Brazil Diagnostic Imaging Equipment Market

Brazil Diagnostic Imaging Equipment Market Size, Share, and COVID-19 Impact Analysis, By Modality (X-Ray, Ultrasound, Computed Tomography, MRI, Nuclear Imaging (PET/SPECT), Fluoroscopy & C-Arms, Mammography, Other), By Application (Oncology, Cardiology, Neurology, and More), By End-User (Hospitals, Diagnostic Imaging Centers, Specialty Clinics), and Brazil Diagnostic Imaging Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Diagnostic Imaging Equipment Market Insights Forecasts to 2035

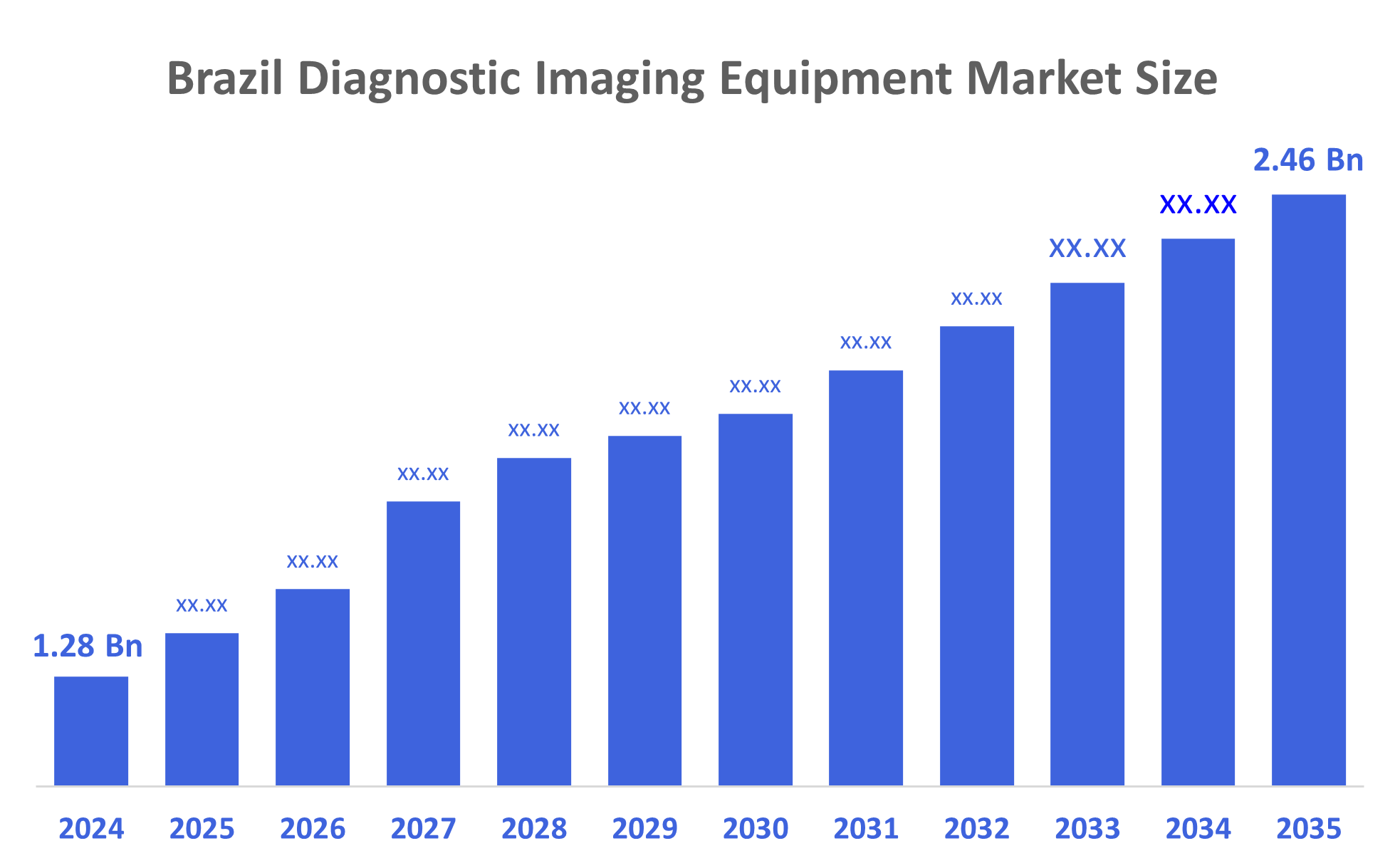

- The Brazil Diagnostic Imaging Equipment Market Size Was Estimated at USD 1.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Brazil Diagnostic Imaging Equipment Market Size is Expected to Reach USD 2.46 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Diagnostic Imaging Equipment Market Size is Anticipated to Reach USD 2.46 Billion by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. Brazil’s diagnostic imaging equipment market is experiencing significant growth, driven by artificial intelligence (AI) integration, expanding public healthcare investments, and rising demand for portable imaging devices. Increasing government support, technological advancements, and private-sector collaborations are enhancing accessibility, efficiency, and diagnostic accuracy across hospitals, clinics, and remote healthcare services.

Market Overview

Diagnostic imaging equipment is medical machines that help doctors look inside the body to find problems. They show images of bones, organs, or tissues without surgery. Common examples are X-rays, CT scans, MRI machines, and ultrasounds. These tools help diagnose illnesses, guide treatment, and monitor recovery safely and quickly. Additionally, the Brazil diagnostic imaging equipment market is growing due to an aging population, rising chronic diseases like cancer and cardiovascular disorders, increasing healthcare spending, government investment in medical infrastructure, and rapid adoption of advanced technologies such as digital and AI-enabled imaging systems, improving diagnosis, treatment, and patient care. Furthermore, in Brazil, the public health system (SUS) performed around 101 million imaging exams in 2023, representing 60% of all procedures, while private healthcare users averaged 1,323 exams per 1,000 people. By 2024, the country had nearly 293,300 diagnostic imaging devices, with 94–95% actively in use, showing strong government investment, widespread adoption, and improved access to advanced medical imaging and Key trends in Brazil’s diagnostic imaging market include digital radiography adoption, portable imaging devices, AI integration for faster diagnosis, and advanced 3D/4D or hybrid imaging systems for precise, efficient healthcare. Furthermore, Brazil’s diagnostic imaging market includes a 43.4% rise in exams in 2024, the 2025 launch of Philips CT?5300 with AI for faster, lower-dose scans, and AI-driven platforms reducing X-ray reading times from one hour to five minutes, improving speed, accuracy, and patient care.

Report Coverage

This research report categorizes the market for the Brazil diagnostic imaging equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil diagnostic imaging equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil diagnostic imaging equipment market.

Driving Factors

The Brazil diagnostic imaging equipment market is driven by several factors. A growing and aging population increases demand for imaging to detect chronic diseases like cancer and cardiovascular disorders. The rising prevalence of lifestyle-related illnesses and accidents boosts diagnostic needs. Government investments in healthcare infrastructure and increasing private healthcare spending support market growth. Technological advancements, including digital radiography, AI integration, portable devices, and 3D/4D imaging, improve efficiency and accuracy. Expanding awareness about early disease detection and preventive healthcare also encourages adoption, fueling steady market expansion across Brazil.

Restraining Factors

The Brazil diagnostic imaging equipment market faces several restraining factors. High costs of advanced imaging devices limit adoption, especially in smaller hospitals and rural areas. Lack of trained professionals to operate sophisticated equipment slows implementation. Maintenance and calibration challenges, along with limited insurance coverage for some imaging procedures, further restrict market growth despite increasing demand.

Market Segmentation

The Brazil diagnostic imaging equipment market share is categorized by modality, application, and end user.

- The x-ray segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil diagnostic imaging equipment market is segmented by modality into x-ray, ultrasound, computed tomography, MRI, nuclear imaging (PET/SPECT), fluoroscopy & c-arms, mammography, and other. Among these, the x-ray segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven due to its affordability, ease of use, and widespread availability in hospitals and clinics across urban and rural areas. It serves as the first-line imaging tool for general diagnostics, trauma, and routine check-ups. X-ray systems require lower maintenance and infrastructure compared to advanced modalities like MRI or CT, making them accessible for smaller healthcare facilities. Additionally, high patient volumes, growing demand for early diagnosis, and government initiatives to expand basic healthcare services further reinforce X-ray’s leading position in the market.

- The oncology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil diagnostic imaging equipment market is segmented by application into oncology, cardiology, neurology, and more. Among these, the oncology segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the rising incidence of cancer, including breast, lung, prostate, and colorectal cancers. Early detection and accurate staging are critical, creating high demand for advanced imaging modalities like CT, MRI, PET, and SPECT. Government health programs and private healthcare investments prioritize cancer screening and treatment, further boosting equipment adoption. Additionally, increasing awareness among patients and physicians about the benefits of imaging for oncology diagnosis and therapy monitoring strengthens this segment’s growth, making oncology the leading application in Brazil’s imaging market.

- The hospitals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil diagnostic imaging equipment market is segmented by end user into hospitals, diagnostic imaging centers, and specialty clinics. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to they serve as the primary point of care for a wide range of patients, including emergency, inpatient, and outpatient services. They require comprehensive imaging capabilities across multiple modalities—X-ray, CT, MRI, ultrasound, and nuclear imaging—to support diverse departments. Large hospital networks, both public and private, invest heavily in modern diagnostic equipment to improve patient outcomes. In contrast, diagnostic imaging centers and specialty clinics have limited scope and patient volumes, making hospitals the leading end-user segment in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil diagnostic imaging equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Carestream Health, Inc.

- Shimadzu Corporation

- Esaote SpA

- United Imaging Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In May 2024, Claritas HealthTech expanded its global reach by establishing a headquarters in São Paulo, Brazil, to meet the growing demand for nuclear medicine imaging solutions. The company will focus on its iPET™ platform, offering advanced, accurate, and affordable imaging solutions for patients, clinicians, and hospitals.

In February 2025, CARPL.ai, a San Francisco-based enterprise imaging AI platform, announced a partnership with Philips to enhance radiology capabilities in Brazil. The collaboration, revealed at the 54th Jornada Paulista de Radiologia, integrates AI with Philips' Vue PACS system, streamlining workflows and improving diagnostic efficiency, particularly in chest X-ray analysis.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil diagnostic imaging equipment market based on the below-mentioned segments:

Brazil Diagnostic Imaging Equipment Market, By Modality

- X-Ray

- Ultrasound

- Computed Tomography

- MRI

- Nuclear Imaging (PET/SPECT)

- Fluoroscopy & C-Arms

- Mammography

- Other

Brazil Diagnostic Imaging Equipment Market, By Application

- Oncology

- Cardiology

- Neurology

- More

Brazil Diagnostic Imaging Equipment Market, By End User

- Hospitals

- Diagnostic Imaging Centers

- Specialty Clinics

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |