Brazil Factory Automation and Industrial Controls Market

Brazil Factory Automation and Industrial Controls Market Size, Share, and COVID-19 Impact Analysis, By Product (Field Devices and Industrial Control Systems), By End-User Industry (Automotive, Chemical and Petrochemical, Power and Utilities, Pharmaceutical, & Other), By Component (Hardware, Software, Services), and Brazil Factory Automation and Industrial Controls Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Factory Automation and Industrial Controls Market Insights Forecasts to 2035

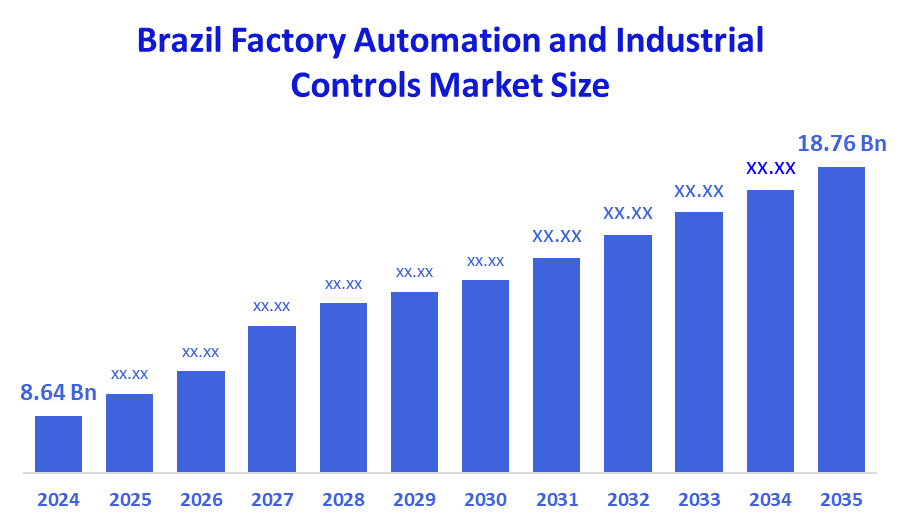

- The Brazil Factory Automation and Industrial Controls Market Size Was Estimated at USD 8.64 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.3% from 2025 to 2035

- The Brazil Factory Automation and Industrial Controls Market Size is Expected to Reach USD 18.76 Billion by 2035

According To A Research Report Published By Decision Advisors, The Brazil Factory Automation And Industrial Controls Market Size Is Anticipated To Reach USD 18.76 Billion By 2035, Growing At A CAGR Of 7.3% From 2025 To 2035. The Brazil Factory Automation And Industrial Controls Market Is Driven By Rising Industrial Digitization, Adoption Of Smart Manufacturing, Government Support For Automation, Demand For Efficiency And Productivity, Integration Of Iot And AI, And The Need To Reduce Operational Costs.

Market Overview

The Brazil factory automation and industrial controls market involves the use of advanced technologies, software, and control systems to automate manufacturing processes, improve efficiency, and ensure consistent quality. It includes robotics, sensors, programmable logic controllers (PLCs), and industrial software, helping industries reduce manual labor, optimize production, enhance safety, and support smart manufacturing initiatives across various sectors. Furthermore, the growth of the market is driven by increasing industrial digitization, adoption of smart manufacturing, rising demand for operational efficiency, integration of IoT and AI, government support, and the need to reduce production costs.

Governments in Brazil are investing in smart industrial parks, automation training programs, and digital manufacturing incentives to boost industrial competitiveness. These initiatives promote the adoption of robotics, AI-based automation, and IoT-enabled control systems across factory floors. Public-private partnerships are helping accelerate modernization across automotive, electronics, chemicals, and heavy industries. Such policy support is fostering a favorable environment for automation vendors and manufacturing enterprises. Government involvement remains a strong catalyst for large-scale automation adoption.

The Brazil factory automation and industrial controls market is shaped by several key trends. Rapid manufacturing modernization drives automation adoption, especially in automotive, food & beverage, and pharmaceutical industries. Government initiatives and tax incentives encourage investment in advanced technologies. Sustainable manufacturing practices promote energy efficiency and waste reduction. IIoT and digital twin technologies enable real-time monitoring, simulation, and optimization. Collaborative robots (cobots) and AI/ML integration enhance precision, productivity, and decision-making. High labor costs and global competition further accelerate automation adoption, supporting overall market growth and technological advancement.

Report Coverage

This research report categorizes the market for the Brazil factory automation and industrial controls market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil factory automation and industrial controls market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil factory automation and industrial controls market.

Driving Factors

The Brazil factory automation and industrial controls market is driven by rapid industrial modernization and increasing adoption of automation across automotive, food & beverage, and pharmaceutical industries. Government initiatives, supportive policies, and tax incentives encourage investment in advanced technologies. Rising labor costs and the need for precision and efficiency make automation attractive. Integration of IIoT, digital twin technologies, and AI/ML-enabled control systems improves monitoring, decision-making, and productivity. Additionally, global competition and the focus on sustainable, energy-efficient manufacturing practices are further accelerating market growth.

Restraining Factors

The Brazil factory automation and industrial controls market faces restraints such as high initial investment and implementation costs, which can limit adoption among small and medium enterprises. Lack of skilled workforce to operate advanced systems, integration challenges with existing infrastructure, and cybersecurity concerns also hinder market growth. Additionally, economic fluctuations and budget constraints in certain industries may delay automation investments, restraining overall market expansion.

Market Segmentation

The Brazil factory automation and industrial controls market share is classified into product, end user industry, and component.

- The industrial control systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil factory automation and industrial controls market is segmented by product into field devices and industrial control systems. Among these, the industrial control systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The industrial control systems segment dominates the market because these systems, including PLCs, DCS, and SCADA, are essential for managing and automating complex manufacturing processes. They help industries improve operational efficiency, maintain consistent product quality, reduce labor costs, and enable real-time monitoring and control. While field devices like sensors and actuators support these systems, the core value and large-scale adoption come from industrial control systems, making them the primary driver of market growth across automotive, food & beverage, and pharmaceutical sectors.

- The automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil factory automation and industrial controls market is segmented by end user industry into automotive, chemical and petrochemical, power and utilities, pharmaceutical, & other. Among these, the automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The automotive industry dominates the market due to its high demand for efficiency, precision, and consistent product quality in complex manufacturing processes. Automotive manufacturers heavily invest in advanced automation technologies, including industrial control systems, robotics, and IIoT solutions, to optimize assembly lines and reduce production costs. Compared to other industries like pharmaceuticals or power, the automotive sector’s scale, competitive pressure, and continuous need for faster, more reliable production make it the largest and most influential end-user segment in the market.

- The hardware segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil factory automation and industrial controls market is segmented by component into hardware, software, and services. Among these, the hardware segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hardware segment dominates the market because physical components like sensors, actuators, controllers, and industrial machinery are essential for implementing and operating automated systems. These components form the foundation of industrial processes, enabling precise control, monitoring, and productivity across automotive, pharmaceutical, food & beverage, and other industries. While software and services support optimization and analytics, the large-scale deployment, maintenance, and replacement of hardware drives higher market demand and revenue, making it the leading segment in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil factory automation and industrial controls market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Rockwell Automation, Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Omron Corporation

- Yokogawa Electric Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In May 2025, Taunos launched the GTK?50 high-performance CNC lathe for Industry?4.0, improving precision machining and smart manufacturing capabilities, showcased at Intermach?2025, attracting industrial automation stakeholders.

In October 2025, Schneider Electric launched Modicon Edge I/O NTS, Altivar Process ATV6100, and ATS490 Soft Starter at ENA?2025, boosting industrial control, energy efficiency, and automated process management in Brazilian factories.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Brazil factory automation and industrial controls market based on the below-mentioned segments:

Brazil Factory Automation and Industrial Controls Market, By Product

- Field Devices

- Industrial Control Systems

Brazil Factory Automation and Industrial Controls Market, By End-User Industry

- Automotive

- Chemical and Petrochemical

- Power and Utilities

- Pharmaceutical

- Other

Brazil Factory Automation and Industrial Controls Market, By Component

- Hardware

- Software

- Services

FAQ’s

Q1: What is the Brazil factory automation and industrial controls market?

It refers to the use of technologies, hardware, software, and control systems to automate industrial processes, improve efficiency, and enhance productivity across various sectors in Brazil.

Q2: What are the key driving factors in the Brazil factory automation and industrial controls market?

Rapid manufacturing modernization, adoption in automotive and pharmaceutical industries, government initiatives, IIoT integration, AI/ML applications, and rising labor costs drive market growth.

Q3: Which segment dominates the Brazil factory automation and industrial controls market by product?

Industrial control systems, including PLCs, DCS, and SCADA systems, dominate due to their critical role in automating complex processes.

Q4: Who are the major players in the Brazil factory automation and industrial controls market?

Key companies include Siemens, ABB, Schneider Electric, Rockwell Automation, Honeywell, Emerson, Mitsubishi Electric, Omron, Yokogawa, and Eaton.

Q5: What are the key trends in the Brazil factory automation and industrial controls market?

Trends include the adoption of IIoT, digital twins, collaborative robots (cobots), sustainable practices, AI/ML integration, and increased investment in smart manufacturing technologies.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |