Brazil Facility Management Market

Brazil Facility Management Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Hard Services and Soft Services), By Offering Type (In-House and Outsourced), By End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, and Other), and Brazil Facility Management Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Facility Management Market Insights Forecasts to 2035

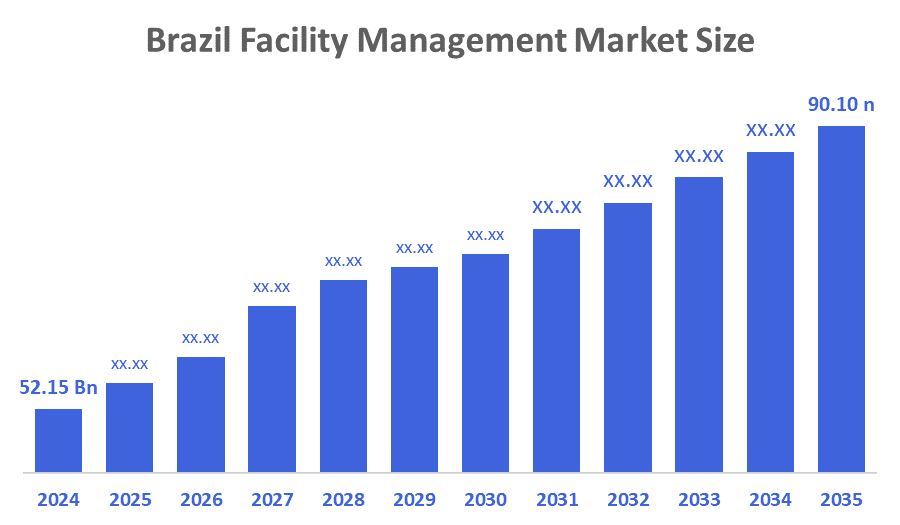

- The Brazil Facility Management Market Size Was Estimated at USD 52.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Brazil Facility Management Market Size is Expected to Reach USD 90.10 Billion by 2035

According to a research report published by Decision Advisior & Consulting, the Brazil Facility Management Market size is anticipated to reach USD 90.11 Billion by 2035, growing at a CAGR of 5.1% from 2025 to 2035. The Brazil facility management market is driven by increasing demand for outsourced services, rising commercial and industrial infrastructure, focus on operational efficiency, cost reduction, sustainable practices, technological advancements, and the growing need for maintenance, security, and integrated facility solutions.

Market Overview

The practice of facility management involves overseeing an organization’s physical assets, infrastructure, and services in a professional capacity. It supports an organization’s ability to operate and maintain efficient, safe, and comfortable buildings/workplaces, while at the same time integrating the organization’s people, processes, and technology to support its objectives, as well as improve the organization’s productivity and sustainability. In addition, the increasing number of companies and municipalities seeking to find new ways to manage their physical space is driving the growth in this industry. Likewise, businesses are increasingly outsourcing their facility management services to concentrate on their core business. Finally, advances in technology and sustainability will play a large role in the future of facility management. With the combination of smart buildings, IoT, and AI technologies, predictive maintenance, energy efficiency, and real-time visibility will allow for more proactive facility maintenance and more sustainable operation of facility systems. As the delivery of facility management services is transformed through these technologies, facility managers will emphasize green business practices, renewable energy sources, and the adaptability of facility systems to accommodate hybrid work environments, so that their facilities will have a strong ability to adapt and provide value in a changing market.

The policies established by the Brazilian government in the Field of Facility Management may address sustainable development, workplace safety, and efficiency. The types of Regulation may include setting a Minimum standard of Maintenance for Buildings, Energy consumption, and Safety at the Workplace. The Federal government's initiatives may provide Incentives to companies Developing Environmental Sustainability practices in the facilities management Field in order for them to align with the larger objectives of the country as a whole. An example of the Brazilian Government Initiatives: In May 2022, the Brazilian Commercial Real Estate Services Firm BRX was acquired by JLL, an International Leader in the facility management Field. JLL will now be Providing Facility Management Services to a wider Variety of Clients and More Comprehensive Support in Brazil Through This Acquisition.

Report Coverage

This research report categorizes the market for the Brazil facility management market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil facility management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil facility management market.

Driving Factors

The Brazil facility management market is driven by rapid urbanization, increasing commercial and industrial infrastructure, and the growing trend of outsourcing non-core activities. Rising focus on operational efficiency, cost optimization, and energy management encourages adoption. Additionally, technological advancements, such as IoT and smart building solutions, along with stricter regulatory compliance and sustainability initiatives, propel demand. The need for integrated services, including maintenance, security, and cleaning, further strengthens market growth.

Restraining Factors

he Brazil facility management market faces restraints due to high initial investment costs, limited awareness of advanced FM solutions among small and medium enterprises, and resistance to outsourcing core operations. Additionally, a shortage of skilled professionals and economic fluctuations can hinder market adoption and slow overall growth.

Market Segmentation

The Brazil facility management market share is categorized by service type, offering type, and end user industry.

- The soft services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil facility management market is segmented by service type into hard services and soft services. Among these, the soft services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their recurring and essential nature across various sectors, including commercial, industrial, and residential. Businesses increasingly outsource non-core activities like cleaning, security, landscaping, and waste management to focus on core operations. Additionally, rising awareness of hygiene, safety, and employee well-being, coupled with cost-efficiency and the flexibility of outsourced services, further drives the demand for soft services.

- The outsourced segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil facility management market is segmented by offering type into in-house and outsourced. Among these, the outsourced segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to organizations’ need to reduce operational costs and enhance efficiency. Outsourcing allows access to specialized expertise, advanced technologies, and integrated solutions that in-house teams may lack. It provides flexibility and scalability to adjust services based on demand, ensuring optimal resource utilization. Additionally, companies can focus on core business functions while professional service providers handle maintenance, security, cleaning, and other non-core facility operations, boosting overall productivity.

- The commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil facility management market is segmented by end user industry into commercial, hospitality, institutional and public infrastructure, healthcare, industrial and process, and other. Among these, the commercial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the high concentration of office buildings, retail centers, and business complexes requiring continuous support for maintenance, cleaning, security, and energy management. Businesses prioritize creating safe, efficient, and comfortable environments for employees and customers, driving demand for professional FM services. Additionally, the growing trend of outsourcing non-core activities, focus on operational efficiency, and the expansion of commercial infrastructure across urban areas further reinforce the adoption of facility management solutions in this sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil facility management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sodexo S.A.

- ISS Facility Services

- Compass Group PLC

- JLL (Jones Lang LaSalle)

- ABM Industries Inc.

- CBRE Group, Inc.

- Grupo Águia

- Atento Facility Services

- Engie Brasil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In July 2025, Addnode Group announced the acquisition of FF Solutions in Brazil, expanding its digital solutions footprint supporting asset and facilities lifecycle workflows in the country.

In August 2024, LATAM Airlines announced plans to invest USD 2 billion in Brazil over the next two years, focusing on enhancing products, technologies, and passenger services, as well as aircraft maintenance. The investment aims to leverage the potential of its São Carlos facility in São Paulo, the largest aircraft maintenance center in South America, to transform it into a prominent Brazilian aerospace hub.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil facility management market based on the below-mentioned segments:

Brazil Facility Management Market, By Service Type

- Hard Services

- Soft Services

Brazil Facility Management Market, By Offering Type

- In-House

- Outsourced

Offering Type (In-House and Outsourced, By End-User Industry

- Commercial

- Hospitality

- Institutional and Public Infrastructure

- Healthcare

- Industrial and Process

- Other

FAQ’s

Q1: What is facility management?

- Facility management is the professional practice of managing and maintaining an organization’s physical assets, infrastructure, and services to ensure operational efficiency, safety, and comfort.

Q2: What are the main service types in the Brazil facility management market?

- The market is segmented into hard services (maintenance, repair, technical services) and soft services (cleaning, security, landscaping, catering).

Q3: Which service type dominates the market?

- Soft services dominate due to their recurring demand across commercial, industrial, and residential sectors.

Q4: What are the market offerings?

- Facility management services are offered as in-house or outsourced solutions.

Q5: Which offering type is more popular?

- Outsourced services dominate, as companies prefer professional expertise, cost efficiency, and scalability.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 222 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |