Brazil Drug Delivery Devices Market

Brazil Drug Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Injectable Delivery Devices, Inhalation Delivery Devices, Infusion Pumps and More), By Route of Administration (Injectable, Inhalational, Transdermal Patches and More), By Application (Cancer, Cardiovascular, Diabetes and More), and Brazil Drug Delivery Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Drug Delivery Devices Market Insights Forecasts to 2035

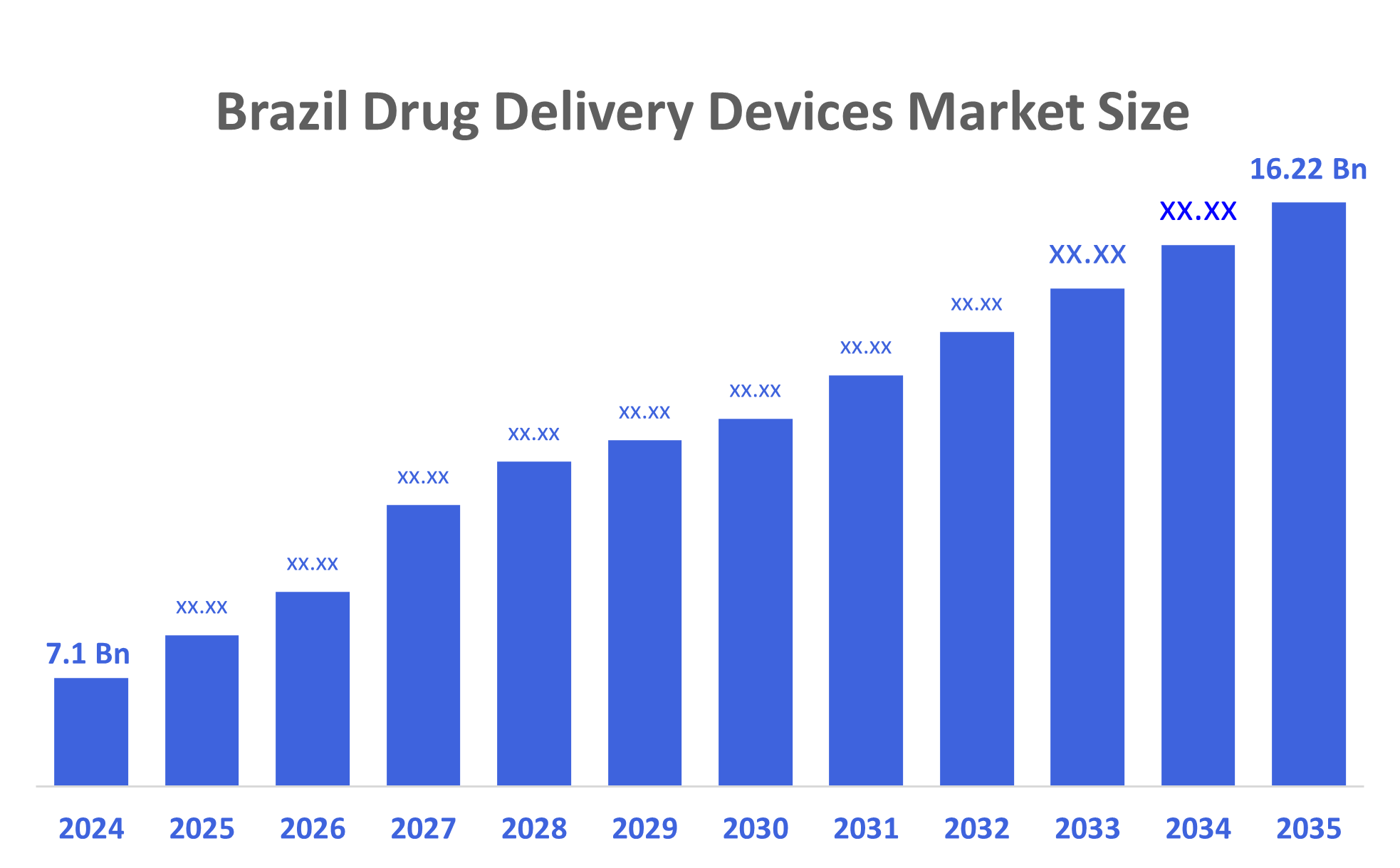

- The Brazil Drug Delivery Devices Market Size Was Estimated at USD 7.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.8% from 2025 to 2035

- The Brazil Drug Delivery Devices Market Size is Expected to Reach USD 16.22 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Drug Delivery Devices Market Size is Anticipated to Reach USD 16.22 Billion by 2035, Growing at a CAGR of 7.8% from 2025 to 2035. The increasing prevalence of chronic diseases, development of biologic drugs and targeted therapies, rising shift toward patient-centric care and self-administration of medications, aging population, growing innovations in drug delivery technology, and the rising trend toward personalized medicine represent some of the key factors driving the market.

Market Overview

Drug delivery devices are made to deliver medications safely, easily, and under control to a person's body. These devices also provide accurate and convenient ways of delivering a drug via several delivery methods: oral and transdermal (through skin), nasal (through sinuses), and injection. They increase the chances that a drug will be administered at the correct dosage at the right time to achieve maximum benefit for patients, thereby resulting in a better quality of life for all patients. The drug delivery device market in Brazil is experiencing rapid growth, which can be attributed to many factors, including an increase in patients suffering from chronic illnesses such as diabetes; therefore, there is a heightened need for more convenient and dependable means of medication administration. The increasing acceptance among patients of receiving home this is driving an increase in demand for straightforward and easily used drug delivery devices. As the Brazil population continues to age, and as access to health care improves for all, and as technological improvements lead to the continued development of new bio-alternatives like modern inhalers, intelligent injectors, and needle-free systems, these factors will all have a positive influence on the future success of the Brazil drug delivery device market.

The technological evolution of contemporary drug delivery techniques (microneedles, inhalation aerosols, etc.), coupled with their improved accuracy, higher safety ratings, and ease of application, has allowed researchers to pursue this branch of research. This is exemplified by the recent report from the Cruz Foundation (Fiocruz) published in May 2021, indicating a surge in the incidence of acute respiratory distress syndrome (ARDS) among COVID-19 patients in Brazil. Most COVID-19 patients had signs and symptoms of ARDS. either nebulised or inhaled medications to relieve their difficulty with breathing. Consequently, there has been a rapid increase in demand for drug delivery devices in Brazil.

Report Coverage

This research report categorizes the market for the Brazil drug delivery devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil drug delivery devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil drug delivery devices market.

Driving Factors

Brazil’s drug delivery device market is growing due to strong technological progress and government support. New technologies such as smart injectors, advanced inhalers, wearable pumps, and needle-free systems make treatment safer, easier, and more comfortable for patients. At the same time, the Brazilian government is promoting local production through incentives, funding programs, and technology-transfer partnerships under the Health Industrial Complex strategy. ANVISA’s faster approval processes and supportive medical-device regulations encourage innovation. These combined efforts improve access to modern therapies and push the market forward.

Restraining Factors

The Brazil drug delivery device market faces restraints such as high device costs, limited patient awareness, and affordability issues in low-income regions. Complex regulatory requirements can delay product approvals. Dependence on imported components increases costs and supply risks. Additionally, healthcare infrastructure gaps, especially in rural areas, and the need for skilled professionals, reduce the widespread adoption of advanced drug delivery technologies.

Market Segmentation

The Brazil drug delivery devices market share is categorized by device type, route of administration, and application.

- The injectable delivery devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil drug delivery devices market is segmented by device type into injectable delivery devices, inhalation delivery devices, infusion pumps, and more. Among these, the injectable delivery devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven due to the widespread use for treating common chronic diseases such as diabetes, cancer, and autoimmune disorders. These conditions often require precise and fast-acting medication, which injections can deliver directly into the bloodstream. Brazil also has a growing diabetic population, increasing the use of insulin pens and syringes. Advances in self-injection devices, such as auto-injectors and prefilled syringes, make treatment easier and safer, boosting their adoption. Hospitals and clinics also prefer injections for reliable and accurate dosing.

- The injectable segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil drug delivery devices market is segmented by route of administration into injectable, inhalational, transdermal patches, and more. Among these, the injectable segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to many essential treatments, such as insulin, vaccines, cancer therapies, and biologic drugs, that must be delivered directly into the bloodstream for fast and accurate action. Brazil has a high number of patients with diabetes, autoimmune disorders, and chronic diseases, increasing the need for injectable medicines. Hospitals and clinics also rely heavily on injections for emergency care and routine treatments. The growing use of prefilled syringes, auto-injectors, and pen injectors makes injections easier and safer for patients, further strengthening their dominance.

- The diabetes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil drug delivery devices market is segmented by application into cancer, cardiovascular, diabetes, and more. Among these, the diabetes segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country having a very high and growing number of diabetic patients who require daily and long-term medication. Insulin must be delivered through devices like pens, syringes, pumps, and modern auto-injectors, creating continuous demand. Many patients prefer easy, safe, and user-friendly devices for home use, increasing adoption even more. Brazil’s rising obesity rates, aging population, and improved diagnosis also contribute to the higher number of diabetes cases, making this segment the largest in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil drug delivery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi

- Pfizer

- Novartis

- Johnson & Johnson

- Becton, Dickinson & Company (BD)

- GlaxoSmithKline (GSK)

- Medtronic

- Eli Lilly

- Roche

- AstraZeneca

- Bayer

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In February 2024, Pfizer improved patient convenience for long-term treatments by introducing a novel injectable device that is intended for self-administration.

In January 2024, Novo Nordisk declared that a smart insulin delivery pen with connection features to assist patients in monitoring their dosages would be available in Brazil.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil drug delivery devices market based on the below-mentioned segments:

Brazil Drug Delivery Devices Market, By Device Type

- Injectable Delivery Devices

- Inhalation Delivery Devices

- Infusion Pumps

- More

Brazil Drug Delivery Devices Market, By Route of Administration

- Injectable

- Inhalational

- Transdermal Patches

- More

Brazil Drug Delivery Devices Market, By Application

- Cancer

- Cardiovascular

- Diabetes

- More

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |