Brazil Food Acidulants Market

Brazil Food Acidulants Market Size, Share, and COVID-19 Impact Analysis, By Type (Citric Acid, Lactic Acid, Phosphoric Acid, Tartaric Acid, Malic Acid, Acetic Acid) By Application (Beverages, Dairy Products, Confectionery, Processed Foods, Bakery, Meat Products, Sauces and Dressings, Others), and Brazil Food Acidulants Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Brazil Food Acidulants Market Insights Forecasts to 2035

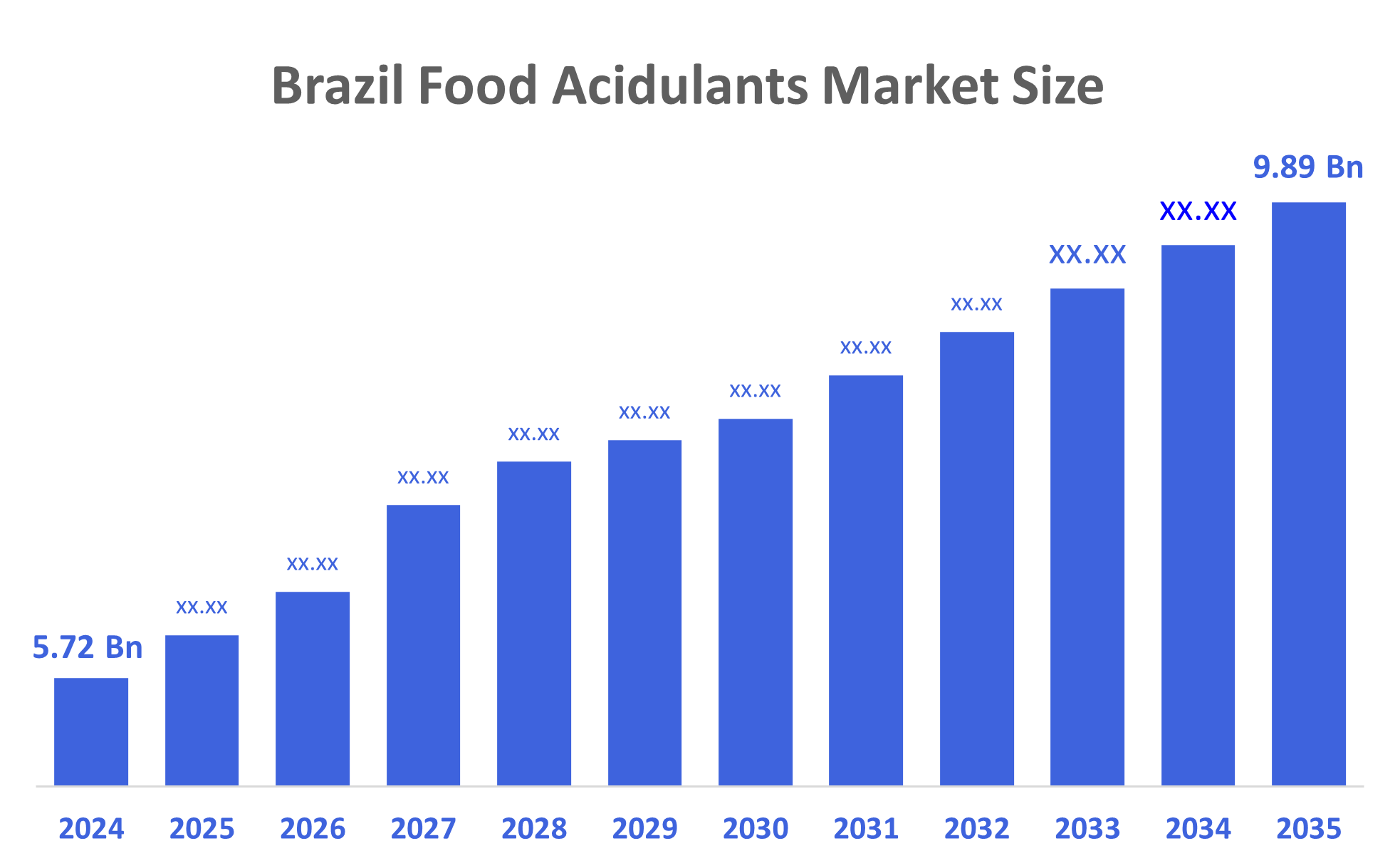

- The Brazil Food Acidulants Market Size Was Estimated at USD 5.72 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Brazil Food Acidulants Market Size is Expected to Reach USD 9.89 Billion by 2035

According to a research report published by Decisions Advisors, The Brazil Food Acidulants Market Size is Anticipated to Reach USD 9.89 Billion by 2035, Growing at a CAGR of 5.1% from 2025 to 2035. The Brazil food acidulants market is driven by rising demand for processed and convenience foods, expanding beverage and food industries, growing preference for natural ingredients, urbanization, increasing disposable income, and the need for longer shelf life, improved taste, and food safety.

Market Overview

Food acidulants are substances added to foods and beverages to give a sour taste, balance flavor, control acidity, and help preserve freshness. They improve taste, extend shelf life, and keep products safe by preventing the growth of harmful bacteria in many packaged and processed foods. Additionally, the market in Brazil is driven by the growing demand for processed and convenience foods, as well as increasing health consciousness among consumers seeking clean-label ingredients. In the future, the market is expected to expand due to the rising consumption of packaged foods, innovations in clean-label products, and a growing preference for natural and plant-based acidulants, aligned with trends in health and sustainability. Furthermore, the Brazilian government has focused on strengthening its food processing industry, which has encouraged investment in food additives, including acidulants. As part of Brazil's 2020-2023 National Food and Nutrition Policy, there has been a concerted effort to promote food safety and innovation, directly benefiting the food acidulants sector. This has resulted in increased production capacity and market availability of acidulants in Brazil.

In Brazil, Innovation in product applications by manufacturers are innovating in the use of acidulants, particularly in beverages and processed foods. New product formulations using acidulants for enhanced texture, flavor, and preservation are emerging, expanding the market scope. Furthermore, the country is increasingly exporting its products to international markets, which is catalysing the demand for food acidulants to meet international quality and taste standards, making Brazilian exports more competitive globally. Moreover, governing agencies are imposing stringent food safety regulations and standards, which are promoting the adoption of food acidulants and stimulating the market growth.

Report Coverage

This research report categorizes the market for the Brazil food acidulants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Brazil food acidulants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Brazil food acidulants market.

Driving Factors

The Brazil food acidulants market is driven by growing demand for processed and convenience foods, rapid urbanization, and changing consumer lifestyles. Expansion of the food and beverage industry, especially in soft drinks and packaged foods, increases the need for acidulants for taste and preservation. Rising health awareness is boosting demand for natural and clean-label ingredients. Higher disposable incomes and population growth are increasing food consumption. Technological advancements in food processing and the expanding retail and distribution networks also support market growth by improving product availability and quality across Brazil.

Restraining Factors

The Brazil food acidulants market faces restraints from fluctuating raw material prices, which increase production costs and affect profit margins. Strict food safety regulations and approval processes can delay product launches. Growing consumer preference for fresh and additive-free foods reduces demand for synthetic acidulants. Supply chain disruptions and dependence on imported ingredients also limit consistent market growth and availability.

Market Segmentation

The Brazil food acidulants market share is categorized by type and application.

- The citric acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Brazil food acidulants market is segmented by product type into citric acid, lactic acid, phosphoric acid, tartaric acid, malic acid, and acetic acid. Among these, the citric acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by highly versatile and widely used across beverages, confectionery, dairy products, bakery items, sauces, and processed foods. It provides strong flavor enhancement, effective pH control, and natural preservative properties. Citric acid is also perceived as a natural, safe ingredient by consumers, supporting clean-label trends. Its cost-effectiveness, easy availability, and compatibility with various food formulations further increase its preference among food manufacturers in Brazil.

- The beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Brazil food acidulants market is segmented by application into beverages, dairy products, confectionery, processed foods, bakery, meat products, sauces and dressings, and others. Among these, the beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the country’s high consumption of soft drinks, fruit juices, energy drinks, and flavored waters. Acidulants are essential in beverages to provide a refreshing taste, balance sweetness, control pH, and ensure product stability. Brazil’s large young population, hot climate, and strong demand for ready-to-drink products further drive beverage consumption. Additionally, the continuous launch of new flavored and functional drinks by manufacturers increases the need for acidulants to maintain consistent flavor and quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Brazil food acidulants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Corbion N.V.

- Jungbunzlauer Suisse AG

- Brenntag AG

- Kemin Industries, Inc.

- Bartek Ingredients Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Tate & Lyle announced an expansion of its operations in Brazil to enhance its presence in the food acidulants market. This expansion focuses on boosting its supply of citric acid, which is increasingly demanded in the beverage industry. The company aims to capitalize on Brazil’s growing demand for acidulants used in food and drink preservation and flavor enhancement.

- In February 2024, Corbion launched a new line of bio-based food acidulants in Brazil, targeting the growing trend toward sustainable ingredients. These products are designed to offer consumers healthier alternatives in processed foods, aligning with the increased demand for natural preservatives and flavor enhancers.

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Brazil food acidulants market based on the below-mentioned segments:

Brazil Food Acidulants Market, By Type

- Citric Acid

- Lactic Acid

- Phosphoric Acid

- Tartaric Acid

- Malic Acid

- Acetic Acid

Brazil Food Acidulants Market, By Application

- Beverages

- Dairy Products

- Confectionery

- Processed Foods

- Bakery

- Meat Products

- Sauces and Dressings

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |