Brazil Ferritin Testing Market

Brazil Ferritin Testing Market Size, Share, By Product (Instrument, Reagent, and Kits), By End Use (Hospitals and Diagnostic Laboratories), Brazil Ferritin Testing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Ferritin Testing Market Insights Forecasts to 2035

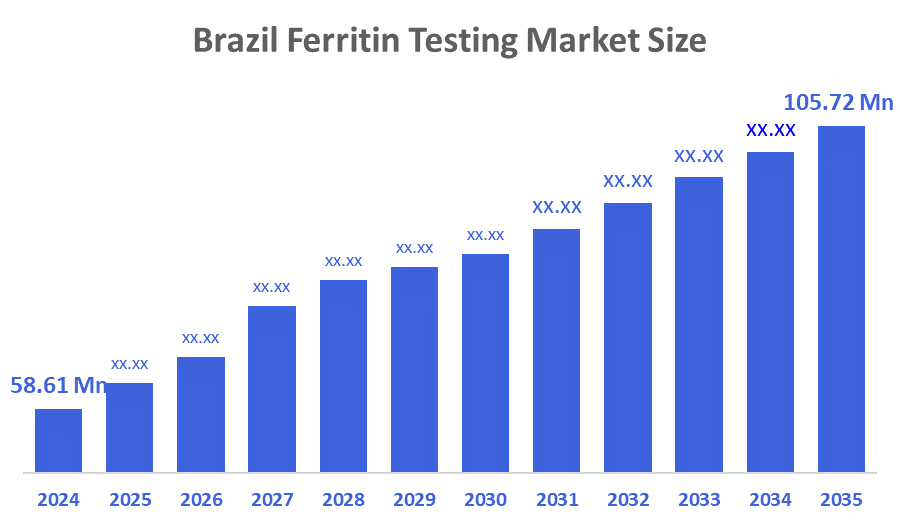

- Brazil Ferritin Testing Market Size 2024: USD 58.61 Million

- Brazil Ferritin Testing Market Size 2035: USD 105.72 Million

- Brazil Ferritin Testing Market CAGR 2024: 5.51%

- Brazil Ferritin Testing Market Segments: Product and End Use

The Market For Ferritin Testing In Brazil Consists Of Diagnostic Tests That Determine The Ferritin Levels In The Blood, And The Results Are Used For Diagnosing Iron Deficiency, Anaemia, Iron Overload, And Their Associated Disorders In Hospitals, Laboratories, And Clinics.

In Brazil, the leading suppliers of diagnostic tests have among their contributions the expansion of ferritin assays and the calibration of reagents for iron panels, which have led to the improvement of laboratory workflow and practices of interpretation.

The Brazilian government backs ferritin testing and its correlated iron-deficiency diagnosis via public health measures within the Sistema Unico de Saude (SUS), for instance, through national iron supplementation and anaemia prevention programs, prenatal care with iron monitoring, and food fortification policies to eliminate iron deficiency. The aforementioned initiatives are directed towards the amelioration of early detection and management of anaemia, wherein ferritin measurement is done at the primary care level most often.

Future opportunities exist in Brazil in the establishment of point-of-care ferritin testing, greater outreach of preventive screening programs, and the increase in demand for maternal, paediatric, and geriatric anaemia diagnostics.

Market Dynamics of the Brazil Ferritin Testing Market:

The Brazil ferritin testing market is driven by the increasing incidence of iron deficiency anaemia, raising awareness of early disease detection, a larger elderly population, and a higher frequency of routine health check-ups. Moreover, the widening of diagnostic laboratory networks, the availability of healthcare services, and the increasing number of chronic diseases like kidney disorders and cancer are among the factors that positively affect the demand for ferritin testing.

The Brazil ferritin testing market is restrained by the high costs of testing for the poor, uneducated people with iron-related disorders, and reimbursement issues are some of the things that hinder the Brazilian Ferritin Testing market. To add to the problems, the lack of skilled laboratory professionals is also a major reason for the low uptake of ferritin testing.

The future of Brazil ferritin testing market is bright and promising, with the adoption of preventive healthcare, the expansion of the diagnostic infrastructure, the rise in the awareness of anaemia management, the technological advancements in immunoassays, and the increasing government emphasis on early disease detection and public health screening programs.

Market Segmentation

The Brazil Ferritin Testing Market share is classified into product and end use.

By Product:

The Brazil ferritin testing market is divided by product into instrument, reagent, and kits. Among these, the reagent segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The main reason for the dominance of reagents is that they are consumable, have to be changed frequently, and are necessary for every ferritin test, which in turn leads to hospitals, diagnostic labs, and routine health screenings in Brazil that are always in need of them.

By End Use:

The Brazil ferritin testing market is divided by end use into hospitals and diagnostic laboratories. Among these, the hospitals segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of the larger number of patients coming in, the regular health check-ups, the inpatient monitoring and the full diagnostic services that are offered compared to the vendor-specific labs.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil ferritin testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Ferritin Testing Market:

- Diagnosticos da America (DASA),

- Group Fleury,

- Labtest Diagnostica,

- Serve Medical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Ferritin Testing market based on the below-mentioned segments:

Brazil Ferritin Testing Market, By Product

- Instrument

- Reagent

- Kits

Brazil Ferritin Testing Market, By End Use

- Hospitals

- Diagnostic Laboratories

FAQ

Q: What is the Brazil ferritin testing market size?

A: Brazil ferritin testing market is expected to grow from USD 58.61 million in 2024 to USD 105.72 million by 2035, growing at a CAGR of 5.51% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increasing incidence of iron deficiency anaemia, raising awareness of early disease detection, a larger elderly population, and a higher frequency of routine health check-ups. Moreover, the widening of diagnostic laboratory networks, the availability of healthcare services, and the increasing number of chronic diseases like kidney disorders and cancer are among the factors that positively affect the demand for ferritin testing.

Q: What factors restrain the Brazil ferritin testing market?

A: Constraints include the high costs of testing for the poor, uneducated people with iron-related disorders, and reimbursement issues are some of the things that hinder the Brazilian Ferritin Testing market. To add to the problems, the lack of skilled laboratory professionals is also a major reason for the low uptake of ferritin testing.

Q: How is the market segmented by product?

A: The market is segmented into instrument, reagent, and kits.

Q: Who are the key players in the Brazil ferritin testing market?

A: Key companies include Diagnosticos da America (DASA), Grupo Fleury, Labtest Diagnostica, Serve Medical and others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |