Brazil Fertilizer Market

Brazil Fertilizer Market Size, Share, and COVID-19 Impact Analysis, By Type (Complex and Straight), By Form (Conventional and Specialty), and Brazil Fertilizer Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Fertilizer Market Insights Forecasts to 2035

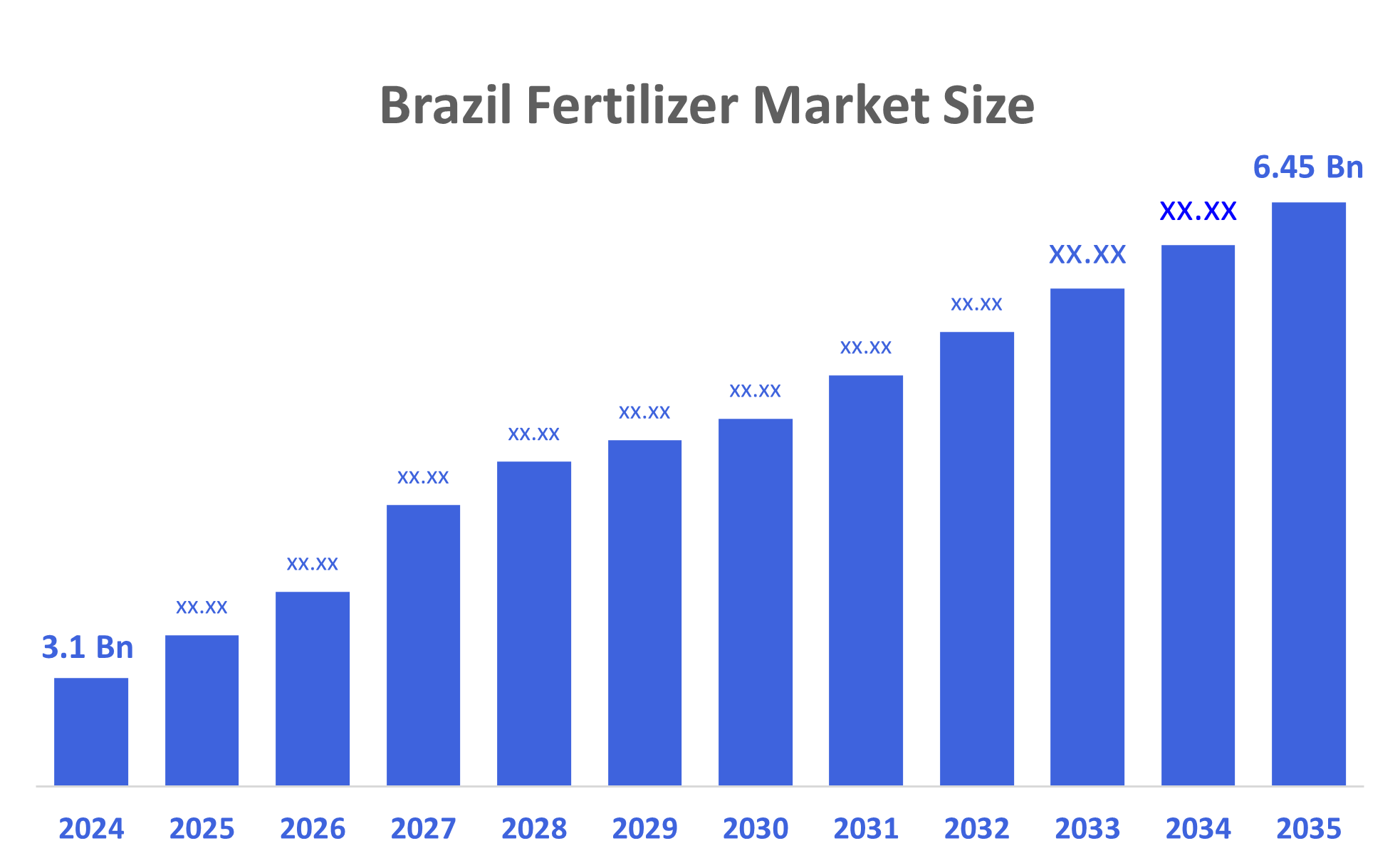

- The Brazil Fertilizer Market Size was estimated at USD 3.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.89 % from 2025 to 2035

- The Brazil Fertilizer Market Size is Expected to Reach USD 6.45 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Fertilizer Market Size is Anticipated to Reach USD 6.45 Billion by 2035, Growing at a CAGR of 6.89% from 2025 to 2035. The Brazil fertilizer market is driven by increasing usage of controlled-release and water-soluble fertilizers that provide better efficiency is another driver for increased fertilizers programs available due to developed infrastructure and fertigation released fertilizer nutrients.

Market Overview

The fertilizer market focuses on the manufacturing, distribution, and sale of products that provide food to sustain plant growth. Brazil’s agricultural sector becomes larger and more productive, it is essential that fertilizer usage increases to enable Brazilian farmers to maximise their potential for producing food on arable land, which will keep the country competitive globally. The Brazilian government has been proactive in promoting the growth and development of its domestic fertilizer industry through initiatives such as the creation of a National Fertilizer Plan. This national strategy aims to decrease Brazil's dependence on imports of fertilizers by increasing domestic production, new product development, and innovation. Additionally, the National Fertilizer Plan provides incentives for both public and private sector engagement in the development of fertilizer production capabilities with the intent of creating an environment conducive to growth.

Report Coverage

This research report categorizes the market for the Brazil fertilizer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil fertilizer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil fertilizer market.

Driving Factors

The Brazil fertilizers market is primarily driven by the growing agricultural production within this market. The most impactful products here are soybeans, corn, and sugarcane. All three of these products require large amounts of nutrient inputs to be successful. Agricultural production growth combined with increased focus on yield intensification, soil fertility management, and the use of precision-farming techniques has contributed to an increase in the use of Fertilizers. There has also been a significant increase in the use of specialty and bio fertilizers. In addition, existing government programs are contributing to higher consumption of fertilizer to support both domestic agriculture and Brazil’s position as a global supplier of food products to other countries.

Restraining Factors

The restraining factors of the market are Brazil's dependence on imported raw materials, which leaves the market open to changes in the supply chain and currency exchange rates. Another major constraint is Brazil's high cost for fertilizers and limited access for farmers. In addition, environmental concerns about nutrient runoff and increasing pressure to reduce chemical fertilizer use create additional constraints on market expansion. Rural logistics and storage infrastructure are poorly developed in Brazil, creating issues with distribution and availability.

Market Segmentation

The Brazil fertilizers market share is classified into types and form.

- The straight segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil fertilizers market is segmented by types into complex and straight. Among these, the straight segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven due to farmers of large-scale crop operations in Brazil utilize straight fertilizer because of having the ability to have greater control over soil nutrient management. Nutrient requirements for large scale crops such as soybeans, corn and sugar cane at different growth stages are different so the ability to apply direct to crop their specific nutritional needs is a direct benefit of the use of straight fertilizer. Using straight fertilizers also helps to increase yield and reduce input costs. The government of Brazil has also promoted the use of straight fertilizers by offering subsidy programs and distribution networks. The simplicity of formulations and the proven effectiveness of the variability of agro-climatic zones in Brazil have contributed to the continued dominance of straight fertilizers as the fertilizer of choice for commercial farmers and cooperatives in Brazil.

- The conventional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil fertilizers market is segmented by form into conventional and specialty. Among these, the conventional segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to conventional fertilizers, due to their low cost, relative accessibility, and high use in commercial agriculture, led the Brazilian fertilizer market in 2025. Urea and ammonium phosphates are very common in commercial agricultural practice for major crops grown in Brazil. The predictable nutrient release of these fertilizers, as well as the ability to use them in large-scale applications, complement Brazil’s extensive agricultural landscape. Use of conventional fertilizers allows farmers to satisfy all their immediate crop nutrient needs during each stage of the growing season, thus enabling a higher-yield crop. Additionally, the relatively small amount of domestic production in Brazil for other types of fertilizers continues to keep conventional fertilizer the preferred method of obtaining fertilizer. Furthermore, due to their relatively low cost and higher availability through importation and government procurement programs, the use of conventional fertilizers has increased significantly, becoming the leading force driving the growth of the Brazilian fertilizer market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil fertilizer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara Brasils S.A.

- Mosaic Fertilizantes do Brasil S.A.

- Agrichem do Brasil S.A.

- Biotrop

- Agrocete

- Adubasul Fertilizantes

- Others

Recent Developments:

- In June 2025: Brazilian agricultural business Wirstchat, which specializes in plant nutrition, announced the development of its first fertilizer production facility in Europe, cementing the company’s international expansion. The unit was planned to be situated in the Alentejo area of Portugal, in the city of Vendas Novas. The factory was set to be operated by Harvest Agro, the corporation's consumer-facing brand, and manufacturing was expected to begin by December 2026.

- In May 2025: International plant nutrition company Yara debuted YaraBasa TURBO, an innovative fertilizer that expanded its YaraBasa product range, at the 30th Agrishow in Sao Paulo, Brazil. The product was created and formulated to meet Brazilian crop and soil requirements.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil Fertilizer Market based on the below-mentioned segments:

Brazil Fertilizer Market, By Type

- Complex

- Straight

Brazil Fertilizer Market, By Form

- Conventional

- Specialty

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |