brazil Diabetes Devices Market, Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- E-Commerce / Online Pharmacies

FAQ’s

1. What are diabetes devices?

- Diabetes devices include tools like blood glucose monitors, continuous glucose monitors (CGMs), and insulin delivery systems used to manage blood sugar levels.

2. Which segment dominates the market by type?

- Blood Glucose Monitoring (BGM) devices dominate due to affordability, accessibility, and ease of use.

3. Which distribution channel is the largest?

- Hospital pharmacies lead as they provide devices at diagnosis and support advanced device usage.

4. What drives market growth?

- Rising diabetes prevalence, government support, technological advances, and awareness of early diagnosis.

5. What restrains the market?

- High device costs, limited reimbursement, rural access issues, and supply shortages.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 255 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |