Brazil Electric Vehicle Market

Brazil Electric Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Car and Commercial Vehicle), By Propulsion Type (Battery Electric Vehicle (BEV) and Hybrid Electric Vehicle (HEV)), By Component (Battery Pack & High Voltage Component, Motor, Brake, Wheel & Suspension, Body & Chassis, and Low Voltage Electric Component), and Brazil Electric Vehicle Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Electric Vehicle Market Insights Forecasts to 2035

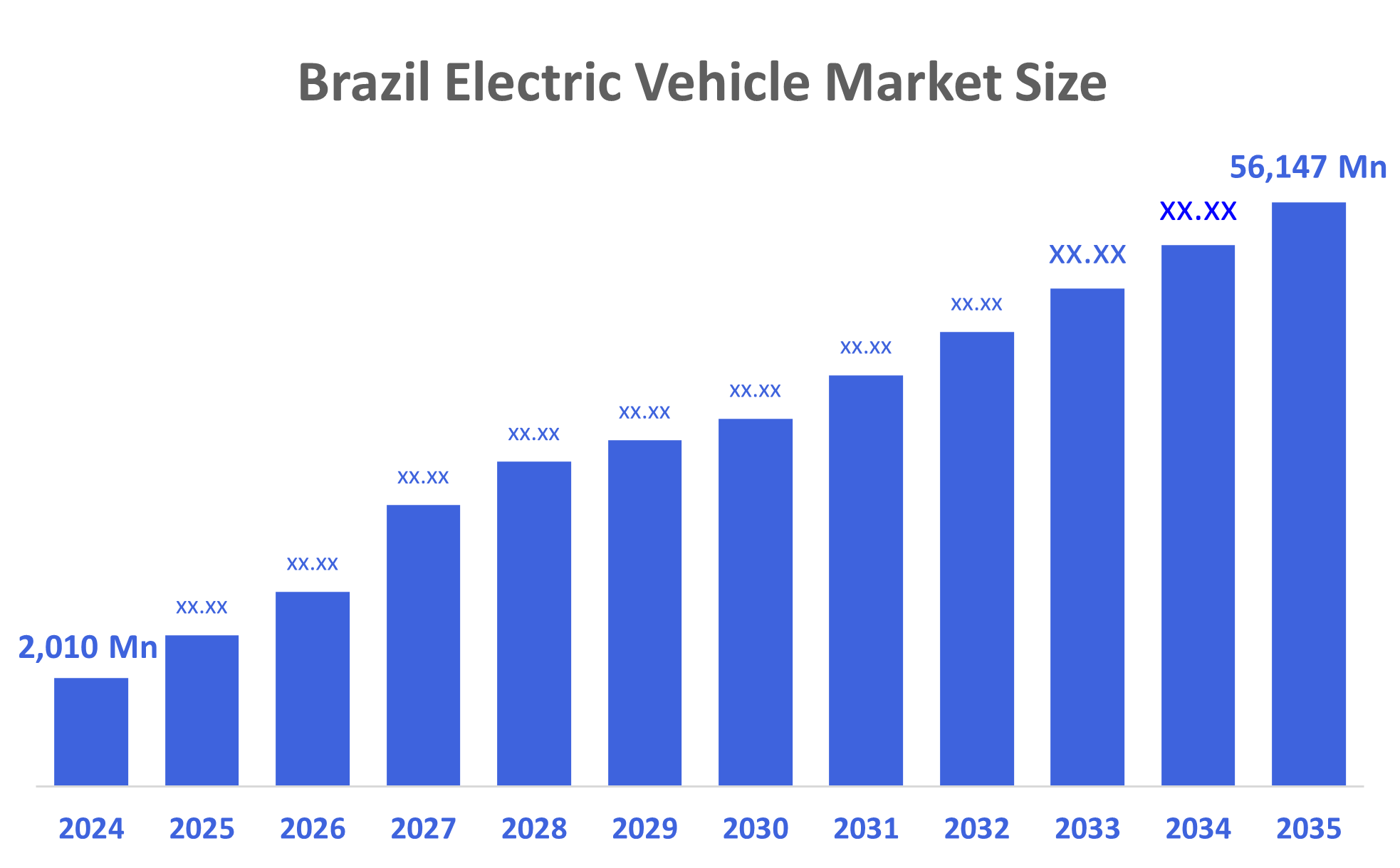

- The Brazil Electric Vehicle Market Size Was Estimated at USD 2,010 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 43% from 2025 to 2035

- The Brazil Electric Vehicle Market Size is Expected to Reach USD 56,147 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Electric Vehicle Market Size is Anticipated to Reach USD 56,147 Million by 2035, Growing at a CAGR of 43% from 2025 to 2035. The electric vehicle industry is expected to be driven by an increase in demand for safe, environmentally friendly, and fuel-efficient motor vehicles. Electric or hybrid electric vehicles are designed to reduce reliance on fossil fuels and reduce carbon footprint. Participants in the market are currently focusing their efforts on developing extremely precise electric vehicles that are unaffected by various types of road/terrain and environmental fluctuations.

Market Overview

The electric vehicle is powered by electricity. Electric vehicles are powered by an electric motor. It necessitates a continuous supply of energy from the batteries. In electric vehicles, various types of batteries are used. These include zinc-air batteries, molten salt batteries, lithium-ion batteries, and nickel-based batteries. The primary reason for producing electric vehicles was to reduce pollution. It has gained traction as a result of various technological advancements. It outperforms conventional vehicles due to higher fuel economy, minimal repairs, charging convenience, and smoother driving.

The negative ecological effects of conventional petrol vehicles, as well as the increase in the cost of fuel, have paved the way for the market adoption of alternative fuel vehicles. Buyers are gradually becoming more inclined to purchase battery-powered or hybrid vehicles, which are projected to propel the electric vehicle market. Propulsion is provided by one or more electric motors in all models. Electricity is the primary source of energy for EVs. They do not have an internal combustion engine. The strong demand for alternative fuel vehicles can be attributed to a rapid increase in the market's CAGR. Furthermore, the Brazilian government actively promotes electric vehicle (EV) adoption through tax incentives, reduced import duties, and subsidies for EV manufacturers. Policies include exemptions on federal taxes, support for charging infrastructure, and programs encouraging fleet electrification, aiming to reduce carbon emissions and foster sustainable mobility across urban and commercial transport sectors.

Report Coverage

This research report categorizes the market for the Brazil electric vehicle market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil electric vehicle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil electric vehicle market.

Driving Factors

The Brazil electric vehicle (EV) market is driven by growing environmental awareness and the government’s push for sustainable transportation. Rising fuel costs and urban air pollution encourage consumers to adopt EVs. Technological advancements in battery efficiency, longer driving ranges, and decreasing EV prices enhance affordability and convenience. Expanding charging infrastructure, coupled with incentives for manufacturers and buyers, further accelerates adoption. Additionally, corporate fleet electrification and increasing investment from global EV players contribute to market growth. Consumer preference for eco-friendly vehicles strengthens demand, positioning Brazil as a promising EV market in Latin America.

Restraining Factors

The Brazil electric vehicle market is restrained by high upfront costs, limited charging infrastructure, and long charging times. Dependence on imported components and fluctuating government incentives creates uncertainty. Low consumer awareness and insufficient battery recycling facilities further hinder adoption, while technological challenges in extreme climates slow market growth despite rising environmental concerns and supportive policies.

Market Segmentation

The Brazil electric vehicle market share is categorized by vehicle type, propulsion type, and component.

- The passenger cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil electric vehicle market is segmented by vehicle type into passenger cars and commercial vehicles. Among these, the passenger cars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising urbanization and increasing environmental awareness among individual consumers. Government incentives, such as tax reductions and subsidies, mainly target private buyers, making EVs more affordable. Improved battery technology and longer driving ranges suit daily commuting needs. In contrast, commercial vehicles face higher costs, slower fleet electrification, and limited charging infrastructure, restricting their market share. Urban lifestyle trends and personal mobility preferences continue to fuel the preference for passenger electric vehicles over commercial ones.

- The battery electric vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil electric vehicle market is segmented by propulsion type into battery electric vehicles (BEV) and hybrid electric vehicles. Among these, the battery electric vehicles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to increasing environmental concerns and government policies favoring zero-emission transportation. BEVs offer complete electrification, lower operating costs, and reduced dependence on fossil fuels, appealing to eco-conscious consumers. The expansion of charging infrastructure and the availability of diverse BEV models for urban commuting further boost adoption. While hybrid electric vehicles (HEVs) provide fuel efficiency, they still rely partially on gasoline, limiting their environmental advantage. Strong incentives, technological advancements, and growing consumer awareness collectively make BEVs the preferred propulsion type in Brazil’s EV market.

- The battery pack & high voltage component segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil electric vehicle market is segmented by component into battery pack & high voltage component, motor, brake, wheel & suspension, body & chassis, and low voltage electric component. Among these, the battery pack & high voltage component segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to its central role in vehicle performance, driving range, and efficiency. As EV adoption rises, demand for advanced lithium-ion and high-capacity batteries increases, making this segment the most valuable. Government incentives and investments in battery technology further boost growth. While motors, brakes, and chassis are necessary, their costs and market impact are comparatively lower. The battery system’s critical influence on overall EV functionality, lifespan, and consumer preference positions it as the leading component segment in Brazil.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil electric vehicle market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BYD Brasil

- GWM Brasil (Great Wall Motor)

- Renault do Brasil

- Nissan do Brasil

- Volvo Car Brasil

- WEG

- ZF Friedrichshafen AG

- Siemens Brazil

- Robert Bosch GmbH

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News

July 2025: Geely Auto launched its first electric vehicle, the Geely EX5, in Brazil, marking a significant milestone in the country's electric vehicle market. The launch emphasized advanced technology, energy efficiency, and design, driving greater adoption of electric vehicles and enhancing market competition.

July 2025: BYD launched its first 100% electric vehicle, the Dolphin Mini, from its new factory in Camaçari, Brazil. This move marked a key development in Brazil’s EV market, enhancing local production capacity, creating thousands of jobs, and strengthening BYD’s leadership in the region's sustainable mobility sector.

May 2025: GAC launched five electric and hybrid vehicle models in Brazil, including the Aion V and Aion Y. With 33 dealerships established, GAC plans to begin local production by 2026, investing USD 6 Billion. This move intensifies competition and accelerates the growth of Brazil's EV market.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil electric vehicle market based on the below-mentioned segments:

Brazil Electric Vehicle Market, By Vehicle Type

- Passenger Car

- Commercial Vehicle

Brazil Electric Vehicle Market, By Propulsion Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

Brazil Electric Vehicle Market, By Component

- Battery Pack & High Voltage Component

- Motor

- Brake

- Wheel & Suspension

- Body & Chassis

- Low Voltage Electric Component

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |