Brazil E-commerce Market

Brazil E-Commerce Market Size, Share, and COVID-19 Impact Analysis, By Product (Clothing, Healthcare, Sports Apparel, Industrial & Science, Beauty & Personal Care and Others), By Deployment Model (Supplier-Oriented, Buyer-Oriented, Intermediary-Oriented and Others), and Brazil E-commerce Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil E-commerce Market Insights Forecasts to 2035

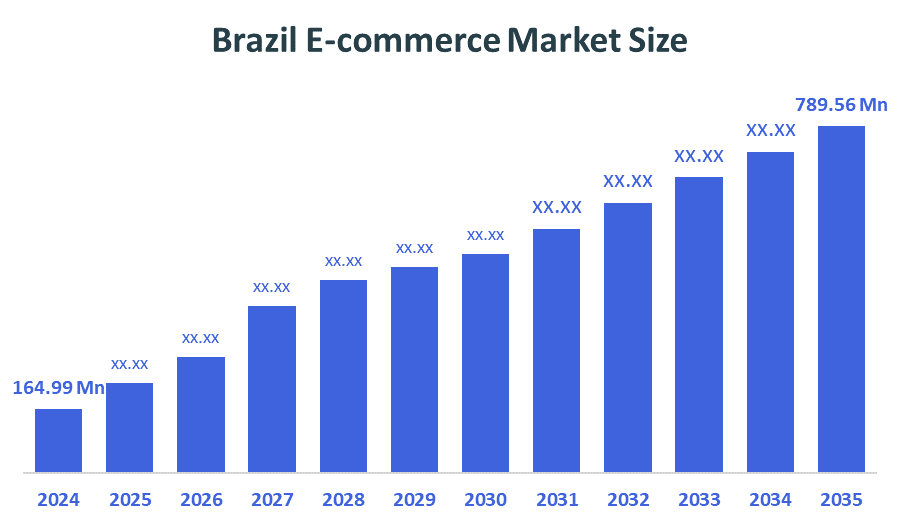

- The Brazil E-commerce Market Size Was Estimated at USD 164.99 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.3% from 2025 to 2035

- The Brazil E-commerce Market Size is Expected to Reach USD 789.56 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Brazilian E-Commerce Market Size is anticipated to reach USD 789.56 Million by 2035, growing at a CAGR of 15.3% from 2025 to 2035. The Brazil e-commerce market drivers are increasing mobile usage, widespread internet coverage, and a strong preference for cutting-edge payment systems like Pix. Groceries are rapidly expanding in the market, and recent import taxes are strengthening domestic platforms by reducing competition from abroad for small boxes.

Market Overview

The Brazilian e-commerce market involves the online buying and selling of goods and services on digital platforms, driven by the expansion of Internet access, mobile use, digital payments and consumer preference for online shopping. The opportunities in the Brazilian e-commerce market include focusing on fast-growing industries such as fashion and food and beverage, integrating the popular PIX instant payment system, and serving mobile-first consumers. There are further possibilities to focus on niche markets such as sustainable and organic goods, collaborate with nearby companies to enhance logistics, and take advantage of the growing popularity of social media and customised shopping experiences. Due to significant changes in consumer behaviour towards online shopping, increasing internet and smartphone penetration and the rapid adoption of cutting-edge payment methods, such as Payments, are the main drivers of growth in Brazil's e-commerce business. Additional contributing factors include advanced delivery and logistics networks, the impact of social media on business, ease of instalment payments, government support and digital projects.

The government efforts in Brazil's e-commerce market are focused on facilitating the integration of digital tools for small and medium-sized businesses (SMEs), promoting digital inclusion through infrastructure investments and the PIX payment system, and streamlining customs duties and taxes through the Remesa Conforma program. These initiatives aim to reduce barriers to e-commerce, promote customer engagement, and promote industry expansion.

Report Coverage

This research report categorises the Brazilian e-commerce market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazilian e-commerce market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazilian e-commerce market.

Driving Factors

The Brazil e-commerce market, driven by high-quality product information and images, secure and flexible payment methods, quick and easy shipments and returns, and excellent customer service, is an essential component. Additionally, utilising multichannel marketing, building a strong brand, and optimising the consumer experience are essential for long-term success. Many recent and developing trends, such as live-streaming sales, BNPL options and rapid commerce (instant delivery of goods and food), are supporting business by attracting a larger consumer base. Enhancing delivery services and fostering customer trust are the results of investments in and upgrades to logistics networks.

Restraining Factors

The Brazilian e-commerce market, although a vast and growing opportunity, is constrained by significant logistics and regulatory challenges, a complex tax system, cybersecurity risks, and intense competition. For international players, these factors are linked to local consumer preferences and import barriers. Due to high import duties and widespread fraud, Brazilian shoppers may be cautious of making online purchases, especially from foreign retailers with whom they are unfamiliar. Therefore, it is essential to establish a straightforward return policy to gain customer trust.

The Brazilian e-commerce market share is classified into product and deployment models

- The clothing (fashion and apparel) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazilian e-commerce market is segmented by product into clothing, healthcare, sports apparel, industrial & science, beauty & personal care and others. Among these, the clothing (fashion and apparel) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fashion and apparel remain a leading sector, driven by consumer preferences that are changing, and the trend of online shopping for clothing and accessories is on the rise. The convenience of online shopping, wide product variety and frequent promotional campaigns make this category particularly attractive to consumers.

- The intermediary-oriented segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazilian e-commerce market is segmented by deployment models into supplier-oriented, buyer-oriented, intermediary-oriented and others. Among these, the intermediary-oriented segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The intermediary-oriented segment is given by intermediary platforms that facilitate transactions, provide diverse product selection, and streamline processes between buyers and sellers, like marketplaces. It includes e-commerce platforms that act as a bridge between multiple suppliers and buyers, offering a wide range of products and services. Brazil's increasing digitalisation is helping intermediary-oriented e-commerce to flourish as companies realise how effective online platforms are in expanding their customer base and increasing productivity.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazilian e-commerce market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyota Tsusho Corporation

- Mitsubishi Corporation

- Mercado Livre

- Amazon Brasil

- Magazine Luiza

- Americanas S.A.

- Shopee

- Casas Bahia

- Ponto

- OLX Brasil

- Carrefour Brasil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, the European Commission published a draft decision on the adequacy of Brazil's level of personal data protection, concluding that Brazil ensures a level of protection for personal data that is "essentially equivalent" to that guaranteed within the European Union under the General Data Protection Regulation (GDPR).

- In June 2025, Pix Automatico launched. The new service rolled out by the Central Bank of Brazil will enable recurring payments to be made using Pix, without the need for credit cards or complex direct debit setups.

- In April 2025, PagBrasil, a digital payments platform, announced that it would integrate Pix Automático into its subscription management platform, PagStream. Through PagBrasil's platform, merchants will be able to easily create and manage subscription plans, set billing frequencies, handle upgrades and downgrades, and automate customer communications related to the payment cycle.

- In January 2024, Brazil launches a new industrial policy named Nova Indústria Brasil (NIB), with development goals and measures up to 2033. The objective of the scheme is to promote neo-industrialisation with a special focus on sustainability, innovation and digital transformation.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazilian e-commerce market based on the following segments:

Brazil E-commerce Market, By Product

- Clothing

- Healthcare

- Sports Apparel

- Industrial & Science

- Beauty & Personal Care

- Others

Brazil E-commerce Market, By Deployment Model

- Supplier-Oriented

- Buyer-Oriented

- Intermediary-Oriented

- Others

FAQ’s

Q: What is the Brazilian e-commerce market size?

A: The Brazilian e-commerce market was estimated at USD 164.99 million in 2024 and is projected to reach USD 789.56 million by 2035, growing at a CAGR of 15.3% during 2025–2035.

Q: What are the different influencing factors of successful e-commerce?

A: Key elements of successful E-commerce. A user-friendly website with intuitive navigation, a robust and mobile-responsive design, and efficient search engine optimisation (SEO) to increase visibility are PC Soft's key success criteria in e-commerce.

Q: What are the key drivers of e-commerce?

A: The expansion of online shopping is fuelled by changing customer behaviour and expectations for convenience and personalisation, as well as technology developments like improved internet connectivity and mobile access.

Q: What are the benefits of e-commerce?

A: The benefits of e-commerce include convenience and wider selection for customers, as well as lower operating costs and allowing global reach, more efficient marketing, inventory management and market expansion for businesses.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 218 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |