Brazil Dried Fruits Market

Brazil Dried Fruits Market Size, Share, and COVID-19 Impact Analysis, By Products (Dried Grapes, Dates, Apricots, Figs, Berries, and Others), By Category (Conventional and Organic), and Brazil Dried Fruits Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Dried Fruits Market Insights Forecasts to 2035

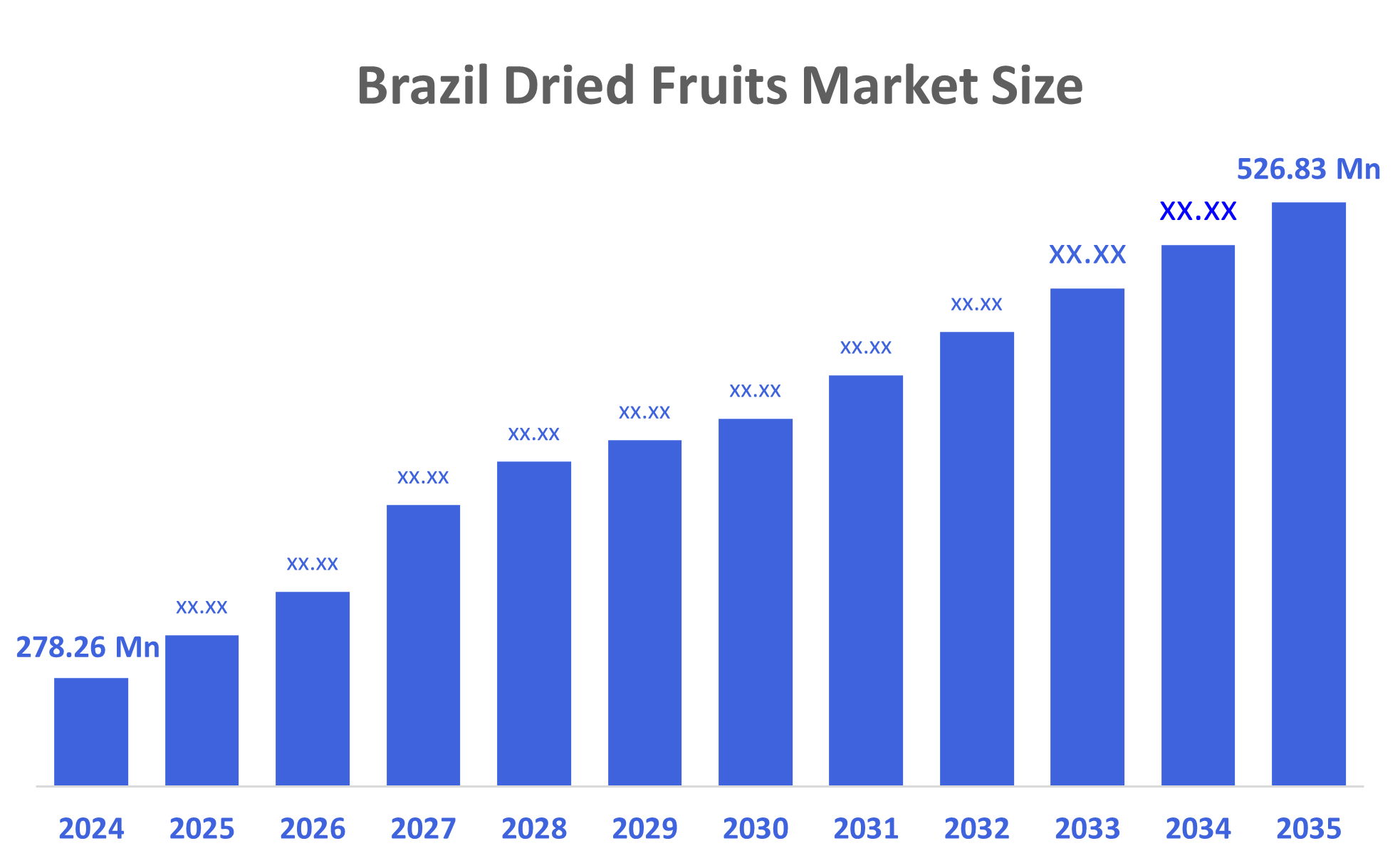

- The Brazil Dried Fruits Market Size was estimated at USD 278.26 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.97% from 2025 to 2035

- The Brazil Dried Fruits Market Size is Expected to Reach USD 526.83 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Dried Fruits Market Size is Anticipated to Reach USD 526.83 Million by 2035, Growing at a CAGR of 5.97% from 2025 to 2035. The Brazil dried fruit market is driven by the demand for naturally produced, readily available, and simplicity associated with health and wellness reasons fuel Brazil's growing interest in dried fruits. This increased interest in dried fruits is primarily due to the growing demand for dried fruits within the bakery, confectionery, and cereals industries and improved availability of local fruit for use as an ingredient through the expansion of e-commerce.

Market Overview

The dried fruit market is a world-wide business that produces, sells, and distributes fruit that has lost almost all its moisture using multiple drying techniques. In the dried fruits industry, there is significant potential for growth by creating products that provide added health benefits using the current consumer trend toward nutritious snacks. Additionally, opportunities exist to create new varieties of dried fruit, exotic combinations of flavours, and specialized functional products. Online purchasing and e-commerce are important due to growth occurring through both traditional supermarkets and through Internet-based sales methods. The Brazilian dried fruit sector has several important government support structures in place, including the annual crop plan which provides subsidized loans to farmers, and the Food Acquisition Program (PAA), which purchases crops from small scale farmers to ensure food security. The establishment of minimum price support helps maintain price stability for dried fruits in Brazil. In addition, increased investment into agriculture infrastructure such as cold storage and food parks create greater efficiencies throughout the value chain of both fresh and dried fruit.

Report Coverage

This research report categorizes the market for the Brazil dried fruits market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil dried fruits market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil dried fruits market.

Driving Factors

The Brazil dried fruits market is driven by consumer awareness and increasing demand for organic products as well as functional foods continue to cause changes in consumer behaviour towards dried fruits as a highly nutritious food. In response to the increased demand for healthy snacks, many snack manufacturers are creating snack bars, breakfast cereals and bakery items that contain high levels of protein and use both dried fruits and nuts. Moreover, with advanced technological advancements in the packaging and processing of these products, such as through freeze-drying, the quality of the product and the shelf life of the products are being improved, leading to more growth in sales.

Restraining Factors

The restraining factors concern over food safety is rising, increasing regulatory requirements and compliance costs for dried fruit manufacturers, especially as exports grow. Issues like mycotoxins have led developed countries to impose stricter import standards, while consumers are also demanding ethically sourced and sustainably produced products. Additionally, the high costs of growing and processing dried fruits continue to limit market growth and profitability.

Market Segmentation

The Brazil dried fruits market share is classified into product and category.

- The dried grapes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil dried fruits market is segmented by product into dried grapes, dates, apricots, figs, berries, and others. Among these, the dried grapes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due largely a reflection of consistent demand from both consumers and processors of food products. In addition to being naturally sweet, raisins are also widely used as an ingredient in packaged foods, and they are easily available in retail stores. As such, they can be considered a common ingredient for several types of food applications.

- The conventional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil dried fruits market is segmented by category into conventional and organic. Among these, the conventional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to it produces lower cost products, which enables mass consumption to easily access products. Wider production capacity, wider sources for raw material, and wide distribution channels for supermarkets and other wholesalers are increasing the dominance of the traditional component over the more premium organic component.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil dried fruits market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sunsweet

- Traina Dried Fruit

- Red River Foods

- Al Foah

- Sun-Maid

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Dried Fruits Market based on the below-mentioned segments:

Brazil Dried Fruits Market, By Products

- Dried Grapes

- Dates

- Apricots

- Figs

- Berries

- Others

Brazil Dried Fruits Market, By Category

- Conventional

- Organic

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |