Brazil Fleet Management Market

Brazil Fleet Management Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Compliance Management Solution, Fleet analytics and reporting, Operations Management, Performance Management, Vehicle Maintenance and Diagnostics, and Services), Type of Fleet (Commercial Fleets and Passenger Vehicles), and Brazil Fleet Management Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Fleet Management Market Size Insights Forecasts to 2035

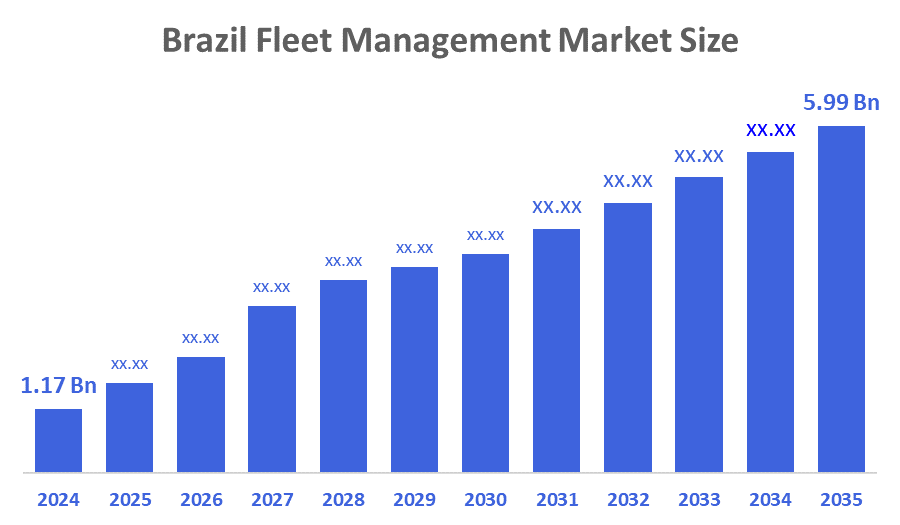

- The Brazil Fleet Management Market Size Was Estimated at USD 1.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16% from 2025 to 2035

- The Brazil Fleet Management Market Size is Expected to Reach USD 5.99 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Brazil Fleet Management Market Size is anticipated to Reach USD 5.99 Billion by 2035, Growing at a CAGR of 16% from 2025 to 2035. The Brazil fleet management industry is being driven by several factors, including an increase in fuel prices and expansion of e-commerce logistics through government regulations on safety, and the growing adoption of GPS and telematics technologies, with an increase in demand for real-time vehicle tracking capabilities, better processes for optimizing routes, and an increased focus on operational efficiencies, cost savings, and improving driver safety.

Market Overview

Fleet Management combines many aspects of Vehicle Fleet management, so companies optimize fleet performance, ensure safe vehicle operations, and minimize vehicle operating costs. Examples of fleet management include vehicle tracking, vehicle maintenance, managing fuel usage, monitoring drivers, complying with regulations, and planning efficient delivery routes. The Brazilian fleet Management Industry is expected to continue growing due to demand for real-time vehicle tracking, rising fuel costs, the increasing volume of goods being shipped through E-Commerce and Logistics, the introduction of Telematics and GPS technology, stricter safety regulations imposed by government authorities, the need for improved Operational Efficiency, and the growth of Data Analytics to measure Fleet Performance. The use of Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) technologies in Fleet Management Systems has allowed Fleets to operate more efficiently and accurately, develop predictive maintenance schedules, and offer real-time tracking capability.

The Brazilian fleet management market is undergoing some exciting, but growing trends. Government regulations around vehicle tracking and safety requirements are pushing fleet operators to implement either advanced fleet management systems or invest in telematics and GPS tracking systems. In addition, there has been a noticeable increase in cloud-based fleet management systems as well as an emphasis on improving fuel efficiency and reducing CO2 emissions, with the addition of AI and data analytics for providing predictive analytics to assist with maintenance, and a rise in the use of mobile apps to allow for real-time monitoring of fleets and improvements to driver performance.

Report Coverage

This research report categorizes the market for the Brazil fleet management market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil fleet management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil fleet management market.

Driving Factors

The growth of the Brazil fleet management industry relies heavily on the rapid expansion of logistics and transportation industries, as well as the increased demand for instant access to operational visibility and vehicle tracking, in addition to higher prices at the pump. Regulatory agencies requiring fleets to adhere to government regulations regarding safety compliance, driving hour limits, and environmental impact will likely encourage many companies to adopt telematics systems. Urbanisation and increased consumer demand for transportation of goods through e-commerce are driving companies to be more effective at routing deliveries. Technological developments within the GPS, IoT, and Cloud technologies have enabled organisations to increase their efficiency, reduce expenses, boost employee productivity, and create safer working conditions for drivers.

Restraining Factors

Brazil’s fleet management sector has many challenges to overcome, including High upfront investment requirements for implementation and installation; limited digital capabilities in outlying territories across Brazil; concerns about data privacy and security; insufficient skilled resources to operate sophisticated systems; and resistance to the adoption of new technologies by smaller-sized and more traditional fleet owners/operators.

Market Segmentation

The Brazil fleet management market share is categorized by component type and type of fleet.

- The vehicle maintenance and diagnostics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil fleet management market is segmented by component type into compliance management solution, fleet analytics and reporting, operations management, performance management, vehicle maintenance and diagnostics, and services. Among these, the vehicle maintenance and diagnostics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by fleet operators prioritizing minimizing vehicle downtime and avoiding costly breakdowns. With Brazil’s large geographic area and long-distance transportation needs, maintaining vehicle health is critical for uninterrupted operations. Predictive maintenance tools and real-time diagnostics help companies detect issues early, reduce repair costs, and extend vehicle life. Additionally, strict safety and emission regulations encourage regular monitoring of vehicle performance. The increasing adoption of telematics and sensor-based technologies further supports demand for advanced maintenance and diagnostic solutions across commercial vehicle fleets.

- The commercial fleet segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil fleet management market is segmented by type of fleet into commercial fleets and passenger vehicles. Among these, the commercial fleets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to a strong dependence on road-based transportation for moving goods across long distances. Rapid growth in e-commerce, retail distribution, and industrial supply chains has increased the number of trucks and delivery vans in operation. Companies require fleet management solutions to track vehicles, optimize routes, reduce fuel consumption, and improve driver safety. Additionally, commercial fleets face stricter regulatory and compliance requirements, which further drives the adoption of advanced fleet management systems for better operational control and cost efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil fleet management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sascar

- Omnilink

- Autotrac

- OnixSat

- Pointer by PowerFleet

- Cobli

- Geotab

- Fleet Complete

- Verizon Connect

- Webfleet (Bridgestone)

- Golsat

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Vertiv, a provider of critical digital infrastructure and continuity solutions, launched Environet Connect, a cloud-based solution whose deployment was in EMEA and North America, offering companies fleet management services. It is a completely neutral platform that permanently carries remote monitoring and managing capabilities of a data center infrastructure of the future, thus single out the light-edge and other distributed environments by efficiency and uptime.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil fleet management market based on the below-mentioned segments:

Brazil Fleet Management Market, By Component Type

- Compliance Management Solution

- Fleet analytics and reporting

- Operations Management

- Performance Management

- Vehicle Maintenance and Diagnostics

- Services

Brazil Fleet Management Market, By Type of Fleet

- Commercial Fleets

- Passenger Vehicles

FAQ’s

1. What is fleet management?

- Fleet management involves tracking, managing, and maintaining company vehicles to improve efficiency, safety, and reduce costs.

2. What is driving the growth of the Brazil fleet management market?

- Growth is driven by rising fuel costs, expansion of logistics and e-commerce, and increasing adoption of telematics and GPS technologies.

3. Which fleet type dominates the market?

- Commercial fleets dominate the market due to high demand in logistics, transportation, and delivery services.

4. What are the key components of fleet management systems?

- Key components include vehicle tracking, maintenance management, fuel monitoring, driver behavior analysis, and compliance management.

5. What challenges does the market face?

- High initial costs, data security concerns, limited connectivity in remote areas, and a lack of technical expertise are major challenges.

6. Is cloud-based fleet management growing in Brazil?

- Yes, cloud-based solutions are increasingly adopted due to scalability, real-time data access, and lower infrastructure costs.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 173 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |