Brazil Drone Market

Brazil Drone Market Size, Share, By Product (Fixed-wing, Multi-rotor, Single -rotor, and Hybrid), By Technology (Remotely Operated, Semi-Autonomous, Fully Autonomous, and Others), Brazil Drone Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Drone Market Size Insights Forecasts to 2035

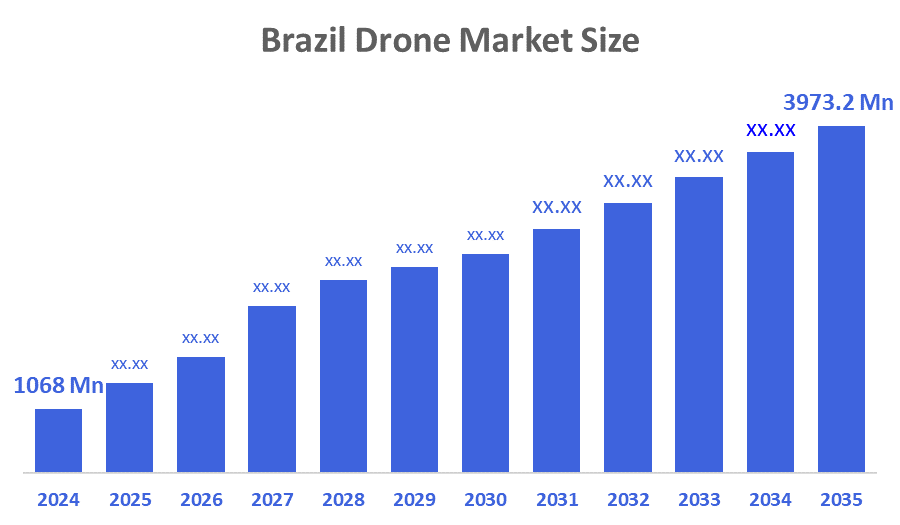

- Brazil Drone Market Size 2024: USD 1068.0 Mn

- Brazil Drone Market Size 2035: USD 3973.2 Mn

- Brazil Drone Market CAGR 2024: 12.69%

- Brazil Drone Market Segments: Product and Technology

The Brazilian Drone Market Size consists of all UAS and software and service providers that are developing and providing technology solutions for use in many industries, such as agriculture, infrastructure inspection, logistics, mining, oil & gas, mapping, surveillance, and environmental monitoring. The growing use of drones in precision agriculture, increasing demand for aerial data collection at lower cost, growing use of drones in a commercial or industrial role, and increasing acceptance and usage of drone services that allow companies to improve their operational efficiency and comply with regulatory requirements are expected to continue to drive growth within the commercial drone market.

As drone service providers and solution providers increase their presence in the market of Brazil, it is important to recognize that their presence is supported by the Brazilian Government's initiative to create clear regulations for drone operations through its commissions, ANAC (National Civil Aviation Agency) and DECEA (Department of Aerospace Operations) regulations, which provides the necessary infrastructure to register UAS, manage airspace, and perform commercial operations. Other government policies supporting modernizing agriculture, promoting smart infrastructure, and advancing digital transformation will continue to encourage greater use of drone technology, as will the public and private sector's continued investment in Aggrotech and geospatial technology to create a robust support and infrastructure ecosystem for the drone market in Brazil.

Technological advancements are rapidly changing how drone service providers in Brazil are integrating the latest innovations in Artificial Intelligence (AI), Machine Learning, high-resolution cameras, LiDAR technology, Cloud-Based Analytics, and others to create a more automated and accurate way to fly drones, capture aerial imagery, and make decisions based on the captured data. The adoption of BVLOS (beyond visual line of sight) and hybrid operations, when combined with real-time data analysis and predictive analytics, will continue to open new large scale commercial drone applications, while enabling safe and compliant operations in a variety of industries.

Market Dynamics of the Brazil Drone Market:

The Brazil drone market is driven by the increase in Brazil's usage of drones for agricultural monitoring and precision agriculture. Additionally, Brazil's drone market is also seeing an increase in the application of drones in infrastructure inspection, mining, and oil & gas industries, as well as an increased demand for drones for aerial surveillance and security purposes. Drone's support from the government, along with advances being made in drone technologies have driven this growth.

The Brazil drone market is restrained by the government regulations that control airspace, lengthy administrative and operational procedures required before utilizing Drones, the small number of people qualified to fly drones, the high expense of advanced drones, data privacy and security issues, limitations on the use of drones beyond sight line, and lack of available support for infrastructure in many areas of the country, especially disadvantaged geographic areas.

Brazil's unmanned aerial vehicles have a bright outlook, opening new avenues for a wide range of applications due to their increasing use in precision agriculture, infrastructure inspection, logistics, public safety, and environmental observation. The improvement of artificial intelligence (AI), automated programming, integrated sensor technology, and the implementation of beyond visual line of sight (BVLOS) operations, because of increasing investments, supportive policies and regulations, and emerging technology, to optimise operational efficiencies, broaden applications and promote large-scale commercial adoption of drones across Brazil.

Market Segmentation

The Brazil Drone Market share is classified into product and technology.

By Product:

The Brazil drone market is divided by product into fixed-wing, multi-rotor, single -rotor, and hybrid. Among these, the multi-rotor segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The popularity of multi-rotor drones in Brazil is based on their affordability, ease of use, and flexibility, making them the most significant type of drone used within Brazil. Multi-rotor drones can be utilized in the sectors such as agricultural, industrial, inspection, surveillance, mapping, and media. Multi-rotor drones’ ability to stay in one location, vertically lift off, and fly into small places, adds to their growing use commercially.

By Technology:

The Brazil drone market is divided by technology into remotely operated, semi-autonomous, fully autonomous, and others. Among these, the remotely operated segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The remotely operated segment dominates because of strict aviation regulations, safety requirements, and operator-in-command regulations, Brazil has the largest market for remotely-operated drones or RPAS. As such, most of the commercial uses of RPAS such as agricultural applications, inspections, and mapping, will still require a human being in command of the RPAS when using the commercial application of RPAS. Therefore, remotely-operated drones provide an affordable and compliant solution while being accepted across a wide variety of industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil drone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Drone Market:

- Skydio

- Mapbox

- 3D Robotics

- Parrot Drones

- Airware

- Autel Robotics

- DJI

- Teledyne Technologies Inc

- AgEagle Aerial Systems Inc

- Others

Recent Developments in Brazil Drone Market:

In July 2025, Xmobots partnered with Embraer to advance the development of high-performance unmanned aerial systems for defense, mapping, and industrial inspection, strengthening Brazil’s domestic drone manufacturing and technology capabilities.

In July 2025, DJI, through its Brazilian distributors, expanded its agricultural drone portfolio in Brazil to support precision farming, crop spraying, and monitoring, responding to rising demand from large-scale agribusiness and commercial farms.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil drone market based on the below-mentioned segments:

Brazil Drone Market, By product

- Fixed-wing

- Multi-rotor

- Single -rotor

- Hybrid

Brazil Drone Market, By Technology

- Remotely Operated

- Semi-Autonomous

- Fully Autonomous

- Others

FAQ

Q: What is the Brazil Drone Market size?

A: Brazil Drone Market is expected to grow from USD 1068.0 million in 2024 to USD 3973.2 million by 2035, growing at a CAGR of 12.69% during the forecast period 2025-2035.

Q: How is the market segmented by product?

A: The market is segmented into Fixed-wing, Multi-rotor, Single -rotor, and Hybrid.

Q: Who are the key players in the Brazil Drone Market?

A: Key companies include Skydi, Mapbox, 3D Robotics, Parrot Drones, Airware, Autel Robotics, DJI, Teledyne Technologies Inc, AgEagle Aerial Systems Inc, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 145 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |