Brazil Fitness Equipment Market

Brazil Fitness Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Body Composition Analysers, Fitness Monitoring Equipment, Cardiovascular Training Equipment, Strength Training Equipment, and Others.), By Application (Mental Fitness, Physical Fitness, Weight Loss, Body Building, and Others), and Brazil Fitness Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Fitness Equipment Market Insights Forecasts to 2035

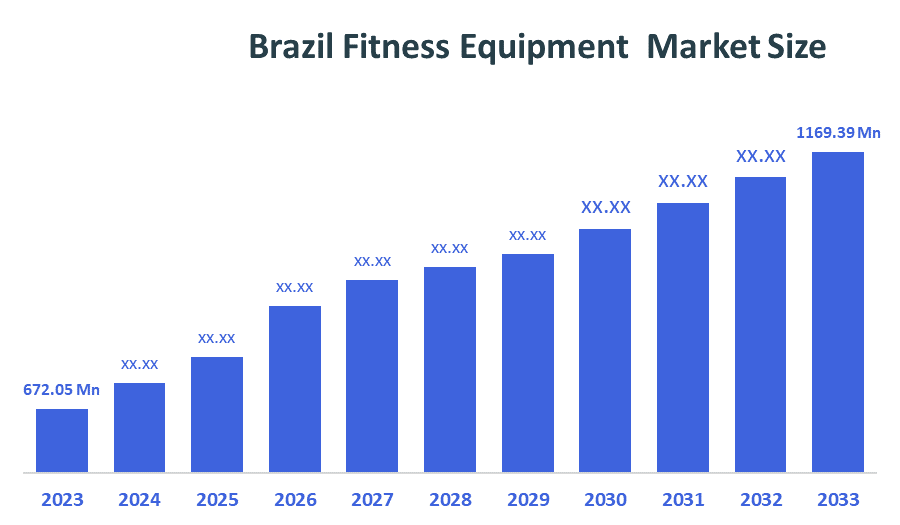

- The Brazil Fitness Equipment Market Size was estimated at USD 672.05 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.16% from 2025 to 2035

- The Brazil Fitness Equipment Market Size is Expected to Reach USD 1169.39 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the Brazil Fitness Equipment Market is anticipated to reach USD 1169.39 million by 2035, growing at a CAGR of 5.16% from 2025 to 2035. The Brazil fitness equipment market is driven by the growing number of gyms and fitness clubs investing in advanced equipment and recovery tools creates a broad range of opportunities. Increasing government interest in public health and sports facilities continues to fuel this growth as well as the continued growth of corporate wellness programs that encourage workers to be physically active.

Market Overview

The fitness equipment sector comprises businesses that manufacture, market, and distribute machines and tools designed specifically for exercise and physical fitness. Brazil’s fitness equipment market offers opportunities rise in popularity of home workout equipment, the digital fitness revolution, growth of gym chains and Fitness industry. Awareness and demand for smart connected equipment catering to the needs of personalized workouts, there is an opportunity to expand within the Brazilian fitness equipment market. The fitness equipment sector in Brazil receives assistance from the Brazilian government in numerous ways. These include assistance promoting public health through training programs, providing tax incentives to promote wellness, investing in sporting facilities, and creating policies that promote physical activity, all of which support the rise in demand for fitness equipment. Additionally, the Brazilian government is also helping to form the employment opportunities for new types of education using upgrades and modernizations, whether it be in education or the fitness equipment industry.

Report Coverage

This research report categorizes the market for the Brazil fitness equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil fitness equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil fitness equipment market.

Driving Factors

The Brazil fitness equipment market is driven due to people’s lifestyles become more modernised, they are increasingly engaging in sports activities but also opting for home-based exercise because of busy schedules, overcrowded gyms and convenience. Due to the cost-effectiveness and flexibility of home fitness equipment, many people have started to use apps that provide virtual access to personal trainers. An increase in awareness of the importance of maintaining a healthy lifestyle, as well as the growing popularity of digital fitness platforms and personalised routines, also increases demand. Further boosts to interest in home-based fitness training are due to social media fitness trends and the introduction of smart, connected devices.

Restraining Factors

The Brazil fitness equipment market is restrained because in Brazil, the level of disposable income has been adversely affected by the current economic situation. Other forms of health and fitness also contribute to lower levels of fitness equipment purchases throughout the country. The lack of physical infrastructures, along with high taxation on imported goods and strict regulatory policies, have hindered the growth of the fitness products industry in many areas. Additionally, many rural parts of the nation have limited access to fitness centres, which limits the growth of local markets.

Market Segmentation

The Brazil Fitness Equipment Market share is classified into product and application.

- The cardiovascular training equipment grapes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil fitness equipment market is segmented by product into body composition analysers, fitness monitoring equipment, cardiovascular training equipment, strength training equipment, and others. Among these, the cardiovascular training equipment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to increased health awareness, rising concern over obesity, increased expansion of gyms, increased home fitness adoption, continued technological improvements, rising affordability, and government wellness initiatives, all contribute to the growing availability of cardiovascular training equipment in Brazil.

- The physical fitness segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil fitness equipment market is segmented by application into mental fitness, physical fitness, weight loss, body building, and others. Among these, the physical fitness segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to urban lifestyle changes, increased disposable incomes, government-sponsored wellness initiatives, employer-provided fitness benefits, and mass consumer interest among younger generations are driving physical activity in Brazil, leading to an increase in demand for fitness equipment within Brazil’s fitness industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil fitness equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Movement

- Riguetto

- Evoque Academia

- Oya Care & Bloom Care

- Others

Recent Developments:

- In August 2025: Technogym unveiled new high-tech gear at Fitness Brazil Expo 2025, including the checkup wellness station and the Artis Luxury line of cardio and strength machines, which featured AI fitness tracking and personalized workout programming.

- In September 2024: Freemotion Fitness partnered with Brazilian distributor Grupo Multi to expand the availability of its cardio and strength equipment along with subscription-based fitness content across Brazil.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Brazil, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Brazil Fitness Equipment Market based on the below-mentioned segments:

Brazil Fitness Equipment Market, By Product

- Body Composition Analysers

- Fitness Monitoring Equipment

- Cardiovascular Training equipment

- Strength Training equipment

- Others

Brazil Fitness Equipment Market, By Application

- Mental Fitness

- Physical Fitness

- Weight Loss

- Body Building

- Others

FAQ’s

Q: What is the Brazil fitness equipment market size?

Brazil Fitness Equipment Market size is expected to grow from USD 672.05 million in 2024 to USD 1169.39million by 2035, growing at a CAGR of 5.16% during the forecast period.

Q: Who are the key players in the Brazil fitness equipment market?

A: Movement, Riguetto, Evoque Academia, Oya Care & Bloom Care, and Others are the key players in the Brazil fitness equipment market.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 168 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |