Brazil Flavors Market

Brazil Flavors Market Size, Share, By Flavouring Agent (Nature Identical Flavouring Substance, Artificial Flavouring Substance, Natural Flavors), By Form (Liquid, Dry), By Application (Beverages, Bakery and Confectionery Products, Dairy and Frozen Desserts, Savouries and Snacks, Others), Brazil Flavors Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Flavors Market Insights Forecasts to 2035

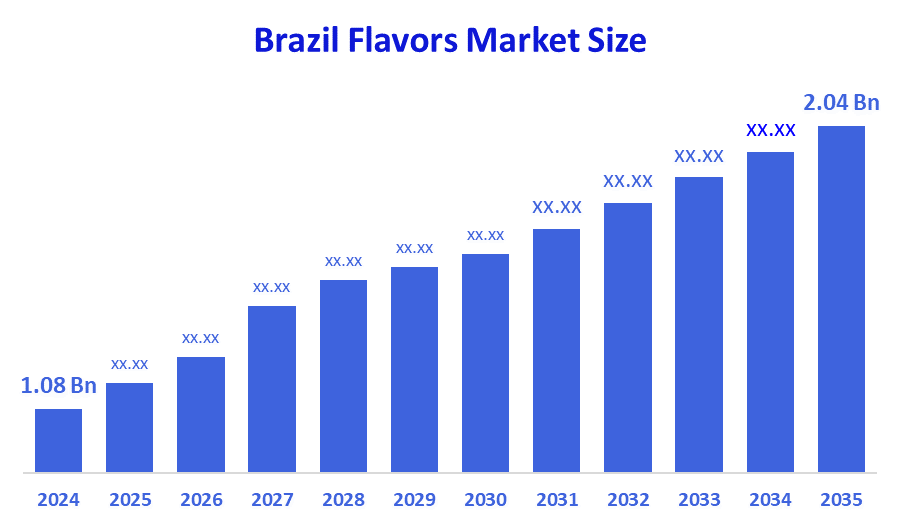

- Brazil Flavors Market Size 2024: USD 1.08 Billion

- Brazil Flavors Market Size 2035: USD 2.04 Billion

- Brazil Flavors Market CAGR 2024–2035: 5.95%

- Brazil Flavors Market Segments: Flavouring Agent, Form, and Application

The Brazil flavors market refers to the production and commercialization of flavoring substances used to enhance the taste, aroma, and overall sensory experience of food and beverage products. These flavors are available in natural, artificial, and nature-identical forms and are widely used across beverages, bakery, dairy, snacks, and savory food segments. Key characteristics of the market include high customization, regulatory compliance, and continuous innovation to meet consumer expectations. The growth of the Brazil flavors market is supported by rising consumption of packaged and processed foods, increasing urbanization, and changing dietary habits. The strong presence of beverage, bakery, dairy, and snack industries further contributes to sustained demand for diverse flavor profiles. Additionally, growing consumer interest in clean-label and natural ingredients is reshaping product development strategies.

Government and private initiatives play a significant role in shaping the Brazil flavors market. Regulatory oversight by Brazilian food authorities ensures safety, quality, and proper labelling of flavoring substances. At the same time, private companies are investing in sustainable sourcing, local ingredient development, and research collaborations to support clean-label trends and export competitiveness.

Technological advancements have significantly transformed the Brazil flavors market. Companies are adopting advanced extraction techniques, fermentation-based flavor development, encapsulation technologies, and digital flavor mapping tools. These innovations help improve flavor stability, shelf life, and consistency while enabling reduced sugar, salt, and fat formulations in food products.

Market Dynamics of the Brazil Flavors Market

The Brazil flavors market is driven by the growing demand for processed and convenience foods, expanding beverage consumption, and rising urban populations. Increasing consumer preference for diverse taste experiences, ethnic flavors, and premium food products is further boosting market growth. The rapid expansion of the foodservice industry, coupled with innovation in plant-based and functional foods, is accelerating the adoption of advanced flavor solutions across multiple applications.

The market is restrained by strict regulatory requirements, high costs associated with natural flavor sourcing, and volatility in raw material prices. Additionally, increasing consumer scrutiny regarding artificial additives and labelling compliance poses challenges for manufacturers operating in the Brazil flavors market.

The future of the Brazil flavors market presents strong opportunities through the rising demand for natural and clean-label flavors, plant-based food innovations, and functional beverages. Growth in export-oriented food manufacturing and advancements in sustainable flavor production technologies are expected to create new revenue streams during the forecast period.

Market Segmentation

The Brazil Flavors Market share is classified into flavouring agent, form, and application

By Flavouring Agent:

The Brazil flavors market is segmented by flavouring agent into natural identical flavoring substances, artificial flavoring substances, and natural flavors. Among these, the natural flavors segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is attributed to increasing consumer awareness regarding clean-label products and the preference for naturally sourced ingredients. Additionally, growing demand for minimally processed foods, regulatory support for natural ingredients, and the expanding use of natural flavors in beverages, dairy products, and functional foods are further driving the growth of this segment in Brazil.

By Form:

The Brazil flavors market is segmented by form, divided into liquid and dry flavors. The liquid flavors segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is dominant due to ease of blending, uniform flavor distribution, and extensive usage in beverages and dairy applications. Moreover, liquid flavors offer greater flexibility in dosage control, faster flavor release, and compatibility with large-scale industrial processing, making them highly preferred in beverages, dairy products, sauces, and syrups. The rising production of ready-to-drink beverages and flavored dairy products in Brazil further supports segment growth.

By Application:

The Brazil flavors market is segmented by application into beverages, bakery and confectionery products, dairy and frozen desserts, savouries and snacks, and others. The beverages segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is dominant due to high consumption of soft drinks, flavored waters, juices, and alcoholic beverages in Brazil. Changing consumer lifestyles, increasing demand for innovative and exotic flavor profiles, and the growing popularity of functional and fortified beverages are key contributors. Additionally, the expansion of the foodservice industry and continuous product innovation by beverage manufacturers are further accelerating the demand for flavors in this segment.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the Japan clinical trials support services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Flavors Market

- Firmenich Brasil

- Givaudan Brasil

- Symrise Brasil

- IFF (International Flavors & Fragrances) Brasil

- Kerry do Brasil

- Sensient Technologies Brasil

- Doremus Aromas

- Duas Rodas Industrial

- Mane do Brasil

- Treatt Brasil

Recent Developments in Brazil Flavors Market

• In March 2025, Duas Rodas Industrial expanded its natural flavor production facility in Santa Catarina to support clean-label food applications.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil flavors market based on the below-mentioned segments:

Brazil Flavors Market, By Flavouring Agent

- Nature Identical Flavouring Substance

- Artificial Flavouring Substance

- Natural Flavors

Brazil Flavors Market, By Form

- Liquid

- Dry

Brazil Flavors Market, By Application

- Beverages

- Bakery and Confectionery Products

- Dairy and Frozen Desserts

- Savouries and Snacks

- Others

Q: What is the Brazil Flavors Market size?

A: Brazil Flavors Market is expected to grow from USD 1.08 billion in 2024 to USD 2.04 billion by 2035, growing at a CAGR of 5.95% during the forecast period 2025–2035.

Q: Who are the key players in the Brazil Flavors Market?

A: Key companies include Firmenich Brasil, Givaudan Brasil, Symrise Brasil, IFF (International Flavors & Fragrances) Brasil, Kerry do Brasil, Sensient Technologies Brasil, Doremus Aromas, Duas Rodas Industrial, Mane do Brasil, Treatt Brasil, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |