Brazil Dietary Supplements Market

Brazil Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Type (Vitamins, Minerals, Amino Acids, Proteins, Probiotics, Blends), By form (Tablets, Capsules, Softgels, Powders, Gummies), and Brazil Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Dietary Supplements Market Insights Forecasts to 2035

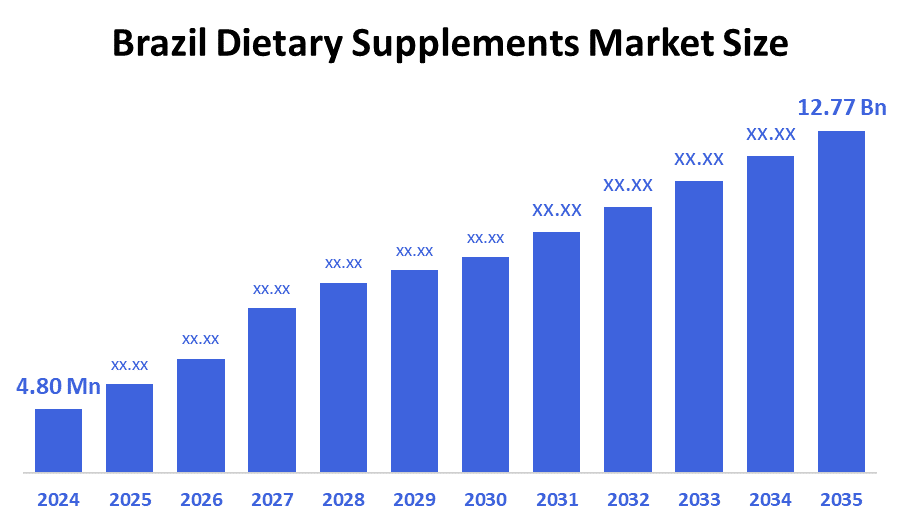

- The Brazil Dietary Supplements Market Size Was Estimated at USD 4.80 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.3% from 2025 to 2035

- The Brazil Dietary Supplements Market Size is Expected to Reach USD 12.77 Billion by 2035

According to a research report published by decision advisor & Consulting, the Brazil Dietary Supplements Market size is anticipated to reach USD 12.77 billion by 2035, growing at a CAGR of 9.3% from 2025 to 2035. Brazil dietary supplements market key factors driving the market include the rising prevalence of chronic diseases, increasing health consciousness, growing demand for natural and functional ingredients, regulatory approvals by ANVISA, expansion of e-commerce, digital health awareness, influence of fitness and wellness trends, and a shift toward preventive healthcare and personalized nutrition solutions.

Market Overview

Dietary supplements are products people take to support their health by adding nutrients that may be missing from their regular diet. They can include vitamins, minerals, herbal extracts, proteins, or other natural ingredients. Available in various forms, including tablets, capsules, powders, and drinks, they help boost immunity, energy, and overall well-being. However, they work best when combined with a balanced diet and a healthy lifestyle. Additionally, the Brazil dietary supplements market is growing due to increasing health awareness, rising chronic diseases, and more people choosing preventive healthcare. Busy lifestyles encourage the use of supplements for energy, immunity, and nutrition. Fitness trends, gym culture, and an aging population also boost demand. Expanding online sales, strong marketing, and wider product availability further support market growth.

The Brazilian Health Regulatory Agency (ANVISA) regulates and monitors dietary supplements to ensure they are safe and effective, which helps build consumer trust and boosts demand. At the same time, the rapid growth of e-commerce makes it easier for people to access a wide range of supplements, encouraging higher usage and supporting market expansion. In addition, environmental sustainability and ethical sourcing are gaining attention, reflecting a broader consumer shift toward responsible consumption in the dietary supplements space. In April 2024, MuscleTech strengthened its partnership with Trust Group to begin local manufacturing operations in Brazil, aiming to enhance market presence, streamline distribution, and cater more effectively to Brazilian consumers.

Report Coverage

This research report categorizes the market for the Brazil dietary supplements market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil dietary supplements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil dietary supplements market.

Driving Factors

Brazil’s dietary supplements market is driven by increasing health awareness, rising chronic and lifestyle-related diseases, and a strong shift toward preventive healthcare. Technological advancements such as improved formulations, personalized nutrition, and digital health platforms are boosting consumer interest. Government support through ANVISA’s strict regulations enhances product safety, quality, and public confidence. The rapid growth of e-commerce makes supplements widely accessible, offering variety and convenience. Additionally, expanding gym culture, sports nutrition trends, and the needs of an aging population further drive steady market demand across the country.

Restraining Factors

Brazil’s dietary supplements market is restrained by such as strict ANVISA rules, which make product approval slow and costly. Many supplements are expensive, so not everyone can buy them. Some people, especially in rural areas, have low awareness about their benefits. Fake or low-quality products reduce trust. Economic problems also make consumers cut spending on supplements.

Market Segmentation

The Brazil dietary supplements market share is categorized by type and form.

- The vitamins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil dietary supplements market is segmented by type into vitamins, minerals, amino acids, proteins, probiotics, and blends. Among these, the vitamins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the most commonly used products for boosting immunity, improving energy, and maintaining overall health. They are affordable, easy to find in pharmacies and online stores, and suitable for all age groups. Doctors and nutritionists also recommend vitamins more often than other supplements. Growing health awareness, especially after the pandemic, has increased daily vitamin use, making this segment the largest and most trusted among Brazilian consumers.

- The tablets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil dietary supplements market is segmented by form into tablets, capsules, softgels, powders, and gummies. Among these, the tablets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to they are affordable, easy to produce, and have a long shelf life. People prefer tablets because they offer accurate dosing and are simple to take every day. They are widely available in pharmacies, supermarkets, and online stores, making them convenient for all age groups. Tablets are also easier to store and transport compared to powders or gummies. Their lower cost and high availability make them the most common and trusted form among Brazilian consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil dietary supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Herbalife

- Amway

- Nestlé

- Abbott

- GNC

- Unilever

- DSM

- Sanofi

- Glanbia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, NXT USA, in partnership with Infinity Pharma Brazil, announced the launch of Digexin in Brazil, under the brand name Motility in Brazil. Made from okra pod and winter cherry root extracts, it supports gut health, digestion, and bowel regularity, while improving stress, sleep, mood, and energy.

- In February 2024, Kilyos Nutrition expanded its product range in Brazil by introducing Superba Krill oil from Aker BioMarine, aiming to supply the ingredient to leading dietary supplement brands in the country.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. decision advisor has segmented the Brazil dietary supplements market based on the below-mentioned segments:

Brazil Dietary Supplements Market, By Type

- Vitamins

- Minerals

- Amino Acids

- Proteins

- Probiotics

- Blends

Brazil Dietary Supplements Market, By Form

- Tablets

- Capsules

- Softgels

- Powders

- Gummies

FAQ’s

1. What are dietary supplements?

- Dietary supplements are products that provide extra nutrients like vitamins, minerals, proteins, or herbs to support health.

2. Why is the dietary supplements market growing in Brazil?

- Because of rising health awareness, preventive healthcare trends, and the popularity of fitness and online shopping.

3. Are supplements regulated in Brazil?

- Yes. ANVISA monitors and approves supplements to ensure safety and quality.

4. Which supplement type is most popular in Brazil?

- Vitamins are the most widely consumed due to their daily health benefits.

5. What forms of supplements are commonly used?

- Tablets are the most common form because they are affordable, easy to use, and widely available.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 199 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |