Brazil Diagnostic Lab Market

Brazil Diagnostic Lab Market Size, Share, and COVID-19 Impact Analysis, By Test Type (Clinical Chemistry, Molecular Diagnostic, Immunodiagnostic, Hematology, and Other Test Types), By Application (Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, and Other Applications), and Brazil Diagnostic Lab Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Diagnostic Lab Market Size Insights Forecasts to 2035

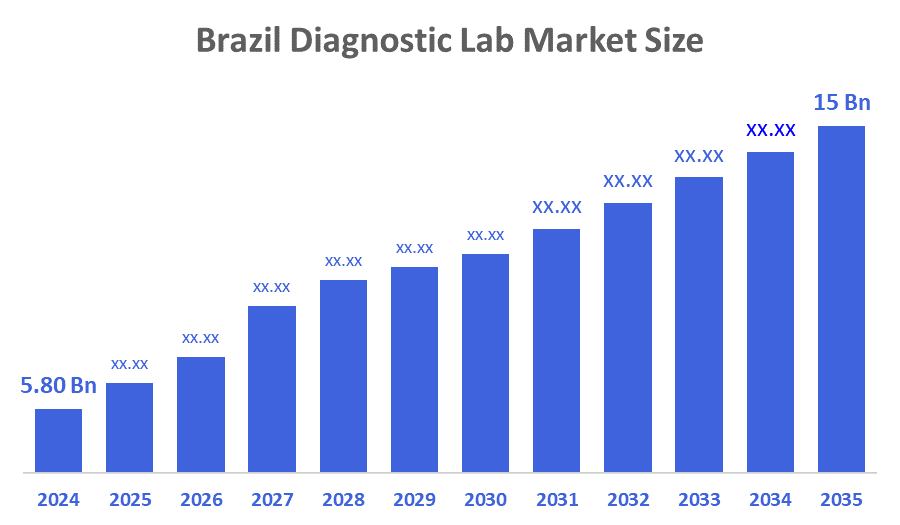

- The Brazil Diagnostic Lab Market Size Was Estimated at USD 5.80 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.2% from 2025 to 2035

- The Brazil Diagnostic Lab Market Size is Expected to Reach USD 15 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Diagnostic Lab Market Size is anticipated to Reach USD 15 Billion by 2035, Growing at a CAGR of 9.2% from 2025 to 2035. This growth is driven by an aging population, increased funding for public healthcare, and a rising prevalence of chronic diseases. Other factors include government initiatives for faster diagnostic pathways, investments in technology like point-of-care and AI, and expanding insurance penetration.

Market Overview

The network of labs and diagnostic facilities throughout Brazil that conduct medical tests on patient samples like blood, urine, or tissue to identify, track, and prevent diseases is known as the Brazil diagnostic laboratory market. These labs are essential in helping healthcare providers by providing precise, prompt diagnostic services and cutting-edge testing technologies. Rising healthcare costs, urbanization, and lifestyle-related illnesses, including diabetes and cardiovascular ailments, are the main factors propelling the growth of the Brazilian diagnostic lab market. Efficiency and accessibility are improved by growing the use of preventative healthcare, growing private diagnostic chains, and digitizing lab services. Additionally, collaborations, R&D expenditures, and the uptake of genetic and molecular diagnostic technologies drive market growth. For instance, in April 2024, Anvisa approved its portable RevDx gadget. This development demonstrates the trend toward diagnostic tools that are more flexible, affordable, and easy to use. The market is expected to rise significantly as this trend develops due to the rising need for innovative, portable diagnostic solutions.

.Report Coverage

This research report categorizes the market for the Brazil diagnostic labs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil diagnostic labs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil diagnostic labs market

Driving Factors

The Brazil diagnostic lab market is driven by growing healthcare awareness, rising prevalence of chronic and infectious diseases, and increasing demand for early and accurate diagnosis. Technological advancements, expanding private healthcare infrastructure, and government initiatives to improve laboratory services further support market growth across the country.

Restraining Factors

The Brazil diagnostic lab market faces restraints due to high equipment and test costs, limited reimbursement policies, and disparities in healthcare access between urban and rural areas. Additionally, a shortage of skilled professionals, regulatory challenges, and dependence on imported diagnostic technologies hinder market expansion and operational efficiency.

Market Segmentation

The Brazil diagnostic lab market share is categorized by test type and application.

The clinical chemistry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil diagnostic lab market is segmented by test type into clinical chemistry, molecular diagnostic, immunodiagnostic, hematology, and other test types. Among these, the clinical chemistry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The clinical chemistry segment is dominated due to its crucial role in disease diagnosis, monitoring, and treatment decisions. High test volumes, wide application across hospitals and laboratories, and advancements in automated analysers and reagents further drive its dominance in the in-vitro diagnostics market.

The infectious disease segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil diagnostic lab market is segmented by application into infectious disease, diabetes, cancer/oncology, cardiology, autoimmune disease, nephrology, and other applications. Among these, the infectious disease segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The infectious disease segment dominates due to the high prevalence of viral and bacterial infections such as HIV, tuberculosis, and hepatitis. Growing awareness about early detection, frequent outbreaks, and increasing demand for rapid diagnostic tests drive this segment’s dominance, supported by continuous advancements in molecular and immunoassay technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil diagnostic lab market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dasa Laboratories

- Grupo Fleury

- Hermes Pardini

- Alliar Medicos a Frente

- Hospital Israelita Albert Einstein

- SYNLAB – Solutions in Diagnostics

- Quest Diagnostics Incorporated

- Boris Berenstein Diagnostic Center

- Clinica da Imagem do Tocant

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In July 2024, Brazil launched the Orion Laboratory Complex, a biosafety level 4 (NB4) facility aimed at revolutionizing pathogen-related research. This trend is expected to further propel the market's growth, expanding diagnostic capabilities and enhancing scientific innovation.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil diagnostic lab market based on the following segments.

Brazil Diagnostic Lab Market, By Test Type

- Clinical Chemistry

- Molecular Diagnostic

- Immunodiagnostic

- Hematology

- Other Test Types

Brazil Diagnostic Lab Market, By Application

- Infectious Disease

- Diabetes

- Cancer/Oncology

- Cardiology

- Autoimmune Disease

- Nephrology

- Other Applications

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 255 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |