Brazil Endoscopy Devices Market

Brazil Endoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Endoscopes, Endoscopic Operative Device, and Visualization Equipment), By Application (Gastroenterology, Pulmonology, Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, Neurology, and Other), and Brazil Endoscopy Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Endoscopy Devices Market Insights Forecasts to 2035

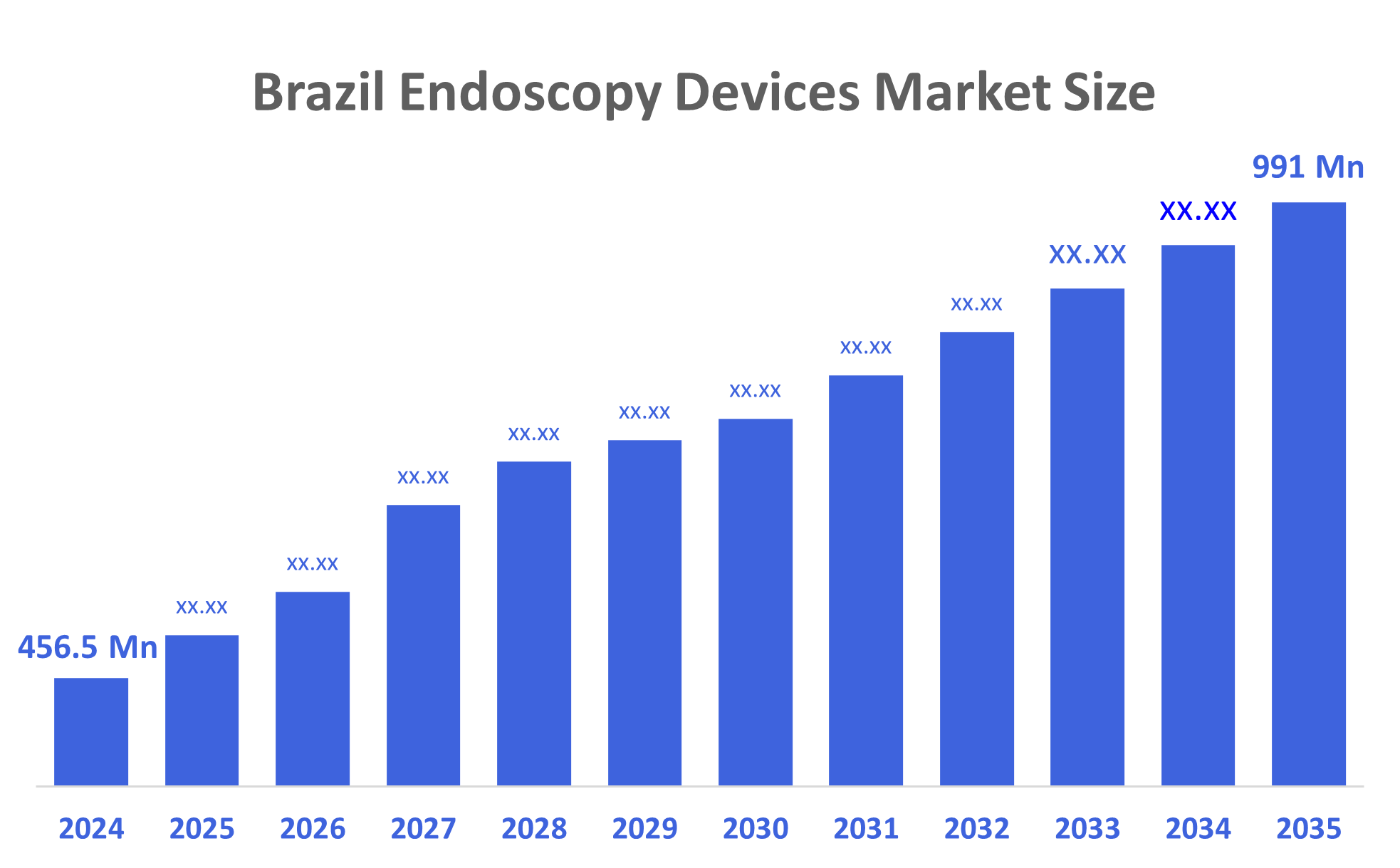

- The Brazil Endoscopy Devices Market Size Was Estimated at USD 456.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.3% from 2025 to 2035

- The Brazil Endoscopy Devices Market Size is Expected to Reach USD 991 Million by 2035

According to a research report published by Decisions Advisors, The Brazil Endoscopy Devices Market Size is Anticipated to Reach USD 991 Million by 2035, Growing at a CAGR of 7.3% from 2025 to 2035. Endoscopic equipment is less invasive, and post- and pre-procedure costs are low. These are the main reasons why the market is expected to grow during the forecast period. Over time, the market is also expected to grow faster as the trend moves toward using disposable endoscopic parts to lower the cost of the operation and the risk of cross-contamination. This is likely to be a major factor in the growth of the market.

Market Overview

Endoscopy is a type of medical equipment that allows doctors to see how the organs inside the body are constructed and how they function. An endoscopic device typically features a rigid or flexible tube, a light system, a lens, an eyepiece, a camera, and a channel that accommodates other medical tools. The less invasive properties and affordable post- and pre-procedure cost of endoscopy devices are the major factors anticipated to boost the market growth over the forecast period. Furthermore, a shift in trend to use disposable endoscopic components to minimize the procedure cost and the chance of cross-contamination is also expected to accelerate market growth over the years. Minimally invasive surgeries are economically viable alternatives to open surgeries and result in reduced risk of postoperative complications, shorter hospital stay and recovery time, and decreased blood loss during surgeries.

Technological advancements in minimally invasive surgeries are expected to drive the demand for endoscopy procedures further. The development of capsule endoscopes and robot-assisted endoscopy has increased the demand for minimally invasive endoscopic surgeries. Technological advancements in minimally invasive surgeries and the introduction of new products, mainly endoscopic visualization systems, in the market, are expected to propel market growth. Furthermore, the growing number of healthcare centers, such as hospitals, oncology specialty clinics, and cancer centers, is increasing the need for endoscopy devices. Furthermore, according to the National Institute of Cancer, Brazil, the country is estimated to register 704,000 cancer cases from 2023 to 2025. The “see-and-treat" TRUCLEAR hysteroscope by Smith & Nephew exemplifies a vital technological advancement in this market,

Report Coverage

This research report categorizes the market for the Brazil endoscopy devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil endoscopy devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil endoscopy devices market.

Driving Factors

The Brazil endoscopy devices market is driven by the rising prevalence of gastrointestinal disorders, colorectal cancer, and other chronic diseases that increase demand for diagnostic and therapeutic procedures. Growing preference for minimally invasive surgeries, supported by technological advancements such as HD imaging, flexible scopes, and AI-assisted detection, further boosts adoption. Expanding healthcare infrastructure, higher procedure volumes, and increased investments by public and private hospitals accelerate equipment purchases. Additionally, greater focus on infection control and the availability of advanced devices from global manufacturers strengthen overall market growth.

Restraining Factors

The Brazil endoscopy devices market faces restraints such as high equipment costs, limited access in rural regions, and budget constraints in public hospitals. Complex regulatory approvals, shortage of trained endoscopists, and concerns over reprocessing standards also hinder adoption. Additionally, economic instability can delay capital investments and slow market expansion.

Market Segmentation

The Brazil endoscopy devices market share is categorized by device type and application.

- The endoscopes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil endoscopy devices market is segmented by device type into endoscopes, endoscopic operative devices, and visualization equipment. Among these, the endoscopes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by they are the primary and most frequently used tools in all endoscopic procedures, across specialties such as gastroenterology, pulmonology, urology, and gynecology. Their high utilization rate, need for multiple units per facility, and regular replacement cycles drive substantial demand. Growing adoption of advanced, flexible, HD, and disposable endoscopes further boosts market share. Additionally, rising GI disease prevalence and increasing screening programs significantly increase procedure volumes, making endoscopes the essential equipment investment for hospitals and diagnostic centers, thereby ensuring their continued market dominance.

- The gastroenterology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil endoscopy devices market is segmented by application into gastroenterology, pulmonology, orthopedic surgery, cardiology, ENT surgery, gynecology, neurology, and other. Among these, the gastroenterology segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the high prevalence of gastrointestinal disorders, including colorectal cancer, gastritis, ulcers, and inflammatory bowel diseases, which drive the largest number of endoscopic procedures. Routine colonoscopies and gastroscopies, along with growing nationwide screening initiatives, further boost demand. Hospitals require multiple specialized GI scopes and frequent upgrades, increasing purchasing volume. Additionally, strong clinical focus on early detection and minimally invasive GI treatments reinforces gastroenterology as the leading application segment compared to pulmonology, cardiology, ENT, and other specialties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil endoscopy devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olympus Corporation

- Karl Storz SE & Co. KG

- Fujifilm Holdings Corporation

- Boston Scientific Corporation

- Medtronic plc

- Stryker Corporation

- Johnson & Johnson (Ethicon)

- Conmed Corporation

- Cook Medical Inc.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Allurion, the world’s first gastric balloon, received approval to launch in Brazil. Through recent launches in Australia, Canada, Mexico, India, and Brazil, the company has nearly doubled its global presence with the aim of bringing cutting-edge technology for efficient GI care.

- In April 2021, Smith & Nephew announced the launch of enabling technology for INTELLO Connected Tower Solution with the introduction of 4KO Arthroscopes and Laparoscopes DOUBLEFLO Inflow/Outflow Pump, which will help surgeons meet the diverse needs of the patient.

- In November 2020, Stryker completed the acquisition of Wright Medical, giving it opportunities to explore in trauma and extremities care and biologics with a complementary product portfolio and customer base.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil endoscopy devices market based on the below-mentioned segments:

Brazil Endoscopy Devices Market, By Device Type

- Endoscopes

- Endoscopic Operative Device

- Visualization Equipment

Brazil Endoscopy Devices Market, By Application

- Gastroenterology

- Pulmonology

- Orthopedic Surgery

- Cardiology

- ENT Surgery

- Gynecology

- Neurology

- Other

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |